Solv Protocol (SOLV)

Solv Protocol (SOLV)

- 60社交熱度指數(SSI)- (24h)

- #89市場預警排名(MPR)0

- 124小時社交提及量- (24h)

- 0%24小時KOL看好比例1位活躍KOL

- 概要Multiple VCs will unlock SOLV supply this week, price down 4% over 24h.

- 看漲訊號

- Multiple VCs holding

- High institutional attention

- Potential buying pressure entering

- Liquidity improvement

- 看跌訊號

- Locked supply unlocking

- Increased selling pressure

- Price down 4%

- Supply dilution risk

社交熱度指數(SSI)

- 總體資料60SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈中性 (100%)社交熱度洞察SOLV social heat is moderate (60/100) and activity score is full (40/40), sentiment is slightly positive (20/30) but KOL attention is zero, attention is dispersed due to supply unlocking.

市場預警排名(MPR)

- 預警解讀SOLV warning rank #89, social abnormality 100/100, indicating VC supply unlocking triggers abnormal selling pressure; no anomalies in other dimensions.

相關推文

Tokenomist Tokenomics_Expert OnChain_Analyst D73.92K @Tokenomist_ai

Tokenomist Tokenomics_Expert OnChain_Analyst D73.92K @Tokenomist_aiWhich investors are set to receive tokens this week (Feb 16 - Feb 22) ? Several VC-backed allocations become liquid this week, putting previously locked investor supply into circulation. And this is just part of the picture, many more funds have emissions coming. 🔓This week, emissions map to: • OKX Ventures → $SOLV, $ZRO, $HAEDAL, $ZK, $ETHFI • Polychain → $STRK, $ARB, $BERA, $LAYER • Coinbase → $ZRO, $STRK, $ZK, $ARB • Spartan → $SOLV, $ZRO, $KAITO • Hashed → $SOLV, $HAEDAL, $ZK • YZi → $SOLV, $ZRO, $LAYER • Sequoia → $ZRO, $STRK, $KAITO • Consensys → $ETHFI, $ZK, $STRK Track all Vc's cliffs & vesting → https://t.co/JJ70pnjtOK

13 3 1.78K 閱讀原文 >釋出後SOLV走勢中性Multiple VC-backed tokens will unlock this week, increasing market circulating supply.

13 3 1.78K 閱讀原文 >釋出後SOLV走勢中性Multiple VC-backed tokens will unlock this week, increasing market circulating supply. CryptoJournaal 🇳🇱 Media Educator D23.76K @CryptoJournaal

