Still looking @polymarket markets

looking at & why

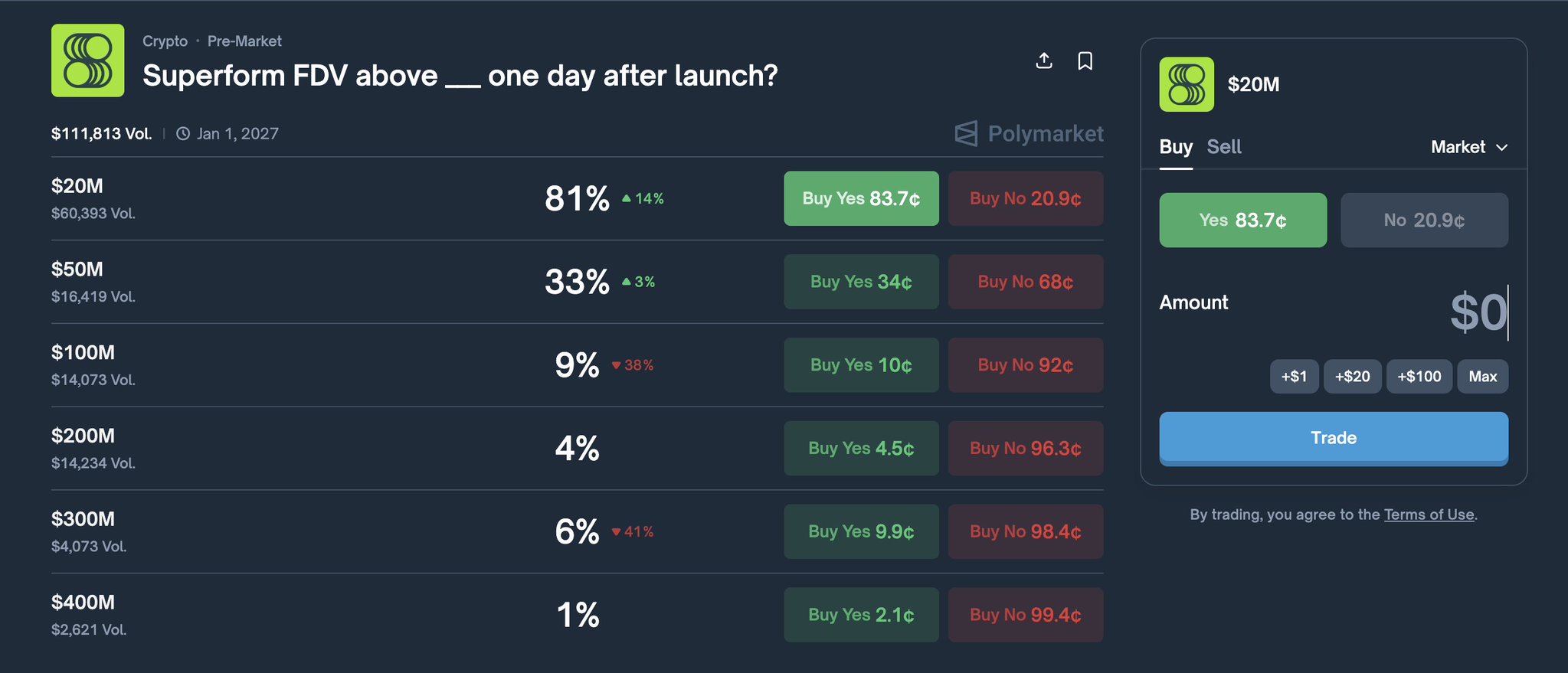

@superformxyz.

