Compound (COMP)

Compound (COMP)

$17.5800 -1.90% 24H

- 68Индекс социальных настроений (SSI)+27.80% (24h)

- #29Рейтинг пульса рынка (MPR)-5

- 4Упоминание в социальных сетях за 24 часа+300.00% (24h)

- 100%24-часовой бычий коэффициент лидеров мнений3 активный лидер мнений

- Краткое содержание

- Бычьи сигналы

- Медвежьи сигналы

Индекс социальных настроений (SSI)

- Общие данные68SSI

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийЧрезвычайно бычий (25%)Бычий (75%)Инсайты по SSI

Рейтинг пульса рынка (MPR)

- Инсайт Оповещение

Посты из X

Bubbafox Influencer OnChain_Analyst B25.89K @bob4punk

Bubbafox Influencer OnChain_Analyst B25.89K @bob4punk Zach Rynes | CLG Community_Lead Influencer A188.21K @ChainLinkGod289 5 7.73K Оригинал >Тренд COMP после выпускаБычий

Zach Rynes | CLG Community_Lead Influencer A188.21K @ChainLinkGod289 5 7.73K Оригинал >Тренд COMP после выпускаБычий Fishy Catfish Influencer Media B14.49K @CatfishFishy

Fishy Catfish Influencer Media B14.49K @CatfishFishy Zach Rynes | CLG Community_Lead Influencer A188.21K @ChainLinkGod289 5 7.73K Оригинал >Тренд COMP после выпускаБычий

Zach Rynes | CLG Community_Lead Influencer A188.21K @ChainLinkGod289 5 7.73K Оригинал >Тренд COMP после выпускаБычий Fishy Catfish Influencer Media B14.49K @CatfishFishy

Fishy Catfish Influencer Media B14.49K @CatfishFishy Compound Foundation D126 @Compound_xyz

Compound Foundation D126 @Compound_xyz 207 6 15.03K Оригинал >Тренд COMP после выпускаБычий

207 6 15.03K Оригинал >Тренд COMP после выпускаБычий Bubbafox Influencer OnChain_Analyst B25.89K @bob4punk

Bubbafox Influencer OnChain_Analyst B25.89K @bob4punk Compound Foundation D126 @Compound_xyz

Compound Foundation D126 @Compound_xyz 207 6 15.03K Оригинал >Тренд COMP после выпускаЧрезвычайно бычий

207 6 15.03K Оригинал >Тренд COMP после выпускаЧрезвычайно бычий Chainlink Dev DeFi_Expert C1.39M @chainlink

Chainlink Dev DeFi_Expert C1.39M @chainlink Compound Foundation D126 @Compound_xyz

Compound Foundation D126 @Compound_xyz 207 6 15.03K Оригинал >Тренд COMP после выпускаБычий

207 6 15.03K Оригинал >Тренд COMP после выпускаБычий- Тренд COMP после выпускаМедвежий

