Disclaimer:

Data from X (Twitter), Property of original creators. For reference only, not investment advice.

X Posts

T-Crypto & Stocks (TCS) Trader TA_Analyst D14.21K @Crypto_TomP

T-Crypto & Stocks (TCS) Trader TA_Analyst D14.21K @Crypto_TomP 🚨BSC Gems Alert🚨 D521.45K @BSCGemsAlert

🚨BSC Gems Alert🚨 D521.45K @BSCGemsAlert 1 0 12 Original >Trend of BTC after releaseExtremely Bullish

1 0 12 Original >Trend of BTC after releaseExtremely Bullish T-Crypto & Stocks (TCS) Trader TA_Analyst D14.21K @Crypto_TomP

T-Crypto & Stocks (TCS) Trader TA_Analyst D14.21K @Crypto_TomP SlumDOGE Millionaire D393.26K @ProTheDoge

SlumDOGE Millionaire D393.26K @ProTheDoge 0 0 9 Original >Trend of DOGE after releaseBullish

0 0 9 Original >Trend of DOGE after releaseBullish T-Crypto & Stocks (TCS) Trader TA_Analyst D14.21K @Crypto_TomP

T-Crypto & Stocks (TCS) Trader TA_Analyst D14.21K @Crypto_TomP The ₿itcoin Therapist B257.81K @TheBTCTherapist0 0 10 Original >Trend of BTC after releaseBearish

The ₿itcoin Therapist B257.81K @TheBTCTherapist0 0 10 Original >Trend of BTC after releaseBearish SOU⚡️仮想通貨 / ビットコイン Media Influencer B132.33K @SOU_BTC

