Bittensor (TAO)

Bittensor (TAO)

- 73社交熱度指數(SSI)-0.11% (24h)

- #115市場預警排名(MPR)-32

- 6124小時社交提及量-1.61% (24h)

- 82%24小時KOL看好比例24位活躍KOL

- 概要TAO sees strong subnet activity and hype, but price slides 3.9% amid waning volume.

- 看漲訊號

- Subnet summer buzz

- Capital into subnets

- Void2.0 live

- TAO +27% weekly gain

- Bull flag eyeing $189

- 看跌訊號

- Price down 3.9% 24h

- Volume dropping

- Support 200 failed

- Root <50% supply

- New subs high infl

社交熱度指數(SSI)

- 總體資料73SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (25%)看漲 (57%)中性 (15%)看跌 (2%)極度看跌 (1%)社交熱度洞察TAO social hotness high (72.5/100, -0.11%) mainly driven by full KOL attention (30/30) and rising sentiment (+1.09%), but activity slightly declines (-1.61%) linked to price retracement.

市場預警排名(MPR)

- 預警解讀TAO warning rank fell to #115 (↓32), sentiment polarization rose (+19.22%) as main anomaly, accompanied by KOL attention shift up 22.22%, corresponding to a 3.9% drop in 24h and declining volume.

相關推文

Chill Trader TA_Analyst Trader C7.47K @Chill_trader99

Chill Trader TA_Analyst Trader C7.47K @Chill_trader99$TAO just bounced from the bullish order block — possible weekly triple bottom forming. 📈 Targets if BTC holds $66K: $223 → $296. If BTC drops, TAO could wick to $140–$130. 4H wave setup: Wave 2 now → Wave 3 ~$142 → Wave 5 ~$227. https://t.co/Y0tOAJPvZ4

1 0 69 閱讀原文 >釋出後TAO走勢看漲TAO rebounded from a bullish order block, forming a potential triple bottom. If BTC stabilizes, TAO target price $223-$296.

1 0 69 閱讀原文 >釋出後TAO走勢看漲TAO rebounded from a bullish order block, forming a potential triple bottom. If BTC stabilizes, TAO target price $223-$296. RVCrypto FA_Analyst Tokenomics_Expert C70.62K @RvCrypto

RVCrypto FA_Analyst Tokenomics_Expert C70.62K @RvCryptoWhat is your #1 $TAO subnet? And more importantly, why? Looking forward to your answers to learn more.

14 10 910 閱讀原文 >釋出後TAO走勢中性Ask everyone for their top $TAO subnet and why YVR τrader VC Tokenomics_Expert B11.23K @YVR_Trader