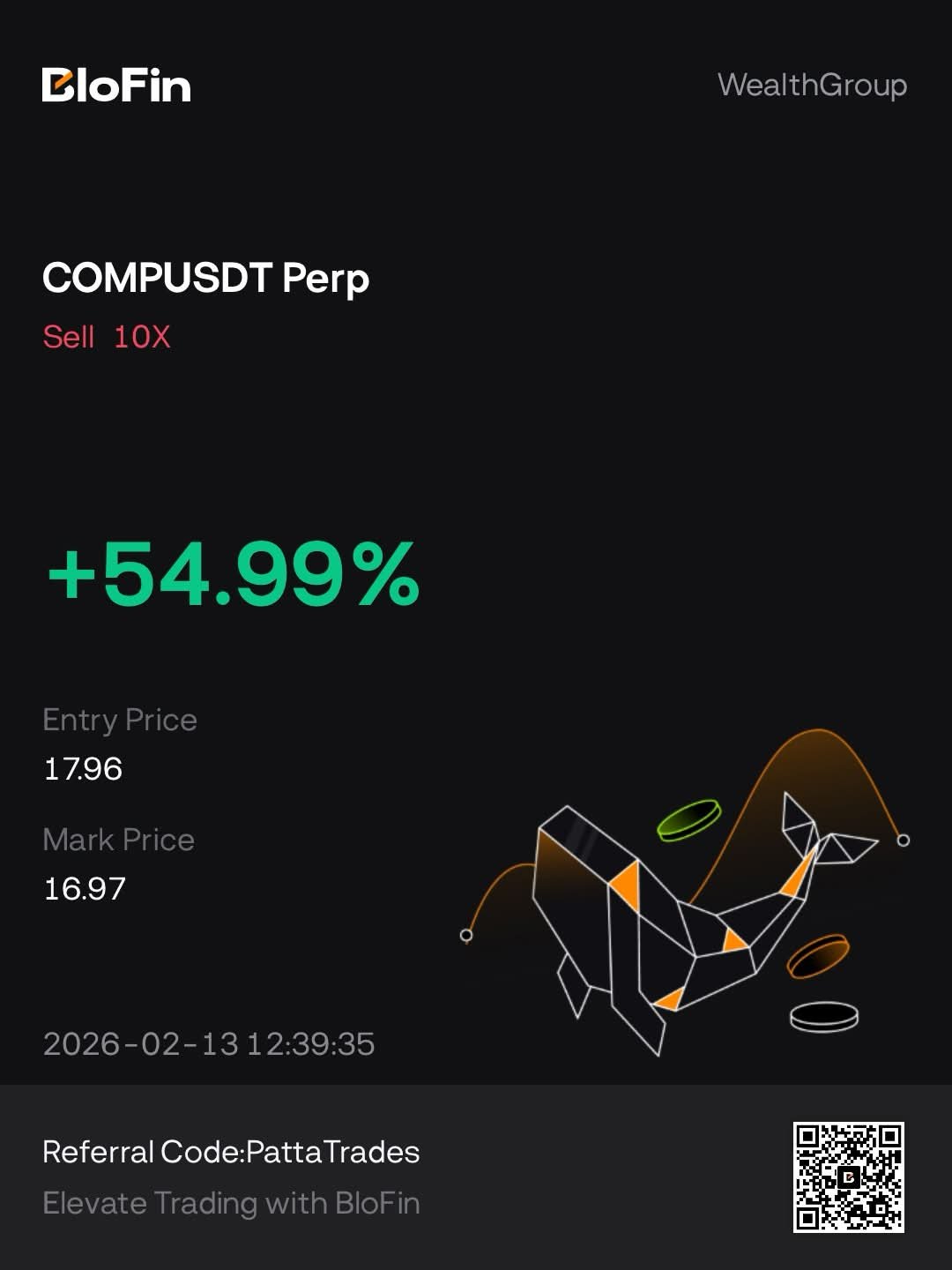

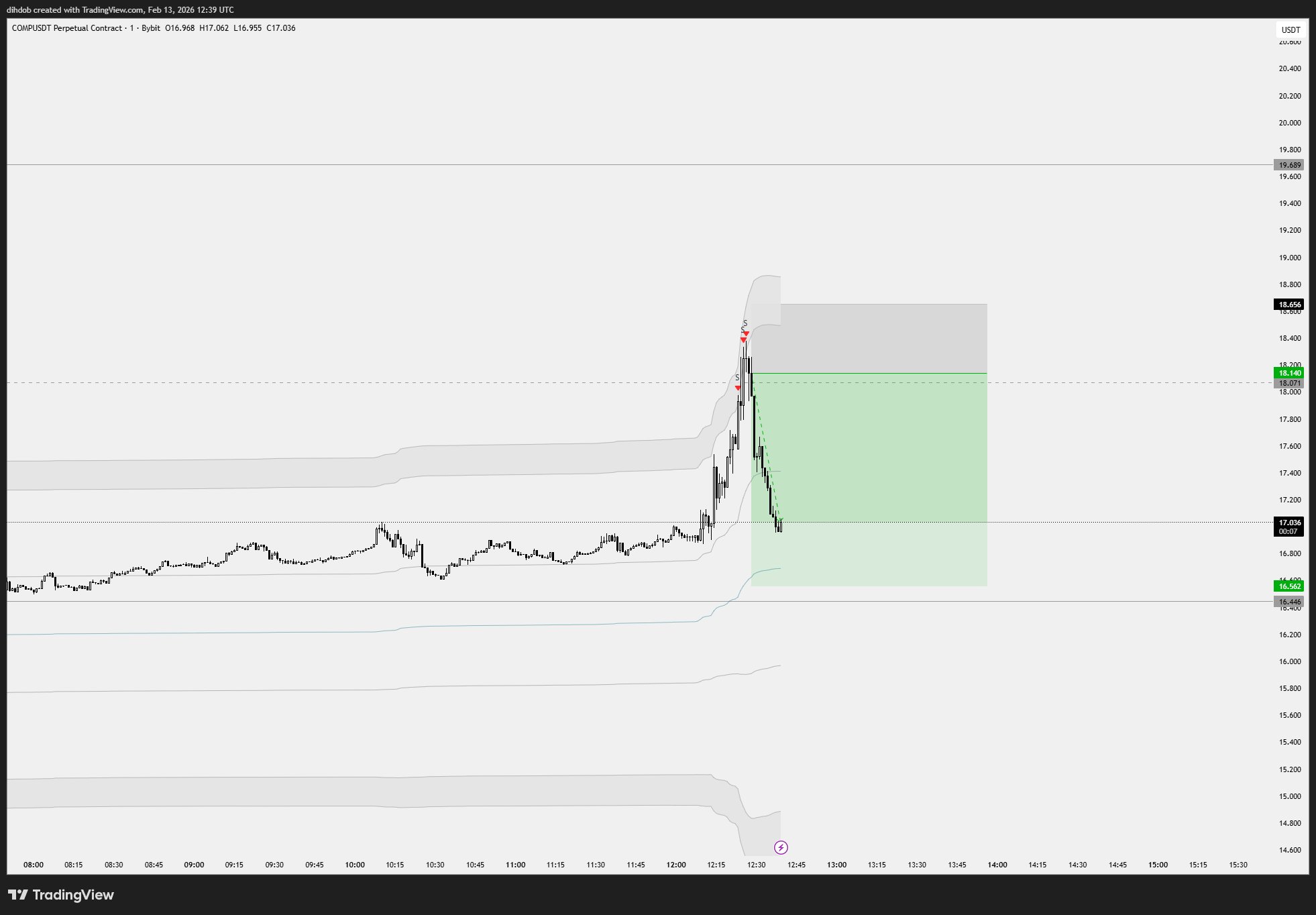

Pat TA_Analyst Trader C21.76K @PattaTrades

Pat TA_Analyst Trader C21.76K @PattaTrades Wealth Group D181.66K @WealthGroup

Wealth Group D181.66K @WealthGroup 12 4 2.48K Оригинал >Тренд COMP после выпускаМедвежий

12 4 2.48K Оригинал >Тренд COMP после выпускаМедвежий Pat TA_Analyst Trader C21.76K @PattaTrades

Pat TA_Analyst Trader C21.76K @PattaTrades

Pat TA_Analyst Trader C21.76K @PattaTrades8 2 2.31K Оригинал >Тренд COMP после выпускаЧрезвычайно медвежий

Pat TA_Analyst Trader C21.76K @PattaTrades8 2 2.31K Оригинал >Тренд COMP после выпускаЧрезвычайно медвежий Eldar FA_Analyst DeFi_Expert A2.03K @eldarcap

Eldar FA_Analyst DeFi_Expert A2.03K @eldarcap Compound Foundation D126 @Compound_xyz

Compound Foundation D126 @Compound_xyz 2 0 393 Оригинал >Тренд COMP после выпускаЧрезвычайно бычий

2 0 393 Оригинал >Тренд COMP после выпускаЧрезвычайно бычий chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda132 25 7.17K Оригинал >Тренд COMP после выпускаБычий

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda132 25 7.17K Оригинал >Тренд COMP после выпускаБычий