Injective Protocol (INJ)

Injective Protocol (INJ)

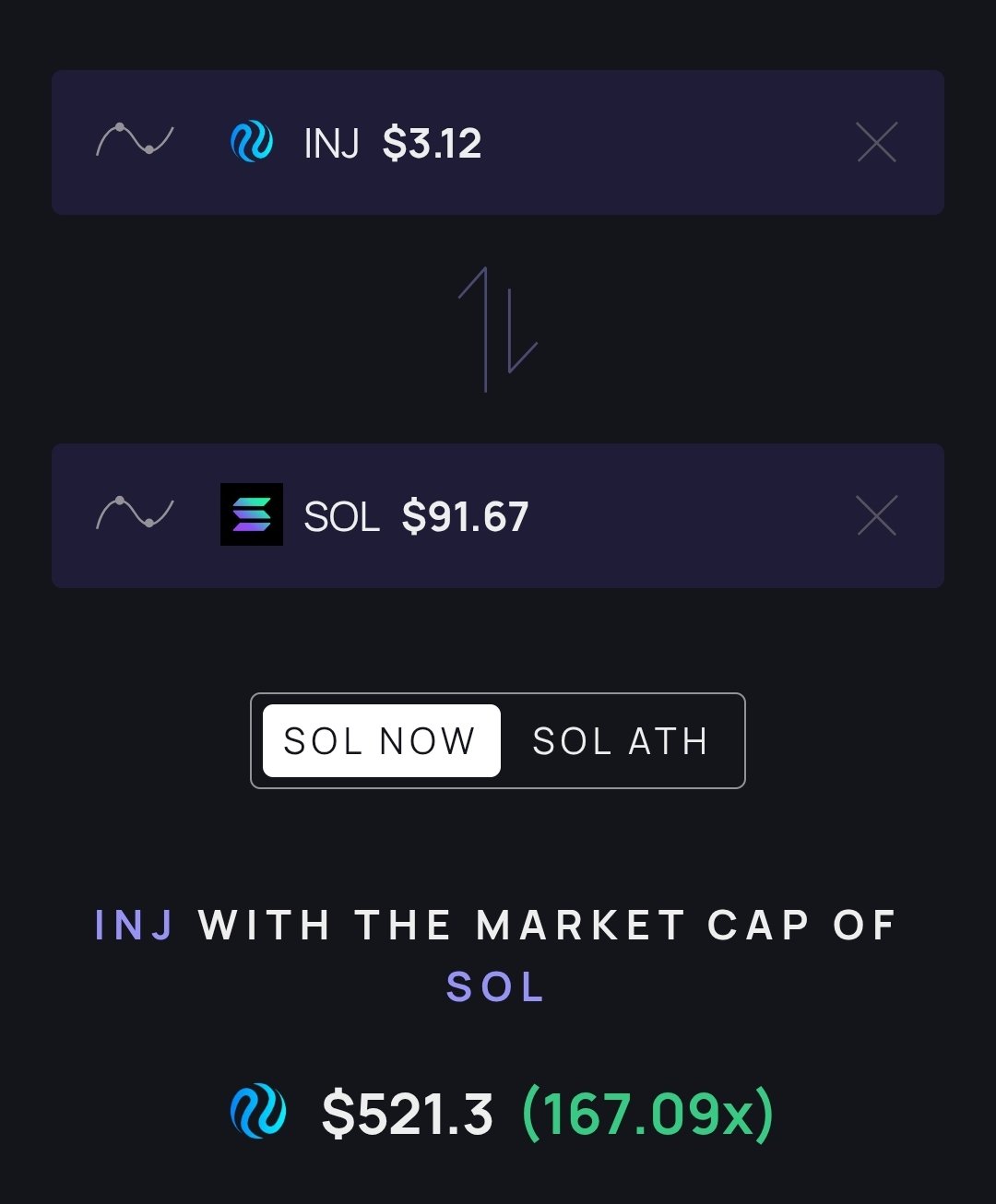

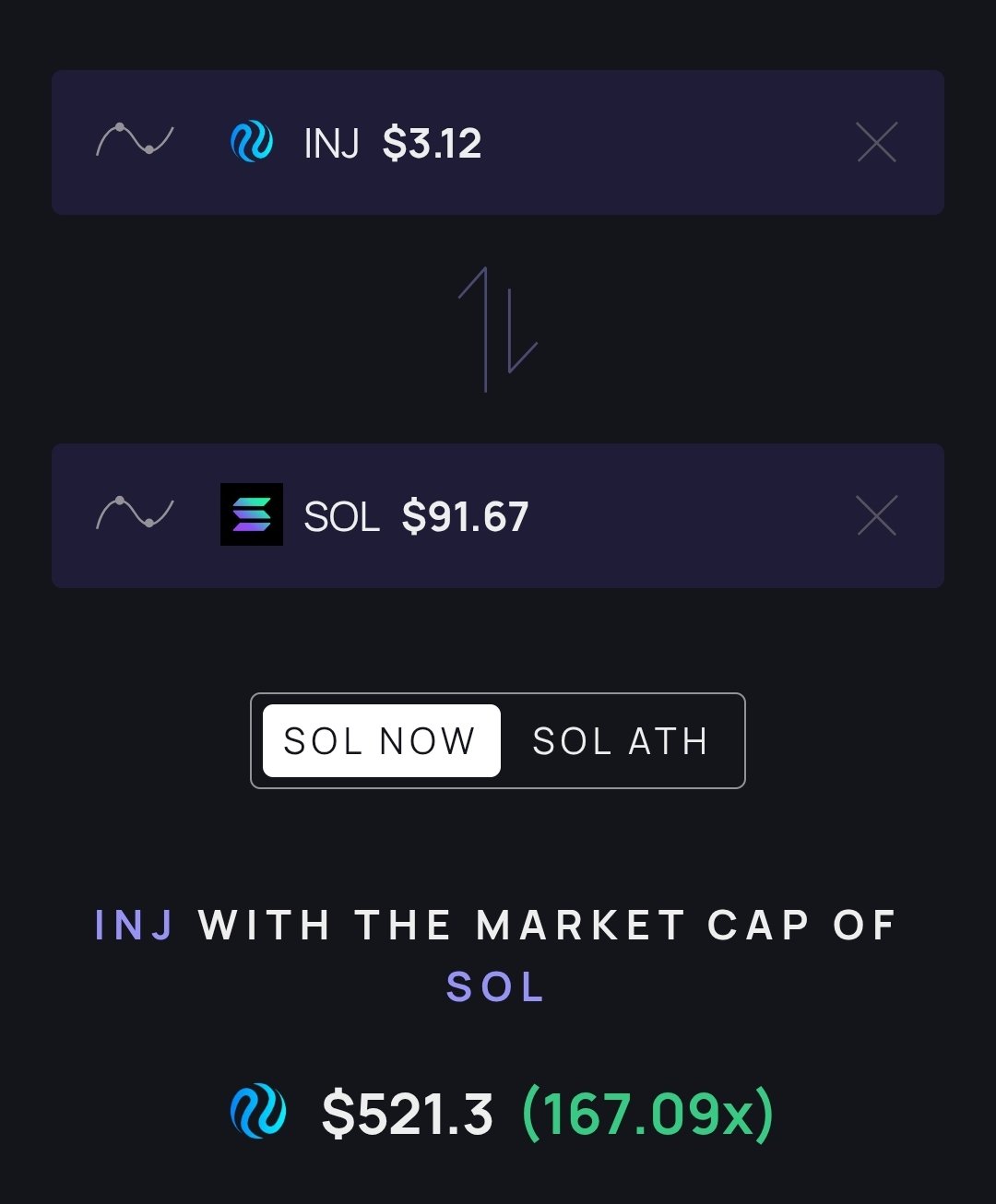

$2.887 -4.85% 24H

- 43Индекс социальных настроений (SSI)-46.05% (24h)

- #110Рейтинг пульса рынка (MPR)-95

- 5Упоминание в социальных сетях за 24 часа-61.54% (24h)

- 80%24-часовой бычий коэффициент лидеров мнений5 активный лидер мнений

- Краткое содержание

- Бычьи сигналы

- Медвежьи сигналы

Индекс социальных настроений (SSI)

- Общие данные43SSI

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийЧрезвычайно бычий (40%)Бычий (40%)Нейтрально (20%)Инсайты по SSI

Рейтинг пульса рынка (MPR)

- Инсайт Оповещение

Посты из X

- Тренд INJ после выпускаНейтрально

- Тренд INJ после выпускаБычий

Cointelegraph Media Influencer C2.90M @Cointelegraph

Cointelegraph Media Influencer C2.90M @Cointelegraph Cointelegraph Decentralization Guardians D30 @CTDG_DevHub

Cointelegraph Decentralization Guardians D30 @CTDG_DevHub 92 9 10.63K Оригинал >Тренд INJ после выпускаБычий

92 9 10.63K Оригинал >Тренд INJ после выпускаБычий- Тренд INJ после выпускаЧрезвычайно бычий

