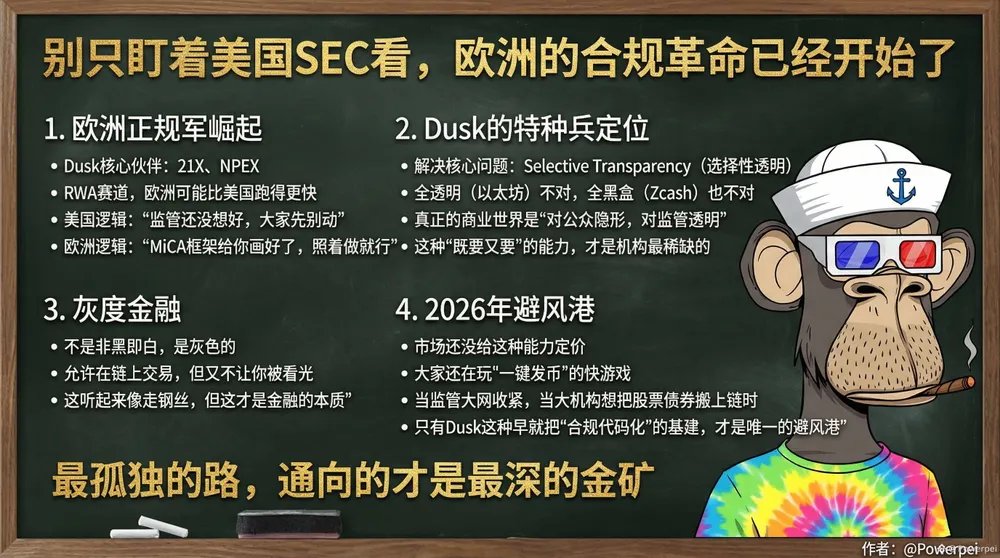

Dusk, with its compliance-oriented RWA solution, is seen as the future safe harbor for institutional funds under the European regulatory framework.

Don't just focus on the US SEC; the compliance revolution in Europe has already begun.

Recently studying the ecosystem of @DuskFoundation, I discovered an interesting phenomenon.

Its core partners are all European established players: 21X, NPEX.

What does this indicate? It suggests that in the RWA track, Europe may be moving faster than the US.

The US logic is “regulation isn’t settled yet, so everyone should hold off.”

The European logic is “the MiCA framework has been drawn for you, just follow it.”

————

Dusk is the special forces unit that grew under this framework.

The core problem it solves is actually just one: Selective Transparency.

Earlier public chains were either fully transparent (Ethereum) or completely black-box (Zcash).

Dusk says: neither is correct.

The real business world is “invisible to the public, transparent to regulators.”

It sounds like walking a tightrope, but that is the essence of finance.

I call this model “gray finance.”

It is not black or white; it is gray. It allows you to trade on-chain while not exposing everything.

This “have both” capability is what institutions scarce for.

————————

My thoughts:

The market has not yet priced this capability.

Everyone is still playing the fast “one‑click token issuance” games, finding compliance too cumbersome.

But by 2026, when the regulatory net truly tightens and large institutions really want to move stocks and bonds on-chain, they will realize:

Only infrastructure like Dusk that has already “codified compliance” will be the sole safe harbor.

It is not an easy path, perhaps even a very lonely one.

Yet the loneliest roads often lead to the deepest gold mines.

#dusk $DUSK