Lighter (LIT)

Lighter (LIT)

- 35社交熱度指數(SSI)+1.47% (24h)

- #116市場預警排名(MPR)+1

- 124小時社交提及量0% (24h)

- 100%24小時KOL看好比例1位活躍KOL

- 概要LIT accelerates rollout of 15% rebate, EVM rollup, staking over half, buyback support, TVL approaching 1B; however price down 3.6%, competition intense.

- 看漲訊號

- 15% fund rebate

- EVM rollup collateral

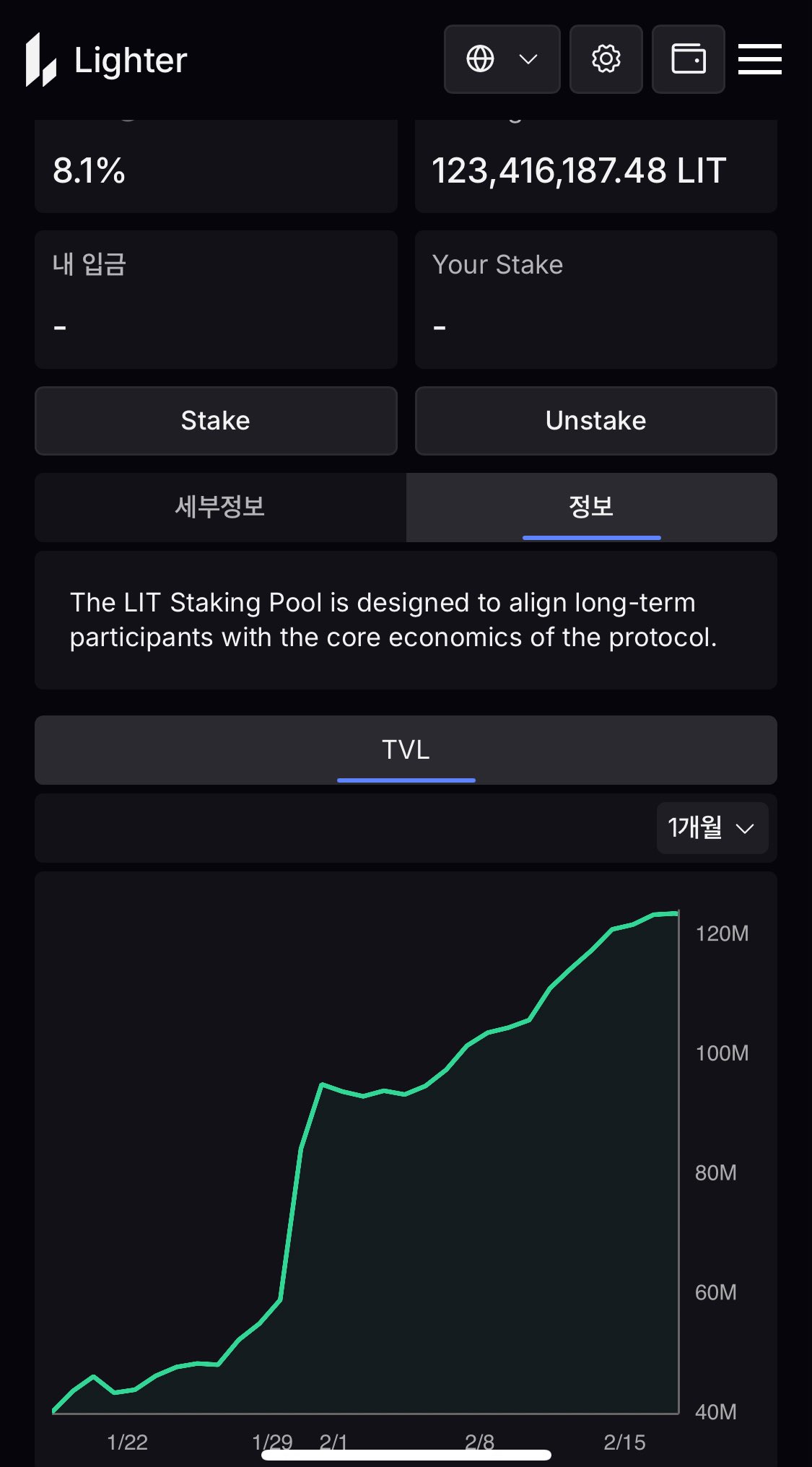

- Staking >50%

- Continuous buyback

- TVL nearly 1B

- 看跌訊號

- Price down 3.6%

- Intense competition

- Selling pressure remains

- Reliance on professional customers

- Market share pressure

社交熱度指數(SSI)