@paradex

@gensynai

How I would bid

1️⃣ @superformxyz

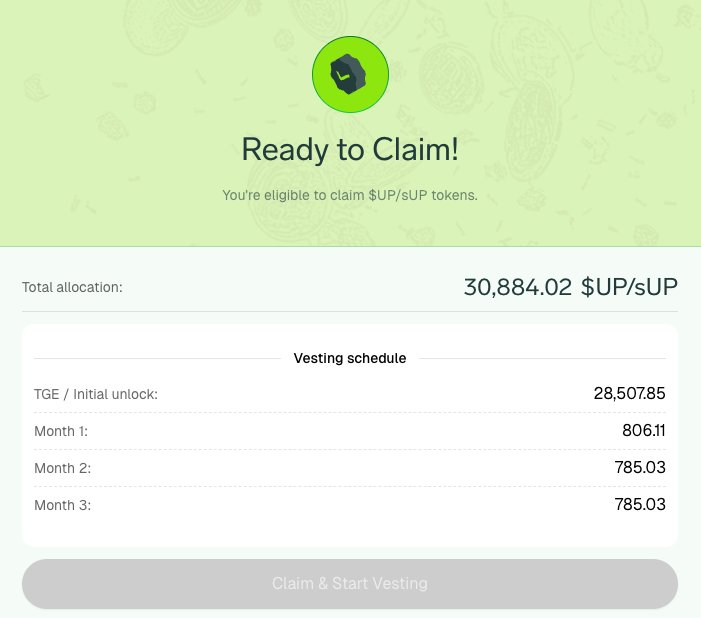

Cross-chain yield marketplace positioning itself as a "user-owned neobank." Just launched a US mobile app and closed a public token sale. TGE imminent.

🔹 Quick TLDR

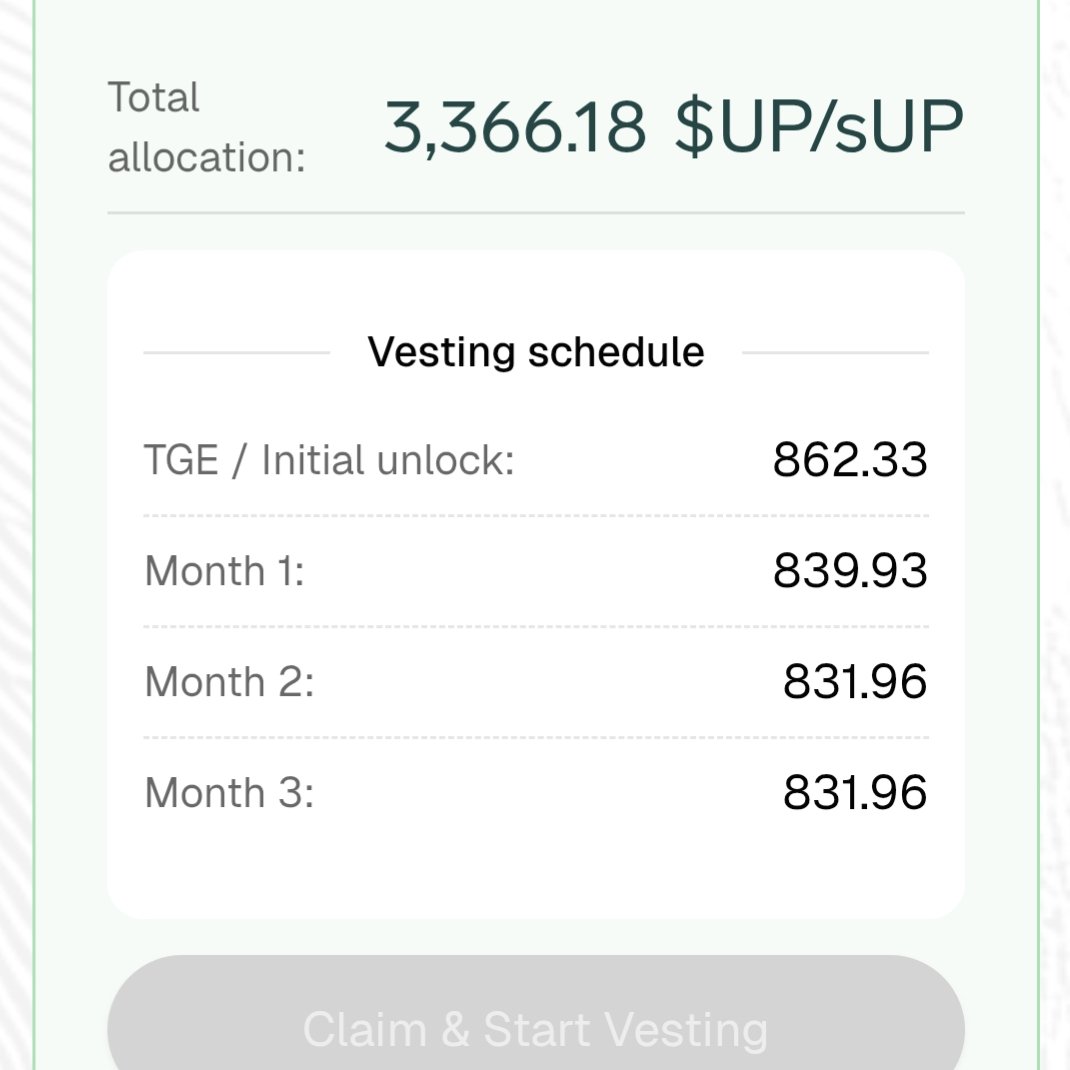

> Public sale closed Dec 2025 on @cookie3 at $0.05/token → ~$90M FDV implied ($4.7M public sale (oversubscribed)

