Disclaimer:

Data from X (Twitter), Property of original creators. For reference only, not investment advice.

X Posts

Ansem Trader Influencer C787.11K @blknoiz06

Ansem Trader Influencer C787.11K @blknoiz06 doug funnie Trader Influencer A24.97K @cryptoklotz33 6 2.03K Original >Bearish

doug funnie Trader Influencer A24.97K @cryptoklotz33 6 2.03K Original >Bearish- Trend of SOL after releaseBullish

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

TRON DAO D1.76M @trondao

TRON DAO D1.76M @trondao 0 0 1 Original >Trend of BTC after releaseExtremely Bullish

0 0 1 Original >Trend of BTC after releaseExtremely Bullish peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter

peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter

peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter 5 1 418 Original >Trend of BTC after releaseExtremely Bullish

5 1 418 Original >Trend of BTC after releaseExtremely Bullish- Neutral

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Tron Inc. D2.43K @TRON_INC0 0 6 Original >Trend of TRX after releaseExtremely Bullish

Tron Inc. D2.43K @TRON_INC0 0 6 Original >Trend of TRX after releaseExtremely Bullish- Trend of BTC after releaseBullish

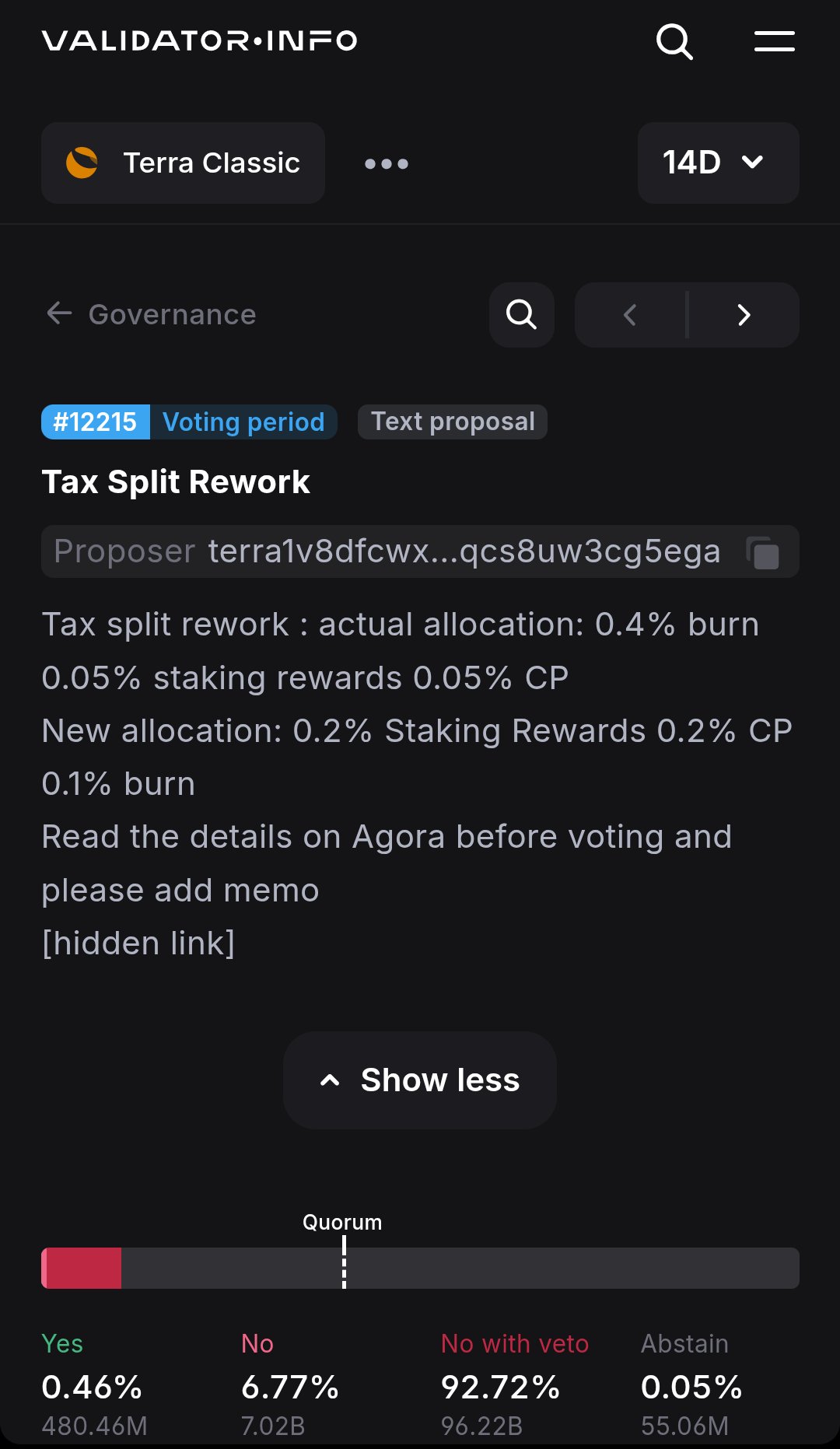

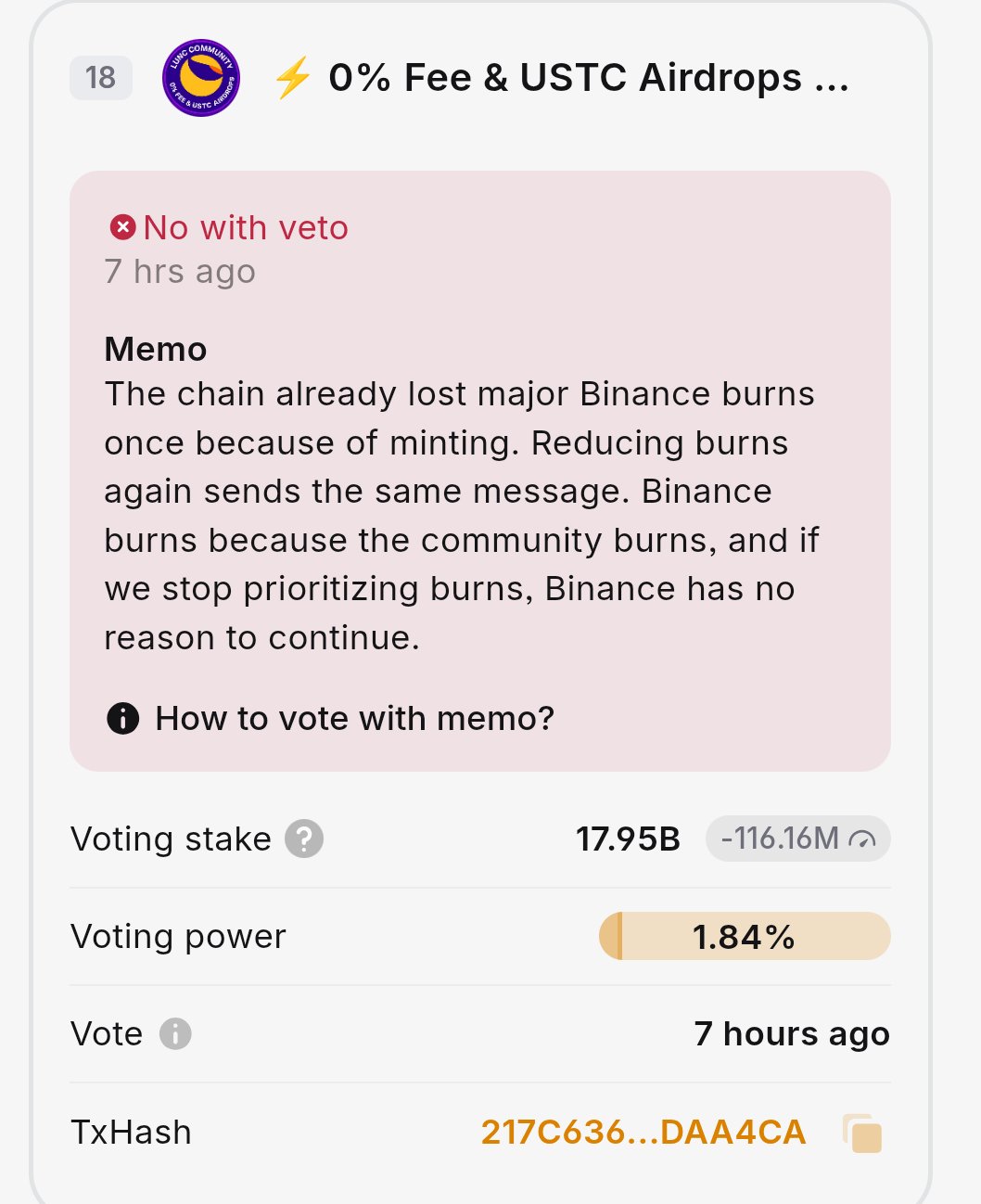

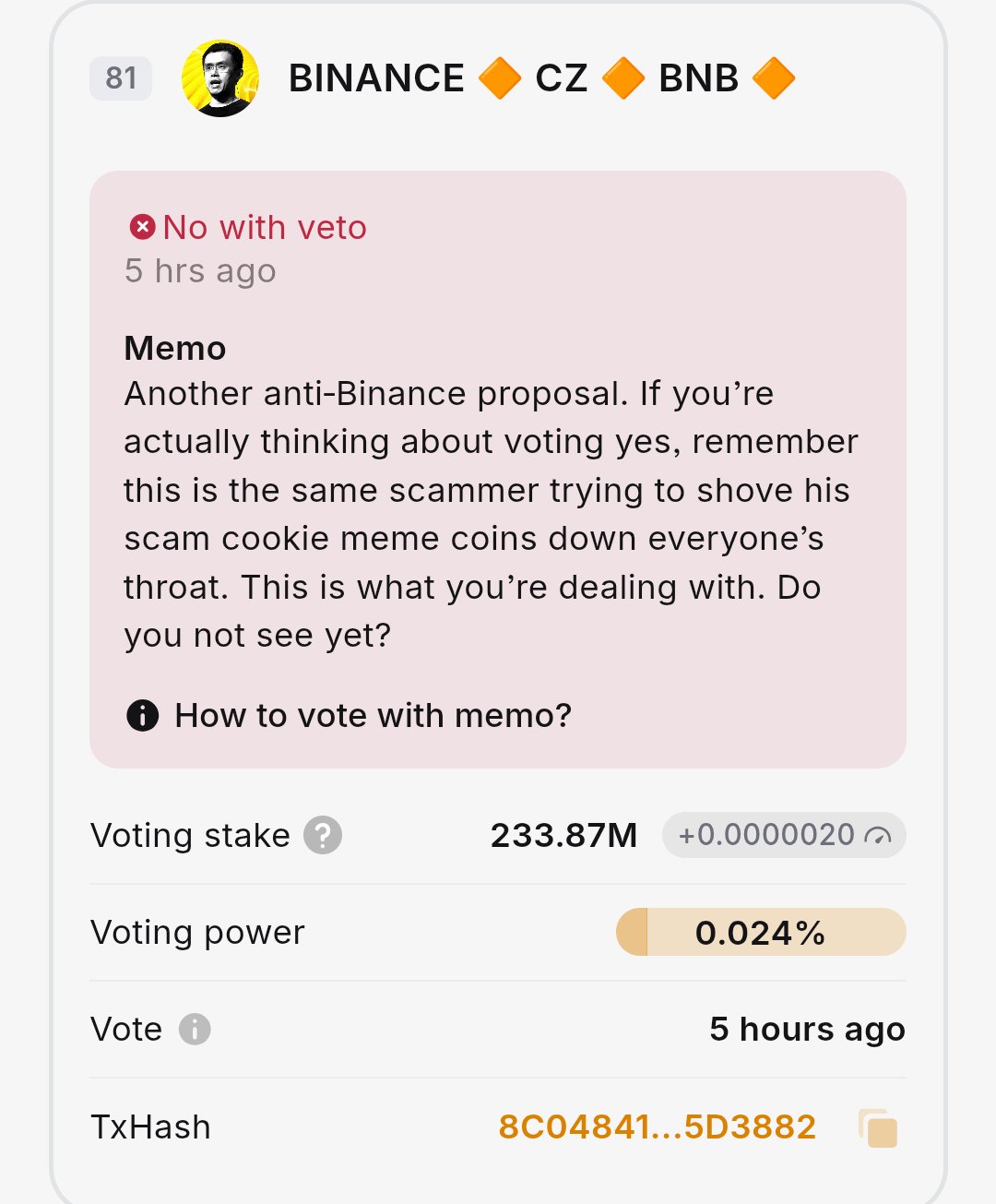

Greenpeace.BNB.probablynothing.LUNC OnChain_Analyst Community_Lead S6.20K @Greenpeace06_09

Greenpeace.BNB.probablynothing.LUNC OnChain_Analyst Community_Lead S6.20K @Greenpeace06_09

1 0 15 Original >Extremely Bearish

1 0 15 Original >Extremely Bearish Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo38104169 Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo381041694 5 25 Original >Trend of TRX after releaseBullish

Hồng Ngọc | Ruby💎 DeFi_Expert Influencer B18.01K @hongngo381041694 5 25 Original >Trend of TRX after releaseBullish- Trend of BTC after releaseNeutral

24h Social Sentiment from X

5,187Analyzed Posts-34.58%2,468Surveyed KOLs+0.04%Market sentiment leans Bullish- CoinsSSIChangeSSI Insights

- CoinsMPRChange

SPACE#1 KOL attention surges+79

SPACE#1 KOL attention surges+79 ON#2 Social mentions surged-

ON#2 Social mentions surged- MANA#3 Social mentions surged-

MANA#3 Social mentions surged- MEME#4 Social mentions skyrocketed-

MEME#4 Social mentions skyrocketed- MINA#5 Sentiment polarization sharply increased+64

MINA#5 Sentiment polarization sharply increased+64

Alert Summary