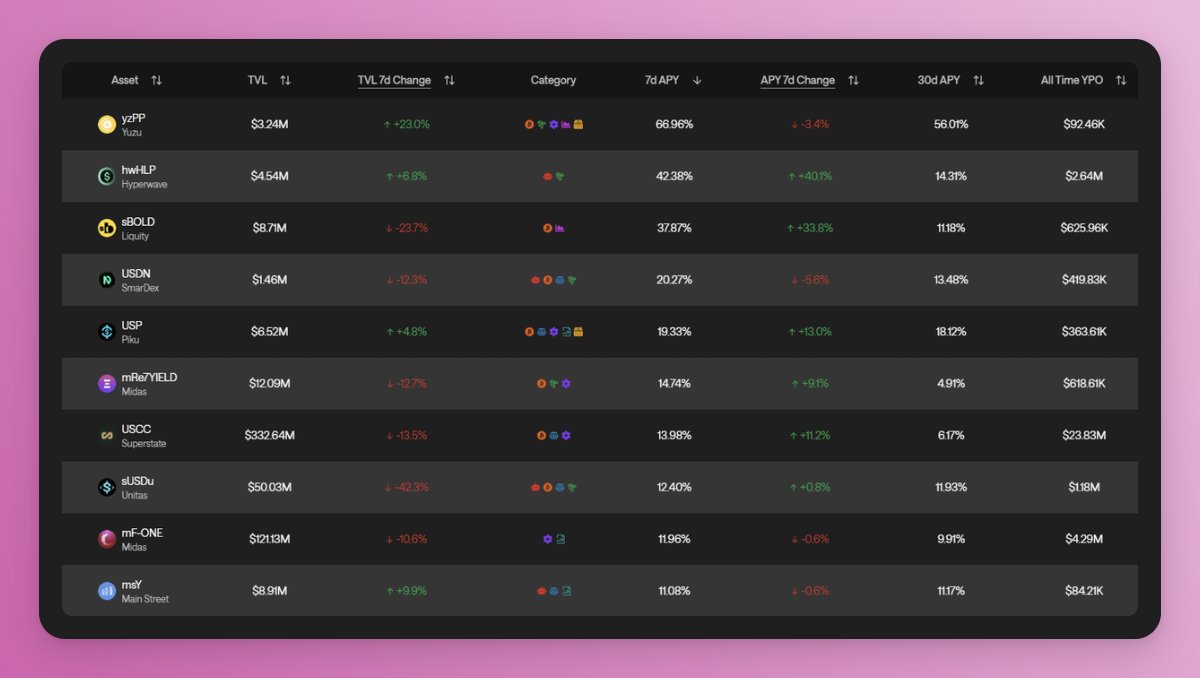

These are the top 10 stablecoin yield opportunities in the last 7 days:

1. @YuzuMoneyX: yield from leveraged loops and risk tranching. TVL +23%

2. @Hyperwavefi: 42.38% – yield from Hyperliquid market-making, liquidations, and trading fees. TVL +6.8%

