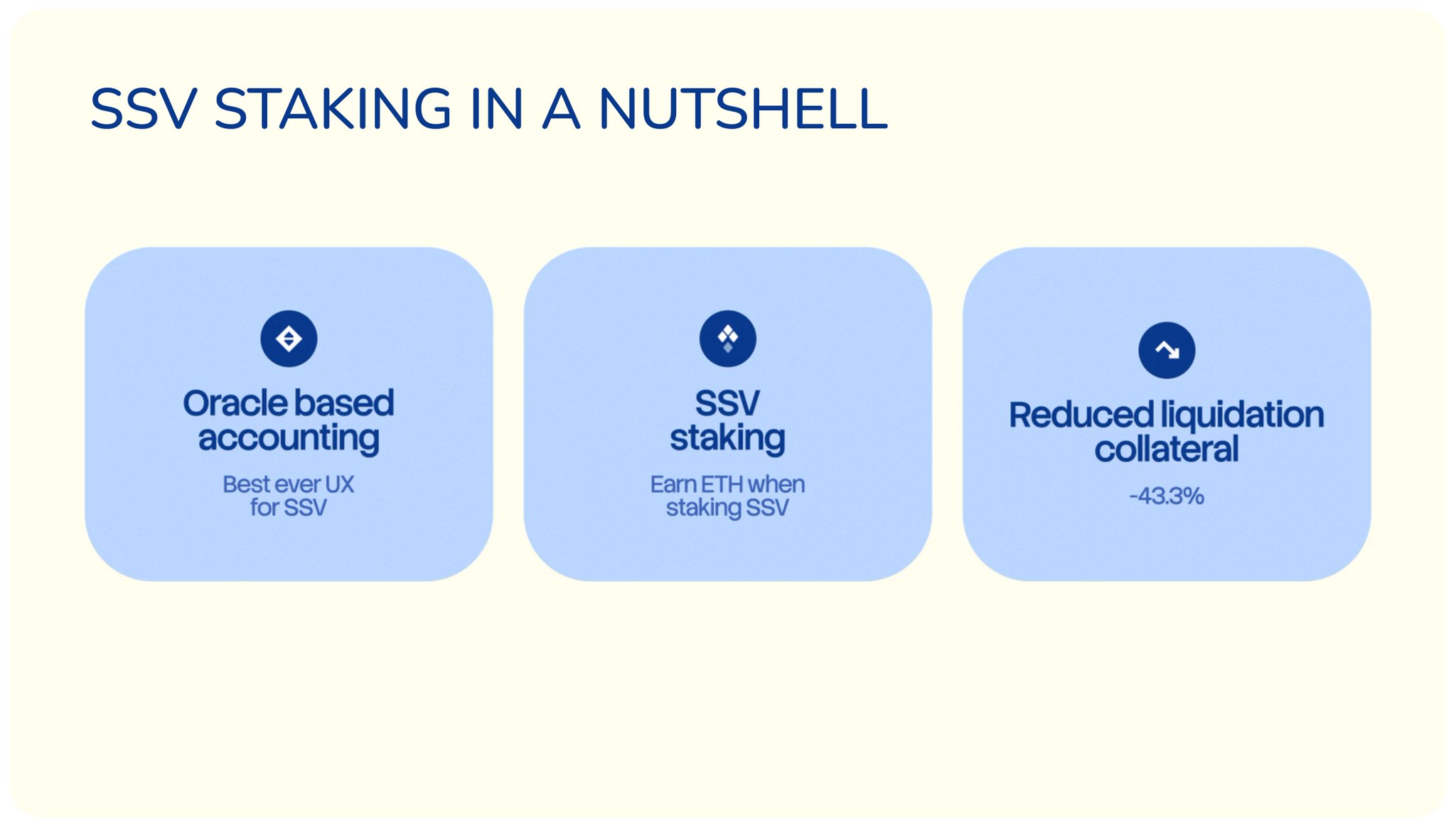

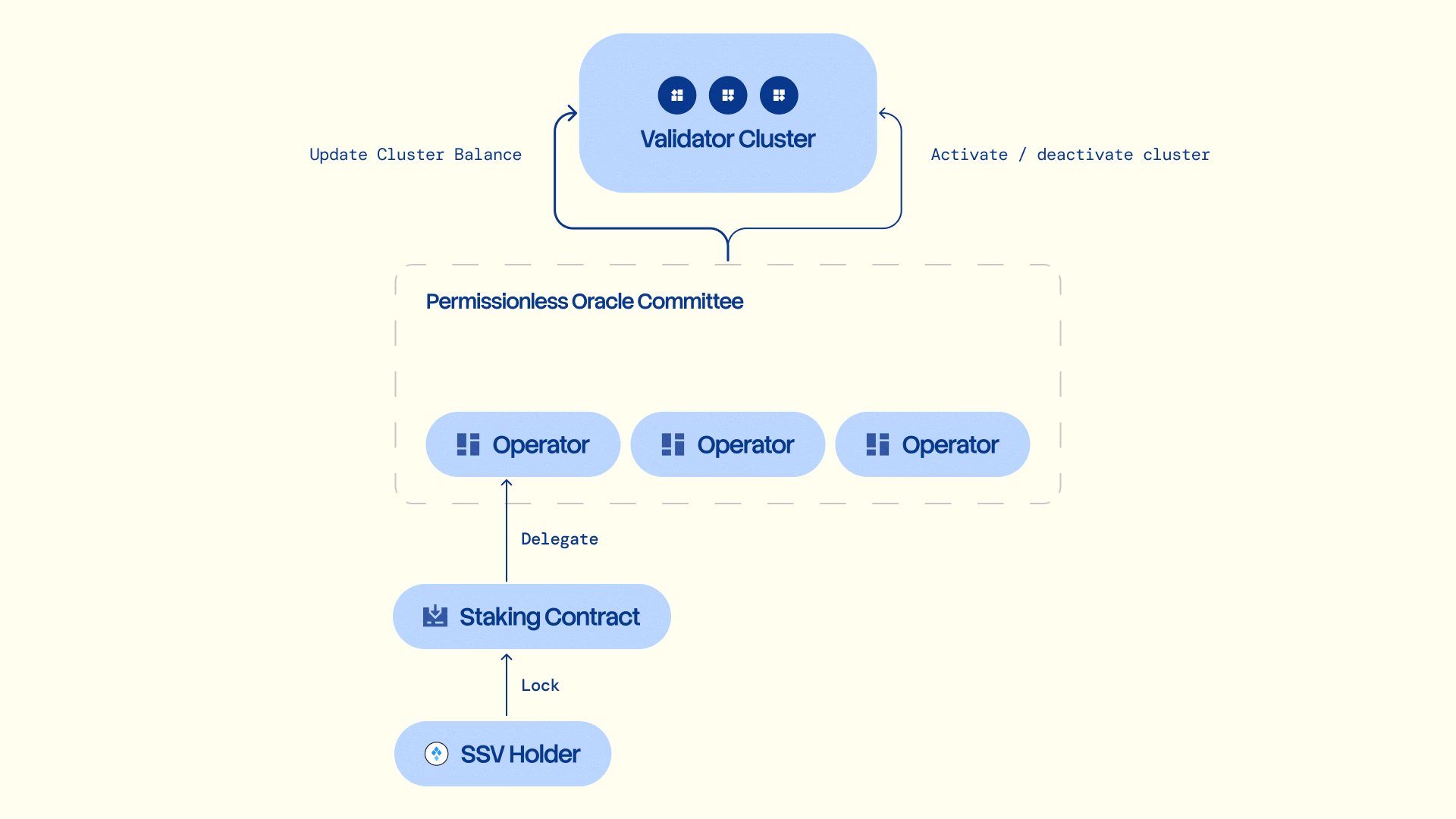

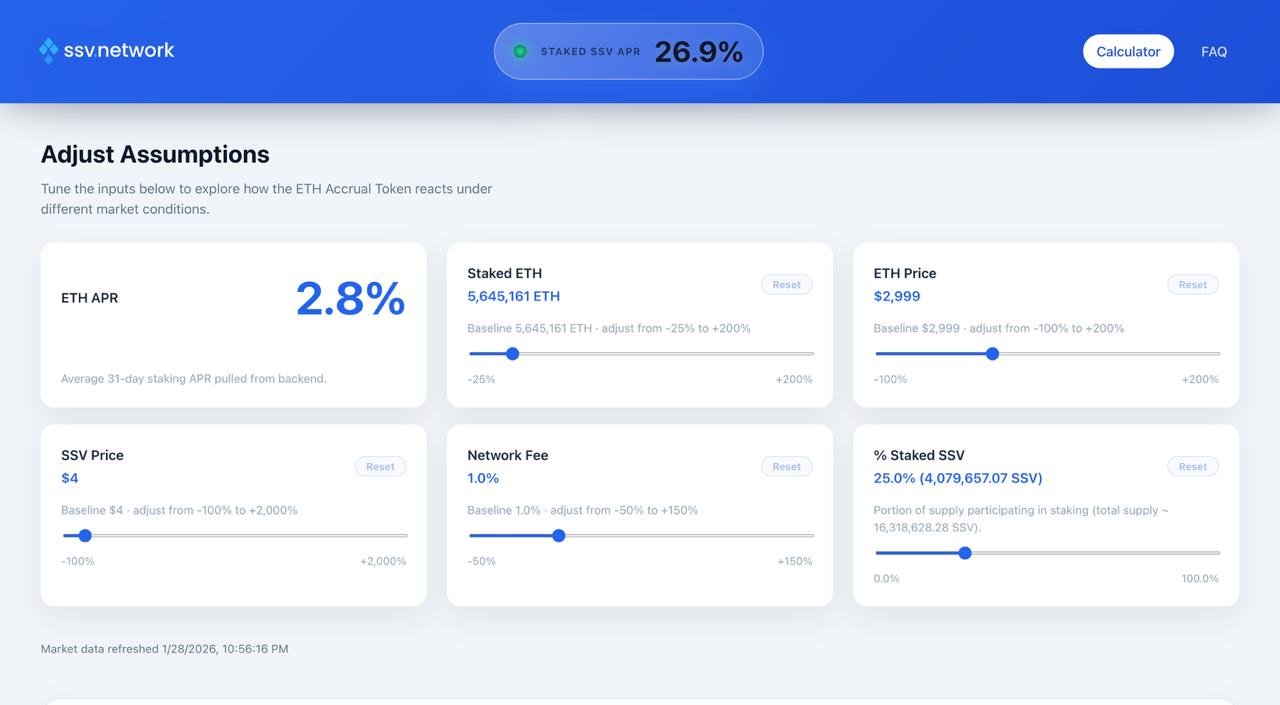

➥ @ssv_network just turned governance token staking into native $ETH infra yield generator

I think $SSV just became the first token to directly yield ETH generated validator infra upon staking the token

SSV already secures ~5.6M ETH → with the upcoming upgrade, fees from that flow will be in native $ETH

Let me explain why this is bigger than it looks ↓↓↓