Render Token (RENDER)

Render Token (RENDER)

- 63社交熱度指數(SSI)- (24h)

- #47市場預警排名(MPR)0

- 124小時社交提及量- (24h)

- 100%24小時KOL看好比例1位活躍KOL

- 概要Render gains AI compute trial, enterprise GPU onboarding, DePIN estimated at 150B, price up 4.1%.

- 看漲訊號

- DePIN size estimated at 150B

- AI compute network in trial phase

- Enterprise GPUs joining

- Transparent finance and emissions

- Price up 4.1% over 24h

- 看跌訊號

- Intense competition with Octa

- Trial not officially launched

- Market heat unchanged

- Still a niche ecosystem

- Limited price volatility

社交熱度指數(SSI)

- 總體資料63SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈看漲 (100%)社交熱度洞察RENDER social heat is moderately high (63.5/100), activity 35/40, positive sentiment 27.5/30 increased, mainly driven by AI compute trial, DePIN 150B estimate and enterprise GPU onboarding, KOL attention still low (1/30).

市場預警排名(MPR)

- 預警解讀RENDER warning rank #47, social abnormality 79.4/100 is high, sentiment polarization 50/100 is moderate, KOL attention only 1/100, anomaly originates from AI compute trial and DePIN 150B valuation stimulating social fluctuations.

