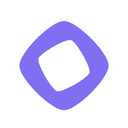

Monad (MON)

Monad (MON)

$0.02193 +1.48% 24H

- 54Индекс социальных настроений (SSI)+28.64% (24h)

- #54Рейтинг пульса рынка (MPR)+60

- 3Упоминание в социальных сетях за 24 часа+50.00% (24h)

- 100%24-часовой бычий коэффициент лидеров мнений3 активный лидер мнений

- Краткое содержание

- Бычьи сигналы

- Медвежьи сигналы

Индекс социальных настроений (SSI)

- Общие данные54SSI

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийЧрезвычайно бычий (33%)Бычий (67%)Инсайты по SSI

Рейтинг пульса рынка (MPR)

- Инсайт Оповещение

Посты из X

Otbills Trader TA_Analyst B2.12K @DeraOt_

Otbills Trader TA_Analyst B2.12K @DeraOt_

Otbills Trader TA_Analyst B2.12K @DeraOt_6 2 456 Оригинал >Тренд MON после выпускаБычий

Otbills Trader TA_Analyst B2.12K @DeraOt_6 2 456 Оригинал >Тренд MON после выпускаБычий- Тренд MON после выпускаБычий

- Тренд MON после выпускаЧрезвычайно бычий

- Тренд MON после выпускаБычий

- Тренд MON после выпускаНейтрально

- Тренд MON после выпускаБычий

- Тренд MON после выпускаБычий

- Тренд MON после выпускаБычий

- Тренд MON после выпускаЧрезвычайно бычий

Rhic Founder Community_Lead B3.42K @0xRhic

Rhic Founder Community_Lead B3.42K @0xRhic Rug Rumble (mainnet arc) D33.75K @RugRumble12 0 189 Оригинал >Тренд MON после выпускаБычий

Rug Rumble (mainnet arc) D33.75K @RugRumble12 0 189 Оригинал >Тренд MON после выпускаБычий