SOU⚡️仮想通貨 / ビットコイン Media Influencer B132.33K @SOU_BTC

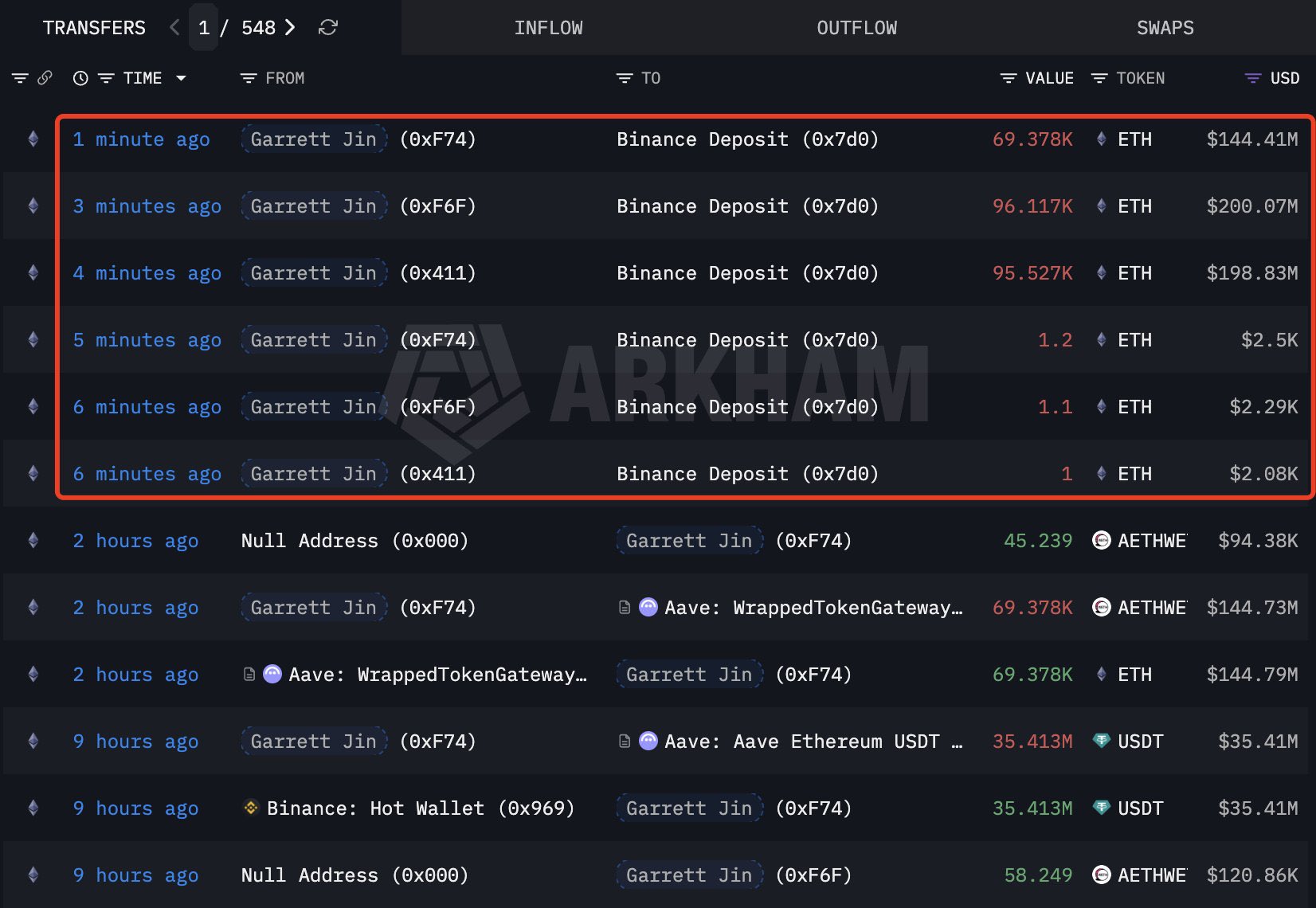

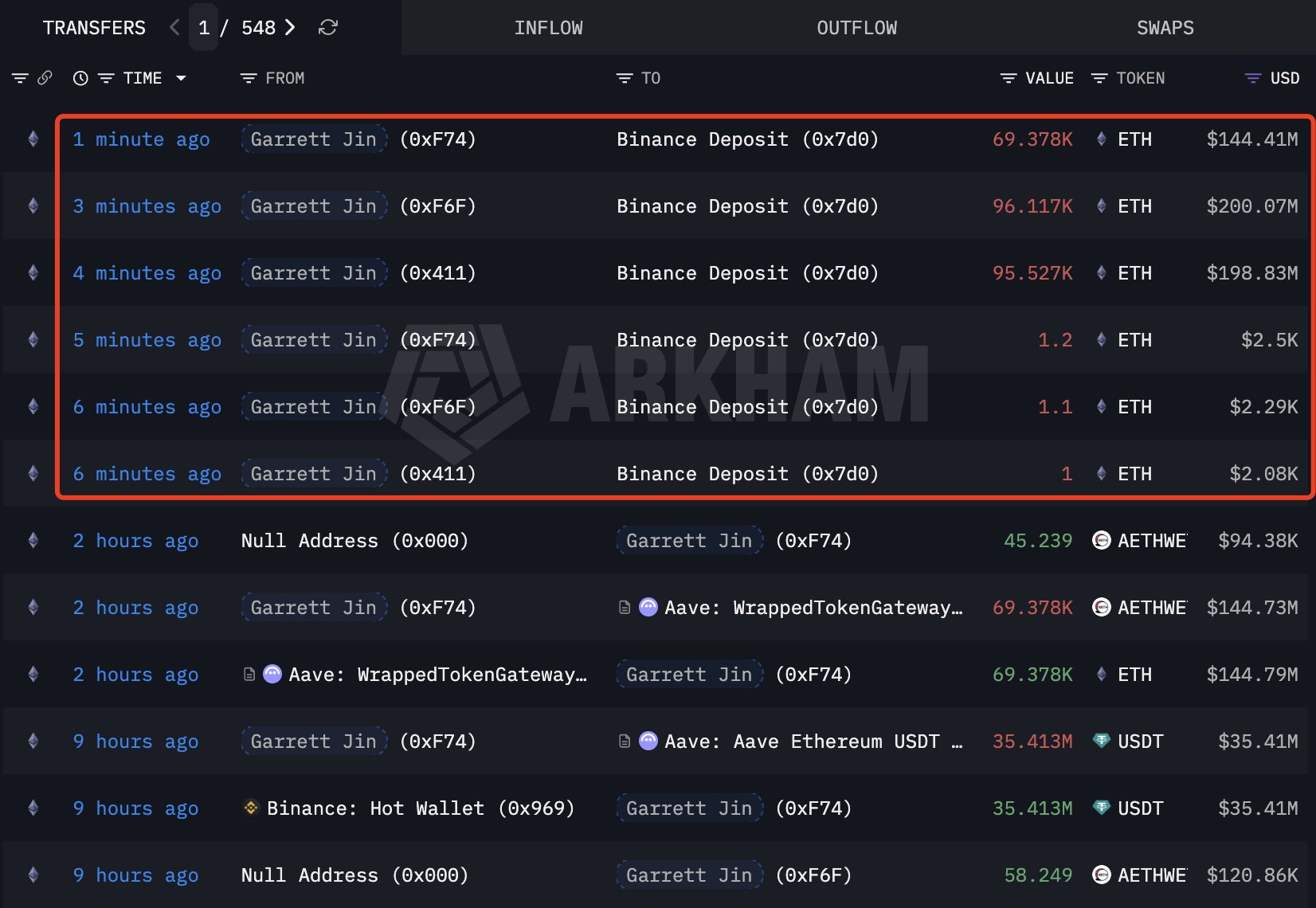

Lookonchain OnChain_Analyst Media C680.82K @lookonchain

Lookonchain OnChain_Analyst Media C680.82K @lookonchain 1 1 541 Original >Trend of ETH after releaseBearish

1 1 541 Original >Trend of ETH after releaseBearish- Bearish

Devmustee🥑 Dev Tokenomics_Expert C29.40K @Dev_Mustee

Devmustee🥑 Dev Tokenomics_Expert C29.40K @Dev_Mustee Bitcoin D8.32M @Bitcoin

Bitcoin D8.32M @Bitcoin 270 82 9.56K Original >Trend of BTC after releaseExtremely Bullish

270 82 9.56K Original >Trend of BTC after releaseExtremely Bullish- Trend of XRP after releaseBullish

