Liquity USD 實時價格數據

今日Liquity USD的實時價格為$ 0.99 (LUSD/USD), 當前市值為 $ 33.76M USD。 24小時的成交量為 $ 89,000.57 USD。 過去24小時內漲跌幅為 +0.00%, 流通量為 33.83M LUSD。

Liquity USD LUSD 價格歷史 USD

跟蹤 Liquity USD 的今日價格、7天、30天和90天價格

週期

漲跌

漲跌幅 (%)

今日

0

0.00%

7日

--

--

30日

--

--

90日

0

0.00%

Liquity USD 市場信息

$ 0.99 24小時價格浮動區間 $ 0.99

歷史最高

$ 1.06

歷史最低

$ 0.94

24小時漲跌幅

0.00%

24小時交易量

$ 89,000.57

流通供給

33.82M

LUSD

市值

$ 33.76M

最大供給

--

完全稀釋的市值

$ 33.76M

交易 LUSD

Liquity USD 社交媒體動態

LUSD remains eligible as Aave collateral, bullish; USDS/DAI removal raises risk

Wow. Looks like Sky's USDS and DAI being removed as collateral from Aave.

Interestingly, Liquity's LUSD is still eligible.

LUSD is exactly the same as when it launched 4 years ago. It's immutable and autonomous. Whereas USDS and DAI can change their backing.

64 日 前

發佈後LUSD走勢

無數據

看漲

LUSD remains eligible as Aave collateral, bullish; USDS/DAI removal raises risk

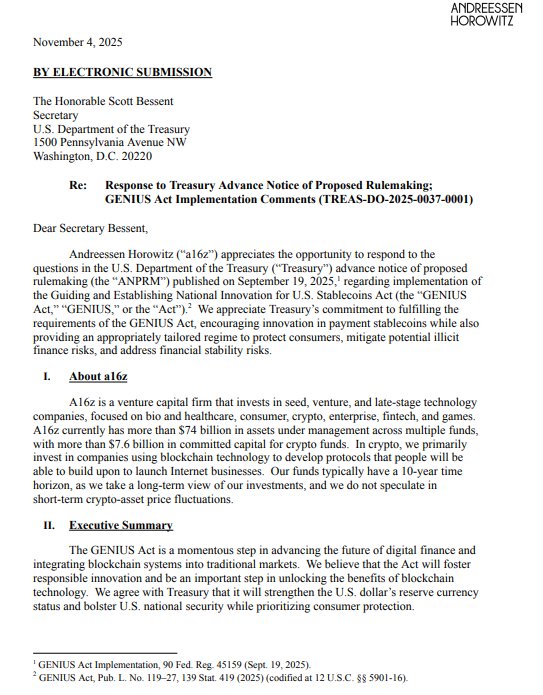

a16z Urges Treasury to Exempt Decentralized Stablecoins From New Rules

a16z Urges Treasury to Exempt Decentralized Stablecoins From New Rules

Venture firm @a16z has urged the U.S. Treasury to clarify its proposed stablecoin rules under the GENIUS Act and exclude decentralized stablecoins from regulation to promote innovation.

In a Nov. 4 letter to Treasury Secretary Scott Bessent, a16z argued that decentralized assets like $LUSD, backed by @ethereum and governed by smart contracts, lack centralized issuers and shouldn’t fall under Section 3(a)’s restrictions on payment stablecoin issuance.

The firm called the GENIUS Act “a major step for digital finance” but said clear exemptions are needed to support innovation in decentralized finance.