相關推文

OCT Gems Educator Influencer B11.32K @oct_gems

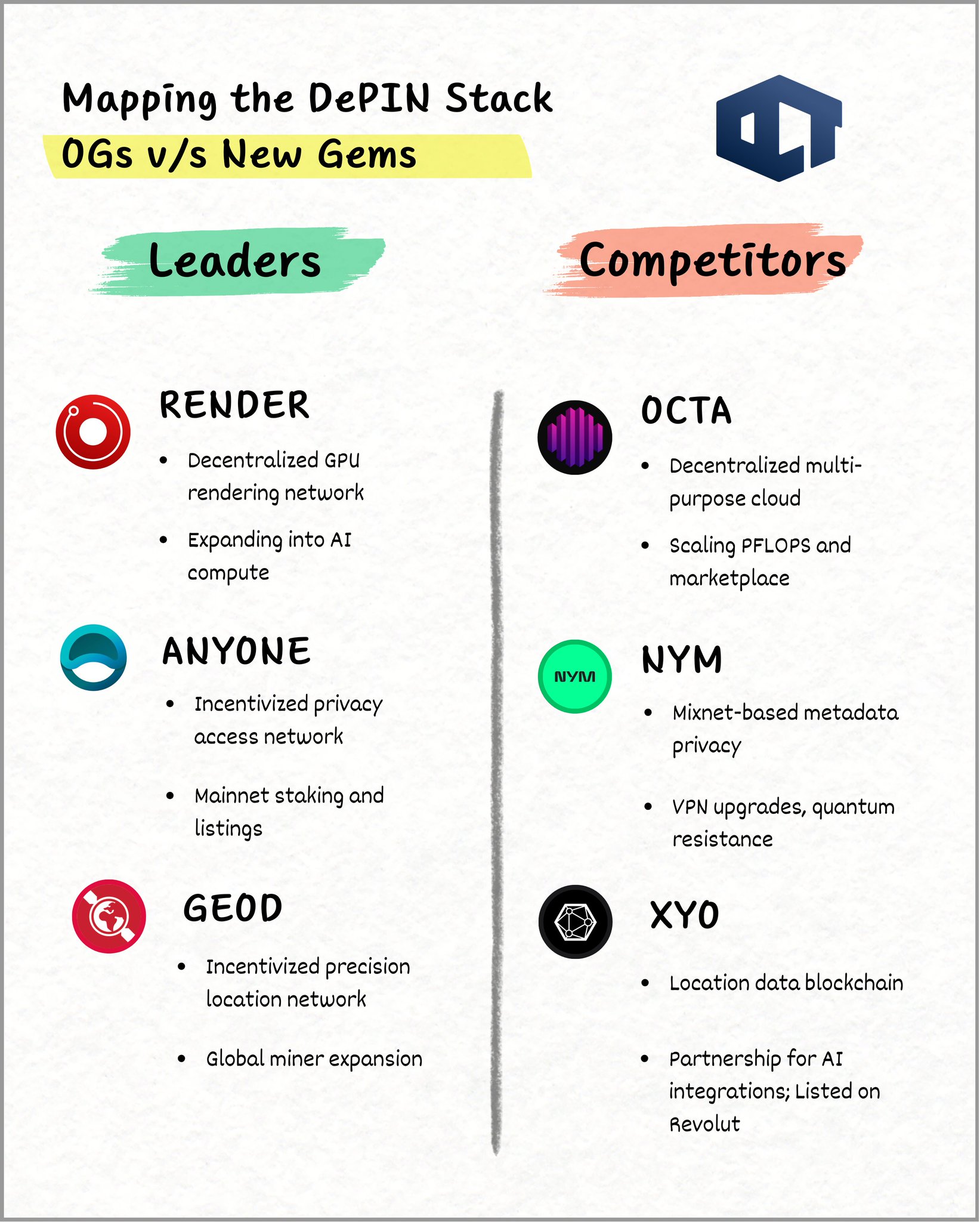

OCT Gems Educator Influencer B11.32K @oct_gemsDePIN isn’t just a niche anymore. It’s projected to become a $150B sector by 2030 as AI, autonomy, and real-world infrastructure move on-chain. Who’s positioned for the next 100×? → $RENDER vs $OCTA → $ANYONE vs $NYM → $GEOD vs $XYO Here’s how the DePIN landscape looks right now 👇 🔴 Render vs OctaSpace: The Battle for Decentralized Compute ✦ Render: the OG of Decentralized GPU Rendering ☞ Vision: Supercharge creative workflows with decentralized GPU power for 3D rendering, spatial computing, AI, and blockchain media. ☞ Tech Stack: Decentralized GPU network · Solana integration · Compute Subnet for AI workloads ☞ Evolution: Shift from pure rendering toward AI‑focused compute; enterprise‑grade GPU onboarding; treasury and emissions transparency. ☞ Recent Behavior: AI Compute Network trial phase (Aug 2025); detailed explainer on emissions, batching, and operations; Render Royale wrapped with Cyber Christmas and Frozen Futures themes. Render was one of the first projects to show that high‑end GPU workloads don’t have to live inside centralized clouds. It started by democratizing access to professional rendering, making it possible for creators to tap global GPU supply without negotiating enterprise contracts. That alone was a meaningful shift. But what’s changed in 2025 is direction. The Compute Subnet signals a clear move toward AI workloads, while the onboarding of enterprise‑grade GPUs shows Render is thinking less about experiments and more about reliability at scale. What stands out is transparency. Render isn’t just pushing upgrades, it’s explaining how batching works, how emissions flow, and how the network sustains itself. That’s usually what mature infrastructure projects do. Even as competition increases, Render still feels anchored in real usage, not narratives. ✦ OctaSpace: the Challenger of Versatile Cloud Platforms ☞ Vision: Instant access to decentralized services for AI, rendering, gaming, and more in a unified platform. ☞ Tech Stack: Layer‑1 blockchain · Virtualized environments · Marketplace for AI agents and models. ☞ Evolution: First Web3 provider with full virtualized environments in July 2025 · New marketplace launch in January 2025 for AI tools and games. ☞ Recent Behavior: Made mining for NeptunePrivacy live with one‑click setup; Announced achievement of 59 PFLOPS computational power, entering top 50 supercomputer territory. OctaSpace approaches DePIN from a different angle. Rather than specializing narrowly in rendering, it’s building a full‑stack decentralized cloud one where users can launch AI agents, train models, render workloads, and host services inside virtualized environments. The 59 PFLOPS milestone matters because it reframes OctaSpace from “alternative compute” to serious infrastructure capacity. Its marketplace strategy in 2025 suggests a focus on user adoption and revenue flow, not just raw hardware numbers. While broader DePIN hype has cooled at times, OctaSpace continues layering features virtual environments, AI tools, privacy mining to make the platform useful day‑to‑day. 👉 Comparison: Render focuses on depth specialized GPU rendering and AI compute. OctaSpace focuses on breadth a multi‑use decentralized cloud stack. 🔵ANYONE vs NYM: The Battle for Privacy Networks ✦ ANYONE: the OG of Censorship‑Resistant Access ☞ Vision: Secure, decentralized internet access with privacy and token incentives for a global network. ☞ Tech Stack: DePIN infrastructure · Privacy‑focused protocols · Token‑based rewards. ☞ Evolution: Technical strides in December 2025 · Kraken spot trading listing in December 2025 as first top‑5 exchange. ☞ Recent Behavior: Rolled out mainnet staking with auto‑compounding and operator selection; Deployed mainnet contracts on Ethereum; Distributed final testnet rewards and revamped ecosystem page highlighting app integrations. ANYONE is focused on practical privacy, not abstract cryptography. It builds real infrastructure nodes that provide censorship‑resistant access and uses token incentives to keep the network alive and growing. The 2025 rollout of staking, operator selection, and Ethereum contracts shows the project shifting from