Drift protocol (DRIFT)

Drift protocol (DRIFT)

- 71Индекс социальных настроений (SSI)- (24h)

- #3Рейтинг пульса рынка (MPR)0

- 1Упоминание в социальных сетях за 24 часа- (24h)

- 100%24-часовой бычий коэффициент лидеров мнений1 активный лидер мнений

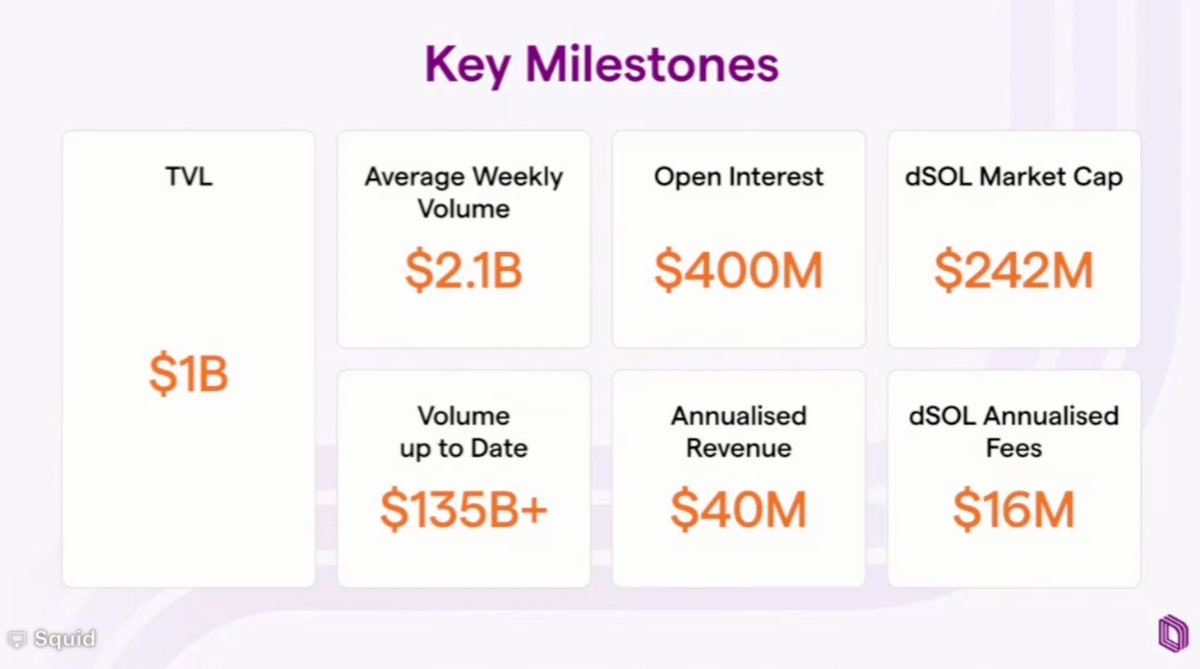

- Краткое содержаниеDRIFT released v3, offering 10× faster execution, instant take-profit/stop-loss, gas-free, with cumulative $135B trading volume, competing with Binance; 24h price down 2.55%.

- Бычьи сигналы

- v3 10× fast execution

- Instant risk control

- Gas-free trading

- $135B cumulative trading volume

- Competing with Binance

- Медвежьи сигналы

- Price down 2.55% in 24h

- Market competition is intense

- Unverified risk of the new version

- Liquidity remains limited

- Investors taking profits

Индекс социальных настроений (SSI)

- Общие данные71SSI

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийЧрезвычайно бычий (100%)Инсайты по SSIDRIFT social hotness 71/100, activity 40/40, sentiment full score 30/30, driven by v3 tenfold execution and gas-free boosting heat, KOL attention remains low at only 1/30.

Рейтинг пульса рынка (MPR)

- Инсайт ОповещениеDRIFT warning rank #3, social abnormality 100, sentiment polarization 100 indicate extreme sentiment polarity, linked to price drop of 2.55% after v3 launch and heightened competition.

