USDC (USDC)

USDC (USDC)

- 75社交熱度指數(SSI)+13.71% (24h)

- #79市場預警排名(MPR)+19

- 3624小時社交提及量+27.59% (24h)

- 78%24小時KOL看好比例33位活躍KOL

- 概要USDC expands payment network: Hedera xMoney launch, Polymarket rewards, EU regulatory approval, large-scale Solana minting, AI proxy payment applications

- 看漲訊號

- Hedera xMoney integration

- Polymarket rewards USDC

- Stablecoin weekly transaction volume leads

- EU regulatory authorization favorable

- AI proxy payment uses USDC

- 看跌訊號

- Slight price decline

- Transfer volume includes active DeFi

- Aave Mantle capacity insufficient

- Stablecoin yield regulatory controversy

- AI payment sustainability in doubt

社交熱度指數(SSI)

- 總體資料75SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (22%)看漲 (56%)中性 (14%)看跌 (8%)社交熱度洞察USDC social hotness high (75.43/100, +13.71%), activity up ↑42.53% and KOL attention at full score, driven by Hedera xMoney launch and other payment expansions, sentiment slightly warming.

市場預警排名(MPR)

- 預警解讀USDC warning level rose to #79 (+19), social anomaly score 69.88 ↑122.5% and KOL attention shift 29.5 ↑156.5% significant, related to EU approval and multi-chain payment launches.

相關推文

SolanaFloor Media Influencer C126.59K @SolanaFloor

SolanaFloor Media Influencer C126.59K @SolanaFloor🚨NEW: The 🇺🇸White House to host a third meeting on stablecoin yield today, as the ongoing deadlock between banks and crypto firms over whether stablecoins can offer yield continues to delay regulatory clarity. A small group representing both sectors is expected to attend. Source: @EleanorTerrett

15 3 621 閱讀原文 >釋出後USDC走勢中性The White House will hold a third meeting on stablecoin yields, with the regulatory deadlock persisting, affecting clarity.

15 3 621 閱讀原文 >釋出後USDC走勢中性The White House will hold a third meeting on stablecoin yields, with the regulatory deadlock persisting, affecting clarity. FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.95K @Freki_OG

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.95K @Freki_OG kimcĦi.ℏ/acc Media Educator B3.99K @HederaKimchi

kimcĦi.ℏ/acc Media Educator B3.99K @HederaKimchi💳🌐 @hedera USDC Goes Live on @xMoney_com — Real Payment Expansion 🧵 🚀 USDC on Hedera is now integrated into xMoney, opening real merchant distribution beyond simple issuance. This marks a move toward scalable, production-ready payment infrastructure. 🏪🔗 What is xMoney? A crypto + fiat payment gateway powering checkout, settlement, and payouts. Hedera = the rails. xMoney = the merchant front door. ⚙️ Why it matters Stablecoin adoption depends on real checkout and treasury flows. Hedera delivers fast finality, fixed low fees, and high throughput — built for real-world volume. 📈 What to watch Merchant onboarding and payout traffic. As usage grows, Hedera’s predictable cost structure and performance gain real visibility. DeFi-ready → Payments-ready. 💳🌍

41 2 871 閱讀原文 >釋出後USDC走勢極度看漲Hedera USDC integration with xMoney launches real merchant payments, advancing stablecoin real‑world use.

41 2 871 閱讀原文 >釋出後USDC走勢極度看漲Hedera USDC integration with xMoney launches real merchant payments, advancing stablecoin real‑world use. OCT News Media Influencer C1.87K @news_oct

