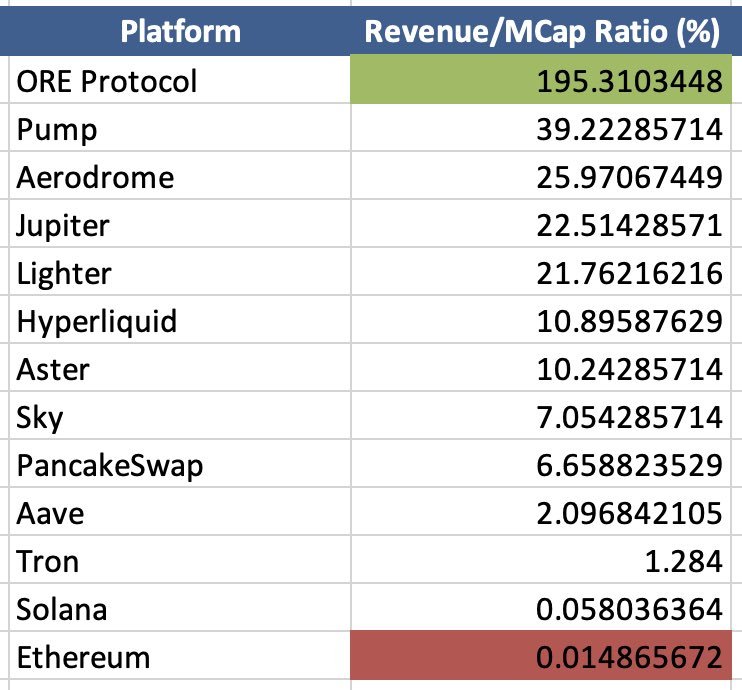

The tweet introduces the ERM valuation method and lists tokens such as PUMP, JUP, and AERO that have high cash‑flow efficiency.

Most P/S ratios in crypto are lying to you.

P/S = Market Cap ÷ Revenue

It tells you how much you're paying for every $1 of revenue.

1. Low P/S (2x) = paying $2 per $1 revenue. Cheaper.

2. High P/S (20x) = paying $20 per $1 revenue. Pricier.

But in crypto, this breaks down:

- Not all tokens receive revenue

- Not all revenue goes to holders

- Circulating supply ≠ eligible supply

A protocol can print $100M in fees while token holders see nothing.

