midday check-in: moved satUSD+ into the new @pendle_fi pool (mat. 2026-03-26), yield ticked up fast

on the old pool? migrate to keep accruals live with @River4Fun https://t.co/gx9tZ4UHXa

midday check-in: moved satUSD+ into the new @pendle_fi pool (mat. 2026-03-26), yield ticked up fast

on the old pool? migrate to keep accruals live with @River4Fun https://t.co/gx9tZ4UHXa

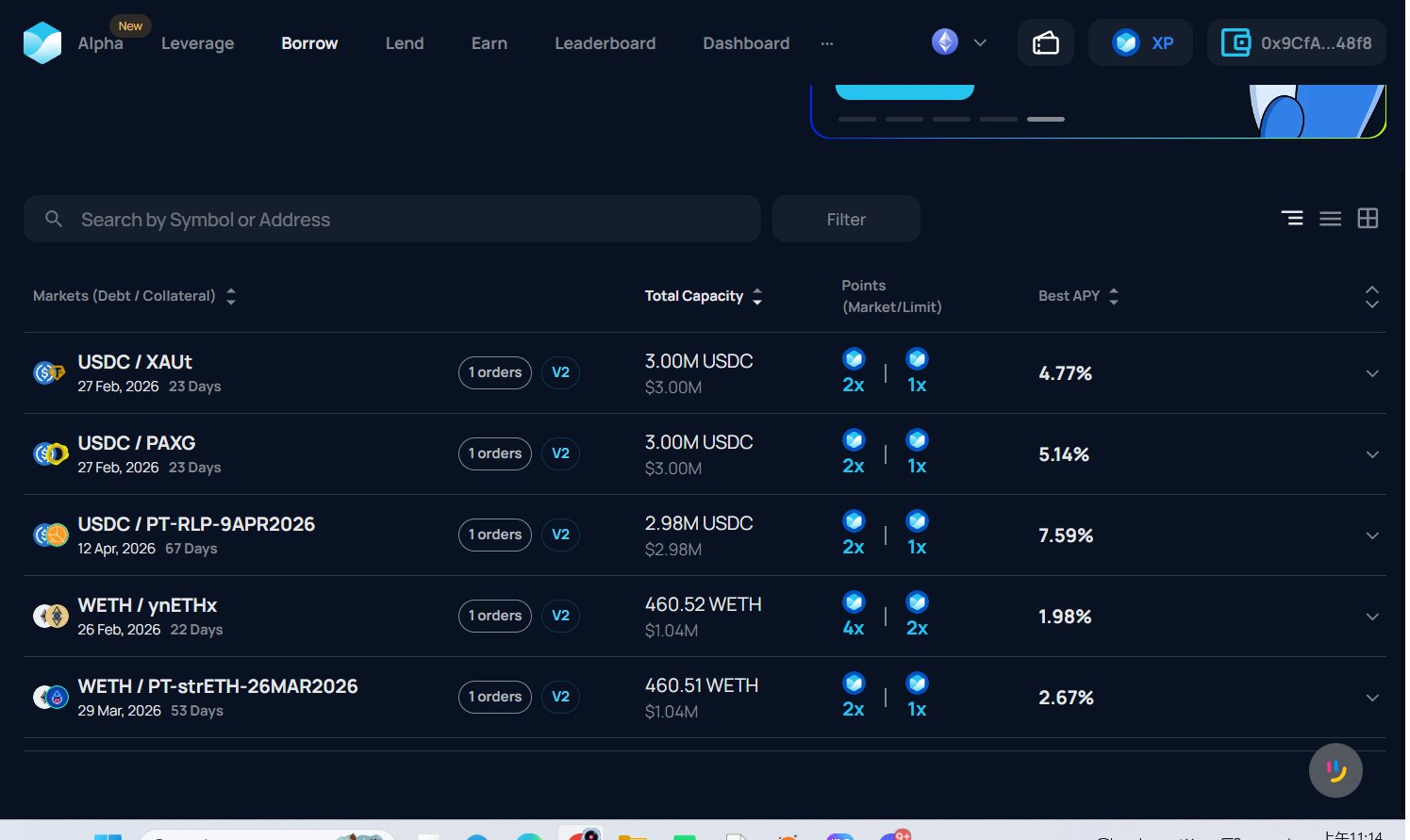

I've recently seen many friends using TermMax

— a fixed-rate lending protocol

So I also took some time to study it~~

First, about fixed rates:

Actually, Aave had a “fixed-rate” feature in its early V1 version

The quotes are because Aave’s lending pool is liquidity-matched, i.e., a peer‑to‑peer pool without a borrowing term

Thus its fixed rate also needs rebalancing; it is a relatively stable rate over a period, not an absolutely constant rate, which can easily lead to user misunderstandings and other inconveniences

When this feature reached V3, it was removed due to potential risks that entangled many assets

Currently, the benchmark fixed‑rate protocol is naturally Pendle

Pendle’s SY = PT + YT, and its innovative liquidity provisioning using SY/PT V3 pools can be compared to Uniswap’s X * Y = K market‑making model, a remarkable presence especially in the post‑DeFi era where RWA-driven on‑chain rates are becoming increasingly complex

——————————Divider——————————

TermMax adopts part of Pendle’s model

It first creates an NFT (GT token) to record the ledger, i.e., the collateral and the corresponding debt issued, and locks the collateral

Then it generates an FT token, akin to an IOU that promises to pay XXX at a future maturity. However, this note is an ERC‑20 token that can be split and transferred, similar to a one‑year note payable of 1000U; you could now buy it on the secondary market for 800U, which corresponds to a 25% annual yield.

The accrued interest, however, is represented by an XT token in TermMax, which expires to zero at maturity, similar to Pendle’s YT.

Thus the mathematical formula is:

Total Debt = Present Value of FT + Present Value of XT

Note that XT, unlike YT, cannot be traded; its role is to serve as a tool for measuring the present value of FT, for example:

Continuing the example, I used 800U in the TermMax market to purchase this one‑year debt payable of 1000U. The smart contract minted 800FT + 800XT for me.

The 800XT will be automatically swapped by the contract into 200FT.

Holding until maturity, 1000FT can be exchanged for 1000U. This is a guaranteed redemption clause written into the contract, effectively locking the lender’s yield in advance.

The advantage of TermMax’s design is that lenders also enjoy the benefits of a fixed rate, whereas Pendle addresses the certainty of returns on the yield side – a different direction.

TermMax’s whitepaper states that it will support more interest‑bearing assets, such as PT assets, RWA assets, or other DeFi yield assets.

This means that in the future TermMax will become a powerful arbitrage tool between different rates, especially on the institutional side, and also one of the few platforms in our industry that allows shorting rates.

I believe:

The flourishing of RWA on-chain is bound to be both a condition and a result of the development of the DeFi rate‑trading ecosystem, the two