- Trend of BTC after releaseBearish

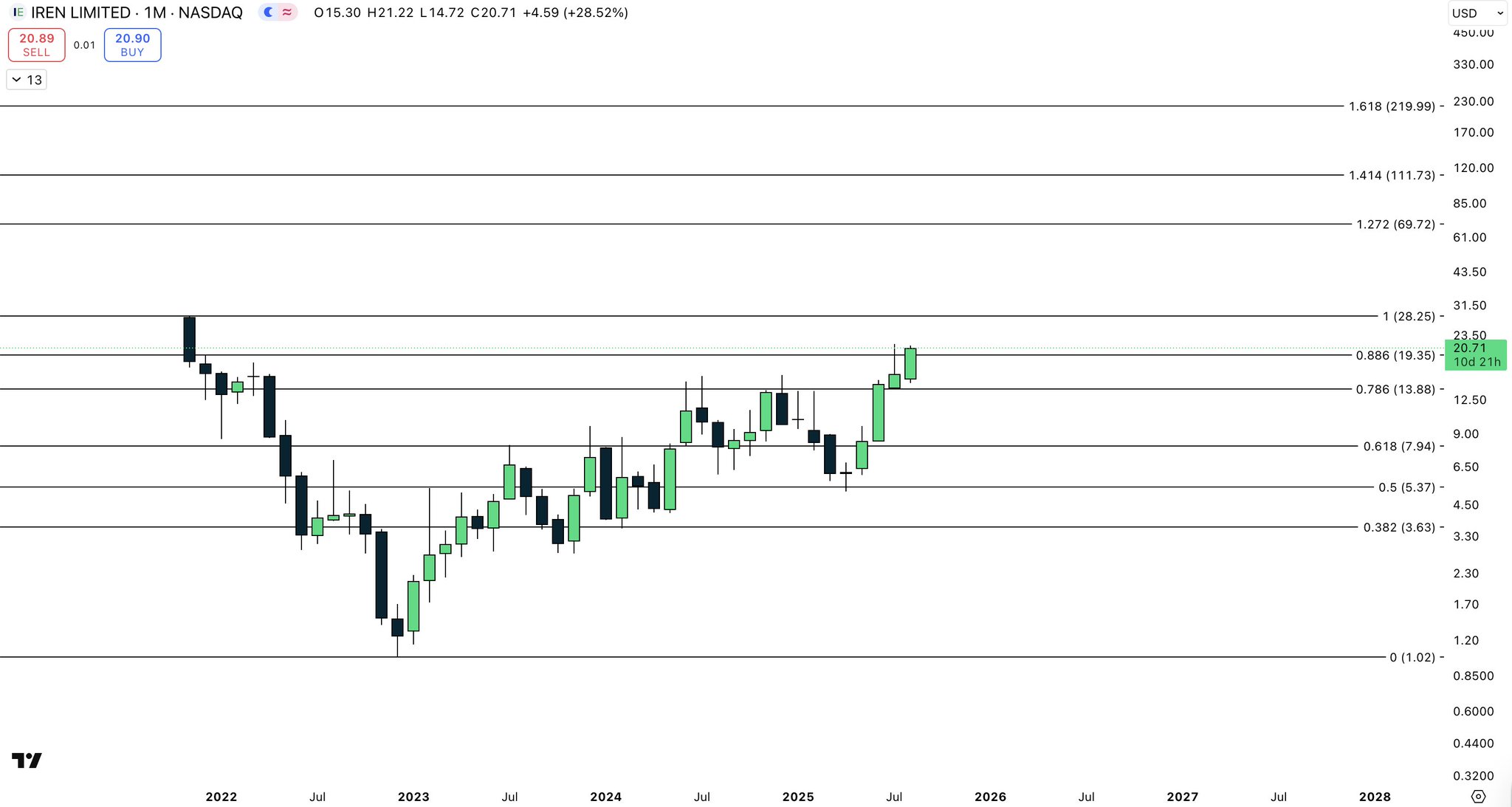

chad. TA_Analyst Trader B13.30K @chad_ventures

chad. TA_Analyst Trader B13.30K @chad_ventures chad. TA_Analyst Trader B13.30K @chad_ventures

chad. TA_Analyst Trader B13.30K @chad_ventures 0 0 22 Original >Extremely Bullish