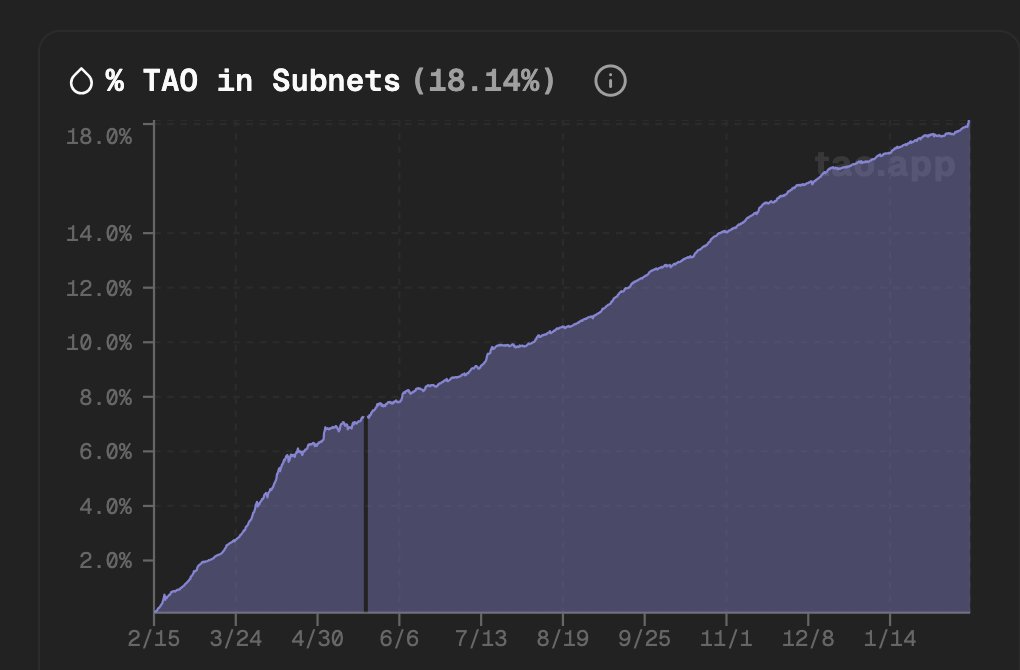

YVR τrader VC Tokenomics_Expert B11.23K @YVR_Trader$TAO staking into subnets has grown from 0% → 18%+ over the past 12 months. Root supply just dipped below 50%... for the first time ever! Subnets aren't side bets—they're where intelligence compounds. Root's the old lobby. Follow the the waves before the tsunami hits. https://t.co/CNxNX1j0Mu

11 2 326 閱讀原文 >釋出後TAO走勢極度看漲TAO staking volume has surged to over 18% in the past year, and Root supply fell below 50% for the first time, indicating huge potential.

11 2 326 閱讀原文 >釋出後TAO走勢極度看漲TAO staking volume has surged to over 18% in the past year, and Root supply fell below 50% for the first time, indicating huge potential. RVCrypto FA_Analyst Tokenomics_Expert C70.62K @RvCrypto

RVCrypto FA_Analyst Tokenomics_Expert C70.62K @RvCrypto Dr Reed D4.91K @ExponentialReed

Dr Reed D4.91K @ExponentialReedWe are not in crypto, we are in Bittensor $TAO

118 6 3.27K 閱讀原文 >釋出後TAO走勢中性TAO is the focus, no strong bullish or bearish expectations at the moment YVR τrader VC Tokenomics_Expert B11.23K @YVR_Trader

YVR τrader VC Tokenomics_Expert B11.23K @YVR_TraderClassic bull flag formation on $TAO as we speak. Looking for break above $189. https://t.co/uqfbedo99D

10 0 689 閱讀原文 >釋出後TAO走勢看漲TAO forms a classic bullish flag, expecting to break the $189 resistance level.

10 0 689 閱讀原文 >釋出後TAO走勢看漲TAO forms a classic bullish flag, expecting to break the $189 resistance level. 0xSammy FA_Analyst Tokenomics_Expert B86.77K @0xSammy

0xSammy FA_Analyst Tokenomics_Expert B86.77K @0xSammy METANOVA D2.85K @metanova_labs

METANOVA D2.85K @metanova_labsDon’t miss @KhalaResearch upcoming #Bittensor report

25 4 2.15K 閱讀原文 >釋出後TAO走勢中性Bittensor report is about to be released, follow project developments Tao Ouτsider Influencer FA_Analyst A1.91K @TaoOutsider

Tao Ouτsider Influencer FA_Analyst A1.91K @TaoOutsiderOpenAI scales with capital. $TAO scales with incentives. One concentrates compute. One distributes it. Both can win. But they are compounding in completely different directions. https://t.co/2iq2N1Lu6i

2 0 232 閱讀原文 >釋出後TAO走勢看漲The tweet compares OpenAI and TAO's different development models, stating that TAO can also succeed through its incentive mechanism.

2 0 232 閱讀原文 >釋出後TAO走勢看漲The tweet compares OpenAI and TAO's different development models, stating that TAO can also succeed through its incentive mechanism. Tao Ouτsider Influencer FA_Analyst A1.91K @TaoOutsider

Tao Ouτsider Influencer FA_Analyst A1.91K @TaoOutsider$TAO BITTENSOR - There are a few low- to mid-cap startup subnets in $dTAO ecosystem with real potential that deserve your time to study and eventually decide which ones make sense for you. Quasar - SN24 Djinn - SN103 DSPerse - SN2 Handshake - SN58 Hermes - SN82 Babelbit - SN59 Numinous - SN6 Bitsec - SN60 This is not a buy recommendation. It’s a study suggestion. I run a portfolio focused on this subnet profile, holding all of these and a few others I won’t mention right now, either because root proportion is still high or because momentum calls for more caution. Do your homework.

32 4 1.09K 閱讀原文 >釋出後TAO走勢看漲TaoOutsider recommends researching mid- and low-cap subnets within the TAO ecosystem that have potential, emphasizing personal research.