85 日 前

發佈後LUSD走勢

無數據

看漲

a16z Urges Treasury to Exempt Decentralized Stablecoins From New Rules

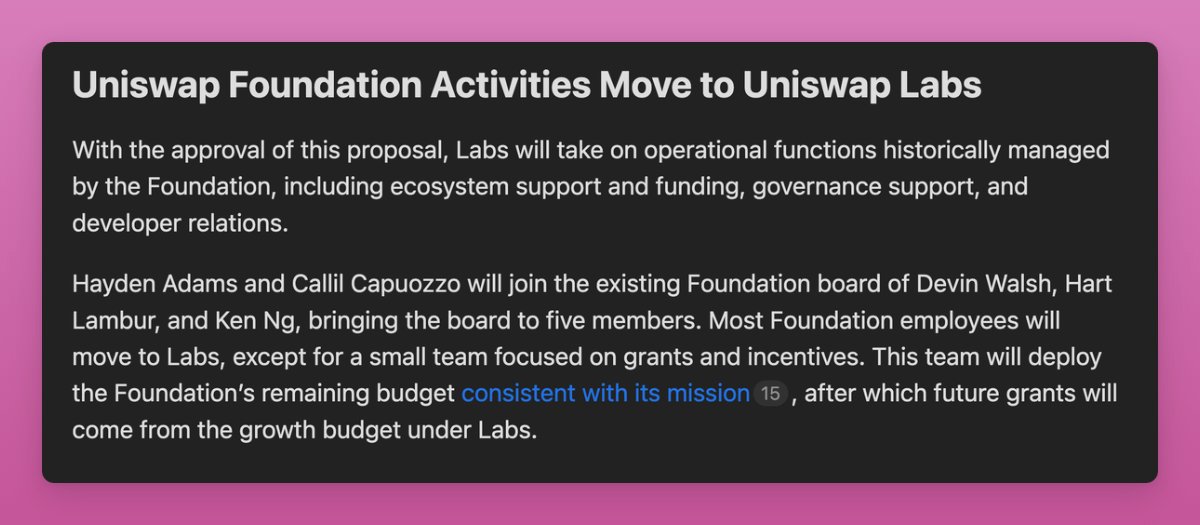

The crypto decentralization vision is faltering, Uniswap and other DAOs are moving towards centralization.

The OG vision of crypto decentralization is struggling:

- Decentralized stablecoins? LUSD is alive yet USDC/USDT dominate the market

- More supply of Bitcoin and ETH moving to ETFs

- DAOs are centralizing (DAO tokens become revenue valued assets)

- Most ICOs require KYC

- Multiple L2s/L1s shut down their chains following Balancer hack

Not all is dark:

- Ethereum's L2s are moving from Stage 0 to Stage 1 decentralization

- Self-custody is still viable for BTC, and ETH despite growing ETF inflows

- DEXs challenging CEXs (perps especially)

- Privacy coins like $ZEC gaining traction

- New solutions like Railgun increase private transactions

Uniswap fee switch proposal is killing the decentralized DAO model.

Uniswap foundation activities move to Uniswap Labs, meaning...

...decision power moves from a non-profit organization governed by $UNI holders to a Delaware centralized corporation.

- Most Foundation employees move to Uniswap Labs

- The Foundation only keeps a tiny grants team

- After the remaining ~$100M grants are deployed, the Foundation shuts down

Thus $UNI token is no longer a DAO token but a token purely valued by buybacks/fees Uniswap will be able to generate.

It's not a criticism but admitting the facts that:

- The DAO model was indeed just pretending decentralization due to regulatory struggles

- DAOs are inefficient at governing and allocating resources

----

Uniswap isn't the first to do it either:

- Scroll fully shuts down the DAO and moved to centralized governance

- Arbitrum's "Vision for the Future" moves many decisions to the core group of Arbitrum Foundation and Offchain Labs to 'fix inefficiencies'

- Optimism Seaso

86 日 前

發佈後LUSD走勢

無數據

看跌

The crypto decentralization vision is faltering, Uniswap and other DAOs are moving towards centralization.

價格預測

什麼時候是購買LUSD的好時機?我應該現在買入還是賣出LUSD?

在判斷現在是否是買入或賣出 Liquity USD (LUSD) 的合適時機時,首先需要結合自身的交易策略和風險承受能力。長期投資者與短期交易者對市場信號的解讀往往不同,因此建議根據個人交易計劃做出決策。 根據最新的 LUSD 4 小時技術分析,當前交易信號為持有。 根據最新的 LUSD 1 天技術分析,當前交易信號為持有。

Beacon預測

概率價格預測(未來24小時)crypto.loading

關於 Liquity USD

Liquity USD (LUSD) is a cryptocurrency launched in 2021and operates on the Ethereum platform. Liquity USD has a current supply of 33,805,650.28090688. The last known price of Liquity USD is 1.00200108 USD and is up 0.10 over the last 24 hours. It is currently trading on 143 active market(s) with $81,248.75 traded over the last 24 hours. More information can be found at https://www.liquity.org/.

查看更多

探索更多

BM發現

新上市

BIGTROUT The Big Trout

0 0.00%

RUNE THORChain

0 0.00%

GSON Goldman Sachs Ondo Tokenized

0 0.00%

SPOTON Spotify Ondo Tokenized

0 0.00%

INTCON Intel Ondo Tokenized

0 0.00%

ABBVON AbbVie Ondo Tokenized

0 0.00%

COSTON Costco Ondo Tokenized

0 0.00%

WAN Wanchain

0 0.00%

WAR WAR

0 0.00%

DANKDOGEAI DankDoge AI Agent

0 0.00%