Посты из X

arndxt OnChain_Analyst Educator B46.73K @arndxt_xo

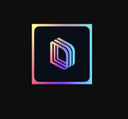

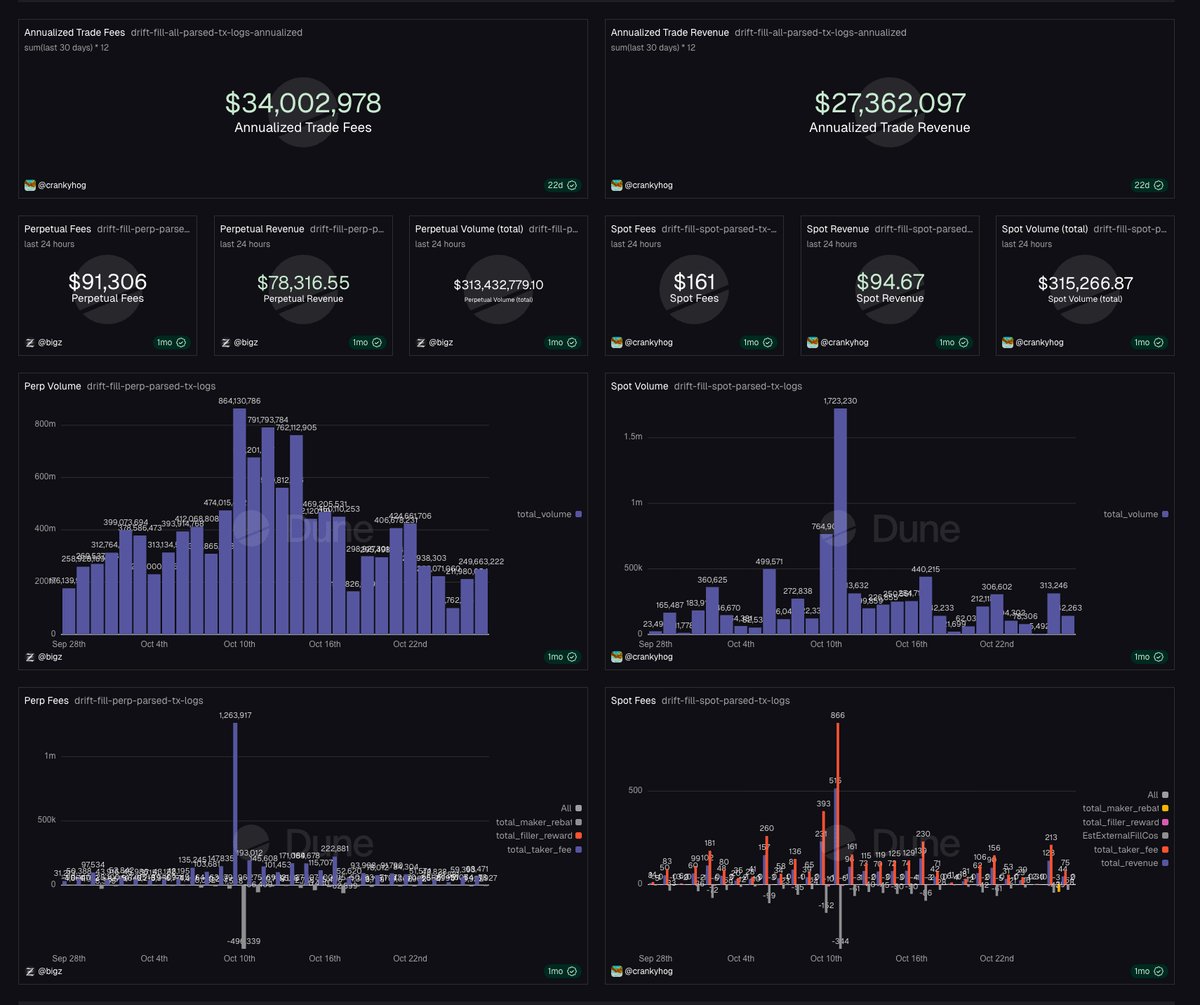

arndxt OnChain_Analyst Educator B46.73K @arndxt_xoif you listened to their latest townhall, one of the most OG perps on solana is making over $40m in revenue is launching their v3 most people are sleeping on this. @DriftProtocol been grinding for 3+ years, $135B in volume, $1B TVL, $42M in revenue. they're the only cross-collateral perp DEX running 47 assets as collateral across 52 pairs. what excites me is their v3, basically positioning to compete against @binance, and their v3 launches just when binance blockchain week is happening just right before @SolanaConf. over the past year, $DRIFT has evolved in three critical areas: • execution speed • liquidity depth • trader experience breaking down the key notes in their townhall 👇 here is what Drift v3 promises to deliver: - 10× faster fills: 85% of market orders execute within the same Solana slot (~400ms). - instant risk controls: TP/SL triggers improved from ~6s to ~0.4s on majors - gasless by default: no per‑trade gas fees eating into PnL. - scales with Solana: more throughput = Drift auto‑gets faster. liquidity would also improve: - 10× lower slippage: market impact on size cut from ~20 bps → ~2 bps. - tighter TP/SL execution: 4–5× better pricing accuracy across majors and long‑tail markets. - DLP (Drift Liquidity Provider): community‑funded liquidity for perps + spot; profit‑sharing pool launching Q1 2026. - expanded MM program: long‑tail alts