CryptoJournaal 🇳🇱 Media Educator D23.76K @CryptoJournaal#Roadmap 🇬🇧 #SolvProtocol ( $SOLV ) — Complete Roadmap 🧵 From an initial vision to make Bitcoin productive within DeFi to building a full-stack Bitcoin finance infrastructure, #SolvProtocol has evolved into a core pillar of the emerging BTCFi ecosystem. Here is the complete journey: Past → Present → Future #CryptoRoadmap 📜 Past: Development & Launch Solv Protocol was founded with the mission to unlock the financial potential of Bitcoin by enabling secure, capital-efficient participation in decentralized finance without sacrificing liquidity. Key milestones: 🔹 Early Research & Concept Phase The founding team introduced the concept of Financial NFTs based on the ERC-3525 Semi-Fungible Token standard, enabling programmable financial positions such as bonds, vesting schedules, and yield-bearing instruments. 🔹 Launch of Solv Bonds & Vesting Infrastructure Solv Protocol deployed decentralized bond products and token vesting solutions, allowing transparent allocation management, fundraising, and on-chain credit structures for Web3 projects. 🔹 Expansion Into Bitcoin Finance The protocol laid the foundation for Bitcoin liquid staking through SolvBTC, a liquid representation of Bitcoin designed to access DeFi yield opportunities while preserving BTC exposure. 🔹 Security, Audits & Infrastructure Hardening Multiple security audits were completed by firms such as Quantstamp and CertiK, reinforcing protocol safety and trust as Solv expanded its financial primitives. 🔹 Strategic Funding & Ecosystem Support Backed by leading investors including Binance Labs and Blockchain Capital, Solv Protocol accelerated development and ecosystem growth. 🔹 Introduction of the Staking Abstraction Layer (SAL) The Staking Abstraction Layer was launched to simplify Bitcoin staking complexity, forming the backbone for scalable, chain-agnostic BTC yield strategies. Impact: A transformation from a Financial NFT platform into a robust foundation for Bitcoin-native DeFi, enabling programmable finance, liquidity efficiency, and secure yield generation. #SolvProtocolHistory ⚡ Present: Current Status & Developments Solv Protocol now operates as a full-stack Bitcoin finance suite, providing lending, liquid staking, yield generation, and fund management services centered around Bitcoin. Ecosystem Expansion: SolvBTC has evolved into a universal Bitcoin reserve asset, integrated across more than 15 blockchains and numerous DeFi protocols. Yield-bearing variants such as SolvBTC LSTs extend utility across multiple ecosystems. Technical Progress: The protocol supports advanced yield strategies, cross-chain interoperability, and modular financial products designed for both retail and institutional participants. Governance & Incentives: $SOLV functions as the governance token, enabling community-driven decision-making on protocol upgrades, integrations, and ecosystem direction through on-chain proposals and voting. Strategic Partnerships: Collaborations span DeFi, CeFi, and specialized markets, including initiatives for Shariah-compliant products and bridges connecting traditional platforms with Bitcoin-native finance. Ecosystem Challenges: Maintaining security, scaling cross-chain infrastructure, and optimizing Bitcoin capital efficiency remain ongoing priorities as adoption increases. #SolvProtocolNow #BTCFi 🚀 Future: Planned Roadmap (2025–2030+) Solv Protocol’s future is centered on building a unified Bitcoin economy that connects DeFi, real-world assets, and institutional finance. Key Roadmap Directions: 🔹 Unlocking Idle Bitcoin Liquidity Expanding access to productive yield strategies for dormant Bitcoin assets while maintaining decentralization and security. 🔹 Advanced Yield & Capital Efficiency Development of sophisticated yield mechanisms that maximize utility for BTC holders across multiple chains and financial products. 🔹 Bitcoin Reserve Offerings (BROs) Introduction of structured Bitcoin-native financial instruments designed to deepen liquidity and broaden participation. 🔹 Integration With Real-World Assets Bridging Bitcoin finance with tokenized RWAs, real-world credit, and traditional financial instruments to expand Bitcoin’s role beyond store of value. 🔹 Institutional-Grade Bitcoin Finance Positioning Bitcoin as a global settlement layer through tokenized ETFs, compliant financial products, and institutional-grade yield solutions. Impact: The emergence of Bitcoin as a core financial primitive powering a borderless, interoperable, and capital-efficient global financial system. Risks & Opportunities: Regulatory complexity, cross-chain security, and institutional onboarding present challenges. Strong infrastructure design, modular architecture, and community governance create long-term growth potential. #SolvProtocolFuture #BitcoinFinance ✅ Conclusion Solv Protocol has evolved from an innovative Financial NFT platform into a comprehensive Bitcoin finance infrastructure powering the next generation of BTCFi. By combining liquid staking, yield generation, governance, and cross-chain interoperability, $SOLV strengthens Bitcoin’s role within decentralized and institutional finance alike. #RoadmapConclusion 🛒 Want to trade $SOLV on #WEEX? WEEX is a global #Exchange where you can easily start trading crypto and futures: ✅ Access to 1,700+ #Altcoins ✅ Up to $30,000 USDT in #Bonuses for new users ✅ User-friendly app & web platform ✅ Trusted exchange with millions of traders worldwide 👉 Sign up now via the link below and claim your welcome bonus! 🔗 https://t.co/q8pSdzpIh8 #CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange #Futures ⚠️ Important Note: 🔹 This post is for educational purposes only and not financial advice! 🔹 Only invest what you are willing to lose! 📚 Useful resources and additional information: Want to dive deeper into the world of #SolvProtocol ( $SOLV ) or looking for the latest updates and developments? These links will help you stay up to date: 🔹Discord: https://t.co/AEhLumoCkG 🔹GitHub: https://t.co/vQOhLLRKPC 🔹Telegram: https://t.co/PfuzVvJcAq 🔹Website: https://t.co/UnPWN4aivc 🔹X (Twitter): https://t.co/rIstMIP6rg ----------------- 👇Follow us👇 ----------------- 🚨 Follow @CryptoJournaal – the go-to source for independent crypto information: 📰 News | 📊 Facts | 🧠 Insights | 🎓 Education 💬 No sponsored tokens 📜 Fully MiCAR-compliant 🔍 Knowledge over hype, always 📲 Join via: 🌐 Website: https://t.co/i0eHsaqt3O 📘 Facebook: https://t.co/he5bTXLFXR 💬 Telegram: https://t.co/i976fBvtv0 👥 CryptoJournaal-AltcoinPedia Community: https://t.co/3yFdzLLS2O 🐦 X-profiel: https://t.co/fd2bI2MInh #Altcoins #Bitcoin #CryptoNews #CryptoEducation #CryptoPrices

