Ore ORE 價格歷史 USD

跟蹤 Ore 的今日價格、7天、30天和90天價格

週期

漲跌

漲跌幅 (%)

今日

--

--

7日

--

--

30日

--

--

90日

--

--

Ore 市場信息

$ 49.75 24小時價格浮動區間 $ 118.71

歷史最高

$ 0

歷史最低

$ 0

24小時漲跌幅

24小時交易量

0

流通供給

425.00K

ORE

市值

0

最大供給

3.00M

ORE

完全稀釋的市值

0

交易 ORE

Ore 社交媒體動態

ORE miners have high activity on Seeker, no clear trend yet

I have been surprised by how many ORE miners are active on Seeker https://t.co/gUT4GnrspH

9 小時 前

發佈後ORE走勢

無數據

中性

ORE miners have high activity on Seeker, no clear trend yet

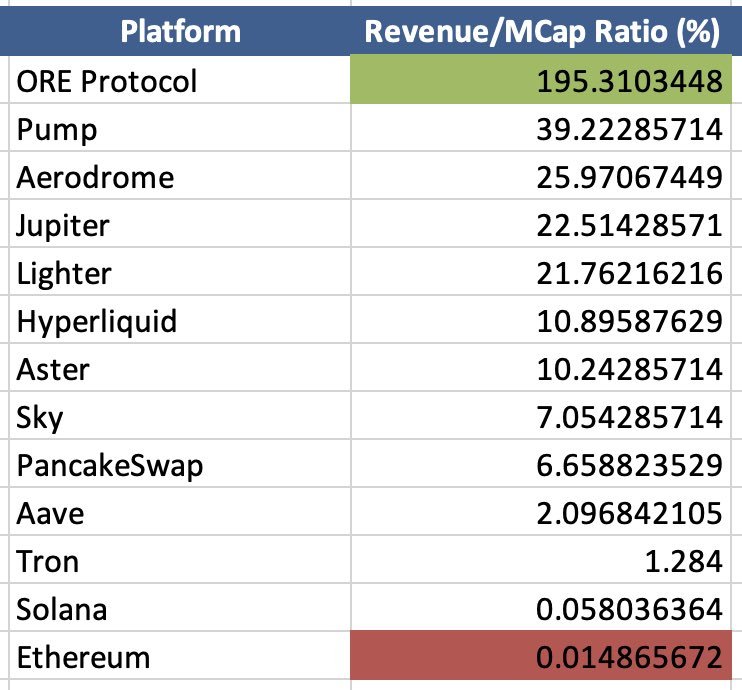

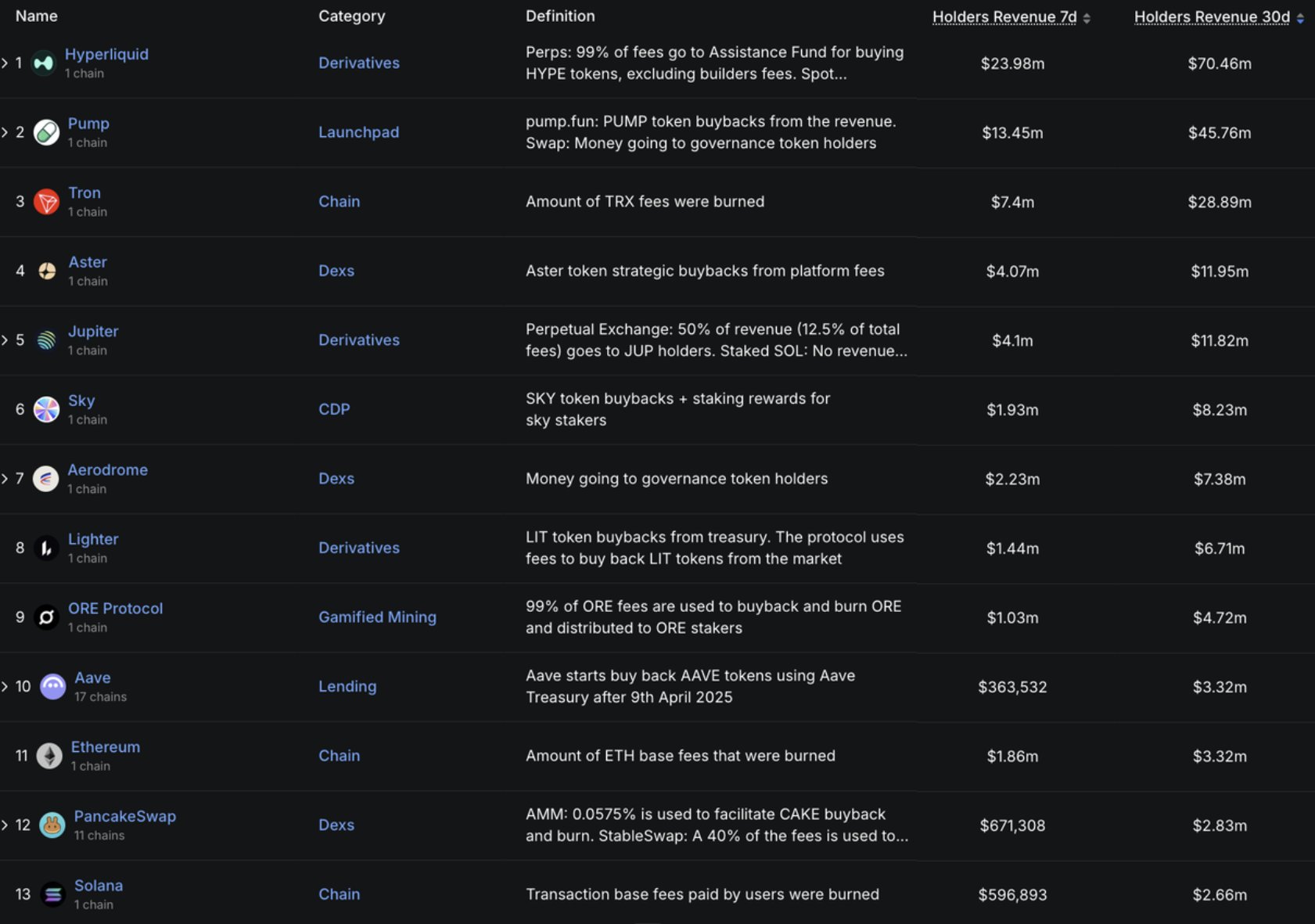

The tweet analyzes the ability of on-chain projects to generate returns for token holders and points out market valuation discrepancies.

Things that should not be on here:

- ORE

Things that should be but revenue is hard to verify onchain:

- Tether

- Circle

- Ethena

Things that surprise me:

- how much Tron makes on stablecoin transfer gas fees alone when other chains have them for free

- that market does not value Pump buybacks

- why Lighter trades at half the relative value of Hyperliquid and Aster

credit to my replyguy @0xSmite

The list of things that actually make money for their tokenholders onchain:

- Perps: Hyperliquid / Lighter / Aster

- Aggregator/AMM: Jupiter / Aerodrome / Pancake

- Banks: Sky / Aave

- Random ponzis with mischaracterized revenue

- Ethereum/Solana/Tron

source @DefiLlama https://t.co/wTm4cUd29s

3 日 前

發佈後ORE走勢

無數據

中性

The tweet analyzes the ability of on-chain projects to generate returns for token holders and points out market valuation discrepancies.

