XAG (XAG)

XAG (XAG)

$93.74 +0.22% 24H

- 65Индекс социальных настроений (SSI)- (24h)

- #15Рейтинг пульса рынка (MPR)0

- 1Упоминание в социальных сетях за 24 часа- (24h)

- 100%24-часовой бычий коэффициент лидеров мнений1 активный лидер мнений

- Краткое содержание

- Бычьи сигналы

- Медвежьи сигналы

Индекс социальных настроений (SSI)

- Общие данные65SSI

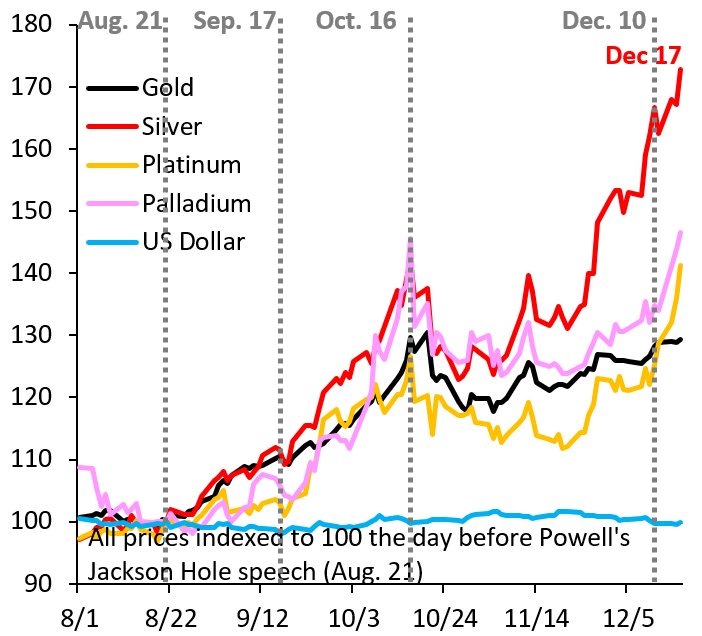

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийЧрезвычайно бычий (100%)Инсайты по SSI

Рейтинг пульса рынка (MPR)

- Инсайт Оповещение

Посты из X

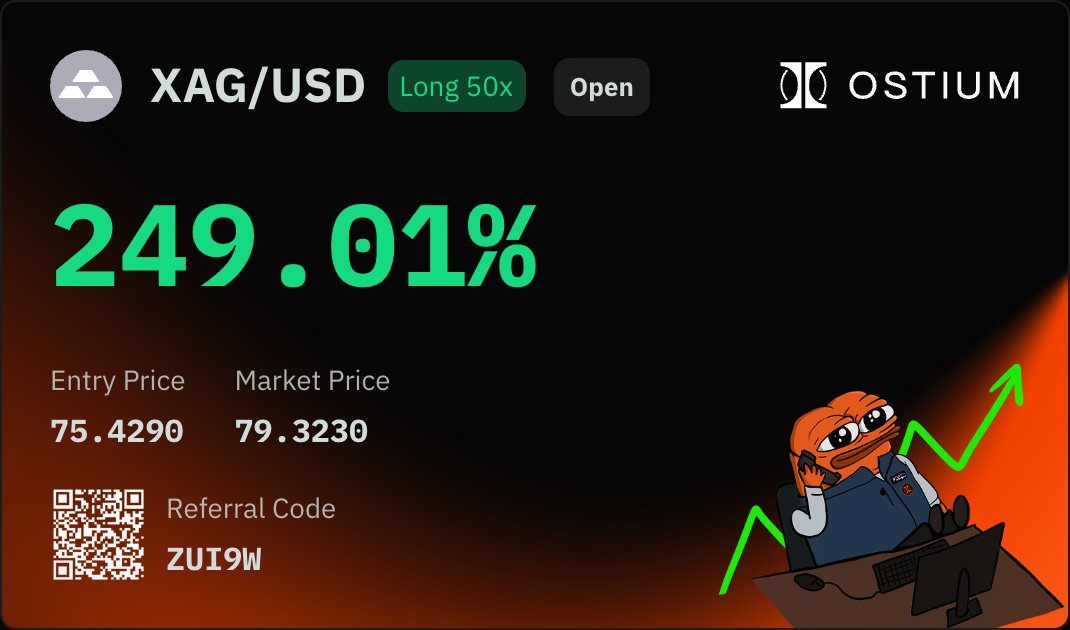

- Тренд XAG после выпускаЧрезвычайно бычий

Bitcoingem TA_Analyst Trader C6.38K @bitcoingem2

Bitcoingem TA_Analyst Trader C6.38K @bitcoingem2 Bitcoingem TA_Analyst Trader C6.38K @bitcoingem2

Bitcoingem TA_Analyst Trader C6.38K @bitcoingem2 2 0 369 Оригинал >Тренд XAG после выпускаЧрезвычайно бычий

2 0 369 Оригинал >Тренд XAG после выпускаЧрезвычайно бычий- Тренд XAG после выпускаНейтрально

- Тренд XAG после выпускаЧрезвычайно бычий

- Тренд XAG после выпускаЧрезвычайно медвежий

- Тренд XAG после выпускаБычий

CupoJOSΞPH 🐌 Founder DeFi_Expert A10.47K @CupOJoseph

CupoJOSΞPH 🐌 Founder DeFi_Expert A10.47K @CupOJoseph

CupoJOSΞPH 🐌 Founder DeFi_Expert A10.47K @CupOJoseph

CupoJOSΞPH 🐌 Founder DeFi_Expert A10.47K @CupOJoseph 25 11 1.11K Оригинал >Тренд XAG после выпускаЧрезвычайно бычий

25 11 1.11K Оригинал >Тренд XAG после выпускаЧрезвычайно бычий- Тренд XAG после выпускаМедвежий

Eralp Büyükaslan TA_Analyst Influencer B60.00K @eralpbuyukaslan

Eralp Büyükaslan TA_Analyst Influencer B60.00K @eralpbuyukaslan

Robin Brooks D359.83K @robin_j_brooks

Robin Brooks D359.83K @robin_j_brooks 57 5 6.68K Оригинал >Тренд XAG после выпускаМедвежий

57 5 6.68K Оригинал >Тренд XAG после выпускаМедвежий ฿LUE WHALΞ TA_Analyst Trader S6.60K @BTCBlueWhale

฿LUE WHALΞ TA_Analyst Trader S6.60K @BTCBlueWhale

฿LUE WHALΞ TA_Analyst Trader S6.60K @BTCBlueWhale

฿LUE WHALΞ TA_Analyst Trader S6.60K @BTCBlueWhale 105 9 3.81K Оригинал >Тренд XAG после выпускаЧрезвычайно бычий

105 9 3.81K Оригинал >Тренд XAG после выпускаЧрезвычайно бычий