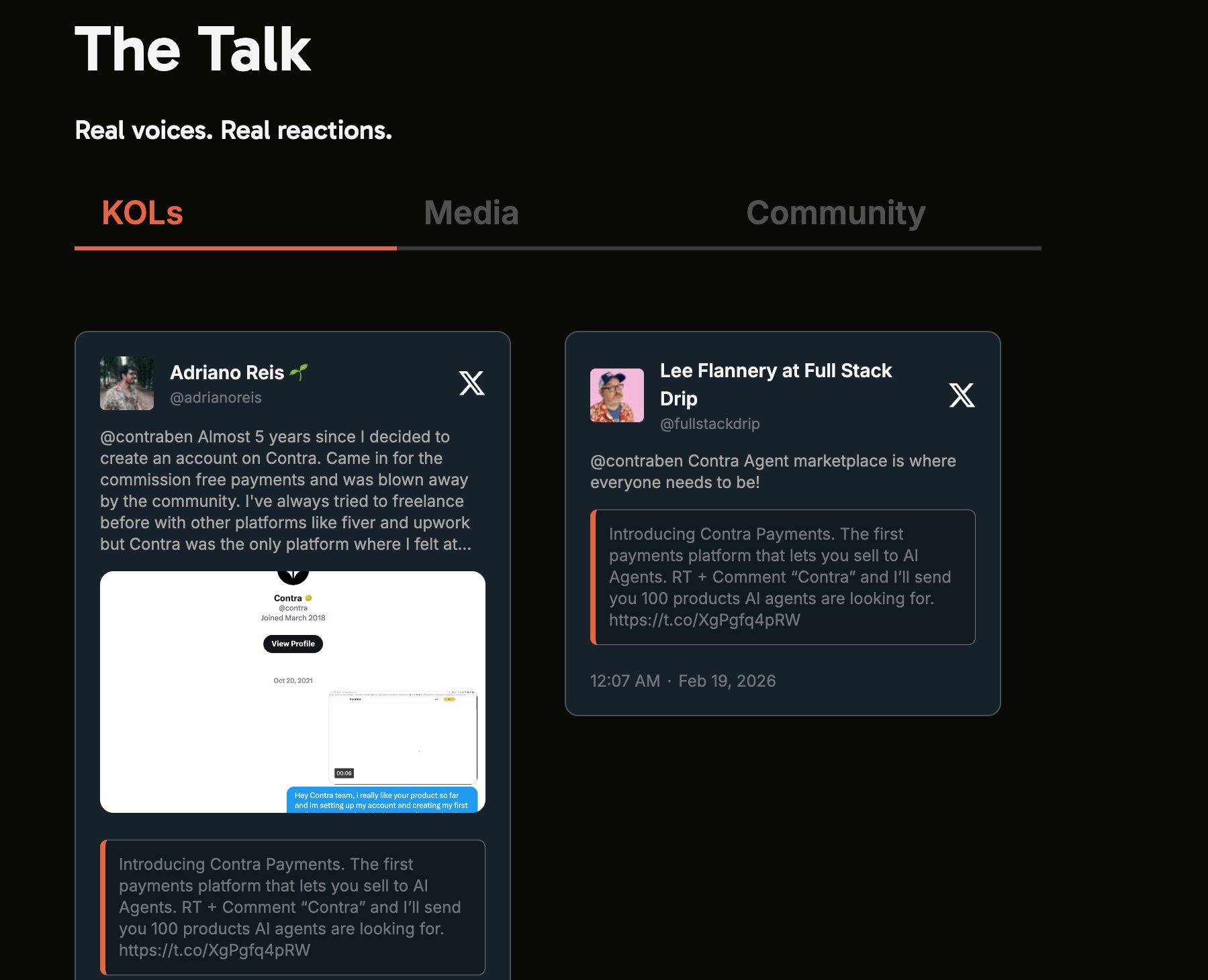

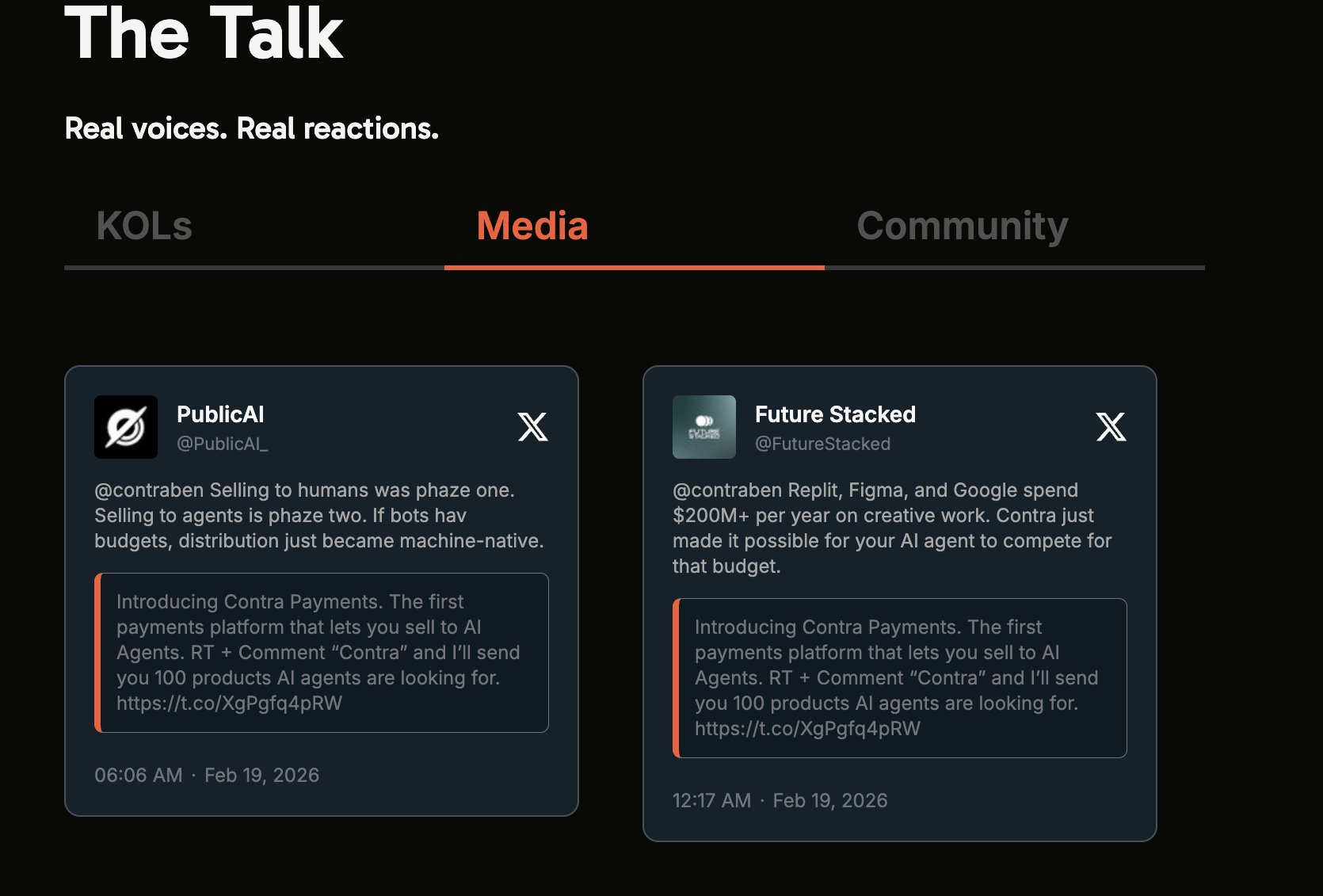

OCT News Media Influencer C1.87K @news_octContra launches agent-native payments, letting AI agents buy directly from creators with seamless checkout and USDC payouts. Read more 👇 https://t.co/uD2aqGBaFZ

OCT News Media Influencer C1.87K @news_oct

OCT News Media Influencer C1.87K @news_octWith reactions from KOLs and important attendees 🔽 https://t.co/ae2b9A4PZe

0 1 20 閱讀原文 >釋出後USDC走勢看漲Contra launches an AI agent payment system, supporting USDC settlement, receiving positive feedback from KOLs.

0 1 20 閱讀原文 >釋出後USDC走勢看漲Contra launches an AI agent payment system, supporting USDC settlement, receiving positive feedback from KOLs. curb.sol Influencer Media B76.53K @CryptoCurb

curb.sol Influencer Media B76.53K @CryptoCurb🚨 JUST IN: $.5 BILLION $USDC MINTED ON SOLANA. #SOLANA ⚡️ https://t.co/DUngAPnCub

49 9 957 閱讀原文 >釋出後USDC走勢看漲5 billion USD worth of USDC newly minted on the Solana chain, indicating an active ecosystem.

49 9 957 閱讀原文 >釋出後USDC走勢看漲5 billion USD worth of USDC newly minted on the Solana chain, indicating an active ecosystem. 區塊先生 🐡 ⚠️ (rock #58) Educator Influencer B99.31K @mrblock