Thanks for watching~

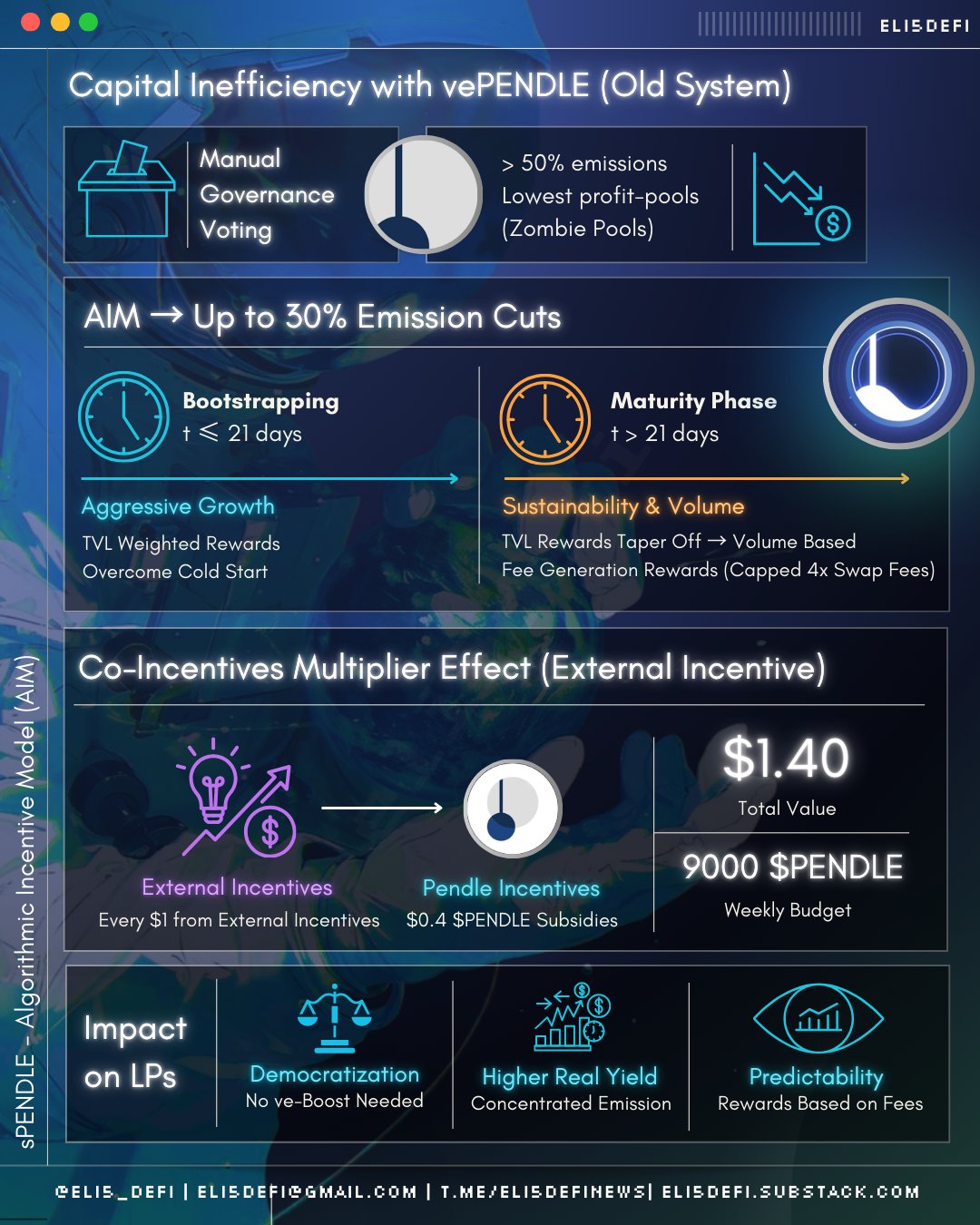

From Manual Voting to Mathematical Meritocracy

Manual governance voting for $PENDLE emissions is dead. Pendle just activated the Algorithmic Incentive Model (AIM), a regime change, not a tweak.

The kicker: 30% emission cuts + higher LP profitability.

Here's how.

—

► The Problem: Capital Inefficiency

Under legacy voting system, 50% of emissions funded the 10 least profitable pools. Liquidity sat in zombie pools, earning rewards without generating volume or fees.

AIM eliminate this by forcing liquidity to justify its existence through measurable activity.

—

► The AIM Engine: Two-Phase Lifecycle

❶ Phase 1: Bootstrapping (t ≤ 21 days)

→ TVL-weighted rewards to overcome cold-start friction

→ New pools earn high emissions just for existing

❷ Phase 2: Maturity (t > 21 days)

→ Training wheels off. Emissions cap at 4x historical swap fees

→ Zombie pools lose rewards. High-volume pools capture the majority

→ No time limit on fee-based rewards. A Day 100 pool earning $7.5k/week is fine if volume justifies