build mode into network scaling mode. A top‑tier exchange listing adds visibility, but the real signal is the steady expansion of integrations and applications highlighted in its ecosystem updates. ANYONE’s thesis is simple: people want privacy if it doesn’t slow them down. ✦ NYM: the Challenger of Advanced Mixnets ☞ Vision: End‑to‑end privacy for communications, protecting against surveillance in Web3 and beyond. ☞ Tech Stack: Mixnet architecture · NymVPN · Quantum‑resistant key exchange. ☞ Evolution: Quantum‑resistant rollout across stack in 2025 · Improved delegations and Binance bridge in August 2025. ☞ Recent Behavior: Released NymVPN v2025.20 with custom DNS support for multiple platforms; Introduced dApp mode for metadata shielding in Ethereum interactions; Announced collaboration with XX Network for quantum‑safe privacy enhancements. NYM tackles privacy at a deeper layer. Instead of just encrypting traffic, its mixnet obscures who is talking to whom, protecting against metadata analysis one of the hardest problems in privacy. The 2025 upgrades focus on resilience: Decentralization improvements to avoid outages, VPN usability upgrades, and quantum‑safe cryptography baked into the protocol. NYM isn’t chasing mass simplicity first. It’s building for high‑stakes privacy environments where failure isn’t an option. 👉 Comparison: ANYONE prioritizes usability and incentives. NYM prioritizes deep, protocol‑level anonymity and future‑proof security. 🔴GEODNET vs XYO: The Battle for Location Oracles ✦ GEODNET: the OG of Precision RTK Networks ☞ Vision: Fuel autonomous systems like robots and drones with centimeter‑accurate RTK data via blockchain incentives. ☞ Tech Stack: Blockchain‑based RTK network·Token rewards for stations·API for global positioning. ☞ Evolution: Revenue up to $1.2M in Q3 2025·API enhancements in September 2025·GEO‑PULSE intro at CES 2025. ☞ Recent Behavior: Hosted joint AMA with ROVR Network; Shared year‑end network scale update with over 20K active miners across 153 countries; Highlighted real‑world RTK use cases in construction, robotics, and more. GEODNET turns physical infrastructure into a decentralized network. By incentivizing contributors to run RTK stations, it creates a global precision‑location layer that would be extremely expensive to replicate centrally. What matters here is traction. Real usage in robotics, construction, and navigation shows that this isn’t theoretical DePIN it’s infrastructure already being relied upon. Revenue growth and governance initiatives like GIP7 signal a network maturing operationally, not just expanding geographically. ✦ XYO: the Challenger of Data‑Focused Blockchains ☞ Vision: Scalable blockchain for verified location data, powering DePIN, AI, and Web3 economies. ☞ Tech Stack: Layer‑1 blockchain·Sharding and ZK proofs planned for 2026·Dual‑token system. ☞ Evolution: Layer One launch in September 2025·10M+ nodes integration·AI data focus unveiled at Token2049. ☞ Recent Behavior: Announced partnership with OORT for AI integrations; Listed on Revolut; Teamed up with BeatSwap for verified ownership in digital and IP rights. With millions of nodes already deployed, the move to a full Layer‑1 allows it to handle larger volumes of verified data especially for AI and autonomous systems. The 2025 L1 launch marks a structural shift, while partnerships and listings expand distribution and visibility. ZK enhancements on the roadmap suggest a future where data verification scales without sacrificing trust. 👉 Comparison: GEODNET delivers immediate precision for hardware‑driven use cases. XYO builds the blockchain layer for scalable data economies. 🔚 Final Thoughts The OGs Render, ANYONE, GEODNET laid the groundwork: Decentralized compute, private access, and real‑world positioning. The challengers OctaSpace, NYM, XYO are expanding those ideas with broader platforms, deeper privacy, and scalable chains. DePIN isn’t fading. It’s quietly becoming the infrastructure layer for AI, autonomy, and real‑world Web3. The question isn’t whether DePIN grows. It’s which of these captures the next 10x of that growth.

31 5 2.01K 閱讀原文 >釋出後RENDER走勢看漲The DePIN industry has broad prospects, with a detailed analysis of the competitive advantages and growth potential of six major projects.

