Liquity USD Live Price data

Today's price of Liquity USD Is $ 0.99 (LUSD/USD). With A Market Cap Of $ 33.76M USD. 24-Hour Trading Volume Of $ 89,000.57 USD, A 24-Hour Price Change Of +0.00%, And A Circulating Supply Of 33.83M LUSD.

Liquity USD LUSD Price History USD

Track the price of Liquity USD for today, 7 days, 30 days and 90 days

Period

Change

Change (%)

Today

0

0.00%

7days

--

--

30days

--

--

90days

0

0.00%

Own LUSD Now

Buy and sell LUSD easily and securely on BitMart.

Liquity USD Market Information

$ 0.99 24h Range $ 0.99

All time high

$ 1.06

All time low

$ 0.94

24h Change

0.00%

24h Vol

$ 89,000.57

Circulating supply

33.82M

LUSD

Market cap

$ 33.76M

Max supply

--

Fully diluted market cap

$ 33.76M

Trade LUSD

Liquity USD X Insight

LUSD remains eligible as Aave collateral, bullish; USDS/DAI removal raises risk

Wow. Looks like Sky's USDS and DAI being removed as collateral from Aave.

Interestingly, Liquity's LUSD is still eligible.

LUSD is exactly the same as when it launched 4 years ago. It's immutable and autonomous. Whereas USDS and DAI can change their backing.

64 days ago

Trend of LUSD after release

No Data

Bullish

LUSD remains eligible as Aave collateral, bullish; USDS/DAI removal raises risk

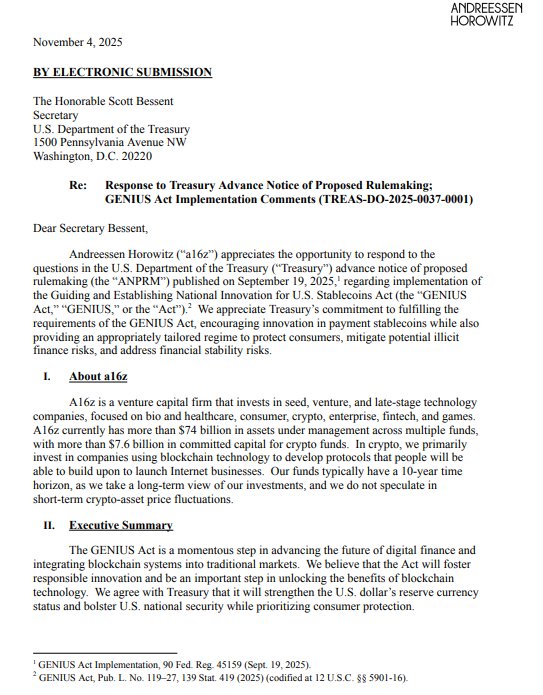

a16z Urges Treasury to Exempt Decentralized Stablecoins From New Rules

a16z Urges Treasury to Exempt Decentralized Stablecoins From New Rules

Venture firm @a16z has urged the U.S. Treasury to clarify its proposed stablecoin rules under the GENIUS Act and exclude decentralized stablecoins from regulation to promote innovation.

In a Nov. 4 letter to Treasury Secretary Scott Bessent, a16z argued that decentralized assets like $LUSD, backed by @ethereum and governed by smart contracts, lack centralized issuers and shouldn’t fall under Section 3(a)’s restrictions on payment stablecoin issuance.

The firm called the GENIUS Act “a major step for digital finance” but said clear exemptions are needed to support innovation in decentralized finance.

