StandX has been quietly moving in that second direction. Instead of pushing noise, they’ve focused on making execution simpler and liquidity incentives cleaner. @StandX_Official

The recent expansion into on chain gold and silver markets signals something important: this isn’t just a crypto playground anymore. It’s becoming a place where different asset classes can be traded under the same logic.

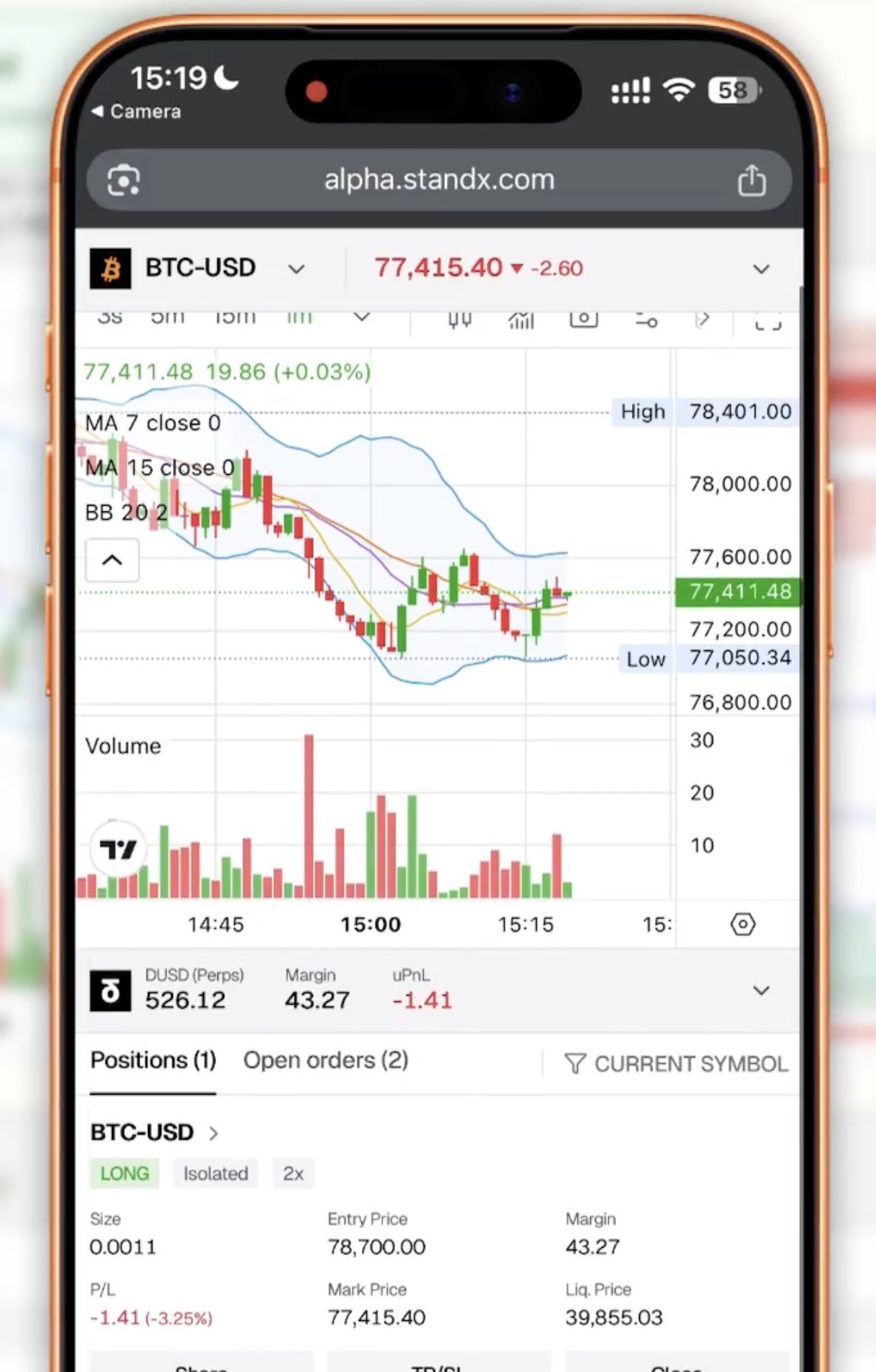

What really changes daily behavior is mobile access. The new app cuts straight to execution scan, connect, trade. No friction, no setup overhead. That matters when you’re managing orders, not just opening positions. $DUSD

Liquidity is still the core. The system favors makers who keep orders close to price, rewarding consistency over aggression. With a monthly 5M token pool, simply maintaining disciplined limit orders within 10 bps turns into a repeatable edge rather than a grind.

This is not about trading more.

It’s about trading cleaner.

When a platform optimizes for structure instead of hype, the compounding happens naturally. And that’s the direction StandX is clearly leaning into.