31 5 2.01K 閱讀原文 >釋出後RENDER走勢看漲The DePIN industry has broad prospects, with a detailed analysis of the competitive advantages and growth potential of six major projects. Dami-Defi DeFi_Expert Trader B90.76K @DamiDefi

Dami-Defi DeFi_Expert Trader B90.76K @DamiDefiMASSIVE: $RENDER | @rendernetwork Just Revealed Their Full BME Tokenomics, This Changes Everything - Every rendering job burns $RENDER tokens at USD-equivalent value - Burns happen regardless of payment method (fiat, USDC, or direct RENDER) - That means REAL network usage = REAL deflationary pressure on supply - Emissions are capped and declining on a fixed schedule to fund ecosystem growth - Foundation uses multi-wallet treasury with batched transactions to minimize gas costs and slippage - The more artists render, the more $RENDER gets burned - Usage is scaling (22M frames in 2025 alone—35% of all-time renders) - Burns are directly tied to revenue, not just hype $RENDER has real utility, real usage, and real deflationary mechanics built in Are you positioned or are you going to watch this fly without you?

The Render Network D228.61K @rendernetwork

The Render Network D228.61K @rendernetworkCheck out our explainer of how the Render Network emissions and operations, including jobs and burns, work under the hood: https://t.co/EbacvRg5xv ▪️Review of RNP-001 key mandate re: jobs resulting in burns ▪️Emissions, Foundation operations, and Network operations explained ▪️How transaction batching works to improve efficiency ▪️Examples of different transaction types onchain

75 12 16.18K 閱讀原文 >釋出後RENDER走勢看漲RENDER achieves deflation through burn-on-render, outlook is bullish Dami-Defi DeFi_Expert Trader B90.76K @DamiDefi

Dami-Defi DeFi_Expert Trader B90.76K @DamiDefiTop #AI cryptos YTD losses: $RENDER: -81% $ICP: -68% $TAO: -49% $FET: -84% $NEAR: -68% Do you think these leaders will recover their losses before the end of Q4?

56 8 3.33K 閱讀原文 >釋出後RENDER走勢中性AI leader coins have seen steep declines this year, and it remains uncertain whether they will rebound before Q4. LA𝕏MAN TA_Analyst Trader A19.57K @Theblockvlog

LA𝕏MAN TA_Analyst Trader A19.57K @Theblockvlog$SILVER THIS GLASS OUTPERFORMING ALTCOINS SINGLE-HANDEDLY https://t.co/mUAO2YE9dD

141 29 4.23K 閱讀原文 >釋出後RENDER走勢看跌The author sarcastically comments on altcoin poor performance, stating it underperforms regular silver cups, implying bearish sentiment towards altcoins.

141 29 4.23K 閱讀原文 >釋出後RENDER走勢看跌The author sarcastically comments on altcoin poor performance, stating it underperforms regular silver cups, implying bearish sentiment towards altcoins. Dami-Defi DeFi_Expert Trader B90.76K @DamiDefi

Dami-Defi DeFi_Expert Trader B90.76K @DamiDefi$RENDER is SHIPPING at an absolutely INSANE pace @rendernetwork just dropped MASSIVE updates at Breakpoint 2025 and the numbers don't lie: - 63 million cumulative frames rendered since 2018 - 22 MILLION frames (35%) rendered in 2025 ALONE - 87% marketplace growth this year - 276 artist grants funded via community proposals Game-Changing Announcements: - Dispersed .com launched as compute subnet's user-facing brand - Enables generative AI model processing on decentralized GPUs - OTOY integrated 600+ open-weight AI models - Blending traditional 3D and AI creation tools (Canvas, Timeline) - Expanding into VR/AR and world models for robotics Tokenomics Reality Check: - 500K RENDER emitted monthly to nodes - Burns rarely exceed 50K - Creating supply pressure with 519M circulating tokens RENDER is scaling usage MASSIVELY (35% of all-time renders happened THIS YEAR), but tokenomics haven't caught up yet. This is your DePIN + AI sleeper play for 2026. Don't sleep on it.

The Render Network D228.61K @rendernetwork

The Render Network D228.61K @rendernetworkHere’s our Breakpoint 2025 talk in full! Big updates from the Render Network https://t.cο/QLhfj3oKna

280 30 17.12K 閱讀原文 >釋出後RENDER走勢極度看漲RENDER 2025 rendering volume surges, supply-demand imbalance, strong 2026 potential OCT News Media B1.83K @news_oct

