There's absolutely no reason to ignore this Monad hackathon; just look at the prizes 🦞 https://t.co/LjIaGgEbLN

There's absolutely no reason to ignore this Monad hackathon; just look at the prizes 🦞 https://t.co/LjIaGgEbLN

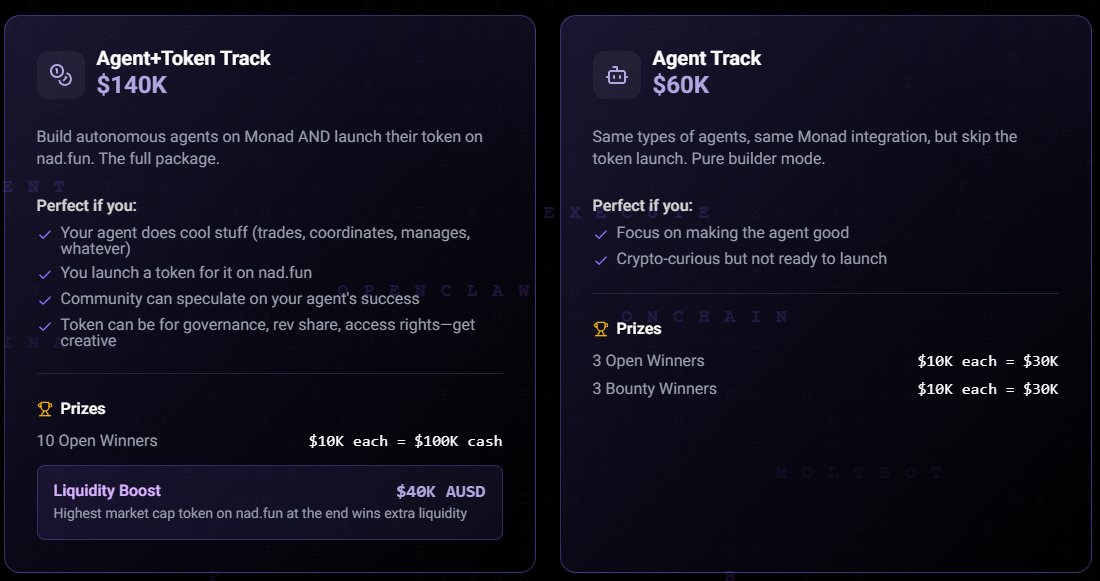

🦞 Moltiverse Hackathon 🦞

A 2-week sprint with $200k in prizes

Brought to you by @monad | @naddotfun | @withAUSD | @paradigm | @dragonfly_xyz | @AttentionX_AI

Let’s see what happens when AI agents can transact at scale, build communities and monetize them

Application below https://t.co/kvb0ppF99n

If you’re managing a small fund or DAO treasury, here’s the cash loop I just spun up with @useTria

1) Park stables in earnAUSD via Tria Earn AUSD is Agora’s digital dollar, 1:1 USD backed, custodied by State Street, managed by VanEck one click, vault lives on Monad but accessible from any chain

2) Keep self-custody for treasury, do card KYC for payables, route expenses through the Tria card

3) Use intent routing to move from any asset → AUSD → spend, no bridging drama

4) Let yield + cashback offset ops while you keep liquidity ready

Tested on my Apple developer fee + cloud credits and it was clean: deposit in one tap, pay online, balances synched without gas guesswork. This is actual cash management, not degen stablecoin hopscotch. DM if you want the walkthrough #stablecoins #treasury #DeFi $AUSD $TRIA

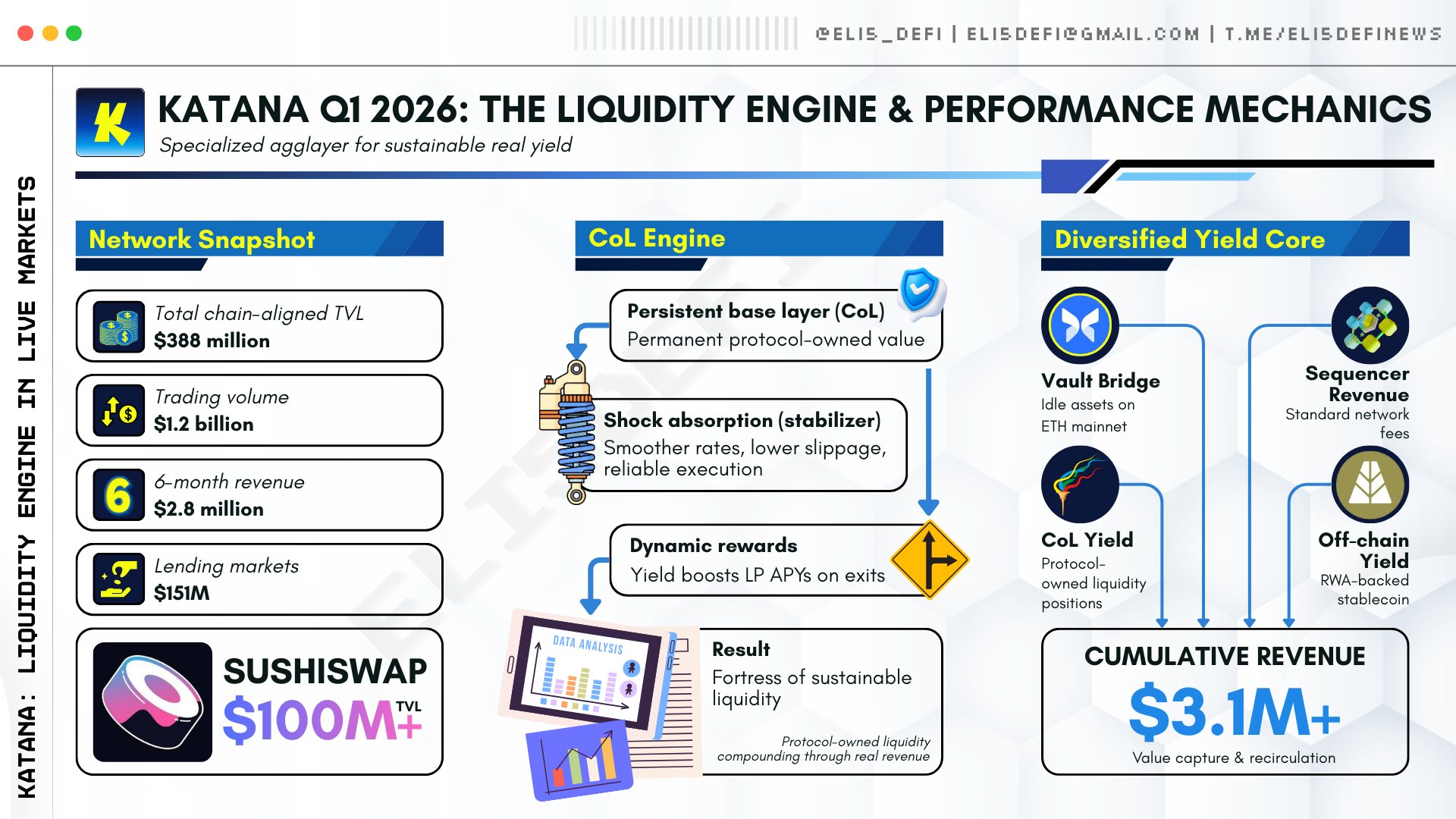

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.