Making money in the market is becoming increasingly difficult; retail investors often chase highs and sell lows. It is recommended to trade fewer swings and hold more.

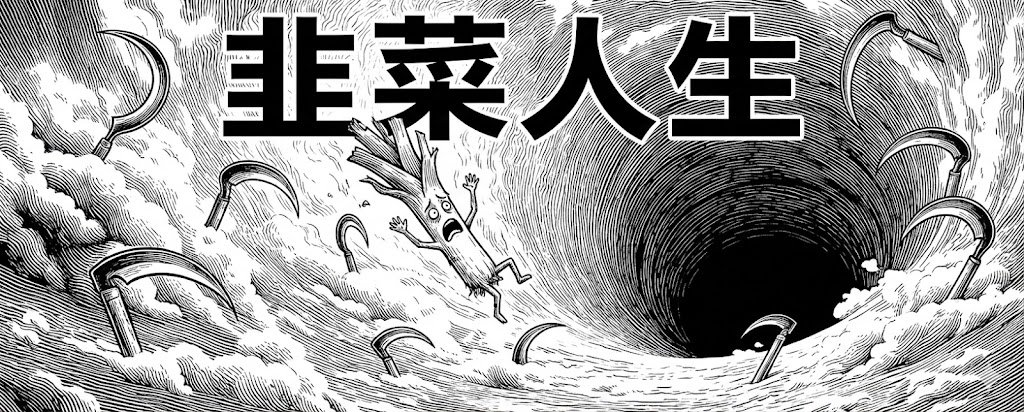

✍️Chives life, simple life

Actually, lately everyone has been discussing how increasingly difficult it is to make money, both on‑chain and off‑chain.

Even exchanges have noticed this; otherwise they wouldn't be turning to gold and silver precious metals. After all, with trading volume gone, exchanges can't make money either—so what can they do?

Think about a casino that can't make money; what should it do?

🌟Are precious metals no longer in a simple mode?

Yesterday gold was extremely FOMO‑driven, pulling in a single day more than its typical one‑year or even multi‑year price moves.

And @SuperBILI even started showing trades; this usually “low‑key bear” began doing that, which means the supply is exhausted.

Yesterday we could see all precious metals and commodities “jetting”; even the traditionally flat “copper” and “oil” took off.

Of course, last night, as “gold collapsed”, everyone joined the “collapse”.

Those who tried to bottom‑fish and didn’t get run‑away essentially got back in.

This at least demonstrates, for now, that “precious metals” seem no longer simple.

Yesterday we chased longs at the high point, then cut our long positions at the low point.

When it rose, we feared buying too much would lead to a loss on a pull‑back; when it fell, we feared buying too little, worrying it might just be a small correction.

In the end, high‑buy low‑sell worked out quite well.

🌟Will the partial simple mode continue in US stocks?

US stocks follow the strongest rallies, such as $SNDRK $MU $INTC, which also saw big pull‑backs yesterday.

When earnings came out at midnight, $SNDK beat expectations and shot up, keeping the storage sector hot.

At least on this front, people are still reluctant to dump their holdings.

The drops are fast, the rebounds faster, and new highs come even faster.

However, this volatility is actually larger than that of precious metals, requiring excellent mental fortitude.

One good thing about US stocks is that after playing many “dog‑coins”, you notice these assets with “fundamental logic” seem unlikely to go to zero.

The 50k/100k “dog‑coins” on the chain turned into industrial crystallization worldwide, making everyone hesitant.

At least it looks simpler than crypto, maybe even simpler than current precious metals.

🌟Chives life

I really can’t pull off swing trades; it feels like wherever a chive operates, it just stays a chive.

At first I thought it was a simple test, opened a small position, and because it kept rising I kept adding, but never dared to sell, just held.

Then it corrected; I thought it was an opportunity and tried to dip‑buy, but it kept falling with no turn‑around, so I wanted to stop‑loss, and as soon as I did, it rebounded.

Seeing the rebound, I wondered if the decline was over, chased another, then the rebound abruptly stopped and fell again.

Staring blankly at the candlesticks, I have to start subtracting again 🤣.

Do fewer swings, be more of a holder, just stay put.

If any operations above resemble real ones, it is purely coincidental.

As an ordinary chive with average IQ, I can only make money in places where everyone else is making money; if only the smart can profit, I certainly can’t.

So even though I’m a chive, I still have to keep doing it.