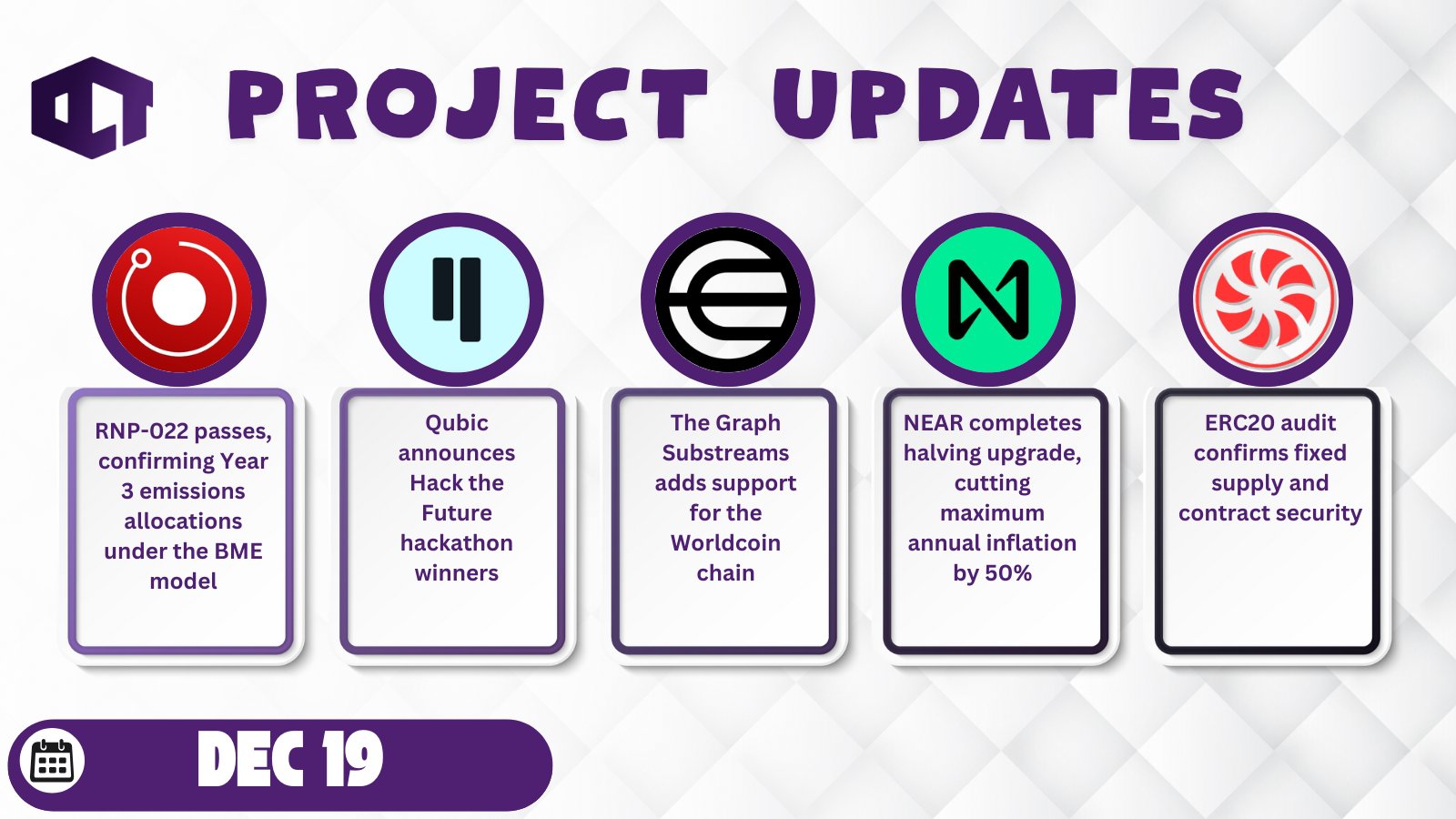

OCT News Media B1.83K @news_oct$RENDER : RNP-022 passes, confirming Year 3 emissions allocations under the BME model. $QUBIC : Qubic announces Hack the Future hackathon winners. $WLD : The Graph Substreams adds support for the Worldcoin chain. $NEAR : NEAR completes halving upgrade, cutting maximum annual inflation by 50% $CLORE : ERC20 audit confirms fixed supply and contract security.

236 15 12.65K 閱讀原文 >釋出後RENDER走勢看漲Several crypto projects released positive updates, including NEAR halving, CLORE security audit, and ecosystem support.

