The fate of platform tokens is determined by their design

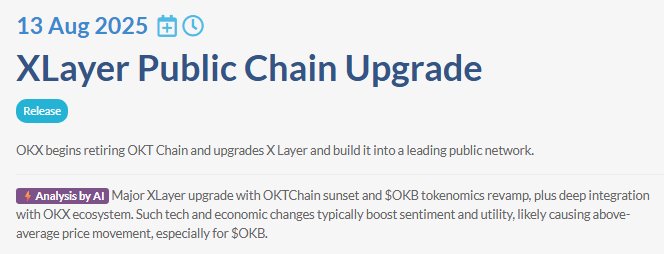

1️⃣ OKT's historical lesson: OKT is a public chain launched by OK in 2021, positioned to compete with BSC. At that time market sentiment was high, and OKT was once seen as “the next BNB”. In reality, after launch OKT's price opened high then fell, TVL briefly surpassed $500 million, then liquidity plummeted to less than $50 million, and eventually the chain was abandoned by the team and the ecosystem stalled.

Many believed in OKT's technology, nodes, and architecture, but its market cap evaporated over 95%, while during the same period BNB rose from about $44 to $1,100, a gain of over 25x. Behind this is the power of an ecosystem loop—exchange, chain, wallet, Launchpool, Earn, DEX multiple linkages.

