One of my top accumulated holdings for small cap ai

Tight supply

no inflation

$TRAC #TRAC

trac (Ordinals) 實時價格數據

trac (Ordinals) TRAC 價格歷史 USD

trac (Ordinals) 社交媒體動態

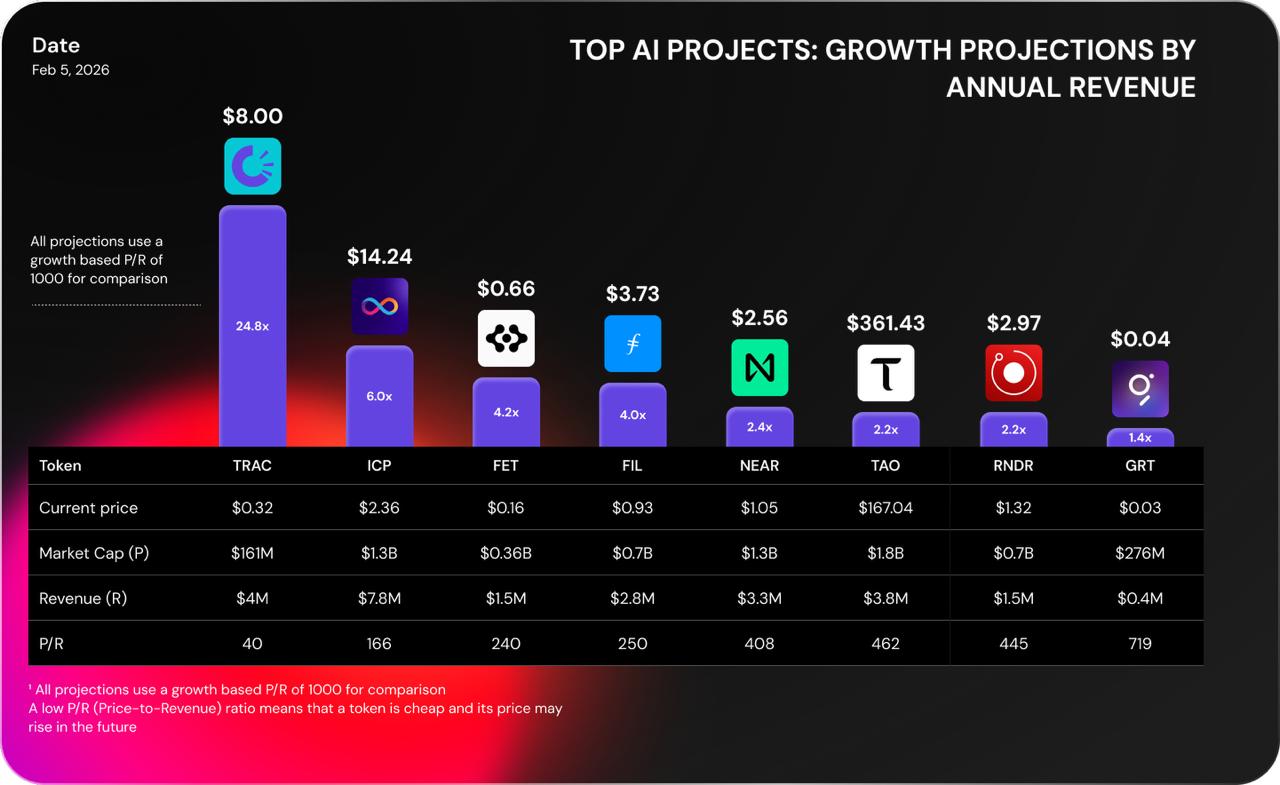

$TRAC is objectively undervalued vs its "AI" peers when comparing revenue to current marketcap.

All revenue generated by @origin_trail is passed on to $TRAC stakers and node operators, and the token has ZERO inflation (fully circulating).

If $TRAC was trading at the same MC/Rev ratios as it's peers, it would be priced at:

ICP- $1.32

FET- $1.92

FIL- $2

NEAR- $3.26

TAO- $3.70

RNDR- $3.56

GRT- $5.75

It currently trades at .32.

$TRAC is objectively undervalued vs its "AI" peers when comparing revenue to current marketcap.

All revenue generated by @origin_trail is passed on to $TRAC stakers and node operators, and the token has ZERO inflation (fully circulating).

If $TRAC was trading at the same MC/Rev ratios as it's peers, it would be priced at:

ICP- $1.32

FET- $1.92

FIL- $2

NEAR- $3.26

TAO- $3.70

RNDR- $3.56

GRT- $5.75

It currently trades at .32.

$TRAC is objectively undervalued vs its "AI" peers when comparing revenue to current marketcap.

All revenue generated by @origin_trail is passed on to $TRAC stakers and node operators, and the token has ZERO inflation (fully circulating).

If $TRAC was trading at the same MC/Rev ratios as it's peers, it would be priced at:

ICP- $1.32

FET- $1.92

FIL- $2

NEAR- $3.26

TAO- $3.70

RNDR- $3.56

GRT- $5.75

It currently trades at .32.

Top AI Projects: Growth Projections by Annual Revenue

$TRAC 8$ (25x)

$ICP 14$ (6x)

$FET 66c (4x)

$FIL 3.7$ (4x)

$NEAR 2.5$ (2.4x)

$TAO 360$ (2.2x)

$RNDR 3$ (2.2x)

$GRT 4c (1.4x)

價格預測

什麼時候是購買TRAC的好時機?我應該現在買入還是賣出TRAC?

Beacon預測

概率價格預測(未來24小時)探索更多

BM發現

新上市