區塊先生 🐡 ⚠️ (rock #58) Educator Influencer B99.31K @mrblockAI agent economy is taking off rapidly! *************Bookmark🔖 now!************* 🤖💥 In 2026, AI agents are no longer just tools; they become “economic actors” that can spend, earn, and trade autonomously. Today I’ll introduce several “magic‑like” solutions and explain how they each solve agent payment pain points—covering infrastructure to applications, each with its own focus on stablecoins, low‑friction payments, and security safeguards. 🛡️💸 What used to be a painful DeFi LEGO puzzle can now be quickly resolved with agents + wallet. First, @sponge_wallet 🧽: launched by @ycombinator at the end of 2025, this AI‑dedicated wallet was built by former Stripe engineers and focuses on letting AI agents “absorb” capital like a sponge and use it autonomously. Its core is a no‑code tool that lets agents register quickly, hold stablecoins (e.g., USDC), issue virtual cards, and handle payments directly. Key difference: it emphasizes enterprise integration, allowing sellers to easily sell services to “non‑human customers,” supports multiple chains (Ethereum, Base, Solana), and includes an OpenClaw plugin for agents to automatically purchase data or services. Ideal for novice developers—once funded, the agent can operate independently. Security is relatively basic, with simple limit controls and no complex DeFi integration. Early adopters are mainly in the crypto‑AI crossover space, and it already has Solana ecosystem backing. 🚀 Next, the x402 protocol ⚡ (by Coinbase): not a wallet but an open payment standard! Based on HTTP 402 “Payment Required,” when an AI agent calls an API that requires payment, the server returns 402 and the agent automatically pays with a stablecoin and retries. The distinction is crystal clear: it solves high‑friction pain points, needing no human approval or account setup, designed for machine‑to‑machine (M2M) transactions. Compared to Sponge, x402 is more of a low‑level protocol that can be embedded in any wallet (e.g., Coinbase Agentic Wallets) and has processed over 50 million transactions. Its strength is real‑time micropayments (sub‑cent level), supporting API paywalls and programmatic resource access, though its weakness is reliance on a blockchain (e.g., Base), where fees are low but latency may occur. Stripe also integrates x402, enabling traditional enterprises to receive agent payments in USDC, handling taxes and refunds. Companies love it because it’s production‑grade and future‑proof! 🔑 Now look at @justinsuntron’s @OfficialAINFT (Bank of AI) 🏦: a Web3 AI platform built on the TRON blockchain that turns NFTs into interactive AI agents and issues a dedicated token. The difference is that it does more than payment; it builds a full “agent banking layer”: supporting x402 and ERC‑8004 (NFT identity standard), allowing agents to automatically engage in DeFi—lending, swapping, yield farming, and even identity management. Compared with Sponge’s simple wallet, AINFT is more of a full‑stack financial system, with a multi‑agent framework (MAS) enabling many agents to collaborate; it has over 400 k users and has expanded to BNB Chain. Unique point: each agent has its own token for governance and economic incentives, suited for heavy DeFi users. Drawbacks: it’s chain‑specific (TRON mainnet), weak cross‑chain capability, and token volatility can bring risk. Recently launched Bank of AI lets agents operate on‑chain autonomously, perfect for NFT‑AI hybrid projects! 🚀🐂 Other similar tools: - AgentWallet (on Solana) 🌟: similar to Sponge but places more emphasis on trustless custody and spending limits. Difference: built‑in 27 MCP (Model Context Protocol) tools let agents not only pay but also optimise context learning; supports x402 and highlights the role of economic participants. More secure than Sponge (has KYT filtering of high‑risk transactions) but limited to the Solana ecosystem, ideal for high‑speed, low‑fee needs. Weakness: no multi‑chain support, limited scalability. - @AnomaPay (private beta on Base) 🔒: focuses on privacy and beta testing; the difference lies in its private nature—using zero‑knowledge proofs to hide transaction details, supporting x402 with an extra encryption layer. Suitable for enterprises sensitive to data privacy, but currently not public and has high adoption barriers. - @blazpaylabs 🔥: AI‑driven financial partner; difference is automated trading + portfolio tracking, real‑time crypto payments. Sits above x402, with built‑in AI decision‑making, but not focused on agent identity, suited for individual users rather than large‑scale agent economies. - BluWhale 🐳: smart yield manager focusing on DeFi strategy automation. Difference: optimises agent yields (e.g., yield farming), supports x402 but is more of a tool than a wallet; downside is high risk, aimed at advanced users. Summary of differences: Sponge is simple and YC‑style; x402 is a low‑level universal payment standard; AINFT is full‑stack DeFi with token economics; AgentWallet offers secure, high‑speed Solana‑centric solutions. In just a few weeks, these tools exploded since late 2025, solving human approval and account‑friction issues, many with token‑incentive ecosystems. Challenges remain in regulation, security, and cross‑chain. Is the AI + Crypto wave about to change the world? 👀 Which one have you used? Share your thoughts! #AIAgents #CryptoPayments #mbkVIBE

5 2 822 閱讀原文 >釋出後USDC走勢極度看漲AI agent economy is taking off rapidly, with multiple crypto payment solutions addressing pain points.

5 2 822 閱讀原文 >釋出後USDC走勢極度看漲AI agent economy is taking off rapidly, with multiple crypto payment solutions addressing pain points. DeFi Dad ⟠ defidad.eth Educator DeFi_Expert C177.11K @DeFi_Dad

DeFi Dad ⟠ defidad.eth Educator DeFi_Expert C177.11K @DeFi_Dad Jai Bhavnani D21.98K @jaibhavnani

