Ondo US Dollar Yield Live Price data

Today's price of Ondo US Dollar Yield Is $ 1.12 (USDY/USD). With A Market Cap Of $ 703.61M USD. 24-Hour Trading Volume Of $ 1.52M USD, A 24-Hour Price Change Of +0.00%, And A Circulating Supply Of 628.94M USDY.

Ondo US Dollar Yield USDY Price History USD

Track the price of Ondo US Dollar Yield for today, 7 days, 30 days and 90 days

Period

Change

Change (%)

Today

0

0.00%

7days

--

--

30days

--

--

90days

0

0.90%

Own USDY Now

Buy and sell USDY easily and securely on BitMart.

Ondo US Dollar Yield Market Information

$ 1.12 24h Range $ 1.12

All time high

$ 1.12

All time low

$ 1.06

24h Change

0.00%

24h Vol

$ 1,520,753.99

Circulating supply

0.62B

USDY

Market cap

$ 703.61M

Max supply

--

Fully diluted market cap

$ 1.40B

Trade USDY

Ondo US Dollar Yield X Insight

USDY joins Sei, RWA value rises to $71.8 million

ICYMI: @OndoFinance brought its USDY yield-coin to @SeiNetwork, increasing its total RWA value to $71.8M

On Sei, the asset can also be used as productive capital, for example as collateral in lending markets, or for trading and payments

https://t.co/1WAeV8ue8h

1 day ago

Trend of USDY after release

No Data

Bullish

USDY joins Sei, RWA value rises to $71.8 million

Recommend using USDY on Takara Lend mining to get 3x rewards, bullish on Takara token airdrop potential.

If you have been farming Takara Lend on Sei you can farm 3x more diamonds with same capital

How ?

They just integrated USDY by Ondon, Yield bearing stablecoin and it gives 3x more diamonds.

APY is low but you get more rewards so I think its worth it if you believe in Takara token/airdrop will be good.

3 days ago

Trend of USDY after release

No Data

Bullish

Recommend using USDY on Takara Lend mining to get 3x rewards, bullish on Takara token airdrop potential.

USDY yield-generating stablecoin has been adopted on Sei, with a promising outlook.

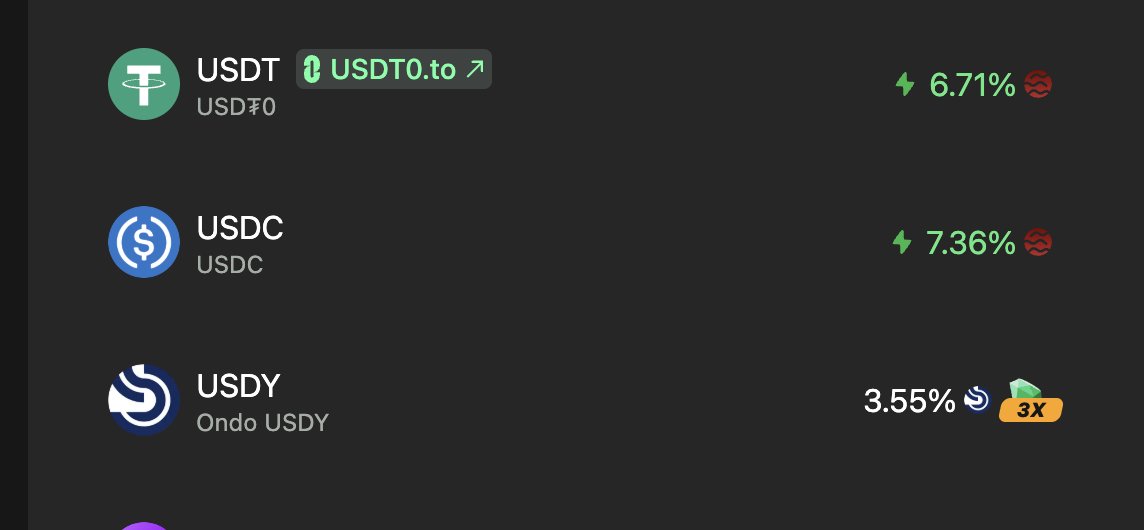

I have been mainly focusing on the stablecoin market, and one of the controversial points of the CLARITY Act’s failure to pass is Brian Armstrong’s view that “stablecoins cannot earn interest” is essentially unfair. The backing assets are interest‑bearing short‑term U.S. Treasury bonds, yet the interest can only stay with the issuer or intermediaries and cannot be directly returned to users, which inevitably reduces the appeal to users.