2 0 109 閱讀原文 >釋出後SOLV走勢極度看漲SolvProtocol is building a comprehensive Bitcoin financial infrastructure, aiming to unlock BTC liquidity and connect DeFi with traditional finance.

2 0 109 閱讀原文 >釋出後SOLV走勢極度看漲SolvProtocol is building a comprehensive Bitcoin financial infrastructure, aiming to unlock BTC liquidity and connect DeFi with traditional finance. Cookie DAO 🍪 Media Community_Lead B198.67K @cookiedotfun

Cookie DAO 🍪 Media Community_Lead B198.67K @cookiedotfunThat’s a wrap on our @SolvProtocol mindshare campaign Snapshot of eligible Snappers has been taken today 18 Dec at 3 PM UTC In case you forgot what you were going in for: → $230K+ in rewards for the top 200 Snappers → You’ll receive your rewards in $vSOLV fully unlocked, which can later be swapped 1:1 for $SOLV - with a burn mechanism that decreases over time (full explanation in the thread below) Claiming goes live on 23 Dec on BNB – time TBC; we’ll share the claim link then. Rewards follow a 7-day TWAP.

Cookie DAO 🍪 Media Community_Lead B198.67K @cookiedotfun

Cookie DAO 🍪 Media Community_Lead B198.67K @cookiedotfunHow does the $vSOLV burn mechanism work? If you’re eligible, you’ll receive $vSOLV. This is a vesting wrapper which can later be swapped 1:1 for $SOLV. But the timing affects how much you actually receive. So here’s the simplest possible explanation: 1. $vSOLV → $SOLV is always a swap. You choose when to swap. 2. If you swap early: A portion of your $vSOLV gets burned (destroyed forever). You get less $SOLV. 3. If you wait: The burn percentage goes down every day. You keep more $SOLV. 4. If you wait until March 17, 2026: Burn = 0% You get a perfect 1 $vSOLV → 1 $SOLV swap. TL;DR • Swap early → get less • Swap later → get more • Swap March 17, 2026 → get full allo The burn ratio updates daily - you can track it in real time here: https://t.co/w43XC365Vg

128 54 6.48K 閱讀原文 >釋出後SOLV走勢看漲SolvProtocol activity has ended, rewards can be claimed on BNB chain on December 23, it is recommended to wait to exchange for SOLV to maximize returns. Naveed Influencer Educator B23.67K @navex_eth

Naveed Influencer Educator B23.67K @navex_ethSolv Protocol has quickly become one of the top revenue makers on BNB Chain In the past month, it earned $2.35M, putting it near the front of the entire network Only a few long-running platforms are ahead, and many familiar names now follow behind It’s unusual for a $BTC-focused project to gain traction this fast, especially in such a competitive space Solv is reaching a level most teams take years to hit At this speed, Solv is positioning itself as one of the standout projects on BNB Chain @SolvProtocol

1 15 138 閱讀原文 >釋出後SOLV走勢極度看漲Solv Protocol has standout revenue on BNB Chain, growing rapidly.

