I think for some time now that DeFi need an actual crypto based currency. A floating non pegged stablecoin with an independent monetary policy.

The @OlympusDAO design is actually a great base for this. It already has the code for a independent code based monetary policy and can hold diverse reserve token as backing.

What would be needed to make it a viable credibly neutral reserve currency:

- Decouple the monetary policy from USD. Currently the monetary policy is based on a $OHM price moving average denominated in USD. It should use another index, like a diversified set of CPI index.

- Diversify its reserve backing to avoid single point of failure and be credibly neutral. Currently it hold in reserve mostly USD pegged stablecoin. It should diversify into different currency reserve (EURO, YEN, etc …), $BTC, $ETH and tokenized gold.

- Decouple governance from the currency. The governance token shouldn’t be the same as the actual currency.

Entertaining the idea of working non this actually. A fork of Olympus with a few changes at the oracle level and the general direction of the project could be viable.

A major challenge is that I am not sure there is actually a lot of demand for such a currency currently. IMO before there is a major shock on the Dollar, creating large inflation/variance, people will be fine dealing in USD. Even country which are at odd with the US and are actually helping them by holding dollars.

Still if somebody is down on this kind of project hit me up, would be interested to discuss.

Olympus v2 OHM Історія зміни цін USD

Стати власником OHM зараз

Купуйте та продавайте OHM легко та безпечно на BitMart.Заробити

Залучайте неактивну криптовалюту до роботи та легко отримуйте пасивний дохід через заощадження, стейкінг та інші послуги.Olympus v2 X Інсайт

We need better decentralized stablecoins. IMO three problems:

1. Ideally figure out an index to track that's better than USD price

2. Oracle design that's decentralized and is not capturable with a large pool of money

3. Solve the problem that staking yield is competition

Tracking USD is fine short term, but imo part of the vision of nation state resilience should be independence even from that price ticker. On a 20 year timeline, well, what if it hyperinflates, even moderately?

If you don't have (2), then you have to ensure cost of capture > protocol token market cap, which in turn implies protocol value extraction > discount rate, which is quite bad for users. This is a big part of why I constantly rail against financialized governance btw: it inherently has no defense/offense asymmetry, and so high levels of extraction are the only way to be stable. And, of course, it's a big part of why I refuse to give up on DAOs entirely.

