Bearish on Polymarket at $11-12B valuation? Misses the plot tbh.

Alpha is looking at the affiliated @PolymarketBuild dapps.. Lower comp than mainnet grinding, but likely qualifies for $POLY drops/multipliers as affiliated builders.

Leverage the ecosystem for asymmetric upside.

Polytrader by Virtuals POLY Price History USD

Own POLY Now

Buy and sell POLY easily and securely on BitMart.Заработать

Даже незадействованная криптовалюта может приносить пассивный доход! Пользуйтесь сбережениями, услугами стейкинга и другими преимуществами.Polytrader by Virtuals Инсайт из X

7 Low Risk-Reward Markets on Polymarket You Can Buy!

A lot of people new to Polymarket have been asking for markets where the downside feels limited, but you still get decent risk-reward while building volume for the $POLY airdrop.

So here are 7 markets you can look at right now. These feel relatively low risk, with “okay-okay” returns.

-----------

1. OpenSea FDV

Go for: YES, $500M and/or $1B

🔗 Link: https://t.co/2Az4QGPDMW

Why: OpenSea is the biggest NFT marketplace. It already makes millions in revenue. When you compare it with other NFT marketplaces that launched tokens, a $1B FDV after TGE feels very realistic.

Even $500M feels almost guaranteed to me. I honestly don’t see OpenSea trading below $500M FDV one day after TGE.

-----------

2. English Premier League Winner

Go for: YES, Arsenal

🔗 Link: https://t.co/SafSzirPx1

Why: There’s already a 9+ point gap. Man City is second, and yes, they’re usually scary when chasing, but this season they’ve been inconsistent and hit with injuries.

They also play Liverpool later today. If Man City lose or even draw, this market should move nicely and can be exited in profit quickly.

-----------

3. HYPE Price in 2026

Go for: YES, $100

🔗 Link: https://t.co/YvZuFuWfeL

Why: If you’re bullish on Hyperliquid, HYPE pumping feels inevitable at some point. But the idea here is not to wait till $100.

This is a risk-reward play. Even if HYPE moves to the $40+ zone, this market should already be deep in profit. In my view, current pricing is too cheap.

-----------

4. Perena TGE

Go for: YES, September 30, 2026

🔗 Link: https://t.co/nXsWlDCtJN

Why: Perena has been running its points program for months. Pre‑Season and Season 0 are done. Season 1 ends on Feb 13.

It feels unlikely they’ll drag this out with many more seasons. They also teased a snapshot recently. Putting everything together, TGE before Sep 2026 feels very likely.

Market is around 60%, which makes the upside pretty attractive too.

-----------

5. Rabby TGE

Go for: NO, March 31, 2026

🔗 Link: https://t.co/RIW26xj2ed

Why: Pure gut feeling here. I really don’t think Rabby will rush a TGE anytime soon. Market already says ~90% NO, so even a small return here feels fine given how high the probability looks.

-----------

6. GRVT TGE

Go for: YES, September 30, 2026

🔗 Link: https://t.co/blVmZXQPcu

Why: The team has already hinted TGE at a Q1 target. Even if things slip, Q3 still feels reasonable. Market is around 78% right now, which feels juicy considering the odds of this hitting are pretty high.

-----------

7. StandX TGE

Go for: NO, March 31

🔗 Link: https://t.co/nej5vBC82K

Why: StandX only recently went public with its alpha. A TGE this early feels very unlikely. Personally, I think it’s at least 4–5 months away.

-----------

These are the 7 markets that feel relatively low risk to me, with decent returns, especially if your main goal is creating organic volume on Polymarket for the airdrop.

Important note: This is still prediction betting. Nothing is guaranteed. Even after doing homework, things can go wrong. Always use only what you’re okay losing.

And yeah… let’s hope $POLY pulls everyone out of the trenches.

