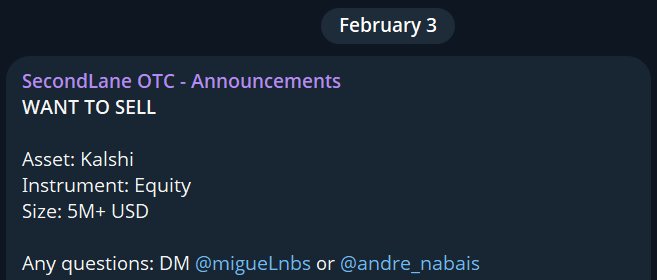

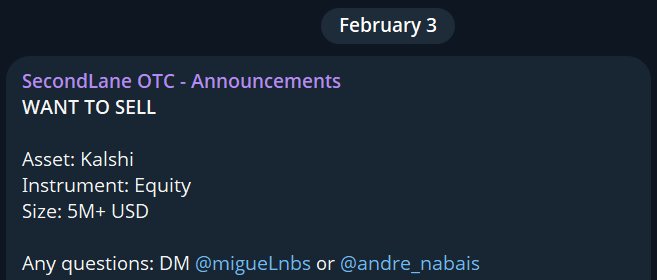

coincidence? https://t.co/9saQyK8Dre

coincidence? https://t.co/9saQyK8Dre

HyperCore will support outcome trading (HIP-4). Outcomes are fully collateralized contracts that settle within a fixed range. They are a general-purpose primitive that are useful for applications such as prediction markets and bounded options-like instruments. There has been extensive user demand in both of these areas, and builders will likely think of novel applications as well.

Outcomes bring non-linearity, dated contracts, and an alternative form of derivative trading that does not involve leverage or liquidations. The outcome primitive expands the expressivity of HyperCore, while composing with other primitives such as portfolio margin and the HyperEVM.

Outcomes are a work in progress and currently only being tested on testnet. Canonical markets based on objective settlement sources will be deployed once technical development is complete. Canonical markets will be denominated in USDH. Pending user feedback, the infrastructure will be extended to permissionless deployment.

One great thing about this bear market:

This is by far the most engaged I have seen CT and most exciting stuff being built.

Last bear was pure goblintown, it’s so over, it’s never coming back.

Few good teams were building, but the excitement just didn’t seem to be there like now.

HyperCore will support outcome trading (HIP-4). Outcomes are fully collateralized contracts that settle within a fixed range. They are a general-purpose primitive that are useful for applications such as prediction markets and bounded options-like instruments. There has been extensive user demand in both of these areas, and builders will likely think of novel applications as well.

Outcomes bring non-linearity, dated contracts, and an alternative form of derivative trading that does not involve leverage or liquidations. The outcome primitive expands the expressivity of HyperCore, while composing with other primitives such as portfolio margin and the HyperEVM.

Outcomes are a work in progress and currently only being tested on testnet. Canonical markets based on objective settlement sources will be deployed once technical development is complete. Canonical markets will be denominated in USDH. Pending user feedback, the infrastructure will be extended to permissionless deployment.

My thesis has always been binaries over "prediction markets". The market is ready for a new instrument that offers leverage yet without the risk of liquidation

HyperCore will support outcome trading (HIP-4). Outcomes are fully collateralized contracts that settle within a fixed range. They are a general-purpose primitive that are useful for applications such as prediction markets and bounded options-like instruments. There has been extensive user demand in both of these areas, and builders will likely think of novel applications as well.

Outcomes bring non-linearity, dated contracts, and an alternative form of derivative trading that does not involve leverage or liquidations. The outcome primitive expands the expressivity of HyperCore, while composing with other primitives such as portfolio margin and the HyperEVM.

Outcomes are a work in progress and currently only being tested on testnet. Canonical markets based on objective settlement sources will be deployed once technical development is complete. Canonical markets will be denominated in USDH. Pending user feedback, the infrastructure will be extended to permissionless deployment.