Отказ от ответственности:

Данные из X (Twitter), собственность оригинальных авторов.Данные приводятся только для справки и не являются инвестиционным советом.

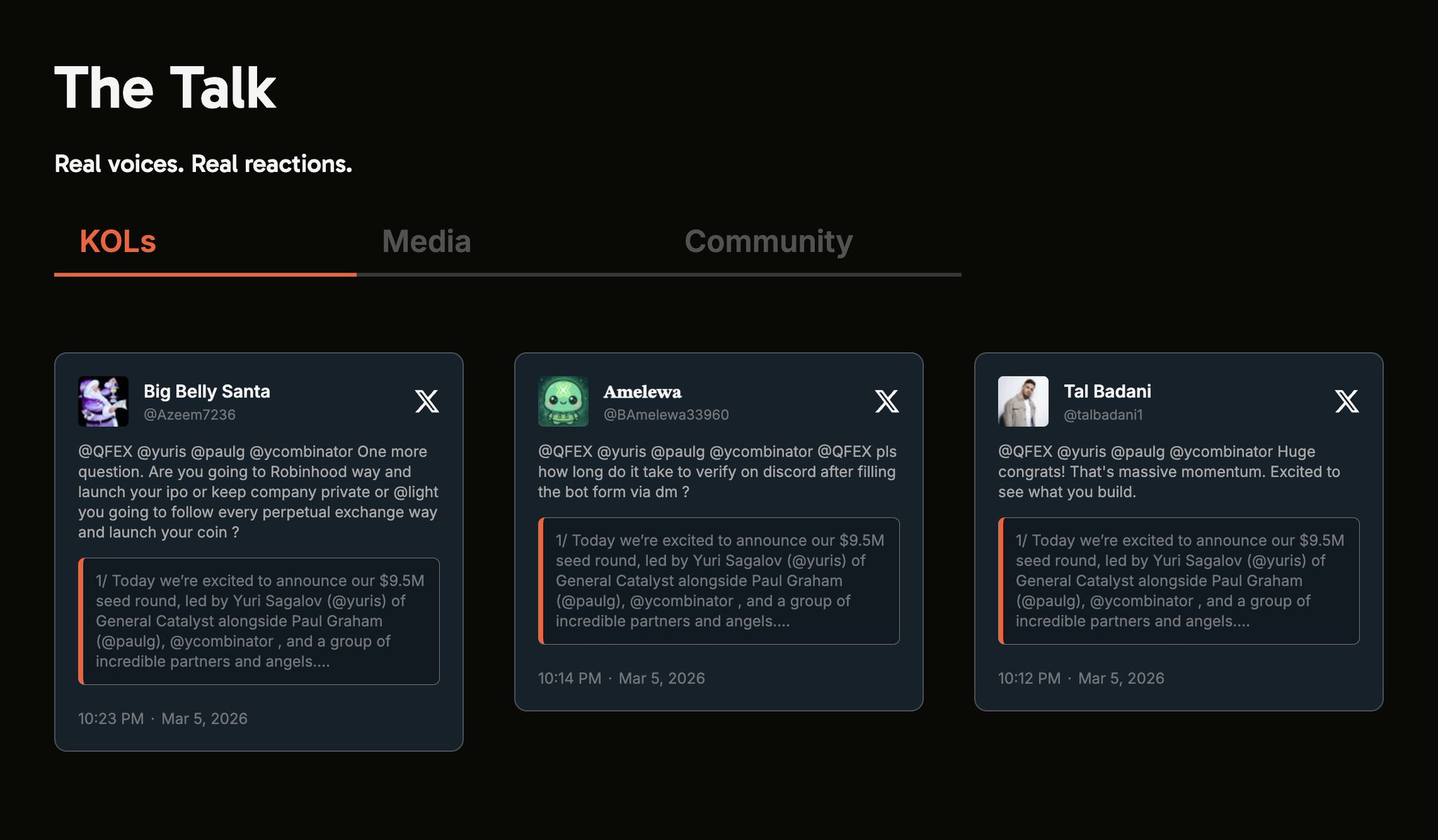

Посты из X

OCT News Media Influencer C1.87K @news_oct

OCT News Media Influencer C1.87K @news_oct OCT News Media Influencer C1.87K @news_oct

OCT News Media Influencer C1.87K @news_oct 0 1 2 Оригинал >Бычий

0 1 2 Оригинал >Бычий- Чрезвычайно бычий

Simply Bitcoin Media Influencer C144.55K @SimplyBitcoin

Simply Bitcoin Media Influencer C144.55K @SimplyBitcoin Simply Bitcoin Media Influencer C144.55K @SimplyBitcoin929 65 24.99K Оригинал >Тренд BTC после выпускаБычий

Simply Bitcoin Media Influencer C144.55K @SimplyBitcoin929 65 24.99K Оригинал >Тренд BTC после выпускаБычий- Тренд BTC после выпускаБычий

- Тренд BTC после выпускаМедвежий

Austin Federa | 🇺🇸 Founder Tokenomics_Expert C174.95K @Austin_Federa

Austin Federa | 🇺🇸 Founder Tokenomics_Expert C174.95K @Austin_Federa Anza D19.91K @anza_xyz6 1 455 Оригинал >Нейтрально

Anza D19.91K @anza_xyz6 1 455 Оригинал >Нейтрально Ethereum Media Educator D4.08M @ethereum

Ethereum Media Educator D4.08M @ethereum Dune | We Are Hiring! OnChain_Analyst Media D237.14K @Dune20 2 3.23K Оригинал >Тренд ETH после выпускаНейтрально

Dune | We Are Hiring! OnChain_Analyst Media D237.14K @Dune20 2 3.23K Оригинал >Тренд ETH после выпускаНейтрально- Бычий

- Тренд HBAR после выпускаБычий

- Тренд LINK после выпускаБычий

24-часовой социальный настрой от X

7,184Проанализированные посты-12.00%2,419Опрошенные лидеры мнений0%Рыночные настроения склоняются Бычий- МонетыSSIИзменитьSSI Инсайты

- МонетыMPRИзменить

BTC#1 KOL attention rise0

BTC#1 KOL attention rise0 Q#2 Social mentions surged-

Q#2 Social mentions surged- XAI#3 Social mentions surged-

XAI#3 Social mentions surged- SIGN#4 Social mentions surged-

SIGN#4 Social mentions surged- TRADOOR#5 Social mentions surged-

TRADOOR#5 Social mentions surged-

Сводка оповещения