now have spreads and depth comparable to majors. - @jito_sol BAM integration (coming): enforced cancel‑before‑take protects MMs from toxic flow, enabling tighter spreads and deeper books. @cindyleowtt also mentioned that they will have DLP in Q1 2026: - Drift Liquidity Pool becomes the counterparty to every perp position. LPs earn trading fees directly. - development is done, testing phase now. - watched GLP scaled to $500M+ and create a flywheel that made @GMX_IO $GMX unstoppable. - DLP is that model but with better capital efficiency because of Drift's multi‑collateral system. more assets = higher utilization = more yield = more TVL. - the flywheel becomes active interesting thing is that mobile app is mentioned Q1 2026 - Drift's mobile app is going to be the first for a perp dex on $SOL - this is the largest distribution unlock looking at the success of @edgeX_exchange's mobile app. desktop‑only is a ceiling. - mobile is how you go from $1B TVL to $10B. retail can't access Drift from their phone right now, this will change in 90 days. - i think this will 5-10xs user acquisition immediately.

22 13 595 Оригинал >Тренд DRIFT после выпускаЧрезвычайно бычийThe Drift Protocol v3 upgrade significantly improves performance and plans to launch a mobile app and DLP, promising substantial growth.

22 13 595 Оригинал >Тренд DRIFT после выпускаЧрезвычайно бычийThe Drift Protocol v3 upgrade significantly improves performance and plans to launch a mobile app and DLP, promising substantial growth. CryptoJournaal Media Educator C18.60K @CryptoJournaal