236 15 12.65K 閱讀原文 >釋出後RENDER走勢看漲Several crypto projects released positive updates, including NEAR halving, CLORE security audit, and ecosystem support. Runner Quant Trader B7.62K @RRunner144

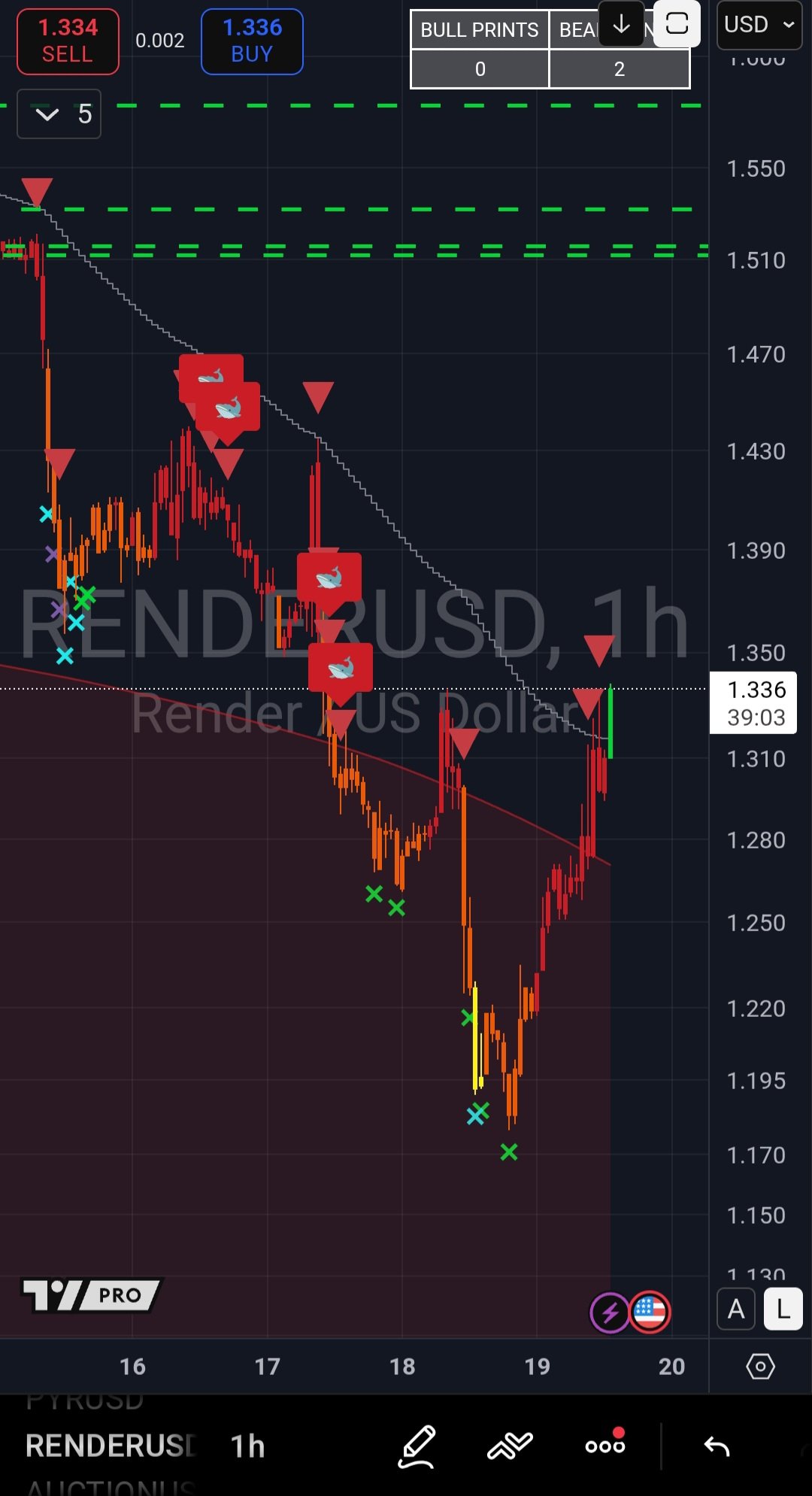

Runner Quant Trader B7.62K @RRunner144Scalped another dip on $RENDER, I want to send this Market Maker a Christmas Card. I'm averaging an 85% win rate due to these operators keeping their algos consistent. https://t.co/NfHUTiOV0u

2 1 502 閱讀原文 >釋出後RENDER走勢看漲The author successfully scalp traded during RENDER's decline, achieving a win rate of up to 85%.