1 15 138 閱讀原文 >釋出後SOLV走勢極度看漲Solv Protocol has standout revenue on BNB Chain, growing rapidly. Crypto_Lad.Apt DeFi_Expert Educator B5.52K @TheopilusE

Crypto_Lad.Apt DeFi_Expert Educator B5.52K @TheopilusE JHIM D1.85K @JUST_HIM_10

JHIM D1.85K @JUST_HIM_10Yes,the market often looks like a bad omen; hype, fear, speculation, chaos. But beneath the noise, real builders are reinforcing the system. @SolvProtocol isn’t chasing the market’s mood. $SOLV is creating a new model: https://t.co/RTham6FeYf

207 117 434 閱讀原文 >釋出後SOLV走勢看漲SOLV acts as a builder in market chaos, creating a new model.

207 117 434 閱讀原文 >釋出後SOLV走勢看漲SOLV acts as a builder in market chaos, creating a new model. TingHu♪ Educator Trader C136.96K @TingHu888

TingHu♪ Educator Trader C136.96K @TingHu888Let's take a look back at history—China hasn't allowed token issuance for several years, right?! Back then, didn't you write articles opposing it and warning about the harms of disallowing token issuance? Later, you went offshore to issue tokens; I feel that's less harmful to Chinese citizens... Apart from that, what contributions have you made? Was the previously prohibited behavior really stupid? It was just blocking you from raising more money. If it were truly legal, how many people would go bankrupt? Is it an additional investment channel or another scam https://t.co/aSLv4md1CZ

Yan Meng @ Solv Protocol | ERC-3525 D91.19K @myanTokenGeek

Yan Meng @ Solv Protocol | ERC-3525 D91.19K @myanTokenGeekThese kinds of articles have always only explained “what consequences occur if you do it,” but never explain “what consequences occur if you don’t do it.” When future generations read this part of history, it will be like when we were kids reading about the Ming and Qing periods and angrily cursing the sea ban as stupid; we can give them this series of articles to read, telling them that the “stupid” actions of the past had their own logic. I will forecast the situation five years after a total ban on stablecoins and RWA: 1. A gap emerges between the domestic and overseas financial systems, especially in the support mechanisms and intensity for technological innovations such as AI, creating a clear distance. 2. On-chain finance becomes completely underground within the country. A large amount of global RWA assets are tokenized and receive stablecoin investment; the yield gap between domestic and overseas financial assets widens continuously, RWA develops a thriving ecosystem among overseas Chinese communities, creating new wealth stories, while domestic citizens can visibly see the changes, and public sentiment fluctuates. 3. The People's Bank and other financial regulators hold meetings frequently, straining themselves to suppress, but other departments, especially some financially strained local governments and powerful agencies, act perfunctorily, paying lip service while actually protecting the underground RWA industry in many regions. 4. A few charismatic figures monopolize crypto deposit and withdrawal channels and earn huge profits; the authorities periodically carry out selective, campaign-style crackdowns. 5. To participate in on-chain finance, large numbers of people go abroad; commercial organizations set up branches in Hong Kong and Singapore, using overseas personnel and institutions as pivots to establish a new “on-chain Hong Kong” financial model.

154 36 68.58K 閱讀原文 >釋出後SOLV走勢極度看跌The author criticizes China's cryptocurrency policy and predicts that the market will be negatively impacted. Tyer 🇸🇦🇶🇦 🏴☠️ NFT_Expert Influencer B16.82K @supertyer

Tyer 🇸🇦🇶🇦 🏴☠️ NFT_Expert Influencer B16.82K @supertyer Unity D1.99K @UNITYMetax

Unity D1.99K @UNITYMetaxGM Web3 fam and $SOLV lovers I just Zoom in on this $SOLV chart real quick… Market: -15% bloodbath $SOLV 24h: only 4.4% $SOLV 7D: +18.2% $SOLV 14D: +29.5% While everything is screaming market, @SolvProtocol is out here casually printing double-digit green candles like it’s still 2021. Why? Because $1.9B+ in actual BTC is locked and earning real yields, not promises. Because zero liquidations is a flex nobody else can copy. Because Jiuzi’s $1B treasury doesn’t care about red candles they care about APY. This isn’t a meme coin surviving the dip. This is the quietest monster in the room eating while others bleed. #SolvSnaps #SolvProtocol #SOLV #BTCfi

46 47 1.74K 閱讀原文 >釋出後SOLV走勢極度看漲SOLV performed strongly during the market-wide decline, thanks to its BTC locking and zero liquidation mechanism.

