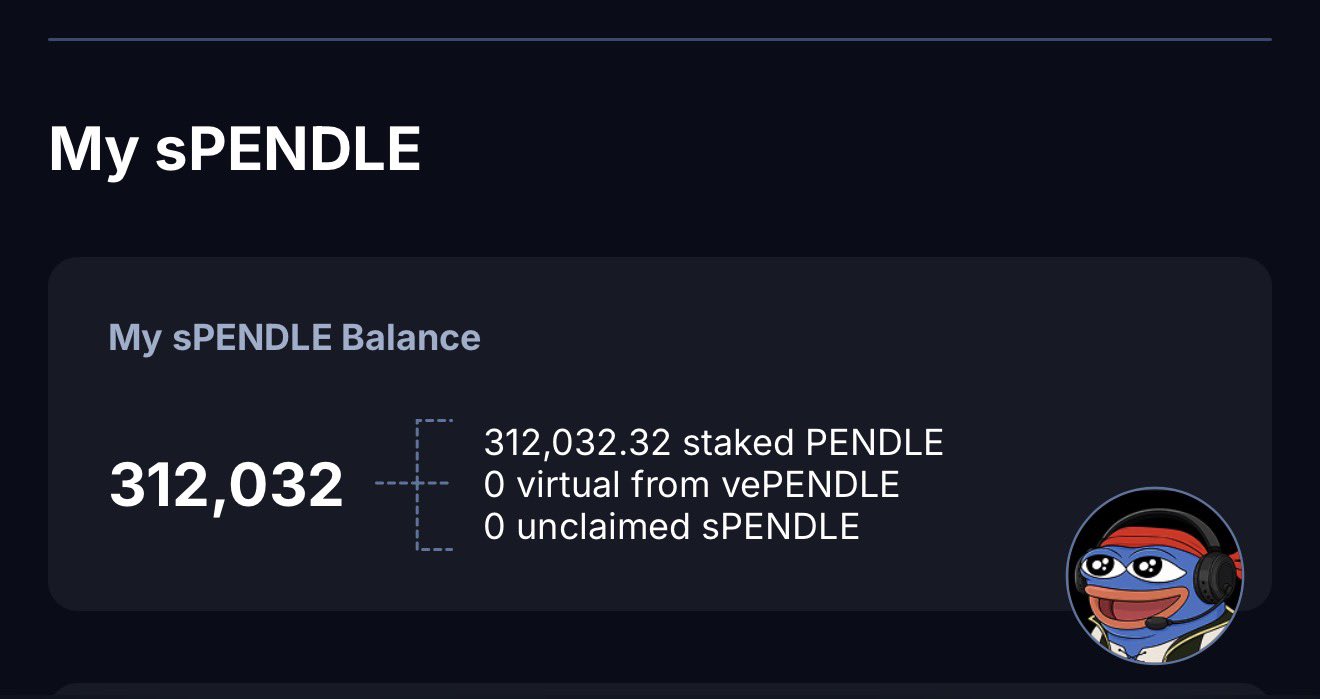

Pendle (PENDLE)

Pendle (PENDLE)

$1.1626 -5.36% 24H

- 74社交熱度指數(SSI)- (24h)

- #24市場預警排名(MPR)0

- 424小時社交提及量- (24h)

- 100%24小時KOL看好比例4位活躍KOL

- 概要

- 看漲訊號

- 看跌訊號

社交熱度指數(SSI)

- 總體資料74SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈看漲 (100%)社交熱度洞察

市場預警排名(MPR)

- 預警解讀

相關推文

FIP Crypto | Footprint OnChain_Analyst Educator C20.30K @fipcrypto

FIP Crypto | Footprint OnChain_Analyst Educator C20.30K @fipcrypto FIP Crypto | Footprint OnChain_Analyst Educator C20.30K @fipcrypto10 4 536 閱讀原文 >釋出後PENDLE走勢看漲

FIP Crypto | Footprint OnChain_Analyst Educator C20.30K @fipcrypto10 4 536 閱讀原文 >釋出後PENDLE走勢看漲- 釋出後PENDLE走勢看漲

Zoomer Oracle Founder Trader C50.87K @ZoomerOracle

Zoomer Oracle Founder Trader C50.87K @ZoomerOracle USD.AI | Public Launch is Live D28.50K @USDai_Official60 5 9.52K 閱讀原文 >釋出後PENDLE走勢看漲

USD.AI | Public Launch is Live D28.50K @USDai_Official60 5 9.52K 閱讀原文 >釋出後PENDLE走勢看漲 Altcoin Sherpa Trader TA_Analyst C260.82K @AltcoinSherpa

Altcoin Sherpa Trader TA_Analyst C260.82K @AltcoinSherpa USD.AI | Public Launch is Live D28.50K @USDai_Official99 13 26.43K 閱讀原文 >釋出後PENDLE走勢看漲

USD.AI | Public Launch is Live D28.50K @USDai_Official99 13 26.43K 閱讀原文 >釋出後PENDLE走勢看漲 𝐌𝐮𝐛𝐢 𝐂𝐫𝐲𝐩𝐭🦺🧡 Media Educator B2.16K @Mubi_crypt

𝐌𝐮𝐛𝐢 𝐂𝐫𝐲𝐩𝐭🦺🧡 Media Educator B2.16K @Mubi_crypt Keno DeFi_Expert Educator A8.70K @kenodnb44 23 917 閱讀原文 >釋出後PENDLE走勢看漲

Keno DeFi_Expert Educator A8.70K @kenodnb44 23 917 閱讀原文 >釋出後PENDLE走勢看漲 UNICORN⚡️🦄 Trader FA_Analyst C133.54K @UnicornBitcoin

UNICORN⚡️🦄 Trader FA_Analyst C133.54K @UnicornBitcoin

Pendle D160.07K @pendle_fi65 17 27.14K 閱讀原文 >釋出後PENDLE走勢極度看漲

Pendle D160.07K @pendle_fi65 17 27.14K 閱讀原文 >釋出後PENDLE走勢極度看漲- 釋出後PENDLE走勢看漲

- 釋出後PENDLE走勢極度看漲

- 釋出後PENDLE走勢極度看跌

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Pendle D160.07K @pendle_fi

Pendle D160.07K @pendle_fi 109 14 7.38K 閱讀原文 >釋出後PENDLE走勢看漲

109 14 7.38K 閱讀原文 >釋出後PENDLE走勢看漲