2 1 502 閱讀原文 >釋出後RENDER走勢看漲The author successfully scalp traded during RENDER's decline, achieving a win rate of up to 85%. Sjuul | AltCryptoGems TA_Analyst Media C477.19K @AltCryptoGems

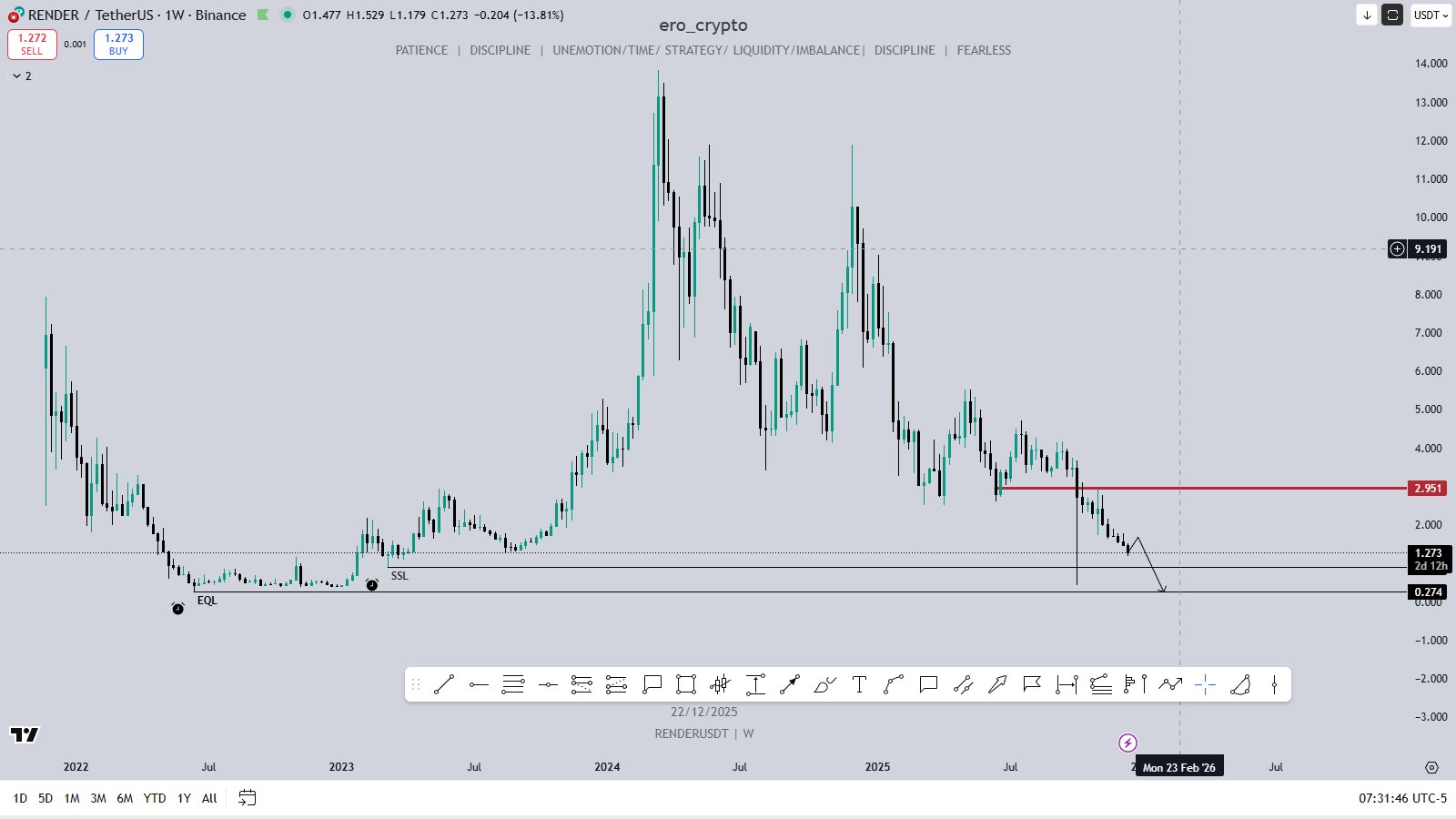

Sjuul | AltCryptoGems TA_Analyst Media C477.19K @AltCryptoGems$RENDER is in full bear market mode, down 90% from the high and trading at levels seen during the last bear market. Really sad to see! https://t.co/SCIbWZjxJj

648 29 33.72K 閱讀原文 >釋出後RENDER走勢極度看跌The RENDER token is in a bear market, down 90% from its peak, price returning to the level of the last bear market.