CryptoJournaal Media Educator C18.60K @CryptoJournaal#Roadmap 🇳🇱 #Drift ( $DRIFT ) — Complete Roadmap 🧵 From a high-performance DeFi trading experiment to a fully community-driven protocol on Solana, #Drift has developed rapidly. Here is the full journey: Past → Present → Future #CryptoRoadmap 📜 Past: Development & Launch Drift Protocol began as a decentralized exchange on Solana, aiming to enable seamless trading of perpetual futures, spot trading, and yield opportunities, while maintaining non-custodial control and transparency. Key milestones: 🔹 Early development phase The founding team, led by David Lu and Cindy Leow, established the core principles for cross-margined perpetual futures with a virtual AMM (vAMM) for decentralized price discovery; devnet launched for initial tests. 🔹 Mainnet launch In October 2021, a limited NFT-gated mainnet release followed for early testers, followed by a public release in December; perpetuals with leverage became available, supported by a dynamic AMM (dAMM) with just-in-time liquidity mechanisms. 🔹 Protocol evolution 2022 marked the introduction of V2, integrating spot trading, lending and borrowing, passive liquidity provision, staking in the insurance fund, and open-source community contributions. 🔹 Security & Governance 2023–2024: stress tests led to improved security measures; launch of the DRIFT governance token and multi-branch DAO structure (Realms DAO, Security Council, Futarchy DAO); token airdrops and the FUEL loyalty program rewarded traders, LPs, and contributors. Impact: Drift established itself as a leading DeFi protocol on Solana, supported by audits from top firms and prominent investors, with a focus on transparency, security, and community-driven development. #DriftHistory ⚡ Present: Current status & developments Drift today operates as a mature, community-driven platform with a focus on technical refinement and ecosystem expansion. Ecosystem expansion: Governance via the Drift DAO enables token holders to vote on protocol upgrades, risk parameters, new markets, and treasury allocations. The Security Council coordinates rapid responses to market changes. Swift Protocol optimizes execution speed, reduces slippage, and enables gas-free trades. Technical advancements: Collateral options include syrupUSDC and CASH, isolated perpetuals with custom leverage per market, and advanced AMM functionalities. Drift Vaults, BET on DRIFT prediction markets, and dSol liquid staking offer diverse yield opportunities. Partnerships & incentives: Integrations with wallets like Phantom and Solflare facilitate onboarding; collaborations with trading firms and market makers strengthen liquidity. Builder Codes (DBC) reward developers for routing trades, while the Ambassador Program engages creators and community-builders. Governance & revenue: Protocol revenues flow to the DAO treasury, with proposals such as DIP-9 for buybacks; mobile UX improvements increase accessibility. #DriftNow #SolanaDeFi 🚀 Future: Planned roadmap (2025–2030+) Drift aims to become a fully integrated “DeFi super protocol,” uniting trading, lending, and yield products across multiple financial primitives. Key roadmap directions: 🔹 V3 launch New liquidity source via Drift Liquidity Provider (DLP) tokens, improved order books, compute-optimized oracles, take-profit/stop-loss functionalities, and isolated sub-account perpetuals. 🔹 Asset expansion From 2026–2027: integration of tokenized assets, options trading, synthetic commodities, and traditional assets; cross-chain bridges increase composability. 🔹 Ecosystem grants Builder Fund finances mobile frontends and ecosystem projects; the FUEL program evolves with seasonal campaigns for long-term community engagement. 🔹 Long-term vision By 2028–2030+: Drift aims for dominance as a full DeFi prime brokerage with advanced vaults, prediction markets, and RWA integrations. Futarchy mechanisms optimize DAO governance and scalability via Solana upgrades, with the goal of providing a centralized, permissionless, and transparent trading experience for both retail and institutional users. Impact: Integrated DeFi access, advanced risk management, improved yield opportunities, and a community-driven ecosystem that grows with Solana’s infrastructure. #DriftFuture #SolanaScaling ✅ Conclusion Drift has evolved from an innovative on-chain derivatives start-up to an advanced, community-driven DeFi ecosystem. With features such as Swift Protocol, Drift Vaults, liquid staking, advanced governance, and cross-chain composability, $DRIFT strengthens Solana as a leading platform for decentralized financial innovation. #RoadmapConclusion 🛒 Want to buy $DRIFT yourself? $DRIFT is easy to buy on #Bitvavo: ✅ More than 400 #Altcoins available ✅ Up to €100,000 #Accountguarantee ✅ Registered with De Nederlandsche Bank (#DNB) ✅ Sign up via the link below and trade up to €10,000 completely #Free! 🔗 https://t.co/DThEHyXfzf #CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange 📚 Useful resources and additional information Want to know more about #Drift ( $DRIFT )? Check out the official channels and documentation below: 🔹Discord: https://t.co/5o5oSTSGD0 🔹Website: https://t.co/Q6fFrrIQOn 🔹X (Twitter): https://t.co/Z5DN2B5hES ⚠️ Important note: 🔹 This post is purely for educational purposes and not financial advice! 🔹 Only invest what you are willing to lose! ----------------- 👇Follow us👇 ----------------- 🚨 Follow @CryptoJournaal – the place for independent crypto information: 📰 News | 📊 Facts | 🧠 Backgrounds | 🎓 Education 💬 No sponsored tokens 📜 Fully MiCAR-compliant 🔍 Always knowledge over hype 📲 Join via: 🌐 Website: https://t.co/i0eHsaqt3O 📘 Facebook: https://t.co/he5bTXLFXR 💬 Telegram: https://t.co/i976fBvtv0 👥 CryptoJournaal-AltcoinPedia Community: https://t.co/3yFdzLLS2O 🐦 X-profile: https://t.co/fd2bI2MInh #Altcoins #Bitcoin #CryptoNews #CryptoEducation #CryptoRates

2 0 100 Оригинал >Тренд DRIFT после выпускаБычийDrift Protocol releases a comprehensive roadmap, aiming to become the leading DeFi super protocol on Solana.