- 總體資料35SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (100%)社交熱度洞察LIT social heat low (34.5/100, +1.5%), activity up 14% and sentiment max up 9% driven, KOL attention sharply down -83% possibly due to lack of star endorsements.

市場預警排名(MPR)

- 預警解讀LIT warning rank rose to #116 (+1), sentiment polarization 100/100 (↑100%) mainly abnormal, linked to price down 3.6% and intensified competition.

相關推文

區塊先生 🐡 ⚠️ (rock #58) Educator Influencer B99.31K @mrblock

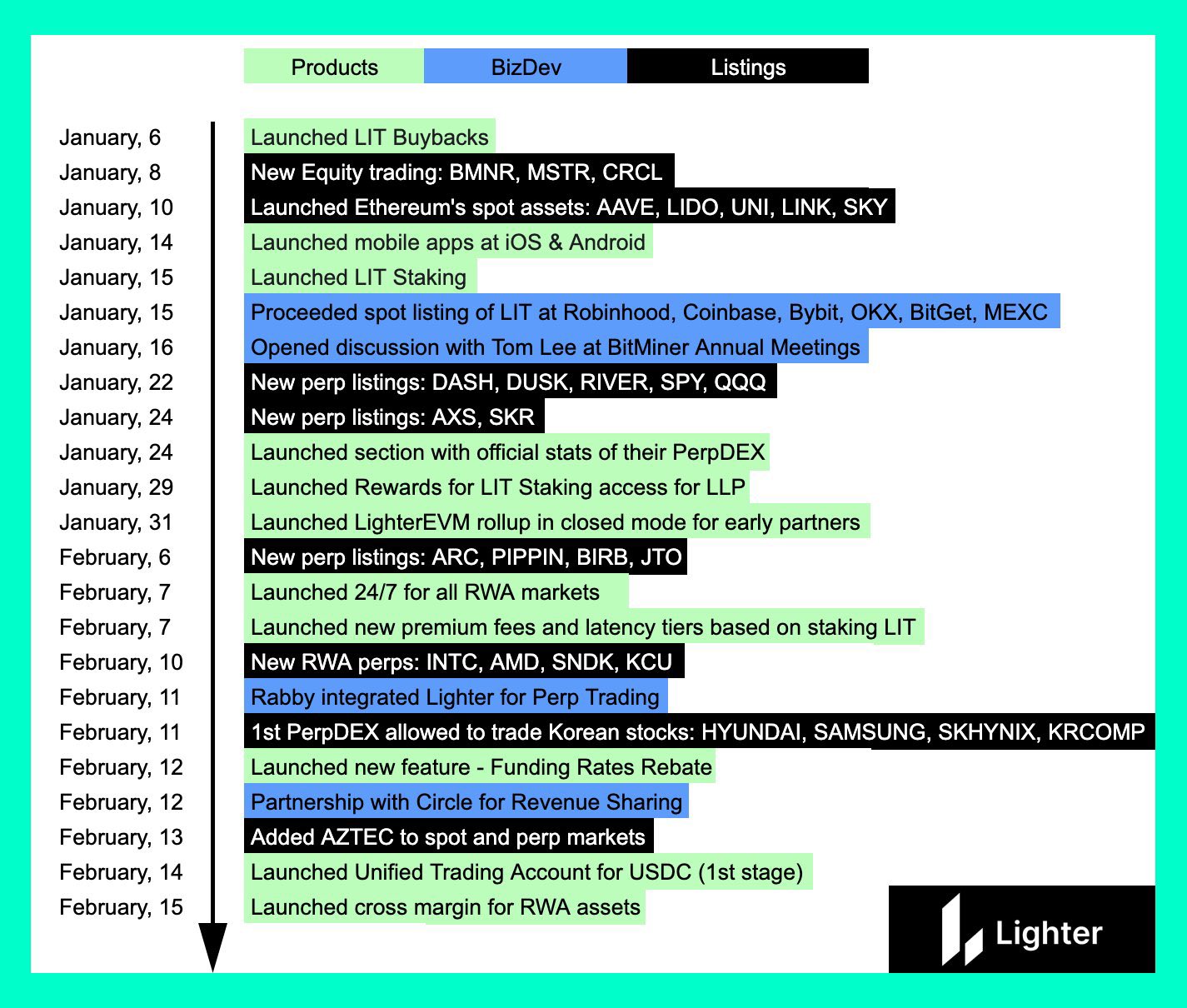

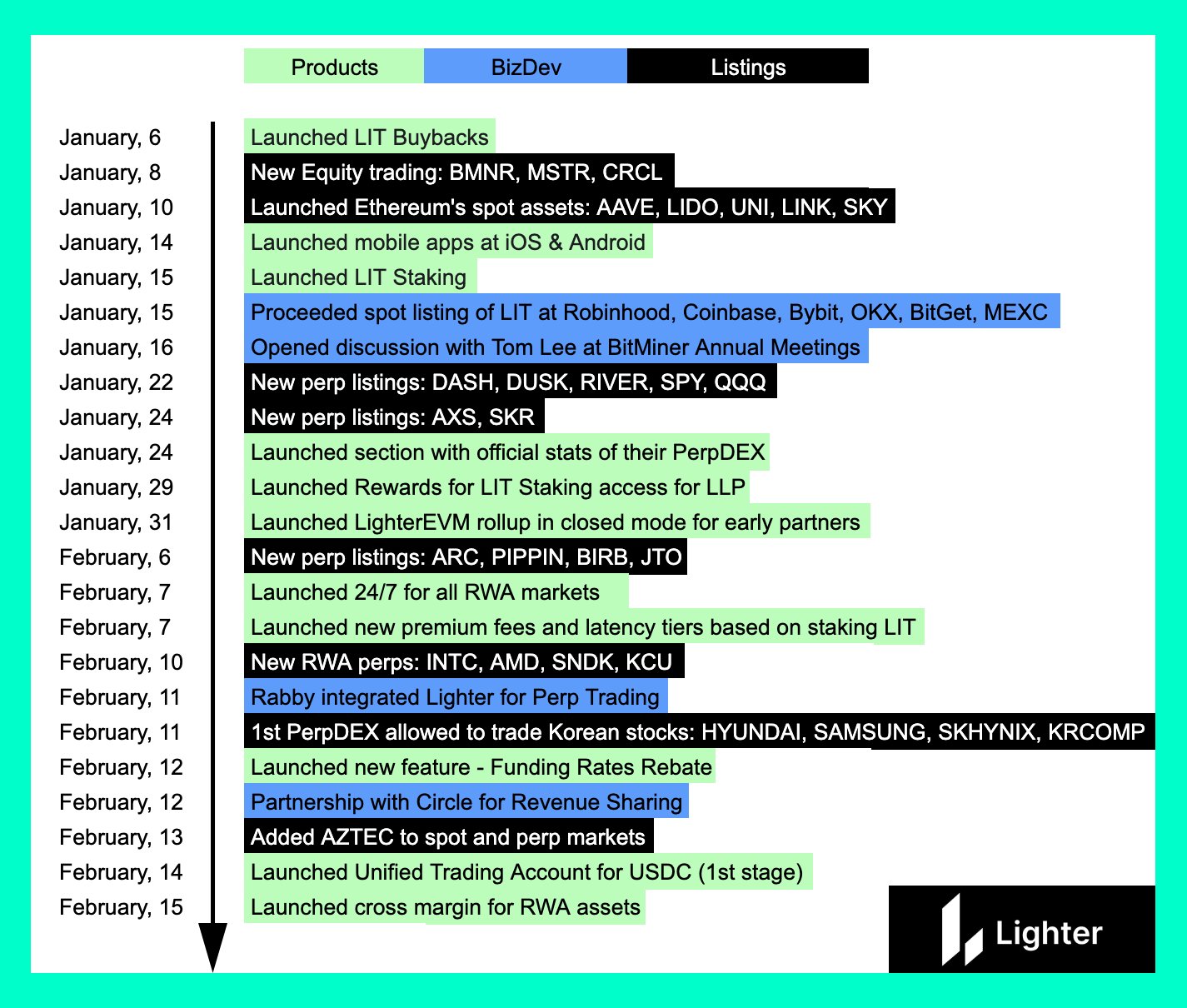

區塊先生 🐡 ⚠️ (rock #58) Educator Influencer B99.31K @mrblockIn the PerpDEX track, @Lighter_xyz currently has execution and product rollout speed that can be considered among the leaders, especially in the roughly two months after the TGE, the team has maintained a very steady iteration pace. ************Bookmark🔖Start************ From public information and recent updates, they have done the following concrete things: - Funding Rate Rebates: launched in mid‑February, holding LIT or using a premium account can receive up to 15% funding rebates. This can actually reduce costs for long‑term holders or HFT strategy players, especially useful in low‑liquidity markets or when funding is high. - LLP bucket upgrade: recently split liquidity provider collateral into different strategy buckets such as crypto, FX, RWA, achieving