just noticed @StandX_Official quietly sunsetting perps daily trade points tmrw

no biggie tho, the real sauce stays: uptime grinding on limits + hodling DUSD for majer points

keep stacking

StandX DUSD Live Price data

StandX DUSD DUSD Price History USD

Own DUSD Now

Buy and sell DUSD easily and securely on BitMart.StandX DUSD X Insight

Just noticed @StandX_Official quietly dropping the Perps Daily Trade points tomorrow at 00:00 UTC.

No panic though this only sunsets the daily volume grind, Trading Points and Majer Points keep rolling as usual.

Means the real game stays: stack uptime on limits, hold DUSD for that baked-in yield, let positions work without forced churn.

Feels like they're trimming noise to reward actual intent over spam volume. Respect the focus.

Still standing 🧍♂️

I'm glad to see product thinking over pure volume. Margin earning yield via DUSD, fees feeding depth, and Maker Points for passive limit orders actually changes participant incentives. Early, but this feels like a real flywheel.

Beem watching perp DEXs for years now, and most just feel like faster CEX clones with worse liquidity.

@StandX_Official actually changes the math your margin earns yield via DUSD instead of rotting, fees feed back into deeper books, and now Maker Points reward you for just hanging limit orders that don't even fill.

That's real product thinking in a space full of volume grinds. Early, but the flywheel is spinning.

Real capital efficiency in next-gen commodity carry trades on @StandX_Official

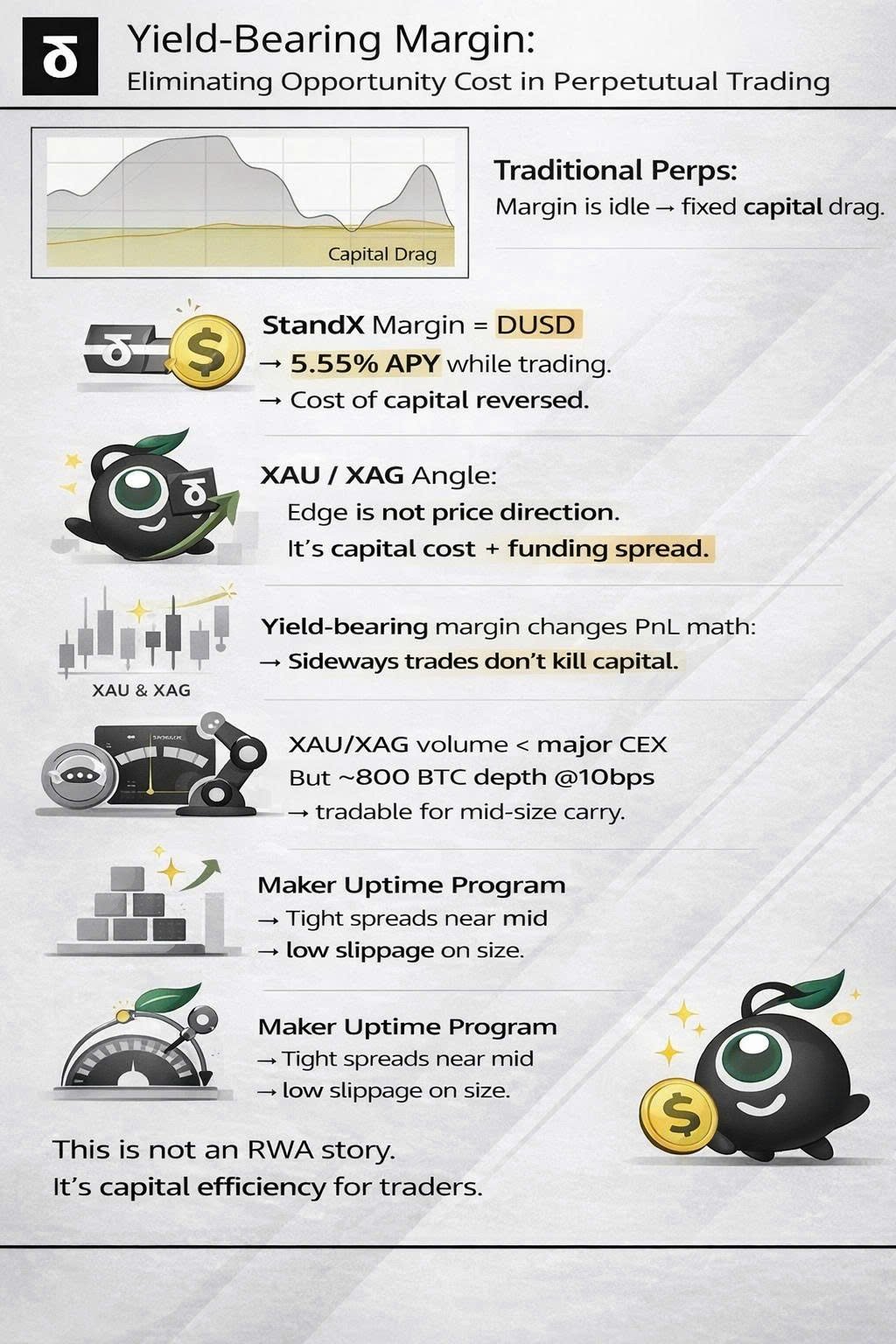

Most traders are overlooking a large hidden cost:

→ idle margin capital that doesn’t earn yield.

On traditional venues, margin only serves as collateral,

while PnL must fully cover funding, fees, and slippage.

StandX introduces a structural difference by allowing margin to be held as DUSD earning ~5.55% APY,

while maintaining exposure to $XAU and $XAG pairs.

→ This is especially relevant because most commodity strategies focus more on carry, funding, and risk management than pure directional bets.

From an execution standpoint, I don’t expect XAU/XAG on StandX to immediately compete with major CEXs on volume.

But with ~800 BTC depth within 10 bps, low slippage, and the Maker Uptime Program,

liquidity at a mid scale is clean enough to deploy carry trades, delta-neutral setups, or light market making.

What matters most to me is the cost of capital differential.

When margin both preserves exposure and generates yield,

the way I calculate capital efficiency changes entirely.

For strategies sensitive to funding and capital utilization,

this is a measurable edge, not a theoretical one.

Price Prediction

When is a good time to buy DUSD? Should I buy or sell DUSD now?