2 0 100 Оригинал >Тренд DRIFT после выпускаБычийDrift Protocol releases a comprehensive roadmap, aiming to become the leading DeFi super protocol on Solana. CryptoJournaal Media Educator C18.60K @CryptoJournaal

CryptoJournaal Media Educator C18.60K @CryptoJournaal#Roadmap 🇬🇧 #Drift ( $DRIFT ) — Complete Roadmap 🧵 From a high-performance DeFi trading experiment to a fully community-driven Solana-based protocol, #Drift has evolved remarkably fast. Here’s the complete journey: Past → Present → Future #CryptoRoadmap 📜 Past: Development & Launch Drift Protocol started as a decentralized exchange on Solana with the goal of enabling seamless trading of perpetual futures, spot markets, and yield opportunities while maintaining non-custodial control and transparency. Key Milestones: 🔹 Early Development Phase Founding team led by David Lu and Cindy Leow establishes core principles for cross-margined perpetual futures with a virtual AMM (vAMM) for decentralized price discovery; initial devnet released for testing. 🔹 Mainnet Launch October 2021 saw a limited NFT-gated mainnet launch for early testers, followed by a public release in December; perpetuals with leverage become available, supported by dynamic AMM (dAMM) with just-in-time liquidity mechanisms. 🔹 Protocol Evolution 2022 marks the introduction of V2, integrating spot trading, borrowing/lending, passive liquidity provision, insurance fund staking, and open-source community contributions. 🔹 Security & Governance Enhancements 2023–2024: market stress tests lead to enhanced security measures; launch of the DRIFT governance token and multi-branch DAO structure (Realms DAO, Security Council, Futarchy DAO); token airdrops and the FUEL loyalty program reward traders, LPs, and contributors. Impact: Drift establishes itself as a leading DeFi protocol on Solana, audited by top firms and supported by prominent investors, emphasizing transparency, security, and community-driven development. #DriftHistory ⚡ Present: Current Status & Developments Drift today operates as a mature, community-led platform with a focus on technical refinement and ecosystem expansion. Ecosystem Expansion: Governance via the Drift DAO allows token holders to vote on protocol upgrades, risk parameters, new markets, and treasury allocation. Security Council manages rapid responses to market conditions. Swift Protocol optimizes execution speed, reduces slippage, and enables gasless trades. Technical Progress: Collateral options include syrupUSDC and CASH, isolated perps with custom leverage per market, and advanced AMM features. Drift Vaults, BET on DRIFT prediction markets, and dSol liquid staking provide diverse yield opportunities. Partnerships & Incentives: Integrations with Phantom and Solflare wallets simplify onboarding; collaborations with trading firms and market makers enhance liquidity. Builder Codes (DBC) reward developers for routing trades, and the Ambassador Program engages creators and community builders. Governance & Revenue: Protocol revenue flows into the DAO treasury, with proposals like DIP-9 for buybacks, while mobile UX improvements broaden accessibility. #DriftNow #SolanaDeFi 🚀 Future: Planned Roadmap (2025–2030+) Drift aims to become a comprehensive “DeFi super protocol,” unifying trading, lending, and yield products across multiple primitives. Key Roadmap Directions: 🔹 V3 Launch New liquidity via Drift Liquidity Provider (DLP) tokens, improved order books, compute-optimized oracles, take-profit/stop-loss features, and isolated sub-account perps. 🔹 Asset Expansion From 2026–2027, tokenized assets, options trading, synthetic commodities, and traditional assets are integrated; cross-chain bridges increase composability. 🔹 Ecosystem Grants Builder Fund finances mobile frontends and ecosystem projects; FUEL program evolves with seasonal campaigns for sustained community engagement. 🔹 Long-Term Vision By 2028–2030+, Drift seeks to dominate as a full-service DeFi prime brokerage with advanced vaults, prediction markets, and RWA integrations. Futarchy mechanisms optimize DAO governance and scalability via Solana upgrades, aiming for a centralized, permissionless, transparent trading experience for retail and institutional users alike. Impact: Unified DeFi access, advanced risk management, enhanced yield opportunities, and a community-governed ecosystem that scales with Solana’s infrastructure. #DriftFuture #SolanaScaling ✅ Conclusion Drift has evolved from an innovative on-chain derivatives project into a sophisticated, community-driven DeFi ecosystem. With features like Swift Protocol, Drift Vaults, liquid staking, advanced governance, and cross-chain composability, $DRIFT strengthens Solana’s position as a leading platform for decentralized finance innovation. #RoadmapConclusion 🛒 Want to trade $DRIFT on #WEEX? WEEX is a global #Exchange where you can easily start trading crypto and futures: ✅ Access to 1,700+ #Altcoins ✅ Up to $30,000 USDT in #Bonuses for new users ✅ User-friendly app & web platform ✅ Trusted exchange with millions of traders worldwide 👉 Sign up now via the link below and claim your welcome bonus! 🔗 https://t.co/q8pSdzpIh8 #CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange #Futures ⚠️ Important Note: 🔹 This post is for educational purposes only and not financial advice! 🔹 Only invest what you are willing to lose! 📚 Useful resources and additional information: Want to dive deeper into the world of #Drift ( $DRIFT ) or looking for the latest updates and developments? These links will help you stay up to date: 🔹Discord: https://t.co/5o5oSTSGD0 🔹Website: https://t.co/Q6fFrrIQOn 🔹X (Twitter): https://t.co/Z5DN2B5hES ----------------- 👇Follow us👇 ----------------- 🚨 Follow @CryptoJournaal – the go-to source for independent crypto information: 📰 News | 📊 Facts | 🧠 Insights | 🎓 Education 💬 No sponsored tokens 📜 Fully MiCAR-compliant 🔍 Knowledge over hype, always 📲 Join via: 🌐 Website: https://t.co/i0eHsaqt3O 📘 Facebook: https://t.co/he5bTXLFXR 💬 Telegram: https://t.co/i976fBvtv0 👥 CryptoJournaal-AltcoinPedia Community: https://t.co/3yFdzLLS2O 🐦 X-profiel: https://t.co/fd2bI2MInh #Altcoins #Bitcoin #CryptoNews #CryptoEducation #CryptoPrices

