Ondo (ONDO)

Ondo (ONDO)

$0.2532 -5.52% 24H

- 34Индекс социальных настроений (SSI)-15.22% (24h)

- #92Рейтинг пульса рынка (MPR)+26

- 1Упоминание в социальных сетях за 24 часа-80.00% (24h)

- 100%24-часовой бычий коэффициент лидеров мнений1 активный лидер мнений

- Краткое содержание

- Бычьи сигналы

- Медвежьи сигналы

Индекс социальных настроений (SSI)

- Общие данные34SSI

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийЧрезвычайно бычий (100%)Инсайты по SSI

Рейтинг пульса рынка (MPR)

- Инсайт Оповещение

Посты из X

- Тренд ONDO после выпускаЧрезвычайно бычий

- Тренд ONDO после выпускаМедвежий

- Тренд ONDO после выпускаБычий

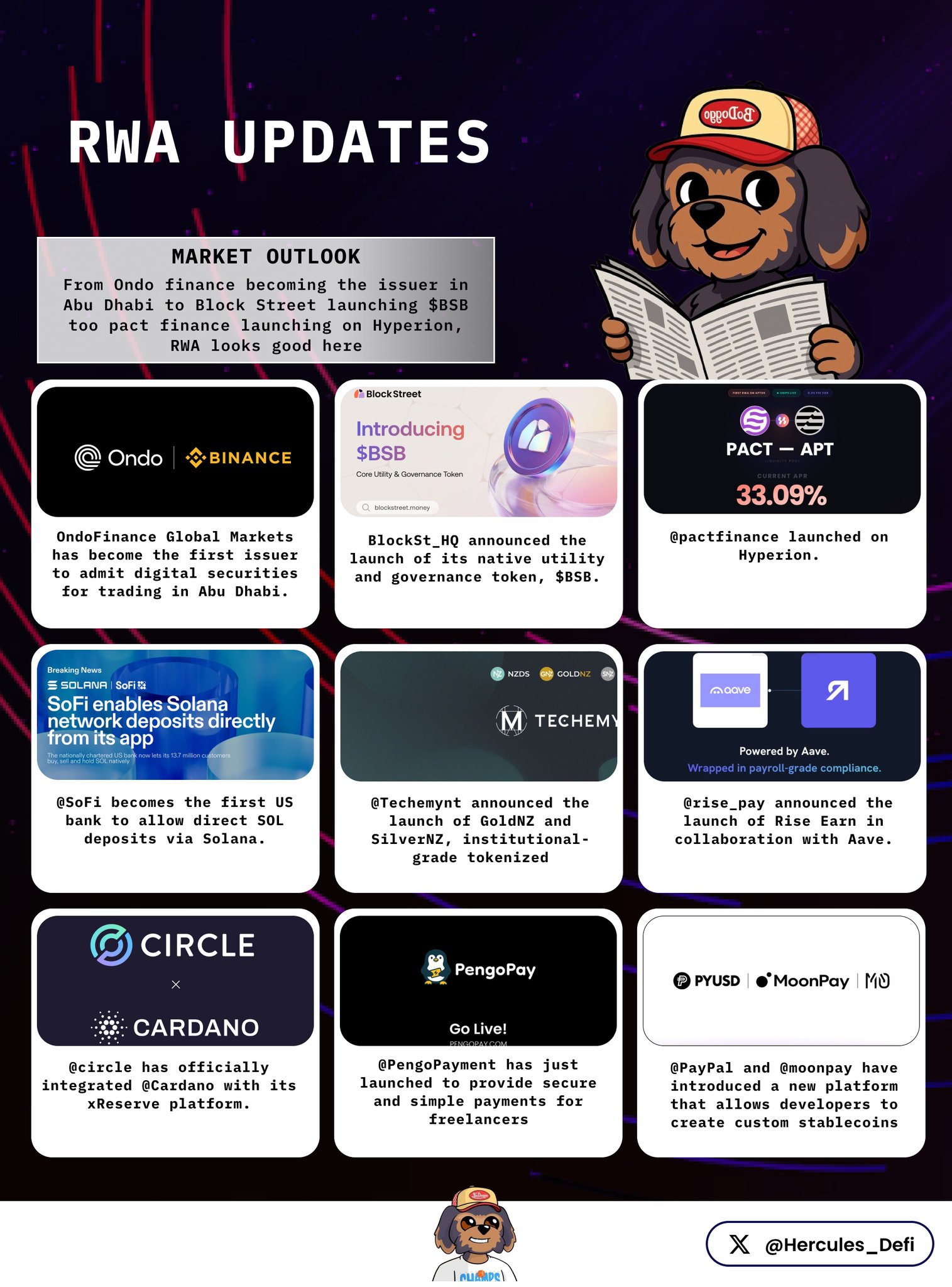

Hercules | DeFi DeFi_Expert Educator C46.69K @Hercules_Defi

Hercules | DeFi DeFi_Expert Educator C46.69K @Hercules_Defi Hercules | DeFi DeFi_Expert Educator C46.69K @Hercules_Defi

Hercules | DeFi DeFi_Expert Educator C46.69K @Hercules_Defi 83 19 8.52K Оригинал >Тренд ONDO после выпускаБычий

83 19 8.52K Оригинал >Тренд ONDO после выпускаБычий- Тренд ONDO после выпускаБычий

- Тренд ONDO после выпускаЧрезвычайно бычий

- Тренд ONDO после выпускаМедвежий

Ondo Finance Founder Regulatory_Expert B361.68K @OndoFinance

Ondo Finance Founder Regulatory_Expert B361.68K @OndoFinance MyEtherWallet | MEW D124.43K @myetherwallet

MyEtherWallet | MEW D124.43K @myetherwallet 64 12 9.33K Оригинал >Тренд ONDO после выпускаБычий

64 12 9.33K Оригинал >Тренд ONDO после выпускаБычий- Тренд ONDO после выпускаБычий

Digital Perspectives Influencer Community_Lead B205.57K @DigPerspectives

Digital Perspectives Influencer Community_Lead B205.57K @DigPerspectives CoinDesk Media Influencer D3.46M @CoinDesk

CoinDesk Media Influencer D3.46M @CoinDesk

1.45K 69 92.77K Оригинал >Тренд ONDO после выпускаБычий

1.45K 69 92.77K Оригинал >Тренд ONDO после выпускаБычий