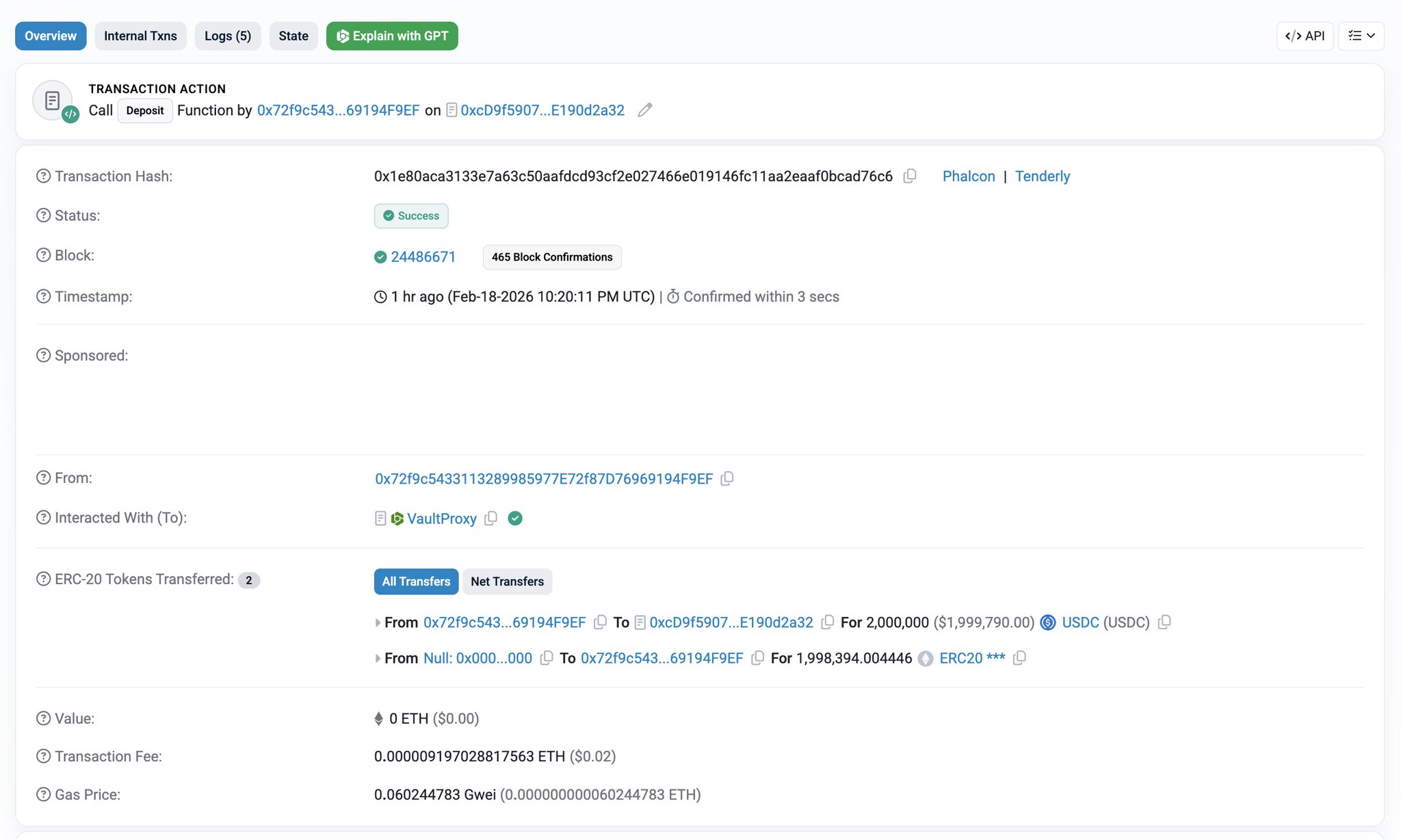

Jai Bhavnani D21.98K @jaibhavnaniA $2M deposit into the Royco Senior Vault in a single transaction. Holy shit. https://t.co/vctG7GScMG

41 5 3.31K 閱讀原文 >釋出後USDC走勢看漲Royco Senior Vault received a single $2 million USDC deposit, causing the author to marvel.

41 5 3.31K 閱讀原文 >釋出後USDC走勢看漲Royco Senior Vault received a single $2 million USDC deposit, causing the author to marvel. Jeremy Allaire - jda.eth / jdallaire.sol Founder Regulatory_Expert B167.91K @jerallaire

Jeremy Allaire - jda.eth / jdallaire.sol Founder Regulatory_Expert B167.91K @jerallaire Gabriel Garrett D2.22K @GabGarrett

Gabriel Garrett D2.22K @GabGarrettI asked my clawdbot to send a letter to me in the mail… and it actually did it. I gave it a crypto wallet and some USDC to make purchases with, and clawdbot went and read the agent documentation on @postalform. It figured out how to draft an order with a PDF of the letter it wrote to me – then it used Stripe’s Purl cli and paid for the order using @stripe's new Machine Payments protocol. This is a huge step forward for real-world agentic task completion and commerce

