late night frens quick LST note: been noodling on liquid staking yields and wanted a low-effort way to rotate into short premium pockets without getting stuck in long cooldowns

How I ran it (20 mins)

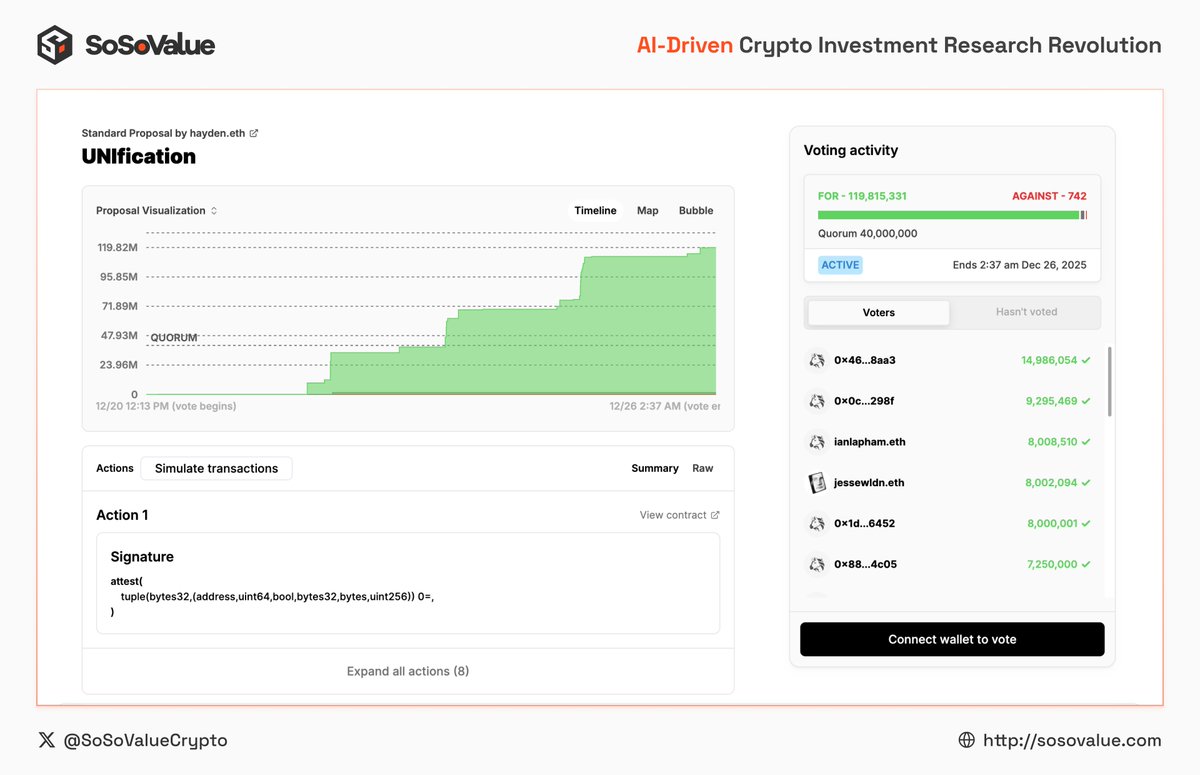

1) export 7d TVL + 7d yield CSV for LSTs from @SoSoValueCrypto

2) add protocol unstake/cooldown windows + on‑chain transfer volume for last 24h

3) compute yield premium vs baseline (eth staking implied) and divide by expected cooldown length = yield/time score

4) flag protocols with >0.35% weekly premium and cooldown ≤7 days

5) size rotating stakes (5 8% portfolio) and set auto‑unwind if active addr drops 20%

Result: caught two 0.4 0.7% weekly windows across $stETH / $rETH without getting locked into a long queue; tradeoff = slightly higher rebalance churn but cleaner risk path

Who else is scoring LSTs by yield/time instead of raw APR and what thresholds do you use for rotation? #LST #LiquidStaking #SoSoValue $stETH $rETH $cbETH $SOSO