Judging whether a project is reliable never depends on how many people are involved or how hype it generates. What is truly scarce in the market is not a “good story” but a mechanism that allows ordinary users to capture long‑term discounts. @TermMaxFi happens to be an excellent reference sample.

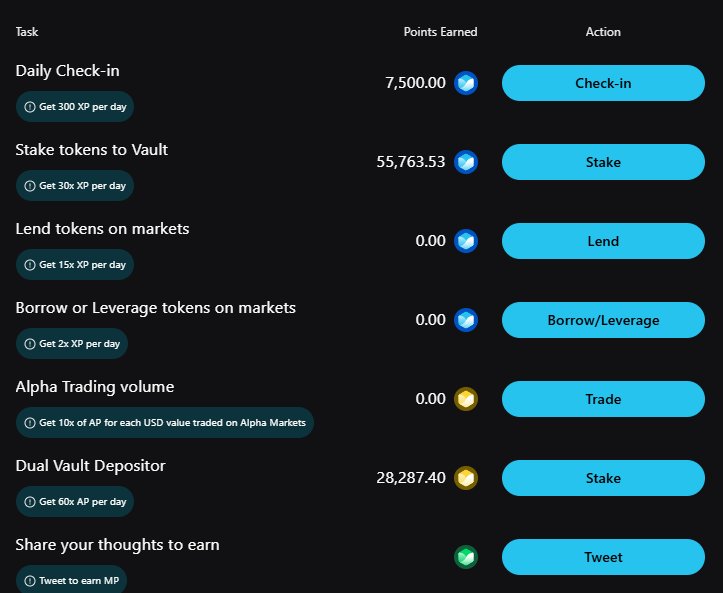

Its biggest distinction lies not in the concept but in the structure. The four point‑earning paths—TMX, AP, XP, MP—operate independently, and 15% of the token allocation is explicitly set aside for airdrops. The rules are intentionally restrained; newcomers don’t need to compete with whales in capital size, and low‑weight accounts can steadily accumulate points through daily actions—a rarity among many “anti‑whale” models.

The most basic activity is actually the most valuable. Daily sign‑ins cost virtually nothing, yet the XP awarded carries a non‑trivial weight within the entire system and provides a steady incremental gain over time. Many overlook this “slow variable,” effectively forgoing low‑risk returns.

If you prefer not to trade, the MP track is user‑friendly enough. Simply bind X, publish content about the project and tag the official account. There’s no long‑form requirement nor need for sophisticated analysis; the algorithm values consistency and genuine interaction, making it clearly more approachable for ordinary users.

To further widen the gap, there are clear routes. AP is geared toward advanced users, obtained via options trading on the Alpha market; the barrier is low yet efficiency is high. XP follows a steady path—sign‑ins, holdings, invitations—all provide definite returns, with a simple route and clear expectations.

Another reason I’m willing to stay involved is that the project’s background and roadmap are transparent. Leading institutions participate, early trading volume is already evident, the TGE timeline is clear, and points will directly map to token value in the future, completing a full logical loop.

My personal focus has been its Alpha product. Fixed‑cost, option‑style leverage essentially locks risk in advance, allowing retail investors to engage in price speculation during the new‑coin phase without fearing liquidation. This fills the gap where new tokens typically only have spot markets and lack hedging tools.

If the goal is efficient point accumulation, the strategy is simple: don’t rely on a single track. Earn base badges through deposits and trading, maintain daily MP output, and layer the invitation mechanism. Running all four tracks simultaneously yields efficiency far beyond single‑track sprints.

In a nutshell, @TermMaxFi is not an emotion‑driven project; it pre‑designs incentives, pacing, and risk boundaries. Before major capital fully enters, ordinary users can actually find suitable positions more easily.