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey 102 14 3.55K Оригинал >Тренд INJ после выпускаЧрезвычайно бычий

102 14 3.55K Оригинал >Тренд INJ после выпускаЧрезвычайно бычий Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey 102 14 3.55K Оригинал >Тренд INJ после выпускаЧрезвычайно бычий

102 14 3.55K Оригинал >Тренд INJ после выпускаЧрезвычайно бычий IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay 115 18 5.29K Оригинал >Тренд INJ после выпускаЧрезвычайно бычий

115 18 5.29K Оригинал >Тренд INJ после выпускаЧрезвычайно бычий Cointelegraph Media Influencer C2.90M @Cointelegraph

Cointelegraph Media Influencer C2.90M @Cointelegraph Cointelegraph Decentralization Guardians D30 @CTDG_DevHub

Cointelegraph Decentralization Guardians D30 @CTDG_DevHub 95 8 13.45K Оригинал >Тренд INJ после выпускаБычий

95 8 13.45K Оригинал >Тренд INJ после выпускаБычий IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay 115 18 5.29K Оригинал >Тренд INJ после выпускаЧрезвычайно бычий

115 18 5.29K Оригинал >Тренд INJ после выпускаЧрезвычайно бычий- Тренд INJ после выпускаЧрезвычайно бычий