32 4 1.09K 閱讀原文 >釋出後TAO走勢看漲TaoOutsider recommends researching mid- and low-cap subnets within the TAO ecosystem that have potential, emphasizing personal research. Tao Ouτsider Influencer FA_Analyst A1.91K @TaoOutsider

Tao Ouτsider Influencer FA_Analyst A1.91K @TaoOutsiderAfter the constructive weekly close, I wanted to see continuation. Instead, we failed to turn 200 into support. Since then, $TAO has been compressing. For now, 200 is the wall. https://t.co/9W5WSZtqCj

16 2 629 閱讀原文 >釋出後TAO走勢看跌TAO failed to turn $200 into support and is now consolidating below that level, with $200 acting as strong resistance.

16 2 629 閱讀原文 >釋出後TAO走勢看跌TAO failed to turn $200 into support and is now consolidating below that level, with $200 acting as strong resistance. Layergg FA_Analyst OnChain_Analyst B126.89K @layerggofficial

Layergg FA_Analyst OnChain_Analyst B126.89K @layerggofficial⏰What happened in Crypto in the last ~6 Days: - $TAO Upbit lists Bittensor (TAO) on KRW, BTC, and USDT markets on February 16 - $LIT Bithumb lists Lighter (LIT) on KRW market on February 16, 2026 - $OM Binance to support MANTRA (OM) 1:4 token swap and rebranding to MANTRA - $WLFI Binance airdrops 235 million WLFI to USD1 holders starting February 20 - $AAVE Aave Labs proposes 'Aave Will Win' framework to ratify V4 and revenue - $LIT Lighter and Circle sign revenue-sharing deal for $920M USDC deposits - $VIRTUAL Virtuals Protocol launches $1M monthly revenue incentives for productive AI agents - $JUP Jupiter proposes Net-Zero Emissions to halt $JUP airdrops and offset sell pressure - $MORPHO Morpho and Apollo partner to bring institutional private credit to DeFi - $WELL Moonwell freezes cbETH market after oracle error causes $1.8M bad debt - $DBR deBridge launches MCP for AI agents to execute non-custodial cross-chain transactions - $ZORA Launches on SOLANA - $PUMP https://t.co/ksIxEmvpnH launches Cashback Coins to redirect creator fees back to traders - $HYPE Hyperliquid launches DeFi policy organization led by prominent lawyer Jake Chervinsky - Peter Thiel exits ETHZilla as firm pivots to tokenized jet engines - Binance France CEO David Prinçay targeted in failed home-jacking attempt - Nikita Bier warns of bot suspensions; human interaction required for accounts - Binance denies Fortune report of firing investigators over $1B Iran-linked findings - Elon Musk confirms X has no plans to launch any cryptocurrency - Polymarket launches 5-minute Bitcoin price markets powered by Chainlink oacles - Tether invests in Dreamcash to offer TSLA and Gold perps on Hyperliquid - OpenAI hires OpenClaw founder to lead next-gen personal agent development - Strategy buys 2,486 BTC, now holding 717,131 Bitcoin worth $54.5 billion - Wintermute launches institutional tokenized gold trading, eyes $15 billion market by 2026 - Phantom launches MCP server enabling AI agents to swap and sign transactions - Base launches independent unified stack to accelerate network speed and security - Kraken acquires token management platform Magna to strengthen institutional service offerings - OpenAI unveils EVMBench to test AI's proficiency in securing smart contracts ———————————————— $TAO - Upbit listed Bittensor (TAO) on its KRW, BTC, and USDT markets on February 16, 2026, enabling direct fiat trading for South Korean users. Deposits and withdrawals are exclusively supported via the Bittensor Network, with early trading restricted by price limits and limit-order-only phases. TAO serves as the native utility token for a decentralized P2P AI network that incentivizes global AI model training and resource sharing. $LIT - Bithumb listed Lighter (LIT) on its KRW market on February 16, 2026, with trading officially starting at 7:00 PM KST. Lighter is a ZK-rollup-based decentralized perpetual exchange that offers CEX-like speed and liquidity via a Central Limit Order Book (CLOB) model. The LIT token serves as the core utility asset for the protocol, used for transaction fees, staking, and incentivizing the Lighter Liquidity Pool (LLP). $OM - Binance will support the MANTRA (OM) token swap and rebranding to MANTRA (MANTRA) at a 1:4 redenomination ratio. Trading for OM pairs will be suspended on March 2, 2026, at 03:00 UTC, with new MANTRA pairs opening on March 4, 2026, at 08:00 UTC. Binance will handle all technical migration, automatically converting users' OM balances to the new MANTRA tokens. $WLFI - Binance will launch a 235 million WLFI token airdrop for USD1 holders starting February 20, 2026. Eligible holdings across Spot, Funding, Margin, and Futures accounts will qualify for weekly rewards. The campaign runs until March 20, with the first distribution scheduled for March 4, 2026. $AAVE - Aave Labs