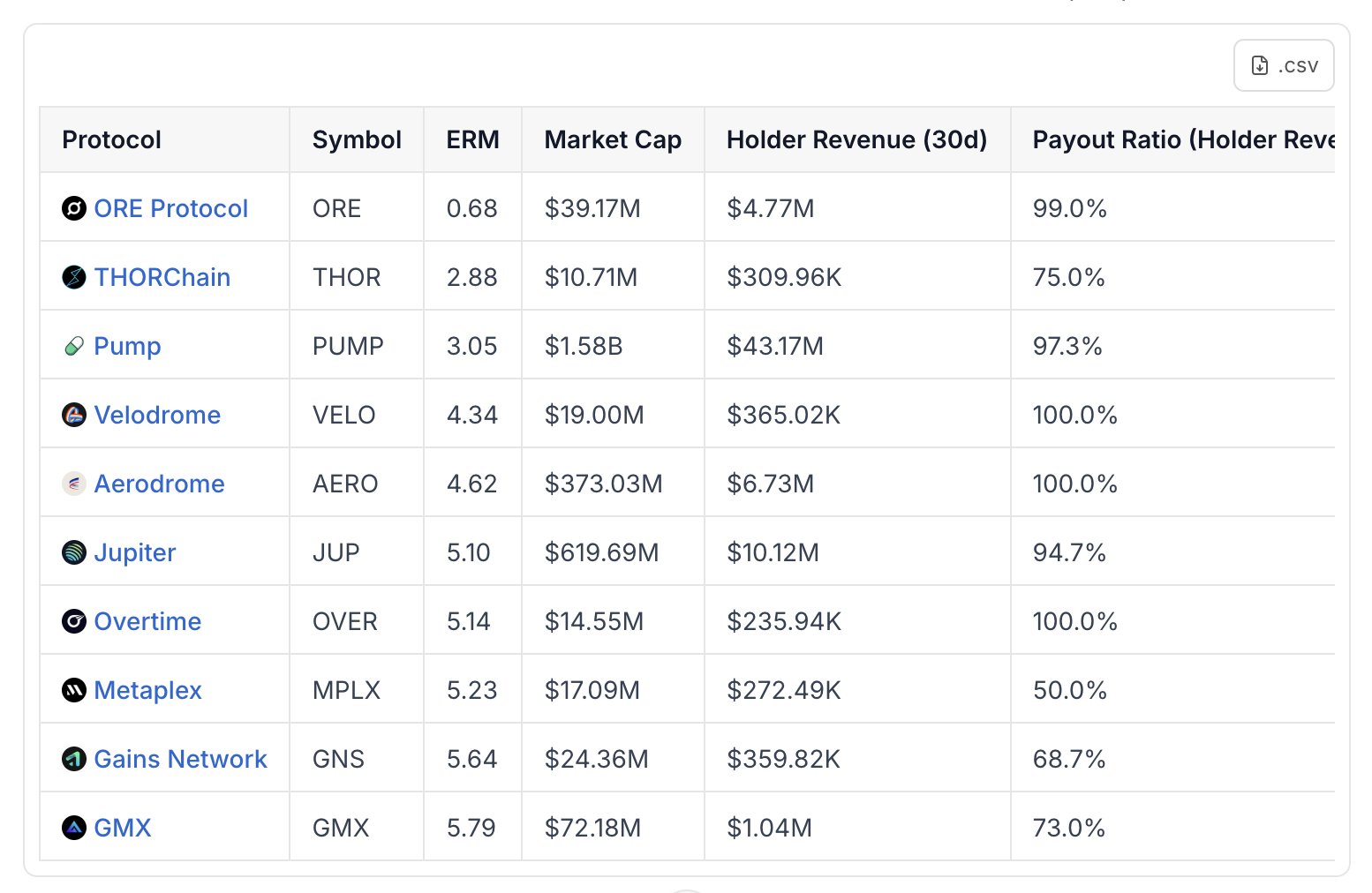

The tweet introduces the ERM valuation method and lists tokens such as PUMP, JUP, and AERO that have high cash‑flow efficiency.

Most P/S ratios in crypto are lying to you.

P/S = Market Cap ÷ Revenue

It tells you how much you're paying for every $1 of revenue.

1. Low P/S (2x) = paying $2 per $1 revenue. Cheaper.

2. High P/S (20x) = paying $20 per $1 revenue. Pricier.

But in crypto, this breaks down:

- Not all tokens receive revenue

- Not all revenue goes to holders

- Circulating supply ≠ eligible supply

A protocol can print $100M in fees while token holders see nothing.

Effective Revenue Multiplier is the fix here:

→ Only count supply that actually receives cashflow

→ Only count cashflow that actually reaches holders

Here are the tokens with the strongest ERM👇

$PUMP $JUP $AERO are the ones with biggest mcap.

(A lower ERM indicates a more efficient valuation from a token holder's cash flow perspective)

h/t to @DefiLlama for the data

7 日 前

發佈後ORE走勢

無數據

看漲

The tweet introduces the ERM valuation method and lists tokens such as PUMP, JUP, and AERO that have high cash‑flow efficiency.

價格預測

什麼時候是購買ORE的好時機?我應該現在買入還是賣出ORE?

在判斷現在是否是買入或賣出 Ore (ORE) 的合適時機時,首先需要結合自身的交易策略和風險承受能力。長期投資者與短期交易者對市場信號的解讀往往不同,因此建議根據個人交易計劃做出決策。 根據最新的 ORE 4 小時技術分析,當前交易信號為持有。

Beacon預測

概率價格預測(未來24小時)crypto.loading

關於 Ore

Ore (ORE) is a cryptocurrency launched in 2024and operates on the Solana platform. Ore has a current supply of 425,030.52317181. The last known price of Ore is 76.16188996 USD and is down -2.74 over the last 24 hours. It is currently trading on 83 active market(s) with $909,801.43 traded over the last 24 hours. More information can be found at https://ore.supply/.

查看更多

探索更多

BM發現

新上市

SOFION SoFi Technologies Ondo Tokenized

0 0.00%

ARMON Arm Holdings plc Ondo Tokenized

0 0.00%

IBMON IBM Ondo Tokenized

0 0.00%

ADBEON Adobe Ondo Tokenized

0 0.00%

NKEON Nike Ondo Tokenized

0 0.00%

TCU29 TCU29

0 0.00%

BIGTROUT The Big Trout

0 0.00%

RUNE THORChain

0 0.00%

GSON Goldman Sachs Ondo Tokenized

0 0.00%

SPOTON Spotify Ondo Tokenized

0 0.00%