75 15 24.76K 閱讀原文 >釋出後USDC走勢看漲USDC successfully used for automated payment of mailed letters, showcasing real‑world agent task implementation Jeremy Allaire - jda.eth / jdallaire.sol Founder Regulatory_Expert B167.91K @jerallaire

Jeremy Allaire - jda.eth / jdallaire.sol Founder Regulatory_Expert B167.91K @jerallaire MIXX / (🍊,💊) D738 @MIXXONI

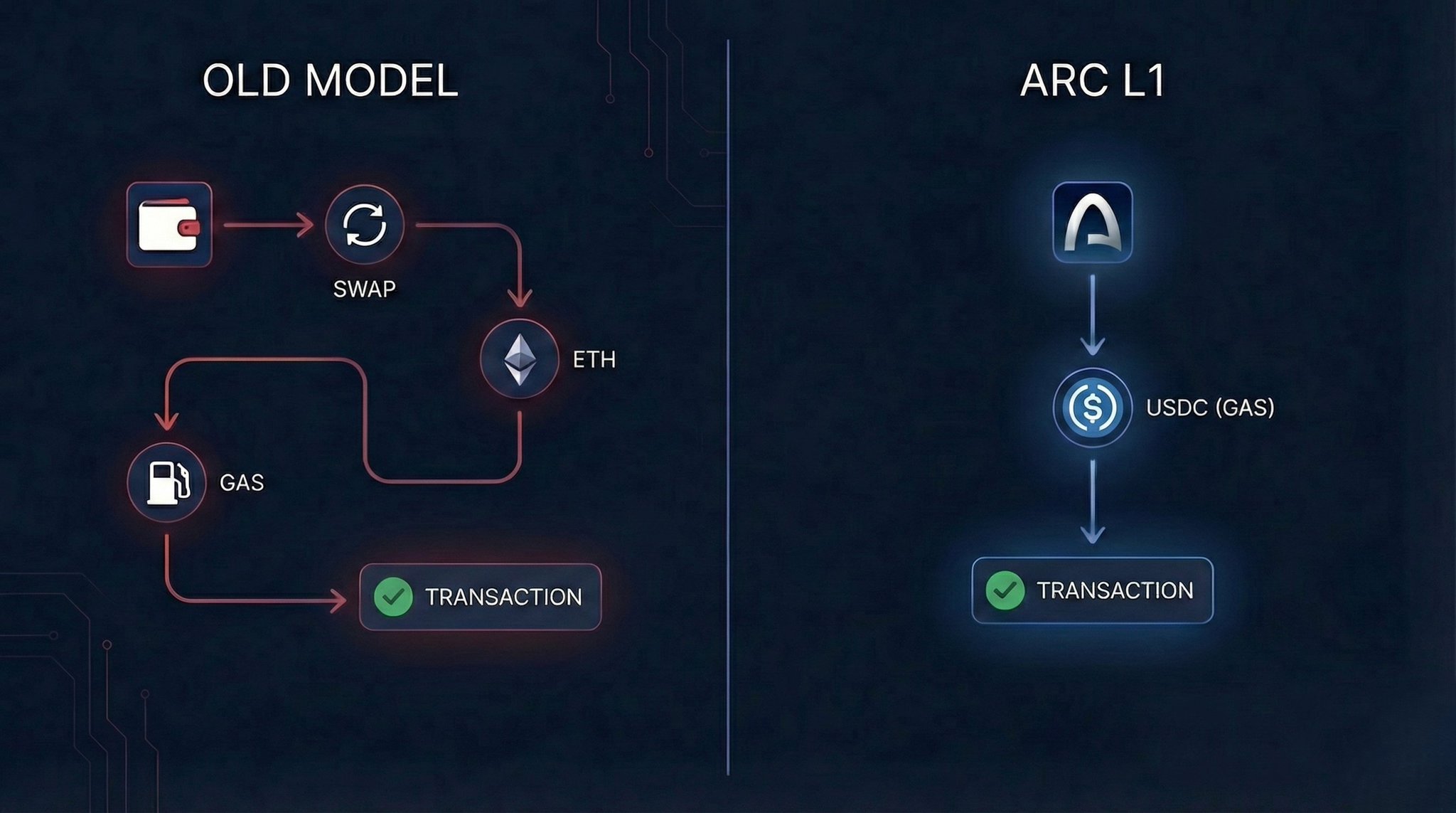

MIXX / (🍊,💊) D738 @MIXXONIUSDC as gas - boring or brilliant? The first time I paid a transaction fee in USDC, I paused for a second: “That’s it?” No separate ETH. No buying a native token “just for gas.” No extra transfers. One asset. One balance. Arc removed one step from every transaction. It doesn’t look dramatic. But in daily use, the difference is noticeable. Sometimes progress isn’t a new feature. It’s simply one less step. @UnitFlowFinance @arc

65 10 4.49K 閱讀原文 >釋出後USDC走勢極度看漲Arc L1 simplifies the transaction process significantly by allowing USDC to pay gas fees directly, enhancing user experience.

