Ordinals (ORDI)

Ordinals (ORDI)

- 54社交熱度指數(SSI)- (24h)

- #34市場預警排名(MPR)0

- 124小時社交提及量- (24h)

- 0%24小時KOL看好比例1位活躍KOL

- 概要ORDI up 1.64% in the past 24h, social heat flat, TraderEthem's detailed release on TG draws attention.

- 看漲訊號

- Price up 1.64%

- KOL posted details

- Engagement 38

- 看跌訊號

- Social heat unchanged

- Increase only 1.6%

社交熱度指數(SSI)

- 總體資料54SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈看跌 (100%)社交熱度洞察ORDI social heat is moderate (53.5/100, flat), mainly due to TraderEthem's detailed release boosting KOL attention (↑1/30) but positive sentiment only 12.5/30.

市場預警排名(MPR)

- 預警解讀ORDI warning rank #34, social anomaly score 100/100 extremely high, sentiment polarization 50/100 moderate, associated with only 1.6% price increase and flat social heat.

相關推文

CryptoTrader TA_Analyst Trader B26.98K @TraderEthem

CryptoTrader TA_Analyst Trader B26.98K @TraderEthem#ordi details posted to TG, boss..

tayfun D75 @ttayfunnk

tayfun D75 @ttayfunnk@TraderEthem Sir #ordı not received

33 3 2.00K 閱讀原文 >釋出後ORDI走勢看跌ORDI not received, recommend waiting Ry Quant FA_Analyst C2.66K @Ry_Guy_NFT

Ry Quant FA_Analyst C2.66K @Ry_Guy_NFTThe beauty of the market is that liquidity decides I personally think memecoins require a faster chain because they change too quickly Liquidity has already chosen the right chain for memecoins The slower chain with the longest Lindy effect is best for hodl and Art (ordinals)

🄱LOCK.btc D17.25K @ChainRacingClub

🄱LOCK.btc D17.25K @ChainRacingClubOrdi and Dog cannot coexist. We need to pick a protocol. Runes ain't it. Honestly. Why Brc-20 wins: ✅First is first ✅Ordi ✅Protocol alignment, unlocking programmability. ✅Indexing SETTLED ✅"Spam" has generated a massive amount of disruption ✅Binance, Hyperliquid, Asia support ✅Better narrative ✅Less salty (Time heals) ✅Runes still bitter (Needs 15 years) ✅Protocol dominance (85% of all Ordinals) ✅Runes has nobody cooking on the protocol level. Nothing coming. Zip, zero, nada.

0 0 73 閱讀原文 >釋出後ORDI走勢極度看漲ORDI/BRC‑20 has clear advantages, recommend bullish DinhTien | 🎒 Community_Lead Educator B8.91K @DinhtienSol

DinhTien | 🎒 Community_Lead Educator B8.91K @DinhtienSolNEW: I just moved an ORDI from Bitcoin L1 to Solana in one flow and it felt like using a proper rails upgrade rather than a duct-taped bridge Step 1: picked the asset on Bitcoin, Step 2: selected target chain, Step 3: signed once swap handled internal standard conversion (BRC‑20 Rune) and cross‑chain relay via LayerZero No wrapping, no custody shuffle, liquidity woke up instead of sleeping Docs and SDKs from @beyond__tech made the flow predictable, fees transparent, and dev tooling actually useful for prod testing If Bitcoin liquidity can move natively across 70+ / 140+ chains and $BYD aligns incentives with 0% team allocation, are we finally turning BTC into productive capital rather than an inert store of value?

32 29 643 閱讀原文 >釋出後ORDI走勢看漲The author successfully bridged ORDI from Bitcoin L1 to Solana, bullish on BTC becoming productive capital.

32 29 643 閱讀原文 >釋出後ORDI走勢看漲The author successfully bridged ORDI from Bitcoin L1 to Solana, bullish on BTC becoming productive capital. Xellos Educator Researcher B2.42K @09pZKuQbSA91Kq3

Xellos Educator Researcher B2.42K @09pZKuQbSA91Kq3 Evergreen D7.75K @talkevergreen

