When DeFi trusts the wrong price,we pay the price.

Welcome, oracle manipulations.....

In DeFi, oracles are basically the group chat everyone trusts for “what’s the price right now?”

And sometimes…... that group chat gets drunk.

Like me earlier the morning 🤪

☆ Thin Liquidity Pools (aka “One Trade, Big Drama”)

Back in 2020, attackers went shopping in low-liquidity DEX pools.

A few oversized trades later, prices were magically inflated, loans were taken against fake value, and the attackers disappeared faster than your funds during a gas spike.

Flash loans helped, of course.

Zero capital, real profits — DeFi on easy mode.

☆ Delayed or Fake Feeds (Time travel, but make It profitable)

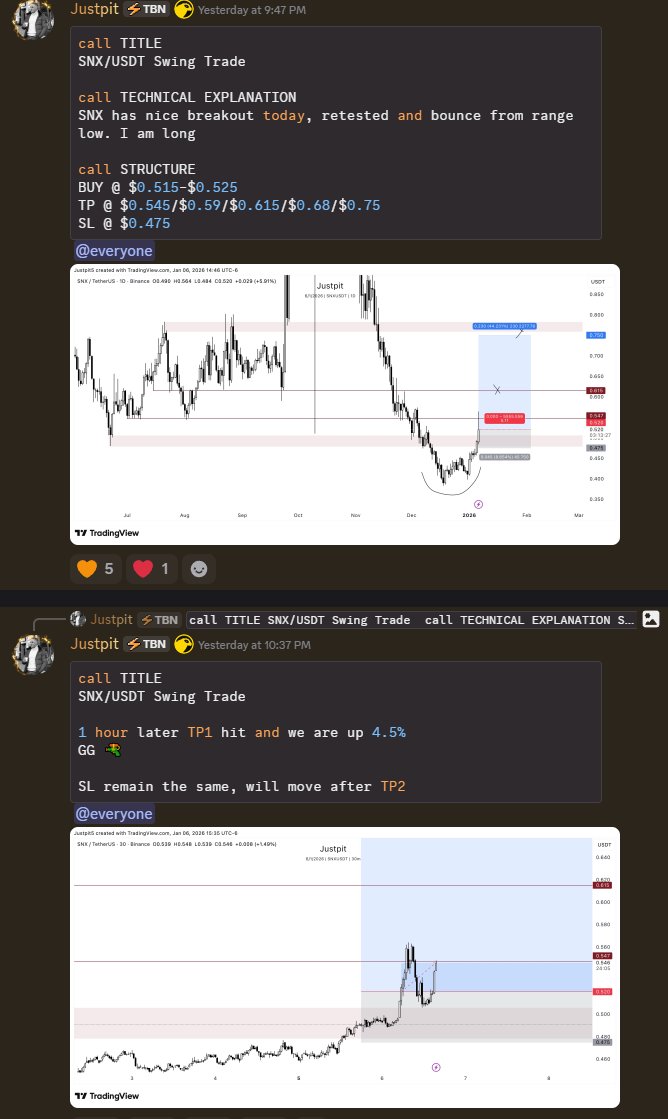

Synthetix learned the hard way that stale oracle data is basically an invitation.

Traders exploited delayed price updates, drained value, and left the protocol wondering what year it was.

Turns out, being early and late can both cost you.

This is where @DroseraNetwork comes in and flips the script

Instead of tr