46 47 1.74K 閱讀原文 >釋出後SOLV走勢極度看漲SOLV performed strongly during the market-wide decline, thanks to its BTC locking and zero liquidation mechanism. CARROT |🌊 RIVER DeFi_Expert OnChain_Analyst B3.83K @hoangquan124

CARROT |🌊 RIVER DeFi_Expert OnChain_Analyst B3.83K @hoangquan124$SOLV continues to maintain one of the most stable short-term structures among lower-cap tokens this week. The price is up 2.82 percent in the last 24 hours, adding to a broader 7-day increase of 15.65 percent. This steady upward drift contrasts sharply with the weakness seen across the 14-day and 30-day windows, suggesting the market may be transitioning from a corrective phase into early recovery. The chart shows a clear pivot point around the 0.013–0.014 zone, where the token found its floor before breaking upward with a clean impulse. Since that breakout, $SOLV has remained unusually stable, holding its higher range without slipping back into the previous lows. This kind of price compression at a higher level is often a sign of accumulation rather than exhaustion. Even though the medium-term metrics still reflect prior downside, with the 14-day at minus 6.51 percent and the 30-day at minus 7.93 percent, the recent price action shows that sellers no longer dominate the structure. The market is now showing reduced volatility, narrower trading bands, and a consistent presence of buyers absorbing any dips. Trading activity remains healthy at over $10.8M in the last 24 hours despite the token’s market cap sitting around $24.4M. This ratio indicates strong engagement relative to size and demonstrates that liquidity is more active than the surface numbers suggest. When a token maintains steady volume through a multi-day climb, it typically signals sustainable interest rather than temporary speculation. My view: $SOLV is showing signs of stabilizing after a prolonged period of uneven performance. The steady 7-day uptrend, combined with stronger liquidity and consistent holding of higher levels, points toward a constructive market shift. If this stability continues, the token may be setting the foundation for a more extended recovery rather than just a brief corrective bounce. $SOLV @EdgenTech