2 0 82 Оригинал >Тренд DRIFT после выпускаБычийDrift发布全面路线图,目标成为Solana上DeFi超级协议。

2 0 82 Оригинал >Тренд DRIFT после выпускаБычийDrift发布全面路线图,目标成为Solana上DeFi超级协议。 CARROT.edge🦭 |🌊 RIVER FA_Analyst OnChain_Analyst B3.78K @hoangquan124

CARROT.edge🦭 |🌊 RIVER FA_Analyst OnChain_Analyst B3.78K @hoangquan124$DRIFT is showing a strong short-term rebound with an 8.43 percent gain in the last 24 hours, marking one of its cleanest green sessions after several days of persistent selling. The move stands out because it comes after price spent most of the week grinding lower, testing support levels without breaking into a deeper cascade. Across the broader windows, the declines remain heavy: minus 13.08 percent over 7 days, minus 35.97 percent over 14 days, and a steep minus 53.31 percent across 30 days. These numbers reflect a prolonged derisking phase for the token. When multiple timeframes remain deeply red while the 24-hour window flips strongly positive, it often signals early bottom-side accumulation rather than another extension lower. The chart shows $DRIFT repeatedly defending the 0.205–0.215 level. Sellers pushed this zone multiple times, but every break attempt lacked follow-through. Instead of accelerating downward, volatility compressed into a tighter range before today’s expansion upward. This kind of structure—slow bleed into sideways flattening—typically marks exhaustion on the sell side. The rebound toward 0.228 indicates buyers stepping in more confidently. Rather than a short fakeout, the move has a clean sequence of higher lows across intraday timeframes. This type of controlled upward structure is often an early signal that downward momentum has faded and positioning is shifting from defensive to opportunistic. My view: $DRIFT is shaping the early stage of a potential recovery after a deep multi-week correction. The strong 24-hour move suggests the market is beginning to reassess risk, and if price can hold above the recent reclaimed range while forming a new series of higher lows, it may transition from stabilization into a broader recovery phase. The long-term trend is still under pressure, but the short-term outlook is turning meaningfully more constructive. $DRIFT @EdgenTech

CARROT.edge🦭 |🌊 RIVER FA_Analyst OnChain_Analyst B3.78K @hoangquan124

CARROT.edge🦭 |🌊 RIVER FA_Analyst OnChain_Analyst B3.78K @hoangquan124$AAVE is showing a clean and decisive rebound with a 4.87 percent gain in the last 24 hours, marking one of its strongest short-term recoveries this week. After dipping toward the 150 zone earlier, buyers stepped back in with consistent strength, pushing the token firmly into an upward structure that now extends across multiple sessions. The broader timeframes still reflect the weight of prior selling: minus 4.82 percent across 7 days, minus 18.12 percent over 14 days, and minus 21.26 percent for the 30-day window. These declines highlight how intense the recent correction was. But when an asset posts a strong daily recovery after weeks of downward pressure, it often signals that selling momentum has weakened and liquidity is beginning to rotate back in. The chart shows $AAVE forming a clear higher-low pattern from the recent bottom near 150. Instead of drifting sideways, price began climbing in a controlled and consistent manner, reclaiming mid-range levels and pushing toward 180. This type of gradual but steady climb typically signals accumulation rather than reactive buying. What stands out is how clean the trend shift is: earlier volatility has transitioned into smoother upward candles, with buyers absorbing dips instead of allowing continuation selling. That shift in behavior is often the first confirmation that an asset is transitioning out of a corrective phase and into early recovery. My view: $AAVE is moving into a constructive recovery phase after a sharp decline. The strong daily rebound, combined with a clear higher-low structure, suggests improving sentiment and controlled accumulation. If the token can maintain support above the reclaim area and continue pressing toward the upper range, a more sustained medium-term reversal could form. $AAVE @EdgenTech