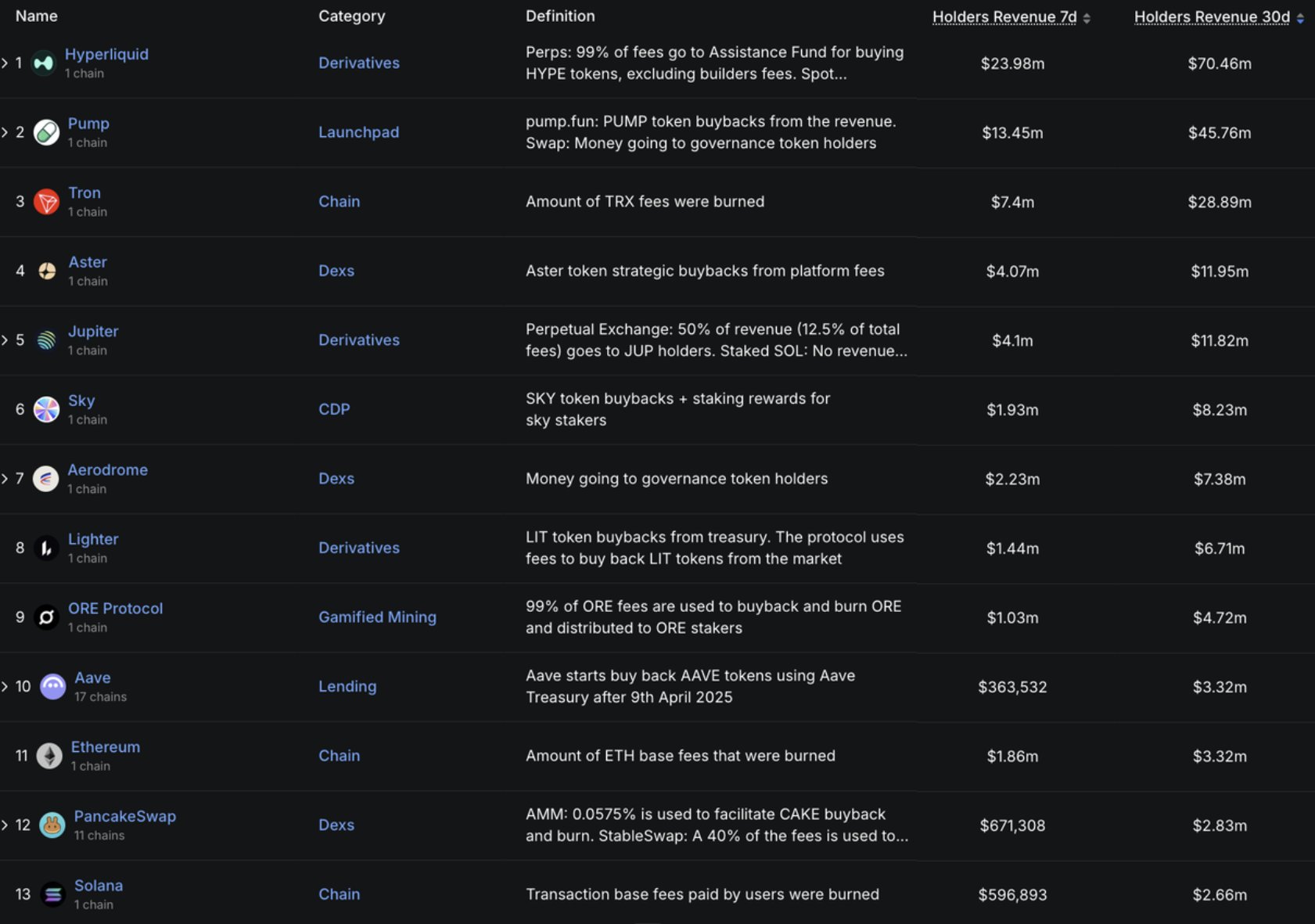

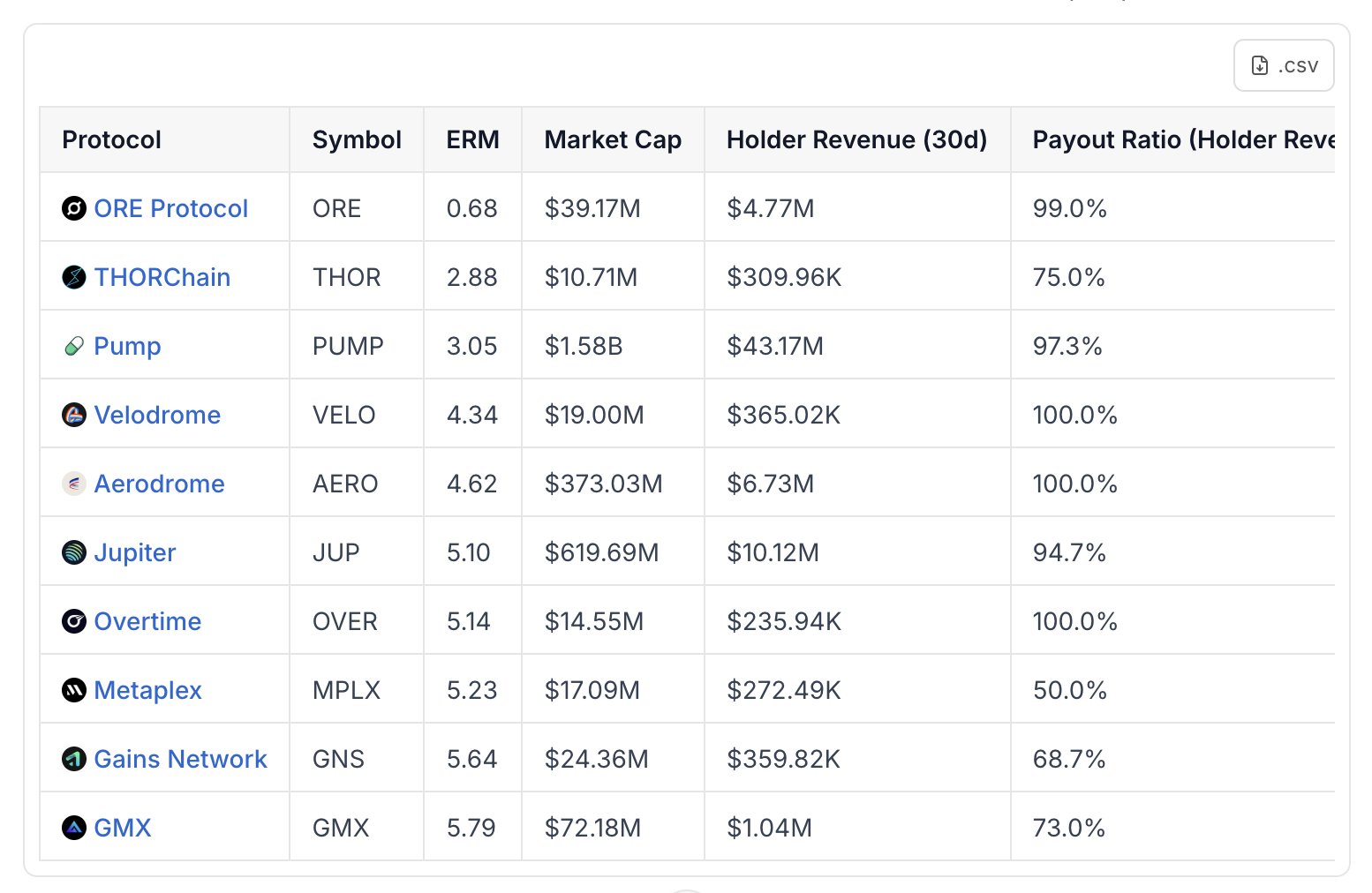

Effective Revenue Multiplier is the fix here:

→ Only count supply that actually receives cashflow

→ Only count cashflow that actually reaches holders

Here are the tokens with the strongest ERM👇

$PUMP $JUP $AERO are the ones with biggest mcap.

(A lower ERM indicates a more efficient valuation from a token holder's cash flow perspective)

h/t to @DefiLlama for the data