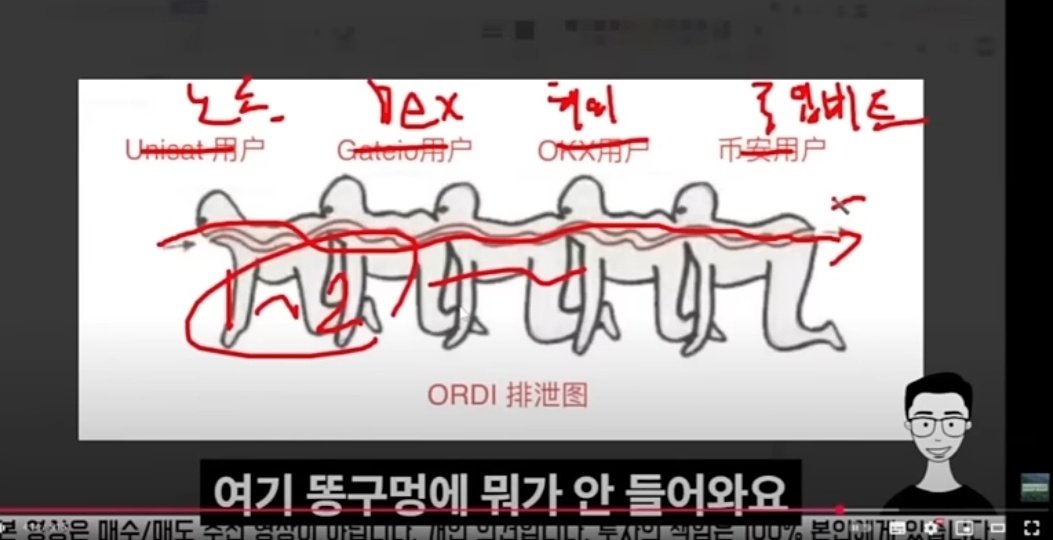

Evergreen D7.75K @talkevergreenThe claim that altcoin supply has been cut off has been around for a long time, and it is heading toward increasingly difficult conditions. The glory of 2017 or 2021 has now become poison, and it is better to just forget it. The reasons are, 1. Because of ETFs. (An already old opinion) In the past, one would buy Bitcoin on centralized exchanges and use the profits to purchase altcoins, but now everything moves through a single ETF line, limiting switching flexibility. 2. There are too many altcoins, continuously issued infinitely. Coin issuance outpaces incoming money, making uniform distribution impossible. 3. New coins keep appearing, but eventually they are ripped off and exited, a recurring fraud that has eroded trust. 4. People no longer buy coins on Upbit and Bithumb (i.e., centralized exchanges); they only grab early ICO spots and then sell back to Upbit and Bithumb. Some even say, “Who would spend money to buy altcoins?” 🤡🤡 5. Wealthy individuals simply deposit stablecoins and are satisfied with a safe 10‑20% return, unwilling to take the risk of buying altcoins on exchanges. 6. They gather people (so‑called DAO), pick up new projects there, and secure early positions, realizing it’s much safer to make money that way. More people are copying this model. It reflects that money is circulating in the so‑called “shit‑hole” liquidity at the front end. 7. In summary, centralized exchanges have become a laundry‑room for money, and to solve this, a large influx of liquidity must flow into the “shit‑hole.” Aren’t points 2 and 3 too serious? -> Yes, that’s correct. Yet, despite these fundamental issues being raised years ago, the market has not changed. Even those claiming to solve the problem have their own issues. And point 4: Most KOLs involved in promoting new coins aggressively say, “Are you here to fix the problem or just to make money? If you’re angry, do it yourself! Wake up!” People are strongly persuaded by this rhetoric, thinking “This is the right way,” and get drawn in.

122 13 24.40K 閱讀原文 >釋出後ORDI走勢極度看跌The author believes that the altcoin market will continue to deteriorate due to ETF issues, liquidity depletion, and problems with centralized exchanges.

122 13 24.40K 閱讀原文 >釋出後ORDI走勢極度看跌The author believes that the altcoin market will continue to deteriorate due to ETF issues, liquidity depletion, and problems with centralized exchanges. FIREANT Trader FA_Analyst B15.26K @ROKMCFIREANT

FIREANT Trader FA_Analyst B15.26K @ROKMCFIREANTOrderly Network with Fireant https://t.co/lyTg2IDwDt

44 11 982 閱讀原文 >釋出後ORDI走勢中性Mentioned the Orderly Network project, no clear market outlook yet UNKNOWN TRADER Trader TA_Analyst B120.66K @Learnernoearner