3. @LiquityProtocol: 37.87% – yield from protocol revenue. TVL -23.7%

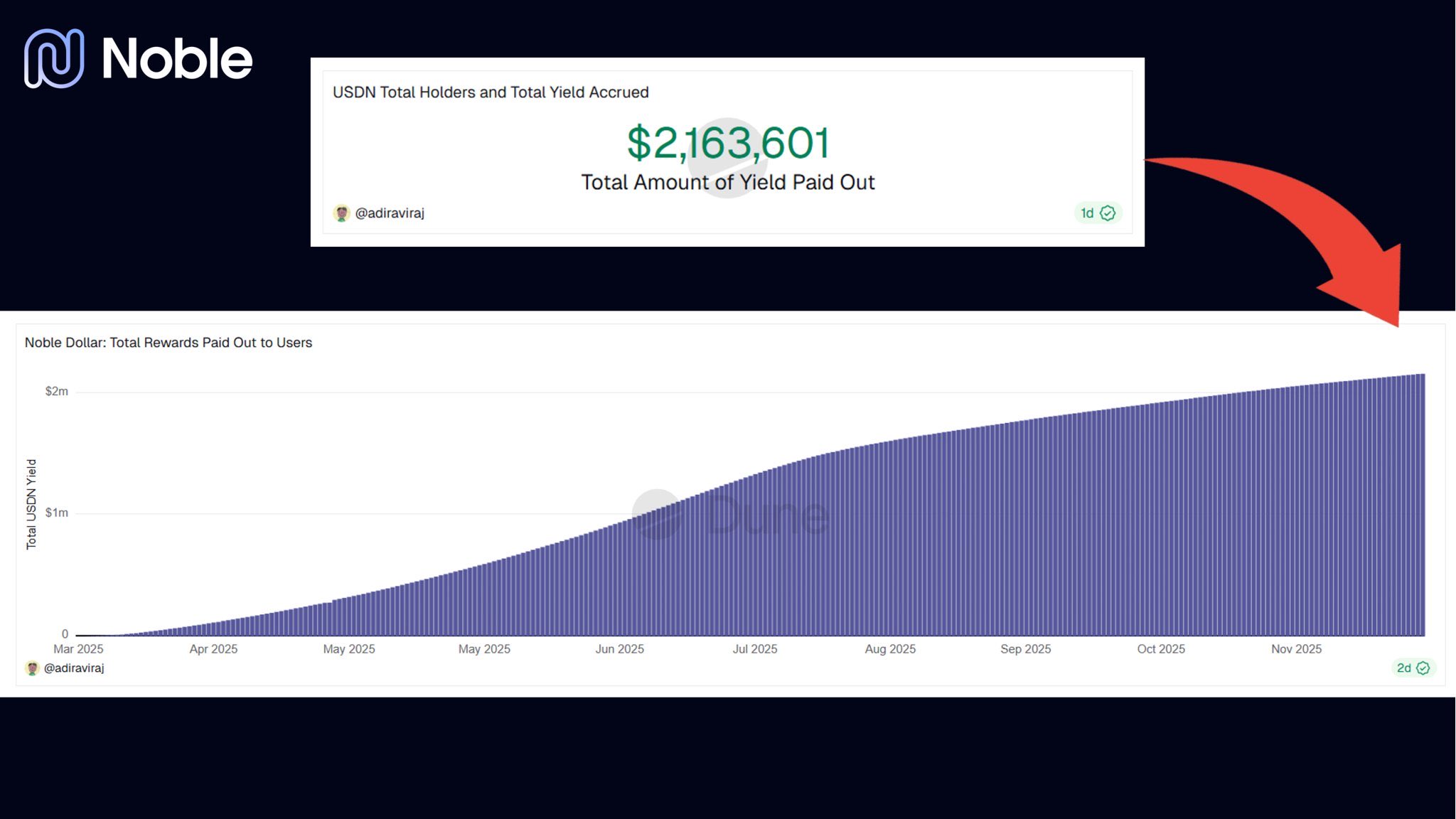

4. @SmarDex: 20.27% – yield from arbitrage of Hyperliquid funding rates. TVL -12.3%

5. @piku_dao: 19.33% – yield from leveraging advanced financial strategies. TVL +4.8%

6. @MidasRWA mRe7YIELD: 14.74% – yield from institutional strategies. TVL -12.7%

7. @SuperstateInc: 13.98% – yield from basis spreads, ETH staking, and U.S. Treasuries. TVL -13.5%

8. @UnitasLabs: 12.40% – yield from delta hedging a Jupiter LP (JLP) position. TVL -42.3%

9. @MidasRWA mF-ONE: 11.96% – yield from institutional strategies. TVL -10.6%

10. @Main_St_Finance: 11.08% – yield from a delta-neutral options strategy. TVL +9.9%

Idle stablecoins continue to be one of the simplest sources of on-chain yield.