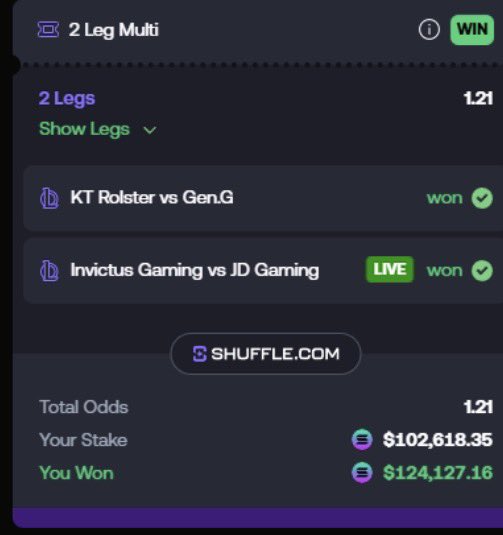

Slight 20 bandos

@PastelAlpha @shufflecom https://t.co/o1sXqU88su

Slight 20 bandos

@PastelAlpha @shufflecom https://t.co/o1sXqU88su

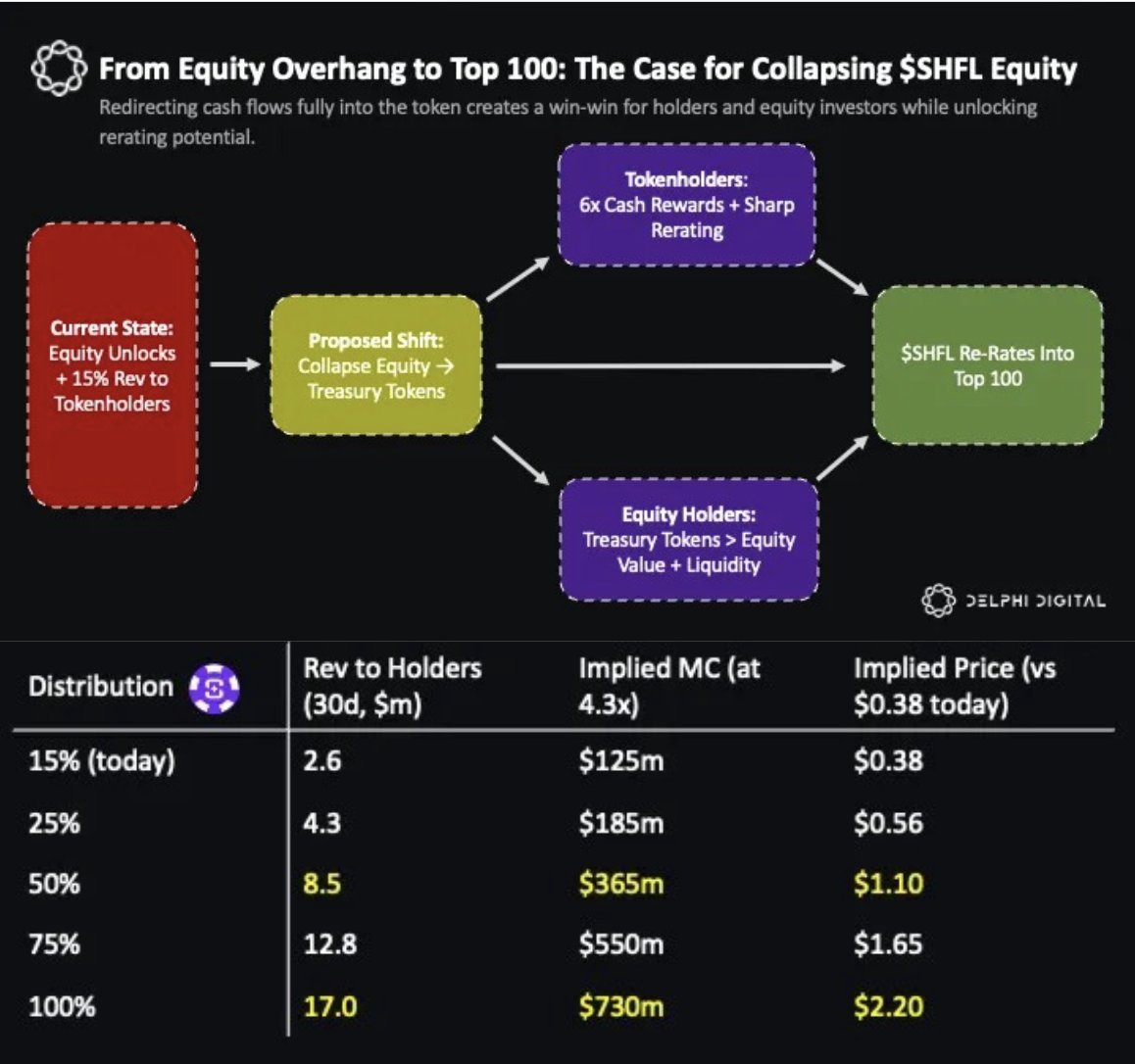

$SHFL is already a top-10 project in crypto on a revenue basis.

In the past 30d it generated ~$17M net revenue (~$200M annualized), yet it isn’t tracked on DeFiLlama and mostly flies under the radar.

Unlike $HYPE and $PUMP, both priced at their theoretical max with ~100% of revenue flowing back to tokens, SHFL only returns 15%.

That leaves a massive embedded call option should the team choose to increase tokenholder capture...

The overhang is equity: tokenholders have taken a back seat while equity holders receive the bulk of value.

But if the team collapsed equity into treasury tokens and boosted distributions, both sides would benefit:

Equity holders gain liquidity and upside, while tokenholders see cash flows 6x overnight.

Even a move to 50% distribution would imply nearly 200% upside at today’s multiple, which is relatively cheap.

That gives SHFL a credible, asymmetric path into the top 100.

But it won’t get there without allocating more to buybacks + burns and/or lottery dividends, at least not in today's market...

full memo w/ all the numbers, comps, and rerating scenarios here: https://t.co/xoR18ZCA6l

In my view, a lot of DeFi and crypto products in general are not exciting from an investment POV.

This is because many are not truly decentralized, one of the actually valuable things that brought most of us here in the first place.

The second is that many onchain businesses do not have the revenue generation potential that hyperscaling traditional offchain tech ventures have.

Whether this is a problem that gets fixed over time with better distribution is one thing;

But if you're not offering a truly differentiated service that actually solves someone's problem, then distribution can only help so much.

For this reason, I see crypto casinos and iGaming at large as a sector that I feel is underloved and worthy of more attention.

I covered $SHFL and $RLB earlier this summer for Delphi and broke down what I saw as two compelling businesses, each with distinct token designs.

One rewarding users through a perpetual "lottery" (essentially a USDC dividend powered by 15% of the platform's net gaming revenue) an