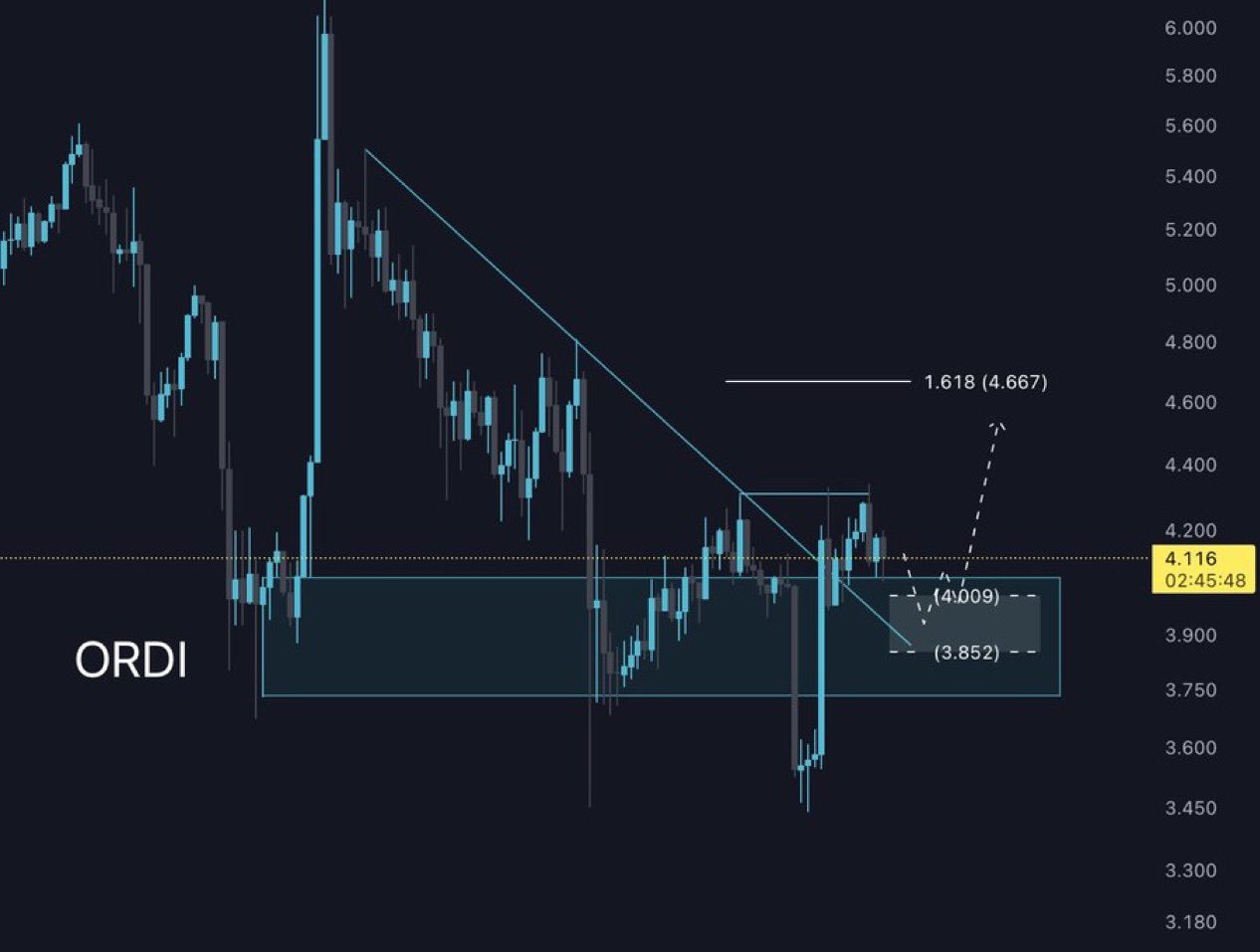

UNKNOWN TRADER Trader TA_Analyst B120.66K @Learnernoearner#ORDI $ORDI LONG TRADE ENTRY: 4.595 TARGET: 5.18 STOPLOSS: 4.39 https://t.co/LJwO9snUSa

243 59 10.66K 閱讀原文 >釋出後ORDI走勢看漲ORDI long trade strategy, entry 4.595, target 5.18, stop loss 4.39.

243 59 10.66K 閱讀原文 >釋出後ORDI走勢看漲ORDI long trade strategy, entry 4.595, target 5.18, stop loss 4.39. 北讲区块链 Educator Trader C110.07K @NFTfafafa

北讲区块链 Educator Trader C110.07K @NFTfafafaOrdi shows bottoming signs When will ordi return to $50

46 54 19.27K 閱讀原文 >釋出後ORDI走勢看漲ORDI may bottom and return to $50, BTC gets MetaMask support 张大善人.eth🪐 Trader Educator A2.12K @getrich_inalpha

张大善人.eth🪐 Trader Educator A2.12K @getrich_inalphaIn the crypto community, the infamous fake KOL Elizabeth apologized again, unsurprisingly. Sea is right, and it has always been my view: the scariest thing on the path of growth is not making mistakes, but having mistakes continuously rewarded. Whether in life or trading, once you treat luck as ability and chance as skill, you will eventually have to pay for it. Many people sail smoothly in a bull market and think they've become "trading gods, A8 A9 are no problem..." When the bear market arrives, the market can expose half of the KOLs back to their original state. The same applies to this controversy—previous luck didn't cost her, creating the illusion: "It's fine, the market won't hammer me." But this time, faced with a real catastrophe, it's a matter of right and wrong. Luck can't hold, nor can the habitual patterns, so a crash is the most normal outcome. You think you're deceiving everyone, but everyone has already been waiting for you to slip up. For a KOL with a bad record, give no chance—just block and mute, because someday their misdeeds will drag you down.