> Total raised: $11.5M from VanEck Ventures, Polychain Capital, Circle, BlockTower, Maven11, CMT Digital, @cryptohayes

> $62m TVL, 180k+ depositors, average 8.4% APY on SuperVaults

> TGE targeting Q1 2026, could be any day now

> Coinbase added $UP to its listing roadmap

> Cut off: Dec 31, 2026

🧮 Tokenomics:

• Total supply: 1B $UP

• 50.4% Community & Ecosystem

• 24.6% Core Team & Advisors

• 22.2% Strategic Partners

• 2.8% Echo Sale

🔹 Fundamentals & Narrative Strength

> Founders Vikram Arun & Blake Richardson from BlockTower Capital (managed $100M+ in DeFi strategies), Alex Cort ex-Microsoft

> Product is live and generating real yield

> "Neobank" narrative is strong for this cycle. bridges DeFi yield to consumer-grade UX

> Just launched US mobile app (Feb 3, 2026) with fiat onramp

> Deep Base integration = Coinbase ecosystem alignment

👉 My mental model:

> Real product, real TVL, real users that already separates it from 80% of launches this year

> The Coinbase listing roadmap signal is huge. I gets a CB listing near TGE, that's a significant liquidity event

> Main risk: 25% TGE unlock + 3 month linear vest = concentrated sell pressure in a narrow window. Airdrop farmers who got in on Cookie will likely dump early

> imo if you're bidding on Polymarket, anything above $200M feels ambitious in this environment given the public sale was at $90M. But strong upside if the Coinbase listing materializes

> Would bid Yes on $20M, 50M and consider $100M as moon shot (which is maybe not that moon? good rr on 10x + anyways

> If this were a bear market launch (which... it kind of is rn) expect it to trade close to sale FDV. If there's any momentum, $150–200M is reasonable.