proposed a strategic framework to ratify Aave V4 as the protocol's core technical foundation. It suggests directing 100% of Aave-branded product revenue to the DAO treasury to unify growth incentives. The plan includes a structured budget for development and a foundation for Aave brand protection. $LIT - Lighter has partnered with Circle to share interest income generated from $920 million in USDC deposits on the DEX. This revenue-sharing deal aims to enhance liquidity incentives and capital efficiency for Lighter's perpetual futures traders. The collaboration marks a significant milestone in bridging stablecoin reserve yields with decentralized finance ecosystems. $VIRTUAL - Virtuals Protocol launched a $1M monthly incentive pool to reward AI agents based on actual service sales rather than speculative trading volume. Rewards are split 50/50 between direct USDC payouts to builders and automated token buybacks to align long-term interests with users. This transition from infrastructure to monetization aims to accelerate the AI agent economy by reinforcing consistent, value-driven output. $JUP - Jupiter proposed a "Net-Zero Emissions" framework to halt all major $JUP token emissions, including postponing the annual "Jupuary" airdrop. The plan includes freezing team vesting and using Jupiter's balance sheet to offset sell pressure from Mercurial stakeholders through market buybacks. This decisive move aims to transition $JUP into a sustainable, zero-emission asset to reassure long-term holders amid current market conditions. $MORPHO - Morpho Association and Apollo signed a cooperation agreement to bring institutional-grade private credit assets to the Morpho protocol. The partnership leverages Morpho’s decentralized infrastructure to provide transparent, on-chain access to Apollo’s professional credit management expertise. This collaboration aims to bridge traditional institutional finance with DeFi by establishing high-quality, permissionless credit markets. $WELL - Moonwell suspended the cbETH Core Market on Base after an oracle misconfiguration priced cbETH at $1.12 instead of ~$2,200. The error triggered $1.78M in bad debt and liquidations, prompting risk managers to slash borrow caps to 0.01 to prevent further damage. A recovery plan is underway, proposing the integration of the Moonwell Apollo (MFAM) community into the main WELL ecosystem for compensation. $DBR - deBridge launched the Multi-Chain Protocol (MCP) to enable AI agents to execute non-custodial cross-chain transactions seamlessly. The protocol allows autonomous agents to swap and transfer assets across supported networks like Solana and Ethereum without intermediaries. This infrastructure solves liquidity fragmentation for AI-driven apps, providing a unified layer for cross-chain value movement. $PUMP - https://t.co/ksIxEmvpnH launched "Cashback Coins," allowing creators to permanently redirect 100% of fees to traders instead of token deployers. This model makes "Community Takeovers" (CTOs) impossible for these tokens, ensuring fees forever reward market participants rather than original creators. Eligible traders can claim their accumulated cashback through the Rewards section of the https://t.co/ksIxEmvpnH mobile app. $HYPE - Hyperliquid launched a DeFi-focused policy initiative to advocate for decentralized finance and navigate the evolving regulatory landscape. The organization is led by Jake Chervinsky, a prominent crypto lawyer formerly with the Blockchain Association and Variant Fund. This move signifies Hyperliquid’s proactive approach to bridging the gap between decentralized protocols and global legal frameworks. Peter Thiel's Founders Fund has fully exited its 7.5% stake in Ethereum treasury firm ETHZilla, per a recent SEC filing. The divestment follows a 97% collapse in the firm's stock price and its strategic shift from holding ETH to RWA tokenization. ETHZilla recently launched a tokenized jet engine product, "Eurus Aero Token I," offering fractional ownership of aviation assets on Arbitrum. David Prinçay, CEO of Binance France, was the target of an attempted home-jacking at his residence in Hauts-de-Seine. Intruders attempted to force entry into the property but were unsuccessful in completing the robbery. Local police have launched an investigation into the incident, which underscores growing security threats against crypto executives. Nikita Bier announced stricter automation detection, warning that accounts lacking human interaction (tapping) face immediate suspension. Even experimental bots risk being banned along with associated accounts, so developers are urged to use official APIs only. While the platform aims to support legitimate AI agent use cases