SΞA 🐸 D48.83K @Sea_Bitcoin

SΞA 🐸 D48.83K @Sea_BitcoinDistorted traffic and values are not built in a day. She said "In February 2023 I allocated to ordi," faced mockery, but also gained many followers. Perhaps it was her first time feeling that 'being wrong' brings more 'rewards' than 'being right.' She said "Playing DeFi without a 30% monthly yield is useless," which was screenshotted into a meme, gaining a second wave of attention and controversy, and attracting more "fans" through the spread. I initially thought it was just imprecise expression and lack of objective data, but later realized it was deliberate falsehood. In interviews, she adheres to the creed "black fame is still fame" and "as long as there is traffic, it's fine." Repeated fake giveaways that never materialized didn't seem problematic. With more fans, traffic and controversy grew. She even received an "Industry Contribution Award," stood in the spotlight, and at that moment felt everything she did was right. Every follower bears some responsibility. Every project team that only looks at follower count and views also has responsibility. A lesson taught by adults in childhood: "Children taking others' belongings aren't held accountable, but grown-ups are more likely to become real thieves." It sounds crude but makes sense. The higher you stand, the harder you fall. I saw someone on X saying that perhaps there's a 'mastermind' behind this, boosting attention and traffic to the max. I want to say, that's not a mastermind; if there is one, they're definitely a trash person. In an era where privacy is like a transparent bag and data farms are like taxis, being a KOL means stripping yourself clean and putting yourself on a grill. You think you're manipulating public opinion and grabbing traffic, but when the backlash hits, everyone pushes you from behind, and there's no sunlight in the abyss. On all social media, being honest with yourself is always more important than chasing traffic. Also, treat each "follower" behind the screen (I don't like calling them fans) as an individual, not as a "fan," and certainly not as an idiot.

5 1 3.42K 閱讀原文 >釋出後ORDI走勢看跌The crypto community harshly criticizes fake KOLs, warns that deceptive actions backfire, and urges followers to stay vigilant.

5 1 3.42K 閱讀原文 >釋出後ORDI走勢看跌The crypto community harshly criticizes fake KOLs, warns that deceptive actions backfire, and urges followers to stay vigilant. 🐋 شيماء || عملات رقمية SHA✨ TA_Analyst Trader B60.77K @Tren_Nd

🐋 شيماء || عملات رقمية SHA✨ TA_Analyst Trader B60.77K @Tren_NdThe coin to be analyzed #ORDI $ORDI A projected scenario for the coin but unconfirmed due to price instability and not surpassing the latest descending peak. Thus the analysis is for owners only https://t.co/wkftxqD8Qx

48 19 2.30K 閱讀原文 >釋出後ORDI走勢中性ORDI technical analysis shows a potential upward scenario, but it is unconfirmed due to price instability; holders are advised to watch cautiously.

48 19 2.30K 閱讀原文 >釋出後ORDI走勢中性ORDI technical analysis shows a potential upward scenario, but it is unconfirmed due to price instability; holders are advised to watch cautiously. DinhTien | 🎒 Community_Lead Educator B8.91K @DinhtienSol

DinhTien | 🎒 Community_Lead Educator B8.91K @DinhtienSolTldr: I ran a community bounty that needed ORDI on an altchain and almost shelved the idea because moving Bitcoin assets used to feel impossible Instead I used @beyond__tech and bridged ORDI to one of their 70+ supported chains in minutes. No awkward routing, no custodial detours, just tri-directional connectivity that didn’t feel like I was “breaking” anything. The UI was simple, the receipt tracking made reconciliation easy, and my experiment shipped without drama That tiny success changed how I build I’m more willing to prototype cross-chain flows, try yield on other networks, and bring value back to Bitcoin when it makes sense Is token mobility the biggest practical unlock for #BTCFi right now?

27 15 395 閱讀原文 >釋出後ORDI走勢看漲Beyond Tech simplifies ORDI cross-chain, enhancing BTCFi token liquidity.

27 15 395 閱讀原文 >釋出後ORDI走勢看漲Beyond Tech simplifies ORDI cross-chain, enhancing BTCFi token liquidity.

- 暫無資料