65 10 4.49K 閱讀原文 >釋出後USDC走勢極度看漲Arc L1 simplifies the transaction process significantly by allowing USDC to pay gas fees directly, enhancing user experience. Greeny TA_Analyst Trader B42.32K @greenytrades

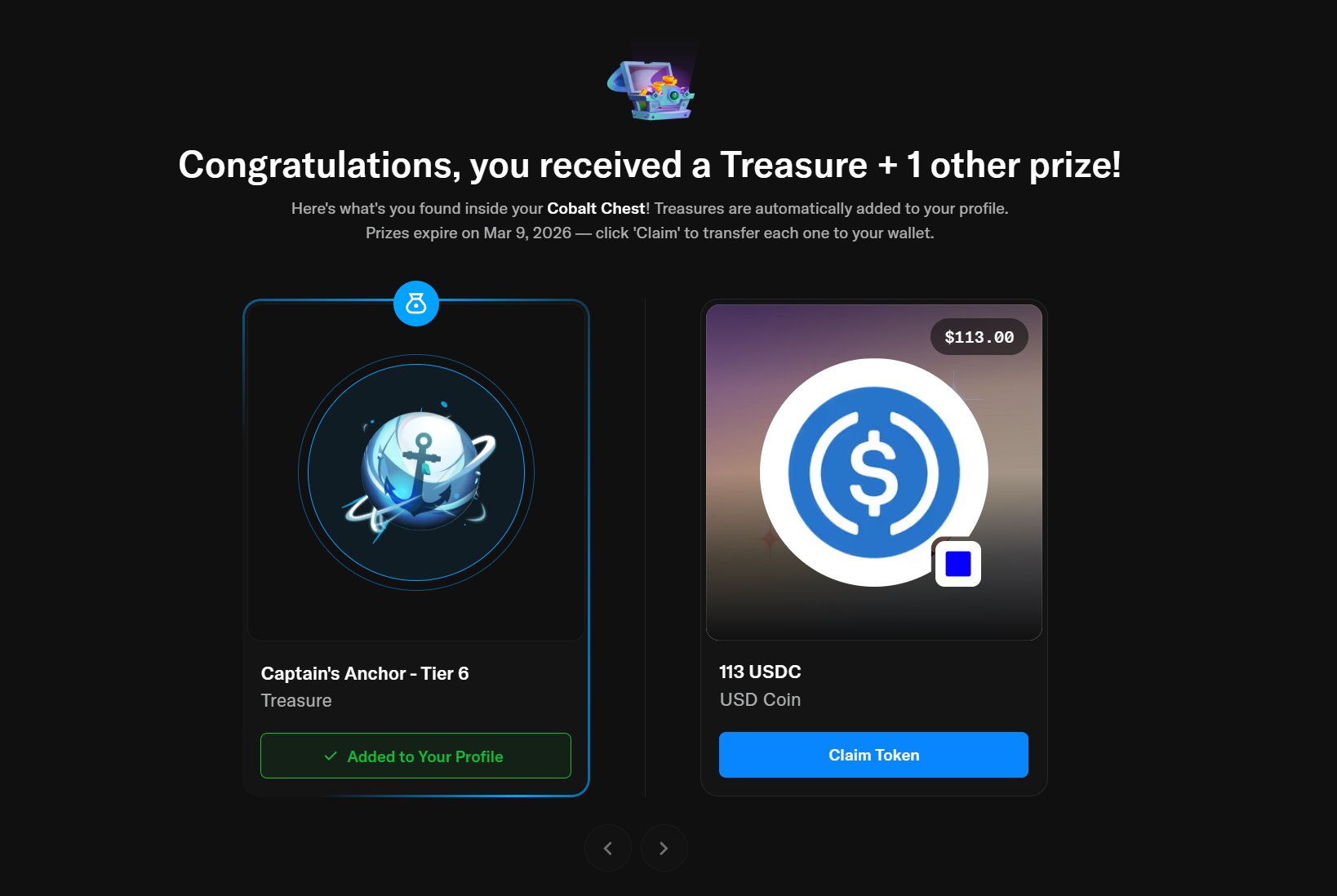

Greeny TA_Analyst Trader B42.32K @greenytradesShoutout to Opensea for the $113 cashback. When is the TGE? https://t.co/kxL64GSgkG

6 4 787 閱讀原文 >釋出後USDC走勢看漲User received a 113 USDC reward and an NFT from an Opensea activity.