If you don't have (3), then again you have a few percent APY suboptimal return

🧑💻 OGAudit Web3 Research

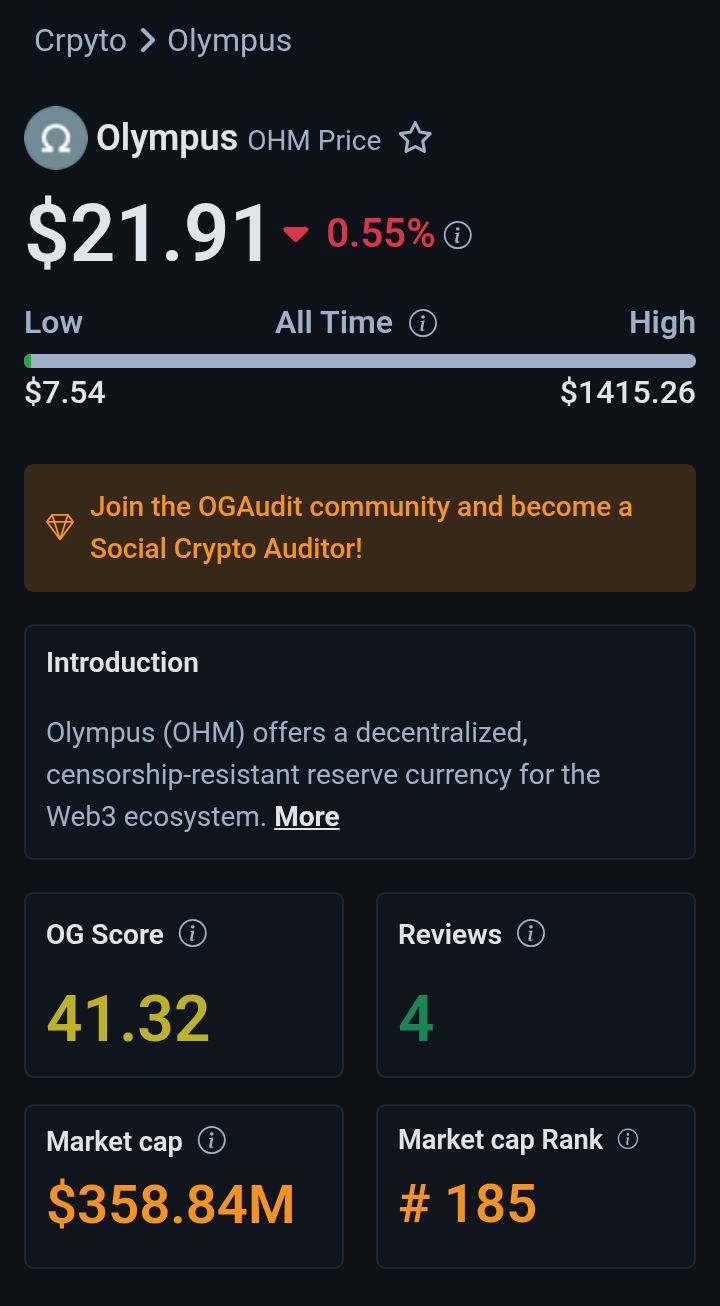

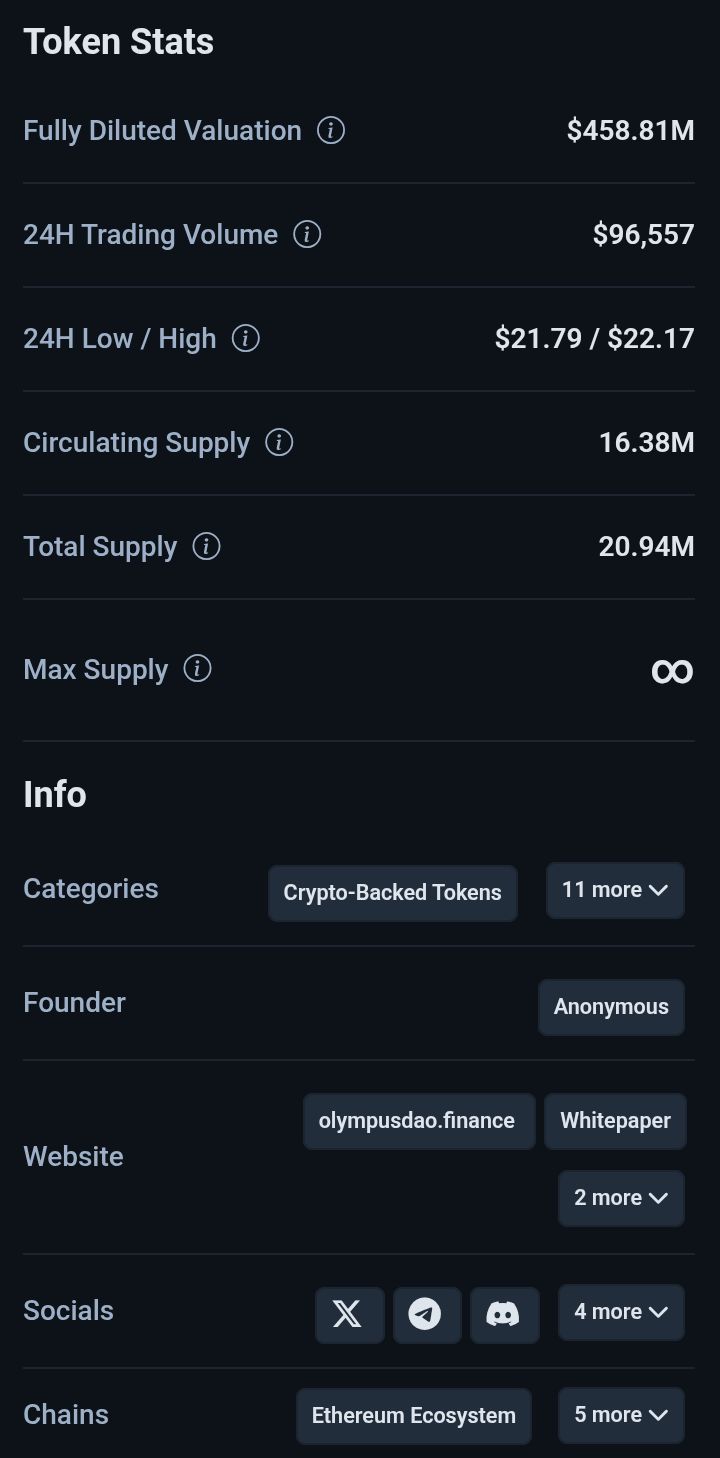

📢 Introducing @OlympusDAO; Olympus ($OHM) offers a decentralized, censorship-resistant reserve currency for the Web3 ecosystem.

Category: DeFi

Ticker: $OHM

Market Cap: $358.84M

Rank: #185

OG Score: 41.32 / 100

Reviewed by: 4 OGs

🔍 More info:

https://t.co/9MpqDQMZtR

Wish I had time to write blogs, I loved doing it even though its super time and energy-intensive for me personally.

The Smoke and Mirrors ones in 2021 for example took 40+hrs..!

On the bright side, its very cool to create a piece of content and years later ppl randomly stumble on it and it still impacts. Content creation is pro-scalability.

One day.. 🥲

I was researching the mechanics of defi protocols and I came an article, a series rather, "OF SMOKE AND MIRRORS" part I and II written by @gametheorizing.

he highlighted the three laws of thermo-ponzinomics and the ten ponzi cOHMandments(yes, you read that right)

if you have ambitions to successfully grift people while taking minimal blame, stay tuned.

first, you must understand the three laws of thermo-ponzinomics:

1. The amount of money in an isolated system can be redistributed in PvP fashion but cannot grow more than the amount that is put in

thus; while there can indeed be individual winners, it is only at the expense of participants who lose.

2. The entropy loss in an Closed System keeps increasing over time

meaning: Running costs, fees, inefficiencies, exploits, gas, etc, steadily degrade value inside the system. Over time, more value is lost to “rent‑seekers” than captured by participants.

3. As the amount of money in the system starts to decrease, the activity of the system spirals down to zero

Прогноз ціни

Чи зараз слушний час для покупки OHM? Чи варто зараз купувати або продавати OHM?

Прогноз Beacon

Ймовірний прогноз ціни (на найближчі 24 години)Дізнатись більше

Огляд BM

Новий лістинг