built like a spring but w/ $BPT it’s that quiet coil where you look around and realize half the float’s already gone and fdv still reads like a typo… then one day it’s just vertical and you’re either in or googling entry points you can’t get back #microcapflow

Best Patent BPT 價格歷史 USD

Best Patent 社交媒體動態

those staircase legs on $BPT aren’t noise they’re the kind of compression phase you can’t backfill once it’s gone

FDV at 4M w/ half the float already freed up = low friction for next leg

file it under “quiet now, loud later” #microcapflow

Attacks are getting more sophisticated!

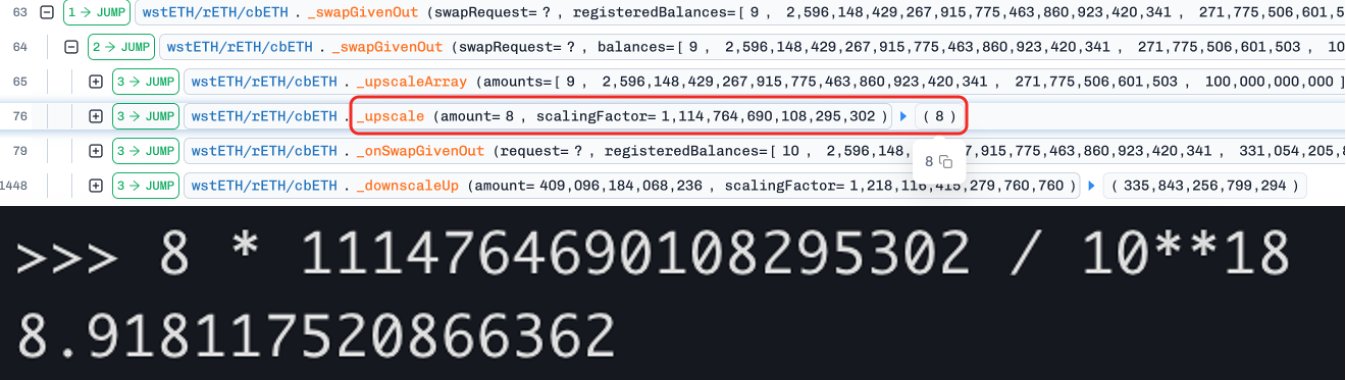

.@Balancer and several forked projects were attacked a few hours ago, resulting in losses exceeding $120M across multiple chains. This was a highly sophisticated exploit. Our initial analysis suggests the root cause was an invariant manipulation that distorted the BPT price calculation, allowing the attacker to profit from a specific stable pool through a single batch swap. Attacks are getting more sophisticated! Take an attack TX on Arbitrum as an example, the batchSwap operation can be broken down into three phases: 1. The attacker swaps BPT for underlying assets to precisely adjust the balance of one token (cbETH) to the edge of a rounding boundary (amount = 9). This sets up the conditions for precision loss in the next step. 2. The attacker then swaps between another underlying (wstETH) and cbETH using a crafted amount (= 8). Due to rounding down when scaling token amounts, the computed Δx becomes slightly smaller (8.918 to 8), leading to an underestimated Δy and thus a smaller invariant (D from Curve’s StableSwap model). Since BPT price = D /

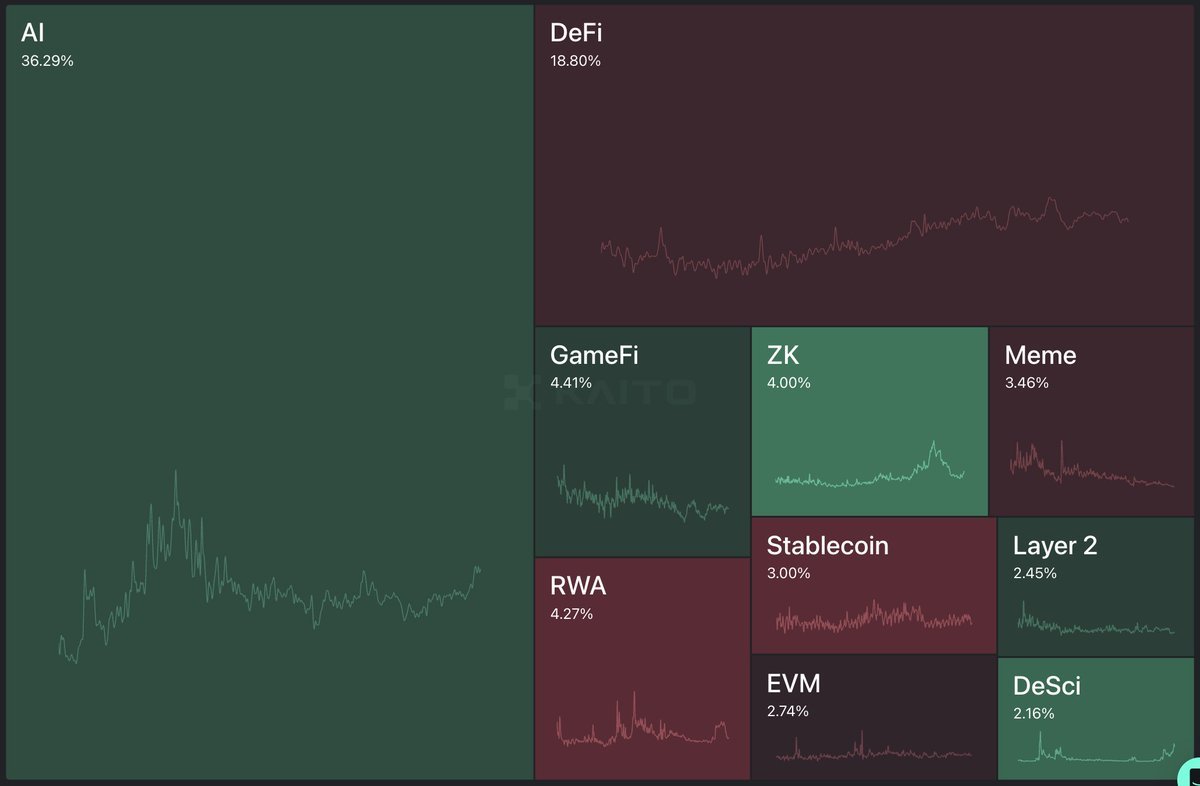

DeSci should rebrand to DeScAi

Bio Protocol is carrying that market segment & the catalyst is Agentic Co-scientists

AI is also up another 3% on the week

Pay attention; If you blink, AI will be back at 70% & you'll be sidelined

The recurring catalyst in each of these is AI https://t.co/MAaRwPgw27

價格預測

什麼時候是購買BPT的好時機?我應該現在買入還是賣出BPT?

Beacon預測

概率價格預測(未來24小時)探索更多

BM發現

新上市