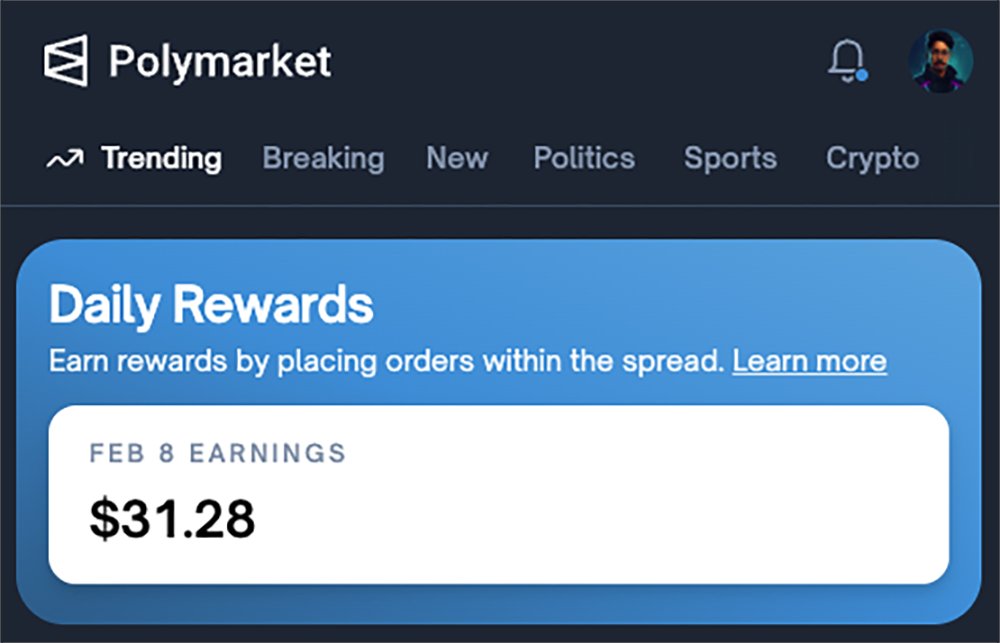

Polymarket Liquidity Rewards: Earned $31 Today!

As shared earlier in a detailed post, there’s a decent chance that anyone who has earned liquidity rewards on Polymarket is already ahead of thousands of other users when it comes to a future $POLY airdrop.

This side of Polymarket is still very under-farmed compared to normal trading. According to PolyRewards, a community-built dashboard:

✅ If you’ve earned $49 in total liquidity rewards across all time, you’re already in the top 10% of Polymarket users.

That alone shows how few people are actually doing this properly when positioning for the Polymarket airdrop.

------------

My result today:

I earned around $31 in about 4 hours using 10,000 USDC.

I didn’t “spend” the 10K. The USDC was placed as resting limit orders. After canceling everything, I got the full 10K back plus the USDC rewards. No capital loss.

Important note before going further:

I used 10K just to speed things up and show the mechanics clearly. This strategy isn’t limited to large balances. Even with $100, you can realistically earn around $1–2 per day if you’re patient and pick calmer markets.

Over 1–2 months, that alone can push your total liquidity rewards past $49, which already puts you in the top 10% of Polymarket users.

------------

I already shared a detailed guide earlier, but here’s the short, practical version of what I did:

- Picked a market with a large daily liquidity rewards pool. Today it was 1,000 USDC

- Avoided highly volatile markets. Slow price movement is key

- Checked the order book to see how fast bids and asks were getting filled

- Placed a resting limit order just behind the best price, not at the very top

- Watched the screen closely for around 4 hours

If the order above me got filled, or if there was less than about $500 of orders sitting in front of mine, I cancelled my order and placed a new one slightly lower so it wouldn’t get filled. This is a very important part if you want to avoid getting filled.

------------

Another good practice: Observe order flow first

Don’t place limit orders instantly. Open the market first and watch the order book for a few minutes to see how fast orders are getting filled.

If buy or sell sizes are getting eaten fast, your resting order can get filled quickly. Skip those markets. Only stick to markets where the order book fills slowly and predictably.

------------

The trade‑off here is simple: you’re exchanging convenience for control. Instead of placing quick market orders and walking away, you’re actively managing where your liquidity sits in the order book.

That extra involvement helps keep risk lower, but it also means this isn’t a passive strategy.

That’s why this isn’t for everyone.

It takes time, focus, and patience. You’ll need to watch the screen closely and react when things change. That’s exactly why most people don’t do it, and that’s also where the edge comes from.

If you’re trying to squeeze the absolute max out of the Polymarket airdrop and don’t mind some stress, this strategy is worth it. If not, simple market orders and regular trading are totally fine too.

At the end of the day, it just comes down to how much time and effort you’re willing to put in. There’s no right or wrong way, just different levels of involvement.

Прогнозирование цен

When is a good time to buy POLY? Should I buy or sell POLY now?

Прогноз Beacon

Probabilistic Price Forecast (Next 24 Hours)Explore More

BM Discovery

Новые листинги