85 days ago

Trend of LUSD after release

No Data

Bullish

a16z Urges Treasury to Exempt Decentralized Stablecoins From New Rules

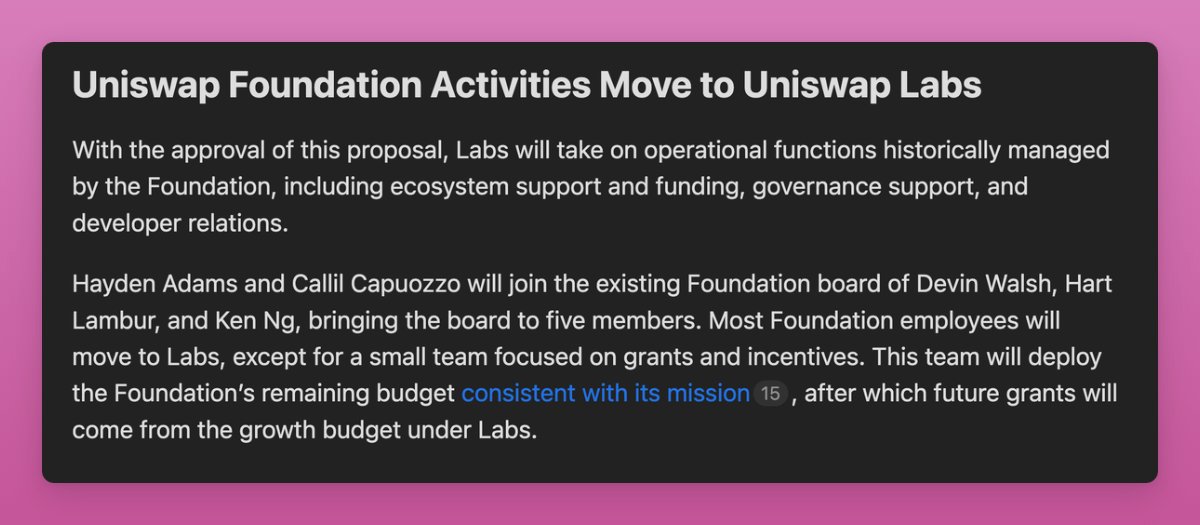

The crypto decentralization vision is faltering, Uniswap and other DAOs are moving towards centralization.

The OG vision of crypto decentralization is struggling:

- Decentralized stablecoins? LUSD is alive yet USDC/USDT dominate the market

- More supply of Bitcoin and ETH moving to ETFs

- DAOs are centralizing (DAO tokens become revenue valued assets)

- Most ICOs require KYC

- Multiple L2s/L1s shut down their chains following Balancer hack

Not all is dark:

- Ethereum's L2s are moving from Stage 0 to Stage 1 decentralization

- Self-custody is still viable for BTC, and ETH despite growing ETF inflows

- DEXs challenging CEXs (perps especially)

- Privacy coins like $ZEC gaining traction

- New solutions like Railgun increase private transactions

Uniswap fee switch proposal is killing the decentralized DAO model.

Uniswap foundation activities move to Uniswap Labs, meaning...

...decision power moves from a non-profit organization governed by $UNI holders to a Delaware centralized corporation.

- Most Foundation employees move to Uniswap Labs

- The Foundation only keeps a tiny grants team

- After the remaining ~$100M grants are deployed, the Foundation shuts down

Thus $UNI token is no longer a DAO token but a token purely valued by buybacks/fees Uniswap will be able to generate.

It's not a criticism but admitting the facts that:

- The DAO model was indeed just pretending decentralization due to regulatory struggles

- DAOs are inefficient at governing and allocating resources

----

Uniswap isn't the first to do it either:

- Scroll fully shuts down the DAO and moved to centralized governance

- Arbitrum's "Vision for the Future" moves many decisions to the core group of Arbitrum Foundation and Offchain Labs to 'fix inefficiencies'

- Optimism Seaso

86 days ago

Trend of LUSD after release

No Data

Bearish

The crypto decentralization vision is faltering, Uniswap and other DAOs are moving towards centralization.

Price Prediction

When is a good time to buy LUSD? Should I buy or sell LUSD now?

When deciding whether it’s a good time to buy or sell Liquity USD (LUSD), it’s important to first align with your own trading strategy and risk profile.Long-term investors and short-term traders often interpret market conditions differently, so your decision should reflect your personal approach. According to the latest LUSD 4-hour technical analysis, the current trading signal is Hold. According to the latest LUSD 1-day technical analysis, the current signal is Hold.

Beacon Prediction

Probabilistic Price Forecast (Next 24 Hours)crypto.loading

About Liquity USD

Liquity USD (LUSD) is a cryptocurrency launched in 2021and operates on the Ethereum platform. Liquity USD has a current supply of 33,805,650.28090688. The last known price of Liquity USD is 1.00200108 USD and is up 0.10 over the last 24 hours. It is currently trading on 143 active market(s) with $81,248.75 traded over the last 24 hours. More information can be found at https://www.liquity.org/.

Read More

Official Links

Chain Explorer

Explore More

BM Discovery

New Listing

BIGTROUT The Big Trout

0 0.00%

RUNE THORChain

0 0.00%

GSON Goldman Sachs Ondo Tokenized

0 0.00%

SPOTON Spotify Ondo Tokenized

0 0.00%

INTCON Intel Ondo Tokenized

0 0.00%

ABBVON AbbVie Ondo Tokenized

0 0.00%

COSTON Costco Ondo Tokenized

0 0.00%

WAN Wanchain

0 0.00%

WAR WAR

0 0.00%

DANKDOGEAI DankDoge AI Agent

0 0.00%