@bull_genius what about all these

https://t.co/FPhL0Cuml9 https://t.co/PORORHuJ8w

@bull_genius what about all these

https://t.co/FPhL0Cuml9 https://t.co/PORORHuJ8w

what do we think about alts these days https://t.co/Ag8rx4pqJU

could be looking at a HTF fartcoin (shitcoins in general) generational bottom against BTC

when btc completes aftermath moves of this crash its volatility is likely to die for the next months so traders will go on chain and for alts to find volatility there

filled bag sub 0.20 https://t.co/VEz4Bx0ufZ

LIT

Bitcoin is also rebounding, and LIT is rising together.

An attempt to break $2 is expected next week.

(Not investment advice) https://t.co/Cz2HTN4Nkv

LIT

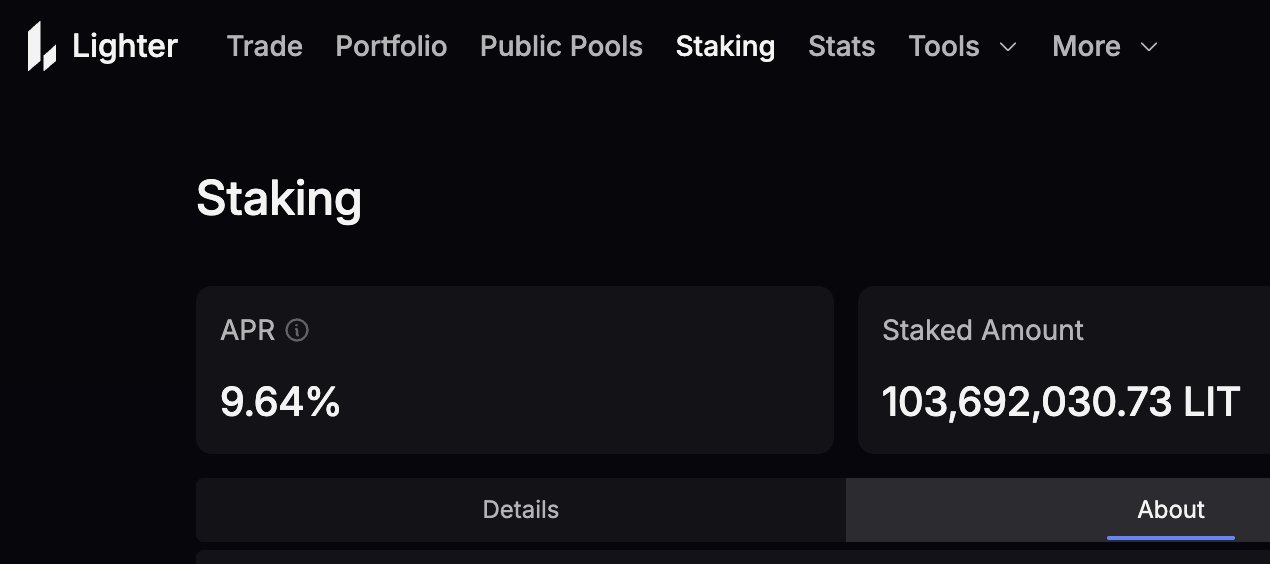

- LIT token currently has 103M being staked.

- More than 40% of the circulating supply is staked.

- Unlocking takes 3 days.

- Staking APR is 9.64%, leading to steady growth.

- The fee structure has been changed to a tiered model proportional to staked amount, expecting increased staking.

- Recent crypto market volatility has led to higher returns and a surge in buyback volume.

- About 2% of the circulating supply has been bought back and buybacks continue.

- If the combined staking and buyback volume exceeds 60%, the price could be positively impacted.

- HYPE also has significant upside; a sharp rise in HYPE could drive a concurrent increase.

( This view is personal and not investment advice. Please make your own investment decisions. )

Enough time has passed to judge whether $LIT is the new $HYPE or not.

Just look at both tokens price action during the first 40 days after TGE:

HYPE: $3.5 → $25 (+614%).

LIT: $2.5 → $1.61 (-36%).

Draw your own conclusions. Maybe the next major “LighterEVM” deployment will change everything.