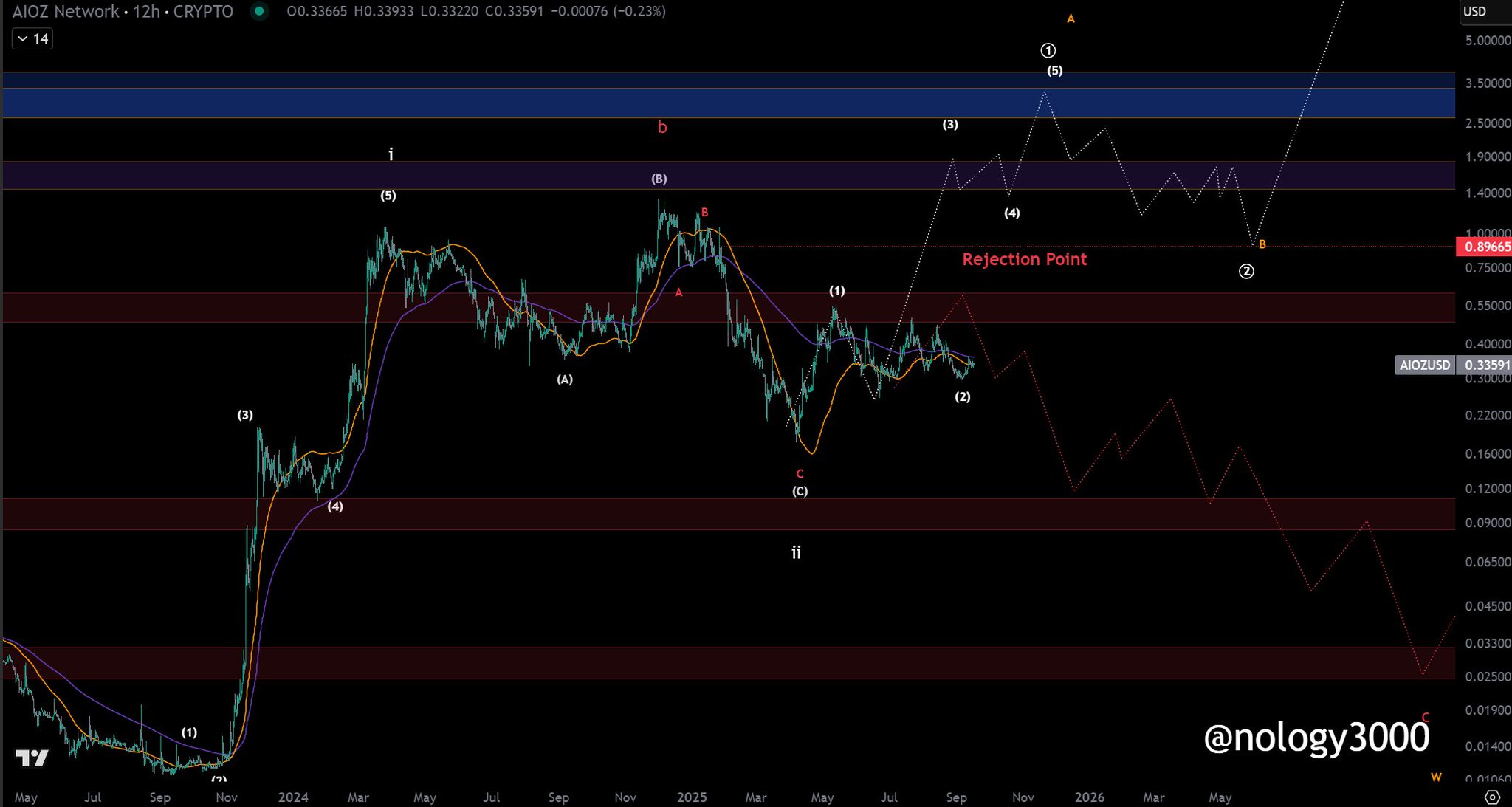

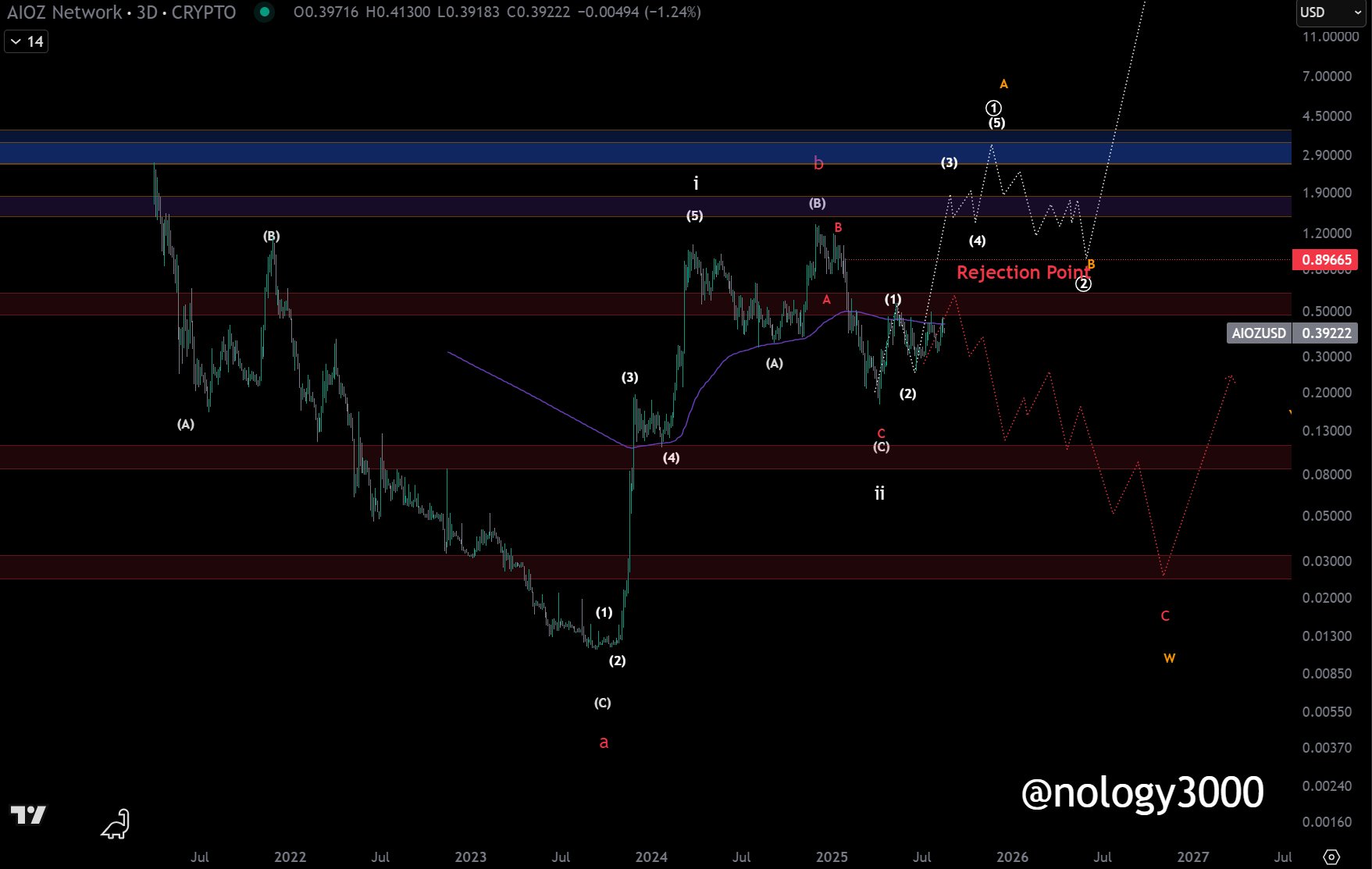

$AIOZ

This chart is looking very interesting. We have a very clear HTF impulse off the ATL, followed by a textbook expanded flat correction. For me, the most critical level on the chart right now is the $0.1079 low. Price broke below it in December but is now actively attempting to reclaim it, turning the previous breakdown into a deviation. Should this reclaim succeed and the level hold firmly as support, it would be extremely bullish. In that case, $0.17 becomes a near-term target.

As for wave structure, I currently see three main scenarios:

1) Wave 5 [and therefore the (C) wave of the expanded flat] has already completed with this deviation.

2) The current deviation is part of the third sub-wave of wave 5 — in this case, we could still see something similar to the green line, especially if the final sub-wave turns out to be truncated.

3) The correction develops into a larger complex combination.

It would be wise to start watching closely for any convincing upward impulses. These will help us determine which of the three scenarios is most likely unfolding.