Especially in a high‑interest‑rate environment, users are left with a 0% dollar substitute, while neighboring money market funds, T‑bills, and even many Web2 cash‑management solutions can offer 4%‑5%. This is not a product experience issue, but rather forcing users to pay the opportunity cost for compliance. This is the most real pain point of current compliant stablecoins: if they aim to be a payment tool or cash substitute, regulators tend to manage them with cash logic and do not want stablecoins to evolve into deposit substitutes or money‑market‑fund substitutes, because allowing stablecoins to openly earn interest would essentially pull the core liability side (deposits) out of the banking system.

Why do on‑chain stablecoins not seem to have this problem? Because many on‑chain “stablecoins” do not adopt a “cash” positioning; they are positioned as “yield‑generating USD assets.” For example, the USDY stablecoin issued by Ondo Finance is a typical case. Its yield logic is based on the interest generated from Ondo’s holdings of short‑duration U.S. Treasury bonds, allowing holders to obtain near‑Treasury base returns on‑chain.

So today the split in the stablecoin market is becoming increasingly clear:

1. Compliance‑oriented payment stablecoins, emphasizing non‑interest, focusing on settlement and compliance boundaries, with the goal of becoming a USD settlement layer.

2. Yield‑generating stablecoins, positioning themselves directly as USD asset management tools, making Treasury yields explicit.

In essence there is no right or wrong, only aligning with user needs from compliance and application perspectives.

Ondo's tokenized U.S. Treasuries are live on Sei 🇺🇸

USDY by @OndoFinance is one of the most adopted tokenized Treasury products in the market, with over $1.2B in circulation.

Now you can use it on the fastest L1—for lending, collateral, savings, and more. https://t.co/L6cUKzdBns

3 days ago

Trend of USDY after release

No Data

Bullish

USDY yield-generating stablecoin has been adopted on Sei, with a promising outlook.

Price Prediction

When is a good time to buy USDY? Should I buy or sell USDY now?

When deciding whether it’s a good time to buy or sell Ondo US Dollar Yield (USDY), it’s important to first align with your own trading strategy and risk profile.Long-term investors and short-term traders often interpret market conditions differently, so your decision should reflect your personal approach. According to the latest USDY 4-hour technical analysis, the current trading signal is Hold. According to the latest USDY 1-day technical analysis, the current signal is Hold.

Beacon Prediction

Probabilistic Price Forecast (Next 24 Hours)crypto.loading

About Ondo US Dollar Yield

Ondo US Dollar Yield (USDY) is a cryptocurrency and operates on the Ethereum platform. Ondo US Dollar Yield has a current supply of 1,253,634,974.84436238 with 628,943,331.8783271 in circulation. The last known price of Ondo US Dollar Yield is 1.11844617 USD and is down -0.05 over the last 24 hours. It is currently trading on 46 active market(s) with $903,836.51 traded over the last 24 hours. More information can be found at https://ondo.finance/.

Read More

Explore More

BM Discovery

New Listing

ANYONE ANYONE Protocol

0 0.00%

TRIA Tria

0 0.00%

GOYIM Goyim

0 0.00%

JNJON Johnson & Johnson Ondo Tokenized

0 0.00%

ORCLON Oracle Ondo Tokenized

0 0.00%

JDON JD.com Ondo Tokenized

0 0.00%

VZON Verizon Ondo Tokenized

0 0.00%

UBERON Uber Ondo Tokenized

0 0.00%

KELLYCLAUDE KellyClaude

0 0.00%

HUNT GreyHunt

0 0.00%