0 0 58 Оригинал >Тренд DRIFT после выпускаБычийDRIFT and AAVE are showing a strong short-term rebound, indicating weakened selling pressure and a potential entry into a recovery phase.

0 0 58 Оригинал >Тренд DRIFT после выпускаБычийDRIFT and AAVE are showing a strong short-term rebound, indicating weakened selling pressure and a potential entry into a recovery phase. Altcoin Sherpa TA_Analyst Trader C259.24K @AltcoinSherpa

Altcoin Sherpa TA_Analyst Trader C259.24K @AltcoinSherpaPerp dex review: $DRIFT I'm going to be reviewing more of these protocols over the next few weeks; I've played on Lighter, Hibachi, PERPL, Pacifica, and a few others. Drift is an older perp dex and was 1 of the premier ones on $SOL. They raised back in 2021 (or 22) and have been around for a while. Think more GMX time vs. HyperLiquid. I remember trading on here a while ago and had a bad experience with the UI so I stopped. Pros: -Decent amount of pairs. There are a lot of things to trade on here, which is what every retail trader likes. -Huge amount of leverage on BTC/ETH/SOL. Not sure if this is necessarily great for the average participant since most ppl are going to die quickly but it's nice seeing those options and a bit of a throwback. If people want to gamble, let them. -Trading UI itself seems decent, everything self explanatory. I wish I could see the top parts a little better under each tab but maybe nitpicking. -I like the advanced orders, some other perp dexes don't offer them. Cons: -The fact that DRIFT has a token. No, really. Every other perp dex right now is being heavily farmed w. fake volume and incentives and DRIFT is one of those older perp dexes. It's a decent experience but people need to ask themselves if they think it's worth it to try something new (lighter/extended/etc) or just go to the older ones like HyperLiquid. -Volume could be better (says every dex). -an HLP/LLP could be interesting on Drift, it's a way to get a bit more exposure and be more involved on some of the gains. -No real spot markets like HyperLiquid has. ------------ Is it better than HyperLiquid ? I don't think so as of right now. Mostly because of the volume- whoever has the most volume is going to win in these types of situations (see Binance vs everyone). Is DRIFT worth a try ? IMO yeah, especially if you're SOL focused.

38 15 9.18K Оригинал >Тренд DRIFT после выпускаМедвежийAltcoinSherpa reviews Drift perp DEX, highlighting pros/cons, but criticizes its token and deems it not superior to HyperLiquid.

38 15 9.18K Оригинал >Тренд DRIFT после выпускаМедвежийAltcoinSherpa reviews Drift perp DEX, highlighting pros/cons, but criticizes its token and deems it not superior to HyperLiquid. merp Trader Derivatives_Expert B45.12K @0xMerp

merp Trader Derivatives_Expert B45.12K @0xMerpBro seriously wrote an essay to shill drift protocol

362 38 23.19K Оригинал >Тренд DRIFT после выпускаМедвежийNegative view on Drift, warning not to trust it lightly. The White Whale Trader Derivatives_Expert S73.26K @TheWhiteWhaleV2