6 4 787 閱讀原文 >釋出後USDC走勢看漲User received a 113 USDC reward and an NFT from an Opensea activity. Edgy - The DeFi Edge 🗡️ FA_Analyst DeFi_Expert C304.41K @thedefiedge

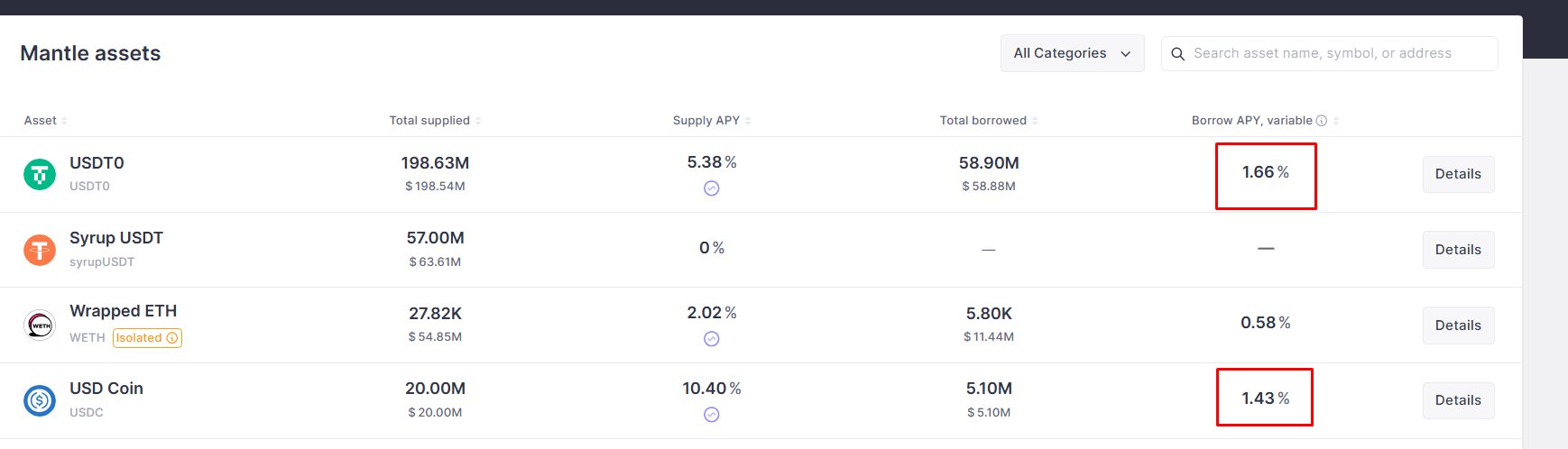

Edgy - The DeFi Edge 🗡️ FA_Analyst DeFi_Expert C304.41K @thedefiedgeWhales can’t farm this. You can. There’s only ~$1.5M of capacity left before this stablecoin loop closes. It's too small for whales to scale, but perfect size for smaller portfolios. Here’s what’s happening: Aave v3 just went live on Mantle Mantle is currently incentivizing USDC and USDT deposits on Aave so heavily that the deposit caps are maxed out → tons supplied with not much borrowed Currently, USDC and USDT can’t be collateralized which is probably why there isn’t as much borrowing/looping happening But syrupUSDT can be collateralized (for now)! • Deposit syrupUSDT (~4%) • Borrow USDC (<1.5%) • Loop the spread The syrupUSDT market is also almost maxed out. Key word is ALMOST. Right now, there is about $1.5m in available room before the deposit cap is reached. syrupUSDT is currently yielding over 4%, and you can borrow USDC for less than 1.5%. That’s a really great spread on bluechip stables that you can leverage/loop. The whales are already in the market - there’s only room for a few smaller fish to eat. If you have a portfolio of $10k-100k - this is your window. And if you’re too late, keep an eye on the syrupUSDT market for another chance in the future. This is how you need to be thinking about yield farming. Understand the advantages you do have, and if you’re looking at a potential opportunity, ask yourself: • Why isn’t the yield getting diluted? • What are the chances I’ll get diluted if I enter? • What is the potential duration before the farming conditions change? Knowing the answers to these questions will help you capitalize on market inefficiencies and take advantage of the position you’re in. Edge in DeFi comes from understanding constraints...not chasing APY. If you want more DeFi strategies, help us by engaging with this post. Takes a lot of effort to find and share this stuff.

43 16 5.20K 閱讀原文 >釋出後USDC走勢極度看漲There are DeFi arbitrage opportunities with syrupUSDT and USDC on Mantle, usable by small capital, but capacity is limited.

43 16 5.20K 閱讀原文 >釋出後USDC走勢極度看漲There are DeFi arbitrage opportunities with syrupUSDT and USDC on Mantle, usable by small capital, but capacity is limited.