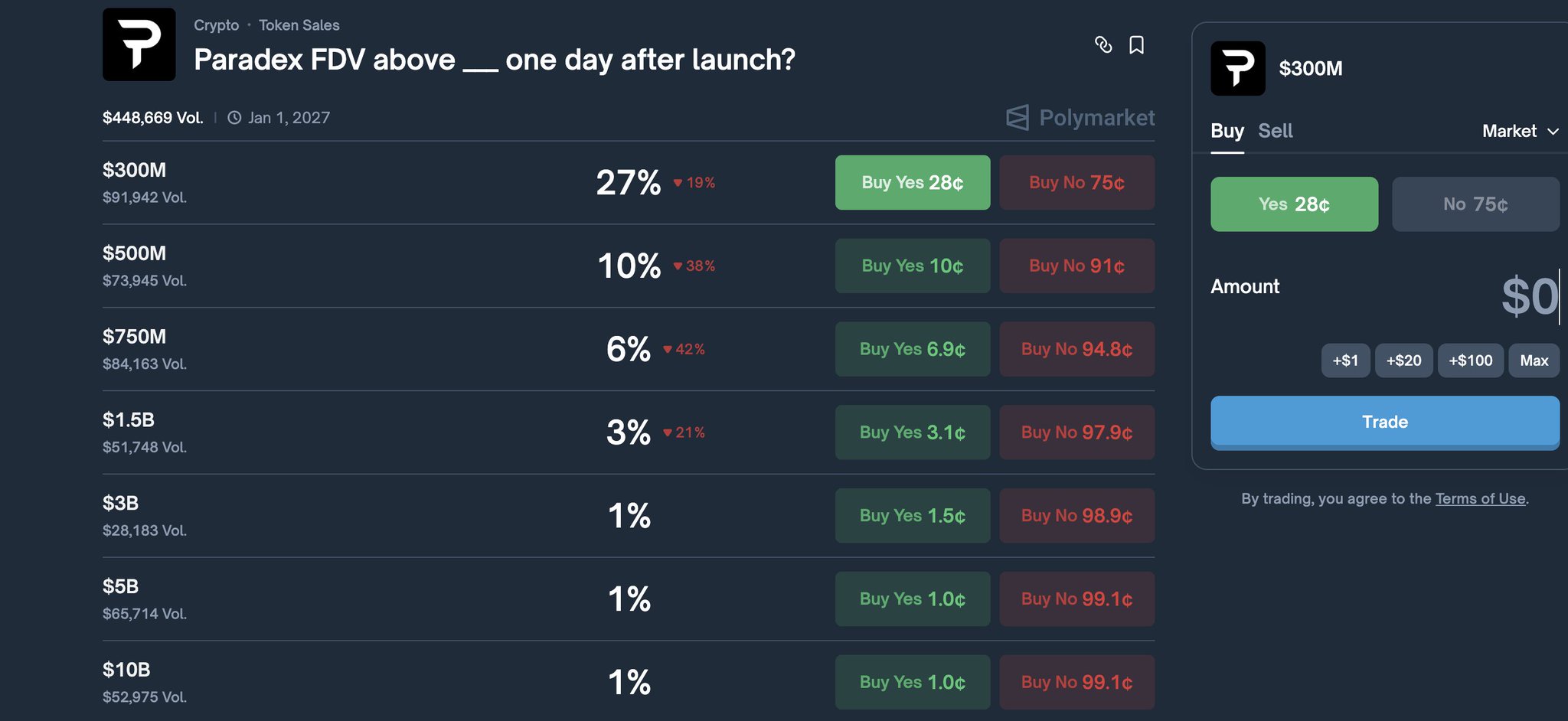

@paradex

Perpetuals DEX incubated by Paradigm, Zero-fee perps on a ZK-powered L2. Clearly positioning as the next Hyperliquid competitor.

🔹 Quick TLDR

> TGE confirmed: late February or early March 2026 (post Chinese New Year). Imminent.

> 25% of total $DIME supply airdropped to all XP holders at TGE fully unlocked, no vesting

> Season 2 allocation bumped from 15% → 20% of total supply (5% for S1, 20% for S2)

> Cumulative volume: $210B+, ~$200M TVL, $600M+ Open Interest

> Zero-fee trading model with maker rebates (-0.005%)

> Polymarket FDV market: $373k volume traded so far

👉 Fundamentals & Narrative Strength

> Incubated by Paradigm access to 3,000+ institutional liquidity network

> Built on StarkNet (ZK L2) with privacy-first architecture, atomic settlement across DEX + dApps

> Zero-fee model undercuts every competitor, including Hyperliquid

> Season 3 already expanding into spot trading, RWA perps, and options = not just another perp DEX

> Money Badgers NFT collection = community/identity layer (Paradigm clearly studied Hyperliquid's playbook)

⚠️ Key risk

> Paradigm shareholders get a significant chunk with full unlock at launch

> Foundation literally wrote: "enables a natural transition of tokens to long-term holders should Paradigm shareholders wish to sell" which basically telegraphs that insiders will sell

> This is the biggest difference vs Hyperliquid which had zero insider unlock pressure

👉 My mental model:

> This is the most interesting perp DEX TGE since Hyperliquid but the dynamics are fundamentally different

> Hyperliquid had surprise + zero insider allocation. Paradex has known timeline + Paradigm insiders unlocked day 1.

> On Polymarket FDV markets, I'd lean cautious toward the higher brackets. Lighter launched at ~$2.6B with stronger metrics, and Paradex doesn't have the same surprise factor

> imo realistic range is $800M–$1.5B FDV. Above $2B requires extreme bull conditions.

> The interesting bid is probably Yes on $500M

> Main edge: if you're already trading perps, farm Paradex S3 XP regardless of the bet. Zero fees means your farming cost is literally zero. Worst case, you got free perp execution.