648 29 33.72K 閱讀原文 >釋出後RENDER走勢極度看跌The RENDER token is in a bear market, down 90% from its peak, price returning to the level of the last bear market. Erik TA_Analyst Trader B13.38K @ero_crypto

Erik TA_Analyst Trader B13.38K @ero_crypto$RENDER- my high probability scenario https://t.co/uxWWyL5sZG

7 4 1.28K 閱讀原文 >釋出後RENDER走勢看跌RENDER price is expected to fall sharply to $0.274

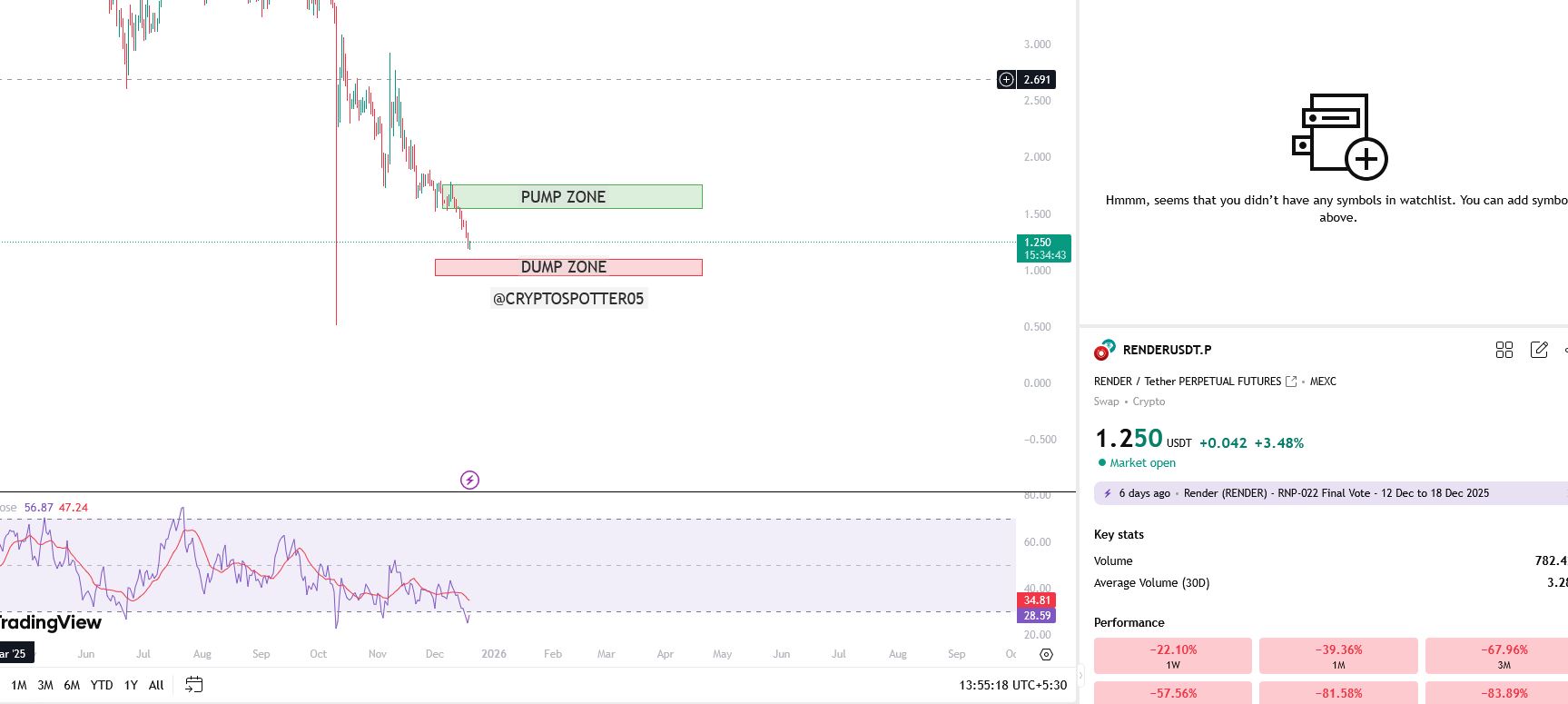

7 4 1.28K 閱讀原文 >釋出後RENDER走勢看跌RENDER price is expected to fall sharply to $0.274 Crypto Spotter TA_Analyst Trader B4.09K @CryptoSpotter05

Crypto Spotter TA_Analyst Trader B4.09K @CryptoSpotter05$RENDER CHART REQUEST 🚨 A bounce is incoming, But before that it Could enter this Dump zone.. https://t.co/GPJv0O1geH

ramana veeru D29 @ramanaveeru

ramana veeru D29 @ramanaveeru@CryptoSpotter05 Render Please

2 4 1.02K 閱讀原文 >釋出後RENDER走勢看跌RENDER may first fall into the DUMP ZONE, then is expected to rebound.