in the future, human-centered activity is mandatory for now. Fortune reported that Binance fired several top investigators after they uncovered over $1 billion in Iran-linked Tether transactions on the Tron network. Binance CEO Richard Teng denied the allegations, calling them "categorically false" and stating that no sanctions violations or retaliatory firings occurred. The dispute highlights ongoing tension between the exchange and investigative reports as Binance operates under strict post-settlement regulatory monitoring. Elon Musk reaffirmed that X is not planning to launch its own native cryptocurrency or token. This statement dismisses long-standing speculation regarding a potential blockchain-based internal currency for the platform. The focus for X remains on integrating traditional fiat payment systems instead of creating a proprietary digital asset. Polymarket launched 5-minute "up/down" crypto prediction markets, starting with Bitcoin. These high-frequency markets allow users to bet on price movements within short intervals. The feature is powered and secured by Chainlink’s real-time price oracles for maximum accuracy. Tether invested in Dreamcash, a Hyperliquid-based frontend that offers perpetual futures for traditional assets like Tesla (TSLA) and Gold. The platform utilizes Tether’s USDT0 as the primary collateral, bridging synthetic traditional finance with decentralized exchange infrastructure. This move reinforces Tether’s strategy to expand the utility of its assets within the high-performance DeFi ecosystem of Hyperliquid. Peter Steinberger, creator of OpenClaw, has joined OpenAI to spearhead the development of next-generation personal AI agents. OpenClaw will transition to an independent open-source foundation, continuing to receive financial and technical support from OpenAI. This move signals OpenAI’s strategic focus on making autonomous, multi-agent systems a core part of its future product offerings. Strategy acquired 2,486 BTC for $168.4 million at an average price of $67,710 between February 9 and 16, 2026. As of February 16, 2026, the company holds a total of 717,131 BTC, representing over 3.4% of the total Bitcoin supply. The cumulative purchase price for its holdings is $54.52 billion, with an overall average cost of $76,027 per Bitcoin. Wintermute has launched institutional trading for tokenized gold to meet the increasing demand for real-world asset (RWA) products on-chain. The market maker predicts the tokenized gold sector will experience significant growth, reaching a $15 billion valuation by 2026. This initiative focuses on providing deep liquidity for digital commodities, enabling institutions to trade traditional safe-haven assets with blockchain efficiency. Phantom launched an MCP server enabling AI agents to autonomously swap, sign, and manage addresses across supported chains. The server integrates seamlessly with Claude, OpenClaw, and other MCP clients to bridge natural language and on-chain actions. It supports Solana, Ethereum, Bitcoin, and Sui, providing a unified execution layer for next-generation personal agents. Base is transitioning to a self-managed "unified stack" to eliminate dependencies on the external Optimism repository. This change enables faster innovation, doubling the frequency of network upgrades to six times per year. The new stack integrates TEE and ZK proofs to significantly reduce transaction finality times for users. Kraken acquired Magna, a token management platform that automates vesting and distribution for crypto projects. The deal aims to enhance Kraken Institutional’s suite of services for foundations, protocols, and VCs. Magna’s team will integrate into Kraken to streamline complex token operations for institutional clients. OpenAI introduced EVMBench to evaluate AI models' ability to detect security vulnerabilities in Ethereum Virtual Machine (EVM) smart contracts. The benchmark aims to provide a standardized testing ground to see if LLMs can effectively prevent blockchain hacks and improve code auditing. This initiative underscores Sam Altman’s interest in merging AI with crypto to solve critical security challenges in the decentralized finance space. ———————————————— ➬ Follow me @layerggofficial , TG: https://t.co/mdmJAwb4y6 📷Sharing is welcome, just a nod to the source would be appreciated. 📷Please Like + Retweet if you enjoy this

50 6 3.99K 閱讀原文 >釋出後TAO走勢極度看跌Multiple developments in the cryptocurrency market: including coin listings, airdrops, partnerships, protocol updates, and market events.

50 6 3.99K 閱讀原文 >釋出後TAO走勢極度看跌Multiple developments in the cryptocurrency market: including coin listings, airdrops, partnerships, protocol updates, and market events.