The White Whale Trader Derivatives_Expert S73.26K @TheWhiteWhaleV2We’ve all been focused on the wrong things - myself included. When we evaluate DEXs, we obsess over fees, architecture, paid order flow, and order execution speed. But the question we should be asking is: who’s building for user protection? After the Binance crash on 10/10, founders lined up to brag about how their systems kept their protocols solvent. They missed something big - the future of finance isn’t about only saving the machine, it’s about also protecting the people who use it. Because you cannot have one without the other. In TradFi, there are circuit breakers. Market makers are required to provide quotes. There’s structure that exists to prevent traders from being vaporized by design flaws, technical glitches, or worse yet - the cabal doing what the cabal does. Yet in crypto, “liquidation efficiency” has somehow become a badge of honor. No one is talking about how to protect the biggest asset of the "machine" - the user. That’s why I’ve moved so much of my volume to Drift. While other protocols bragged about record liquidations, Drift quietly highlighted how their liquidation protection saved traders. That’s the signal everyone missed. This isn’t an ad. My voice isn’t for sale. Drift isn’t perfect - no protocol is (gasp - sorry to insult your religion). But as someone known for being a fierce advocate for end-users in this space, I have to put my money where my values are. User protections need to become the next narrative. Whether it's against CEXs treating user funds as their own, or DEXs only building to protect the DEX. Let's call on all founders to push this issue forward. Governments will eventually pass laws requiring it. The beauty of this space is we've always been able to solve out own problems. Let's continue to do so now. Protecting the machine is only half of the mission. 🫡 From the depths — The White Whale 🐋

514 95 35.85K Оригинал >Тренд DRIFT после выпускаБычийThe tweet emphasizes that user protection will become the new narrative in DeFi, recommending attention to Drift Protocol.

514 95 35.85K Оригинал >Тренд DRIFT после выпускаБычийThe tweet emphasizes that user protection will become the new narrative in DeFi, recommending attention to Drift Protocol. Purnama Wulan A.K.S - SMI 🇮🇩 TA_Analyst Trader A3.02K @PurnamaWulanAK1

Purnama Wulan A.K.S - SMI 🇮🇩 TA_Analyst Trader A3.02K @PurnamaWulanAK1$DRIFT #DRIFT https://t.co/kwIJcwgqXo

26 2 2.42K Оригинал >Тренд DRIFT после выпускаБычийDRIFTUSDT shows potential upside, with targets at 0.4878/0.5955, entry between 0.3272-0.3613, and a stop loss at 0.2799.

26 2 2.42K Оригинал >Тренд DRIFT после выпускаБычийDRIFTUSDT shows potential upside, with targets at 0.4878/0.5955, entry between 0.3272-0.3613, and a stop loss at 0.2799. toly 🇺🇸 Founder Dev C657.01K @aeyakovenko

toly 🇺🇸 Founder Dev C657.01K @aeyakovenkobam + mcp would mean there is always competition to provide the best possible censorship resistance for trading. With mcp it won’t matter if bam has 10% market share or 90% market share because it would have no way to degrade quality of service for anyone else. Maximum competition => better pricing for consumers than any centralized system.

Jito D101.99K @jito_sol

Jito D101.99K @jito_solBAM eco continues to grow 🌱 Excited to welcome @DriftProtocol as a new BAM validator! 💥 https://t.co/JhlYwOMsZp

13 0 2.13K Оригинал >Тренд DRIFT после выпускаЧрезвычайно бычийBAM announces Drift Protocol's integration, strengthening decentralized trading competition and censorship resistance.

13 0 2.13K Оригинал >Тренд DRIFT после выпускаЧрезвычайно бычийBAM announces Drift Protocol's integration, strengthening decentralized trading competition and censorship resistance. Tim Copeland Media Influencer B41.27K @Timccopeland

Tim Copeland Media Influencer B41.27K @Timccopeland DJ DeFi_Expert Derivatives_Expert A13.58K @0xDeejay

DJ DeFi_Expert Derivatives_Expert A13.58K @0xDeejayHyperliquid, Lighter, Paradex, Varitional, Extended, Reya, Drift, Bullet, Pacifica, Apex, CeX, GmX, DeX, SNX, MommyX, Aster, Farcaster, Avantis, Flash, Jup, Order, WOO, POO, Doodoo, PERP, UNIPERP, DILDOPERP, MEXC, YOUARESEXY, FOMO, Share, StandX, ByeX. I'm tired bros. https://t.co/VemIWAzBMB

527 122 42.91K Оригинал >Тренд DRIFT после выпускаЧрезвычайно медвежийThe author expresses fatigue with the numerous platforms and 'points' activities in the cryptocurrency space, reflecting a common sentiment regarding airdrop farming.

527 122 42.91K Оригинал >Тренд DRIFT после выпускаЧрезвычайно медвежийThe author expresses fatigue with the numerous platforms and 'points' activities in the cryptocurrency space, reflecting a common sentiment regarding airdrop farming.