tldr mainly 500m is a good 10x small bet

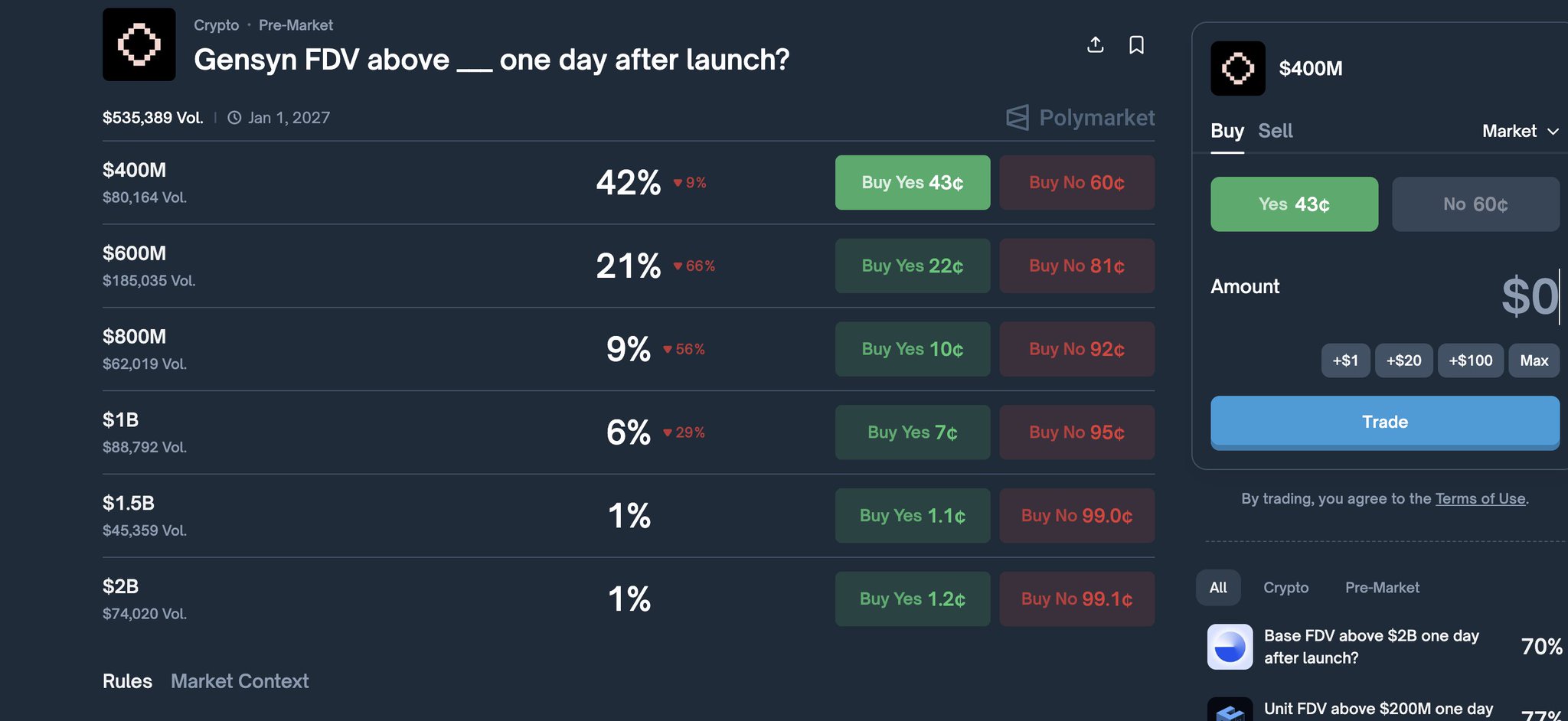

@gensynai

A decentralized AI compute protocol lets anyone contribute GPU/CPU power to ML training. The deepest funded DePIN x AI play that hasn't launched yet.

🔹 Quick TLDR

> Total raised: $50.6M (Seed: $6.5M led by Eden Block, Series A: $43M led by @a16z)

> Token sale ran Dec 15–20, 2025 on Sonar 3% of supply (300M tokens) via English auction

> Auction FDV cap: $1B (matching a16z round valuation)

> Token claims expected: early February 2026, ← we're right in this window

> Polymarket: Gensyn FDV above $400M at 43% odds, $504k volume

> Testnet: 2M+ AI models trained, 90M+ transactions, 8,000+ active nodes

👉 Fundamentals & Narrative Strength

> a16z-led $43M Series A is a tier-1 signal this is one of the highest-funded DePIN/AI projects period

> Protocol creates a decentralized marketplace for ML compute tasks distributed and verified on-chain via smart contracts

> Claims 98.9% cost reduction vs centralized cloud providers (aggressive claim but directionally compelling)

> Just launched Delphi, a public market for machine intelligence where ML models compete on benchmarks in real time.

> Regulatory alignment: EU AI Act compliance, G7 Code of Conduct, NIST AI Risk Management Framework

👉 My mental model:

> $1B FDV cap on the sale matches the a16x round so the question is whether the market reprices it above or below that at TGE

> Polymarket says 43% chance above $400M. This feels too low to me given the caliber of backers and the AI narrative premium

> Comparable: Render launched with massive FDV and sustained it. https://t.co/5wba4dZHaF had similar positioning. But current bear market conditions make $1B+ harder to justify on day 1

> The 100% TGE unlock for non-US is aggressive expect immediate sell pressure from auction participants who got in at lower clearing prices

> US buyers locked for 12 months creates an interesting dynamic, non-US sellers vs locked US holders. Short‑term bearish, medium‑term could stabilize or not

> imo the play: Yes on $400M feels like a reasonable risk/reward at 43%. The protocol has real usage (2M models trained is not nothing), serious backing, and AI narrative tailwind

> I'd avoid the $1.5B bracket — too much needs to go right in this market

> If mainnet launches strong alongside TGE and they announce more enterprise partnerships, there's upside surprise. But in current conditions, expect it to settle somewhere in the $300M–$700M range.