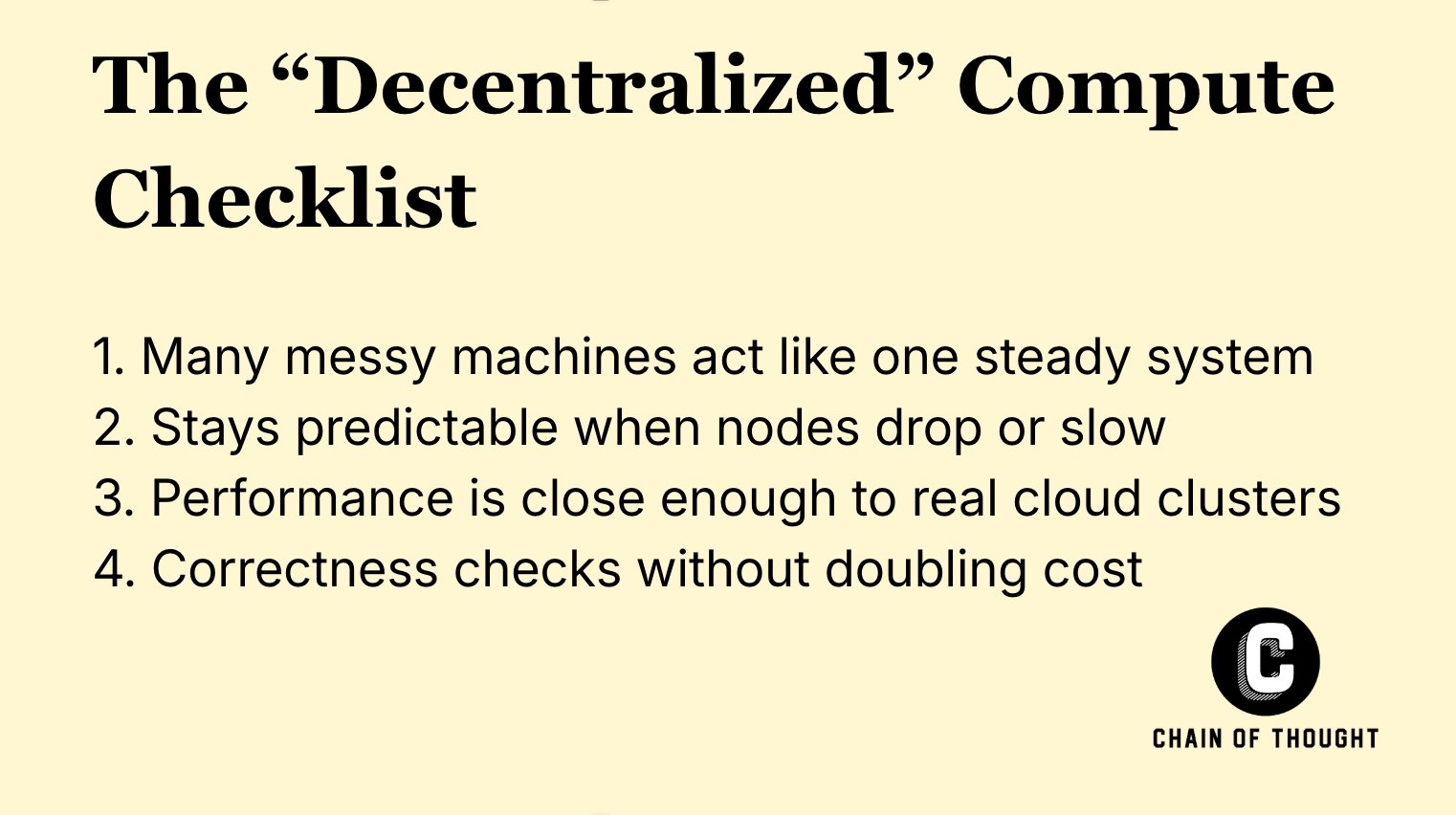

0 0 22 Original >Extremely Bullish Teng Yan · Chain of Thought AI Educator Researcher B41.47K @tengyanAI

Teng Yan · Chain of Thought AI Educator Researcher B41.47K @tengyanAI Teng Yan · Chain of Thought AI Educator Researcher B41.47K @tengyanAI

Teng Yan · Chain of Thought AI Educator Researcher B41.47K @tengyanAI 35 12 4.65K Original >Neutral

