📈 BS Bulletin|#Issue87

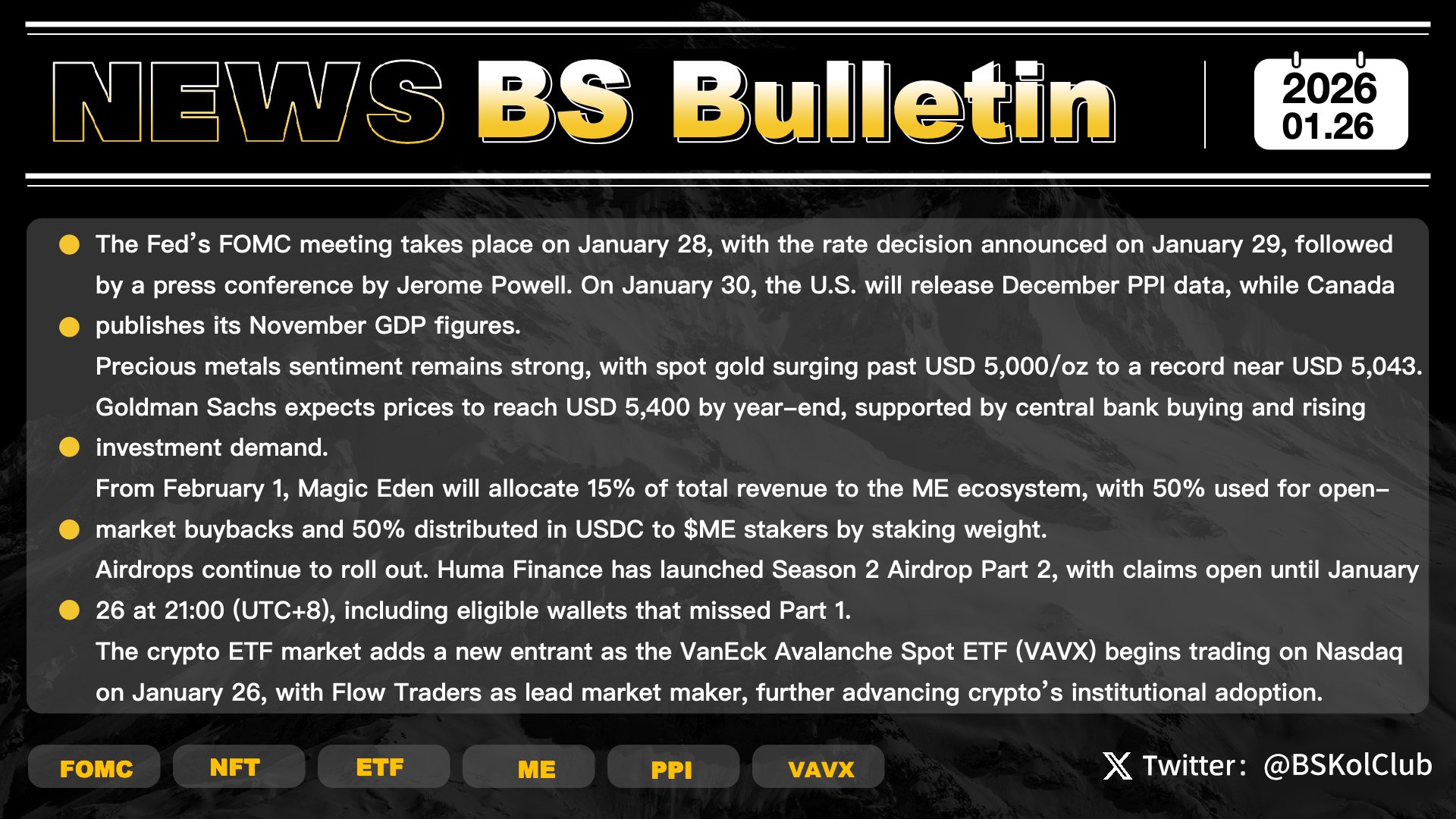

1️⃣ A packed week of macro events. The U.S. Federal Reserve’s FOMC meeting will take place on January 28, with the interest rate decision announced at 3:00 a.m. on January 29, followed by a monetary policy press conference by Jerome Powell. On the evening of January 30, the U.S. will release December PPI data, while Canada will announce November GDP figures.

2️⃣ Precious metals sentiment remains strong. Spot gold surged past USD 5,000/oz, reaching a peak near USD 5,043, a new all-time high. Goldman Sachs expects gold to climb to USD 5,400 by year-end, driven by ongoing central bank buying and rising investment demand, highlighting gold’s safe-haven and allocation value.

3️⃣ NFTs and trading platforms are redirecting value back to native tokens. Starting February 1, Magic Eden will allocate 15% of total platform revenue to the ME ecosystem—half for open-market buybacks and half distributed in USDC to $ME stakers by staking weight—replacing the previous buyback mechanism limited to marketplace revenue.

4️⃣ Airdrops continue to roll out. Huma Finance launched Season 2 Airdrop Part 2, with claiming open until January 26 at 21:00 (UTC+8). Eligible wallets that missed Part 1 can still participate.

5️⃣ The crypto ETF space gains a new member. The VanEck Avalanche Spot ETF (VAVX) will officially start trading on Nasdaq on January 26, with Flow Traders as the lead market maker. Major public blockchain assets continue to be integrated into traditional financial products, further deepening institutional adoption.

#MarketWatch #BTC #ETH #MacroData #Airdrop #Web3 #ETF #VAVX #Huma #ME #FOMC #PPI