CARROT |🌊 RIVER DeFi_Expert OnChain_Analyst B3.83K @hoangquan124

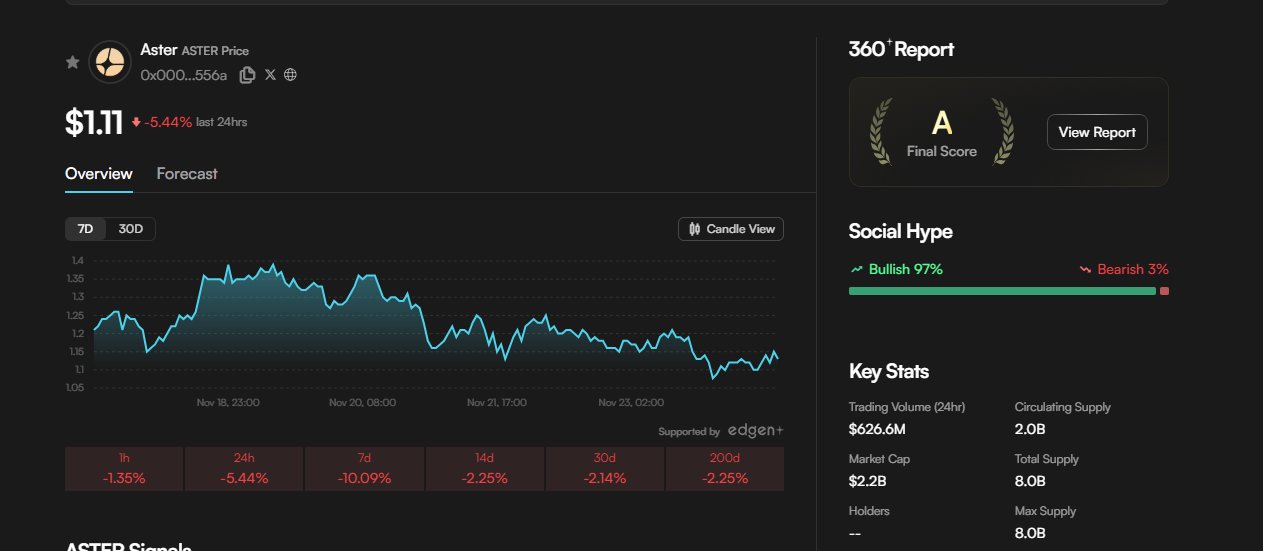

CARROT |🌊 RIVER DeFi_Expert OnChain_Analyst B3.83K @hoangquan124$ASTER is currently moving through a consolidation phase as the market cools down, but the underlying structure of the project remains notably strong. Despite the price sitting around $1.11 after a 5.44% drop in the last 24 hours, the signals behind the chart tell a different story than what the candles suggest. Social sentiment is overwhelmingly positive, with 97 percent bullish and only 3 percent bearish. This type of sentiment profile during a pullback usually indicates confidence from both the community and active market participants. It suggests that the recent decline is more technical than fundamental. Trading volume remains impressive at more than $626M in the last 24 hours. High volume during a corrective move typically means liquidity is stable, buyers are still present, and the market has not entered any kind of exit-driven phase. With a market cap of $2.2B and a circulating supply of 2B tokens, the tokenomics remain balanced enough to support medium-term expansion without sudden shocks. From a

0 0 45 閱讀原文 >釋出後SOLV走勢看漲SOLV stabilizes and recovers, ASTER dips in the short term but fundamentals are strong and social sentiment is extremely bullish.

0 0 45 閱讀原文 >釋出後SOLV走勢看漲SOLV stabilizes and recovers, ASTER dips in the short term but fundamentals are strong and social sentiment is extremely bullish. Yaki OnChain_Analyst FA_Analyst A6.54K @Yaki_fomoArt