35 12 4.65K Original >Neutral

24h Social Sentiment from X

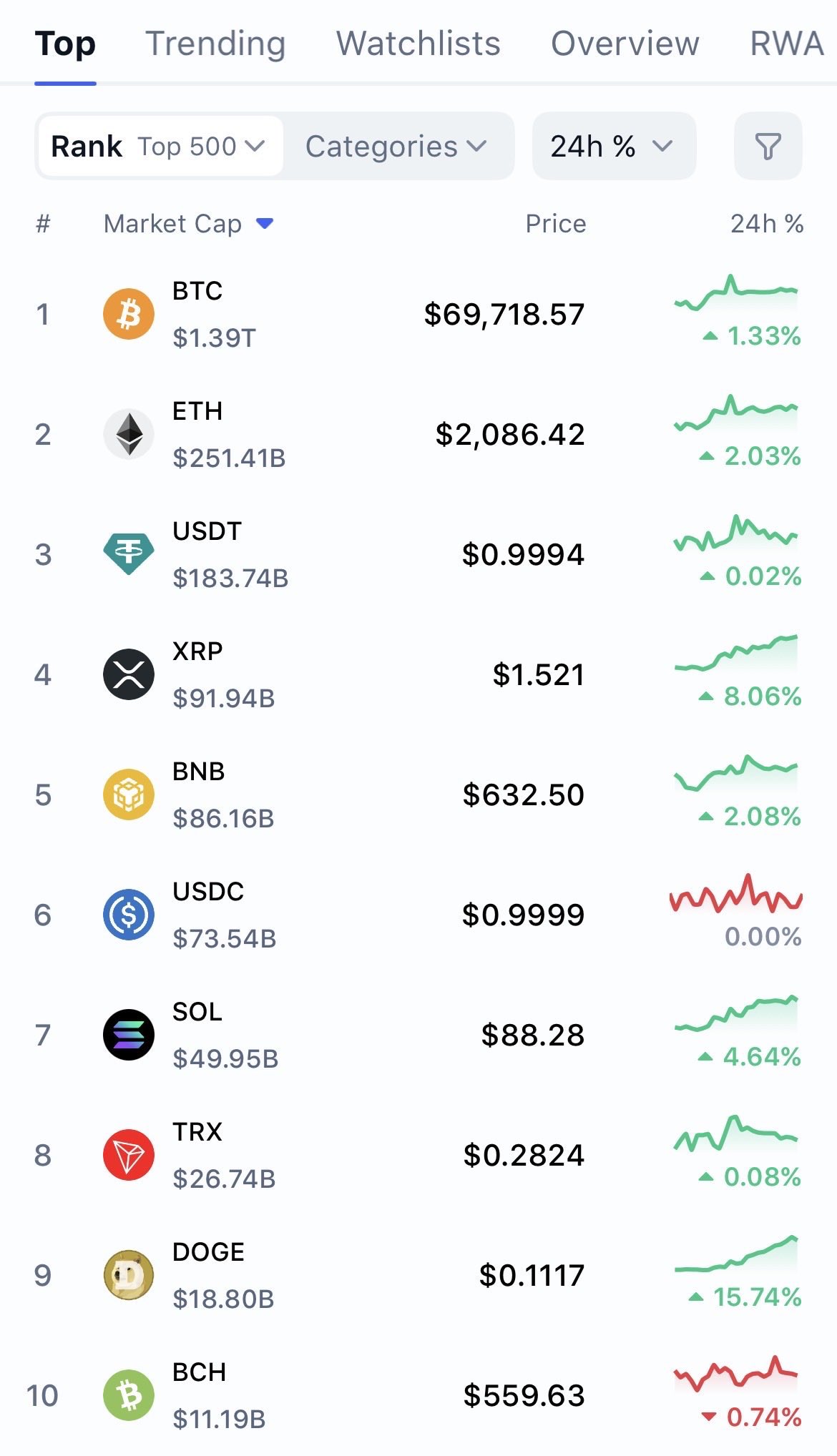

5,189Analyzed Posts-34.87%2,468Surveyed KOLs+0.04%Market sentiment leans Bullish- CoinsSSIChangeSSI Insights

- CoinsMPRChange

SPACE#1 KOL attention surge+81

SPACE#1 KOL attention surge+81 ON#2 Social mentions skyrocketed-

ON#2 Social mentions skyrocketed- MANA#3 social mentions surge-

MANA#3 social mentions surge- MINA#4 Sentiment polarization skyrocketing+67

MINA#4 Sentiment polarization skyrocketing+67 SOMI#5 Extreme sentiment polarization-

SOMI#5 Extreme sentiment polarization-

Alert Summary