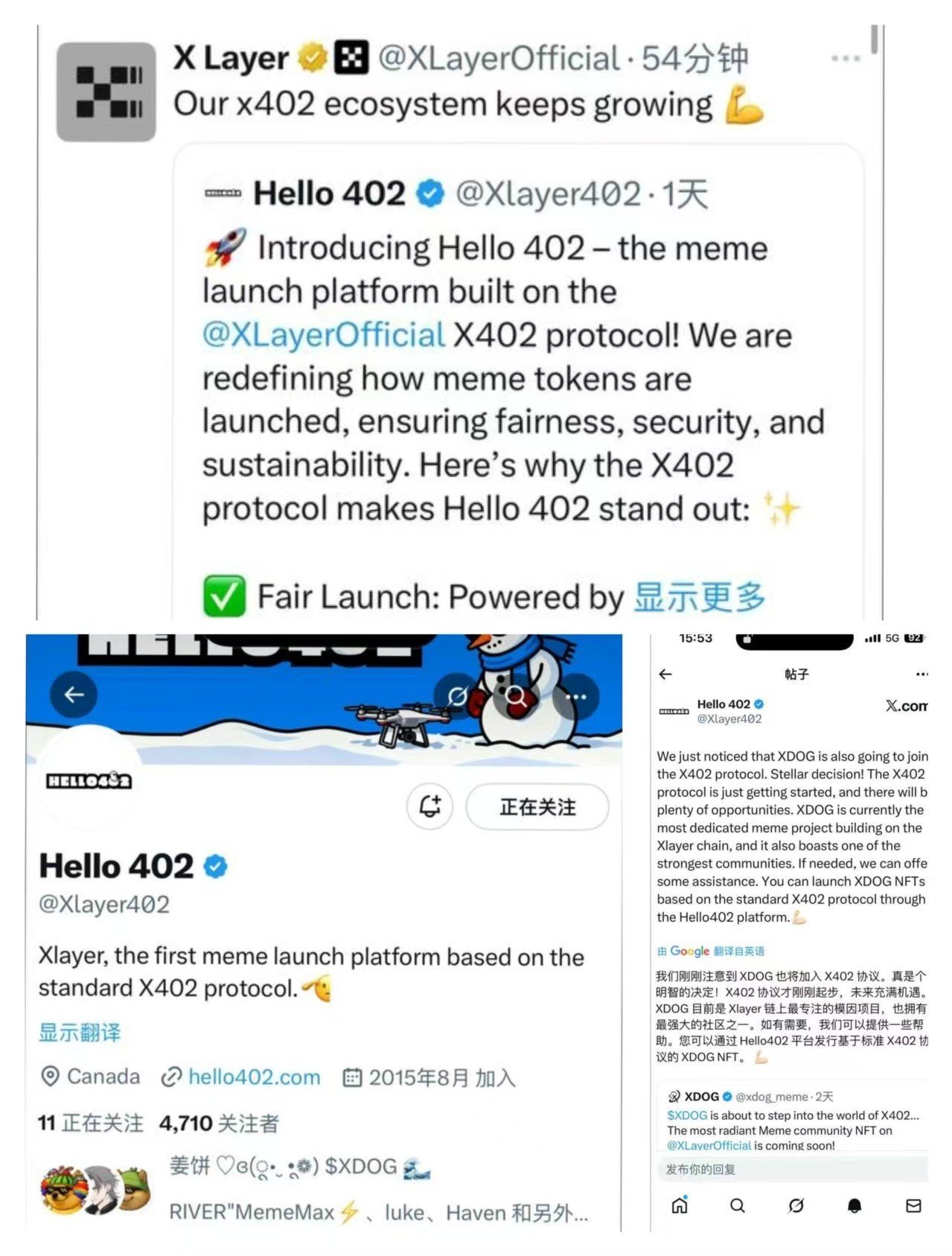

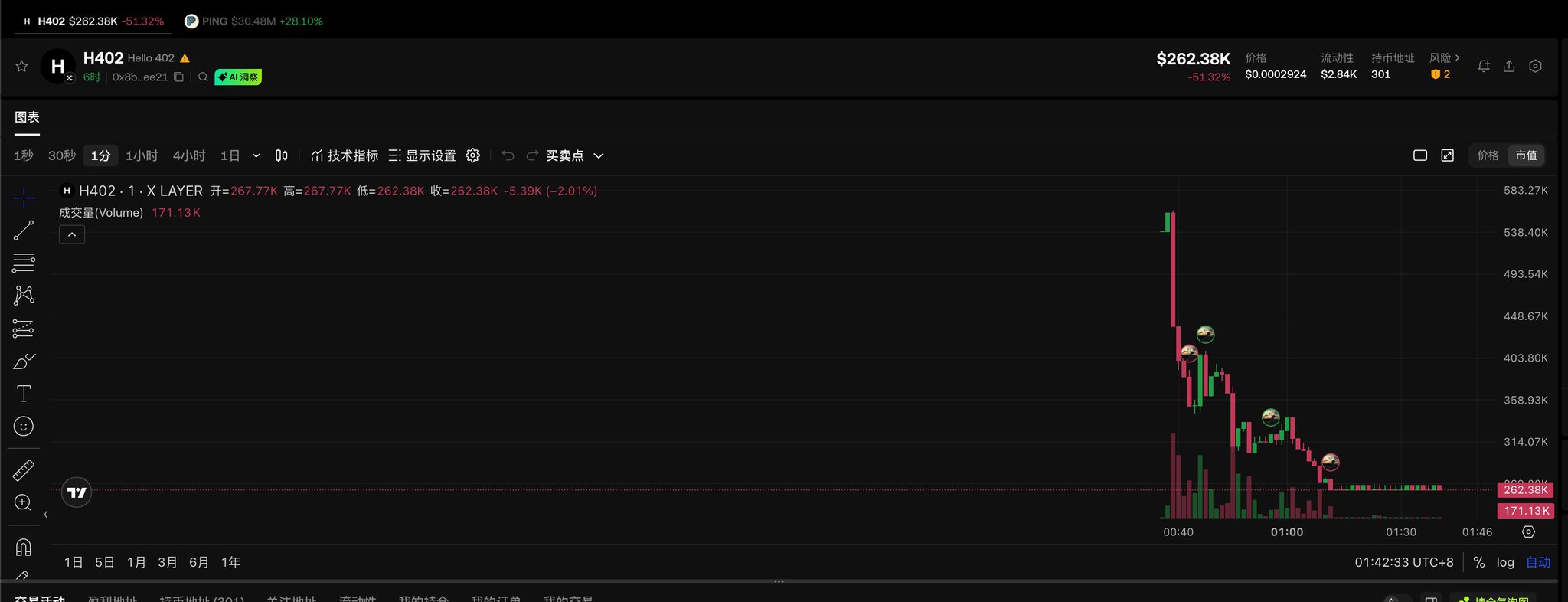

X Layer launched only three months ago, with TVL under $100 million. Yet its problems mirror those of OKT:

Ecosystem fragmentation: exchange, wallet, and public chain lack a closed loop, data and asset flow are disconnected;

Single user source: mainly relies on OK Wallet referral, but lacks sustained incentives;

Lack of Alpha model: no positive cycle of points—airdrop—trading like Binance Alpha.

Although OK Wallet launched many activities, over 50% of airdrop projects are issued on the BNB Chain. This means users receive airdrops in OK Wallet, but the actual trading, settlement, and burning occur on BNB Chain assets. Objectively, these activities actually help $BNB’s deflation and increase its ecosystem activity.

The logic of Binance Alpha is complete:

Project teams seek exposure and real trading volume → proactively airdrop to Alpha users;

Users seek airdrops → use Binance Wallet, trade;

Trading volume aggregates on BNB Chain → drives BNB fee consumption and burning;

Token price rises due to stronger deflation expectations → forms a positive flywheel.

This is a systematic value capture model, while OKX remains at a single-point incentive stage.

Last month, BNB burned $1.6 billion worth of tokens, while $OKB’s total market cap is only $2.9 billion. BNB is not just rising; it is a closed-loop system: exchange, chain, wallet, Launchpool, Alpha, all revolve around it. Every transaction contributes to deflation and strengthens the ecosystem.

OKB lacks a continuous burn mechanism and ecosystem linkage; OKT stopped, X Layer never took off, and half of wallet activities are still BNB Chain projects. The result is that OKB cannot build a wealth story.

Many Binance employees have gotten rich from BNB, but you rarely hear of anyone turning their fortunes around with OKB. This is not about luck, but a systemic issue: one is an economy that can siphon and recycle, the other is just exchange points.

And many people looking forward to OKX listing should understand that OKX listing is a capital operation, unrelated to holding OKB.