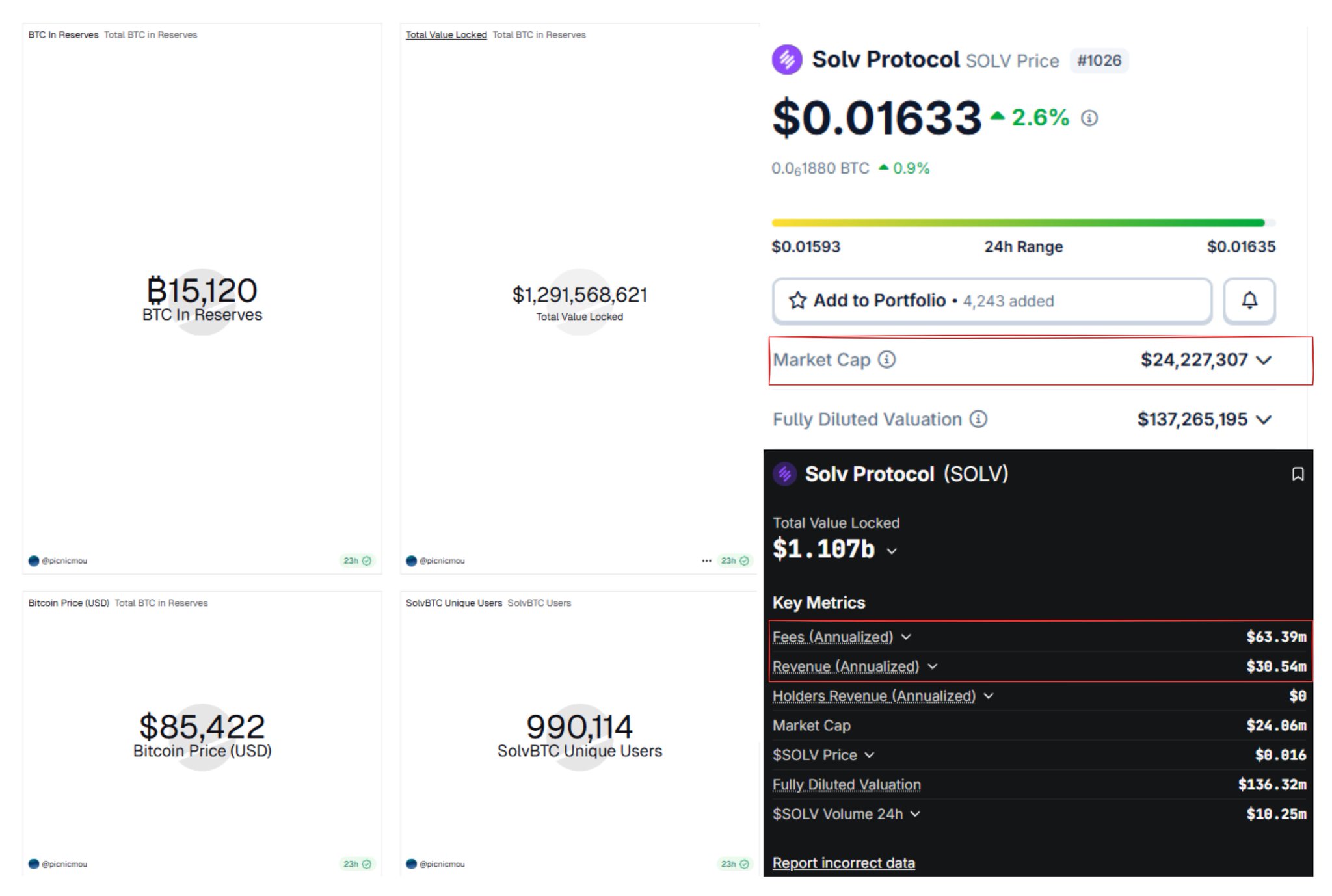

Yaki OnChain_Analyst FA_Analyst A6.54K @Yaki_fomoArtanyone know how the f a protocol backed by @yzilabs, sitting on $1.6B TVL, printing $30M in annual revenue and $63M in fees, is chilling at a $24M mcap? this market’s so cooked it’s larping @SolvProtocol. already literally the yield engine behind Binance Earn, the same infra that lets normies stake BTC and farm $SOLV rewards. it’s running 15K BTC reserves, almost a million users, and quietly powering Binance’s institutional BTC vaults. SolvBTC and BTC+ already became the backbone for cross-chain yield, integrated with @VenusProtocol, ListaDAO, @Aster_DEX, @pendle_fi, and bridging into RWA vaults. that’s product-market fit with capital attached. > $605M+ in SolvBTC supplied across BNB DeFi > $300M in active borrows > #1 in BTC asset consensus across all chains if this was any other token yielding this much real revenue, CT would’ve already 10x’d it. market’s in fear mode now, but when liquidity rotates back, BTC leads the rebound and BTCFi will be the first catalyst to turn that risk‑on mode. so $SOLV is the Yziest play next run.

80 76 4.00K 閱讀原文 >釋出後SOLV走勢極度看漲Solv Protocol (SOLV) is considered an excellent investment opportunity for the next bull market due to being severely undervalued and having strong fundamentals.

80 76 4.00K 閱讀原文 >釋出後SOLV走勢極度看漲Solv Protocol (SOLV) is considered an excellent investment opportunity for the next bull market due to being severely undervalued and having strong fundamentals. Dongtaniㅣ🟢STABLEㅣETHGas ⛽️ Influencer Community_Lead B3.73K @sontanidonghei

Dongtaniㅣ🟢STABLEㅣETHGas ⛽️ Influencer Community_Lead B3.73K @sontanidonghei DDongtani D1.56K @mindkaito

DDongtani D1.56K @mindkaitoWhy sprinkle salt on a painful wound..... @MemeMax_Fi I thought Solv was the future Everyone, Perp DEX is really dangerous When you load up a lot of positions, "Anyway, if it drops, how much will it drop?" Those words were my final testament on Binance Futures. (Essential principles for crypto futures trading) 1. Set a stop-loss when opening a position 2. If you can't do that, decide on a loss percentage at which you will always stop out (you don't need to think about take-profit, but you must consider stop-loss). 3. If you still can't, please don't trade futures. 4. Trade (futures) only with money you can afford to lose without affecting your livelihood. So today I again put money into @OrderlyNetwork to trade.... "This time

39 35 657 閱讀原文 >釋出後SOLV走勢極度看跌The author suffered a massive loss of over 2300% in SOLV futures trading, warning about the extreme risks of perpetual contract DEXs.

39 35 657 閱讀原文 >釋出後SOLV走勢極度看跌The author suffered a massive loss of over 2300% in SOLV futures trading, warning about the extreme risks of perpetual contract DEXs.