finer risk isolation and reducing cross‑category impact. - Lighter EVM: announced at the end of January, an EVM‑compatible rollup that will allow assets on Ethereum (Aave deposits, LP positions, etc.) to be used directly as perps margin, theoretically boosting capital efficiency. - Staking attractiveness: after platform staking launched, more than 50% of circulating supply has been staked (including LLP portion), indicating many users choose to lock rather than sell pressure. - Buyback mechanism: continuously conducting $LIT buybacks, accumulating several million tokens, indirectly supporting the token economy. - Other minor updates: mobile app is live, network upgrade frequency is high (almost weekly or bi‑weekly), showing continuous infrastructure optimization. On the data side: - Currently in perp DEX rankings, volume usually fluctuates within the top 3–4 (Hyperliquid, Aster still lead, but Lighter has not fallen behind). - OI and TVL remain high (TVL once approached the $1 billion level, recent inflows observed). - The combination of zero retail fees + ZK verification gives it a head start on the “CEX‑like experience + DeFi security” path. Of course, PerpDEX competition is fierce; Hyperliquid’s first‑mover advantage and other newcomers’ incentives continue to tug at market share. Lighter’s advantage lies in not relying on short‑term farming spikes, but continuously delivering substantive features, gradually attracting professional traders and institutional‑level demand. Overall, it is not “invincible” or “rule‑changing,” but at the beginning of 2026, Lighter’s product‑valuation disconnect still exists, and its execution is indeed more stable than many projects in the same track. If you are already trading perps, open an account and try it out, feel the differences in latency, fees, and rebates, you should get a more intuitive judgment. Lighter 🕯️ Still moving forward steadily, worth continued observation. Community 👉🏻 https://t.co/o4FC4Q0m8W

Eugene Bulltime.🕯️ D4.48K @Eugene_Bulltime

Eugene Bulltime.🕯️ D4.48K @Eugene_BulltimeLighter's team is one of the most productive in the market. In the 6 weeks since the TGE, they've added 11 new products, not including listings Product delivery speed is exceptional Products are innovative Value is real and based on feedback Matter of time when LIT catches up with the product

14 3 2.11K 閱讀原文 >釋出後LIT走勢極度看漲Lighter_xyz demonstrates strong execution in the PerpDEX sector, and the LIT token is undervalued, making it worth attention.

14 3 2.11K 閱讀原文 >釋出後LIT走勢極度看漲Lighter_xyz demonstrates strong execution in the PerpDEX sector, and the LIT token is undervalued, making it worth attention. Smart Drop Farmer DeFi_Expert OnChain_Analyst A2.74K @SmartDropFarmer

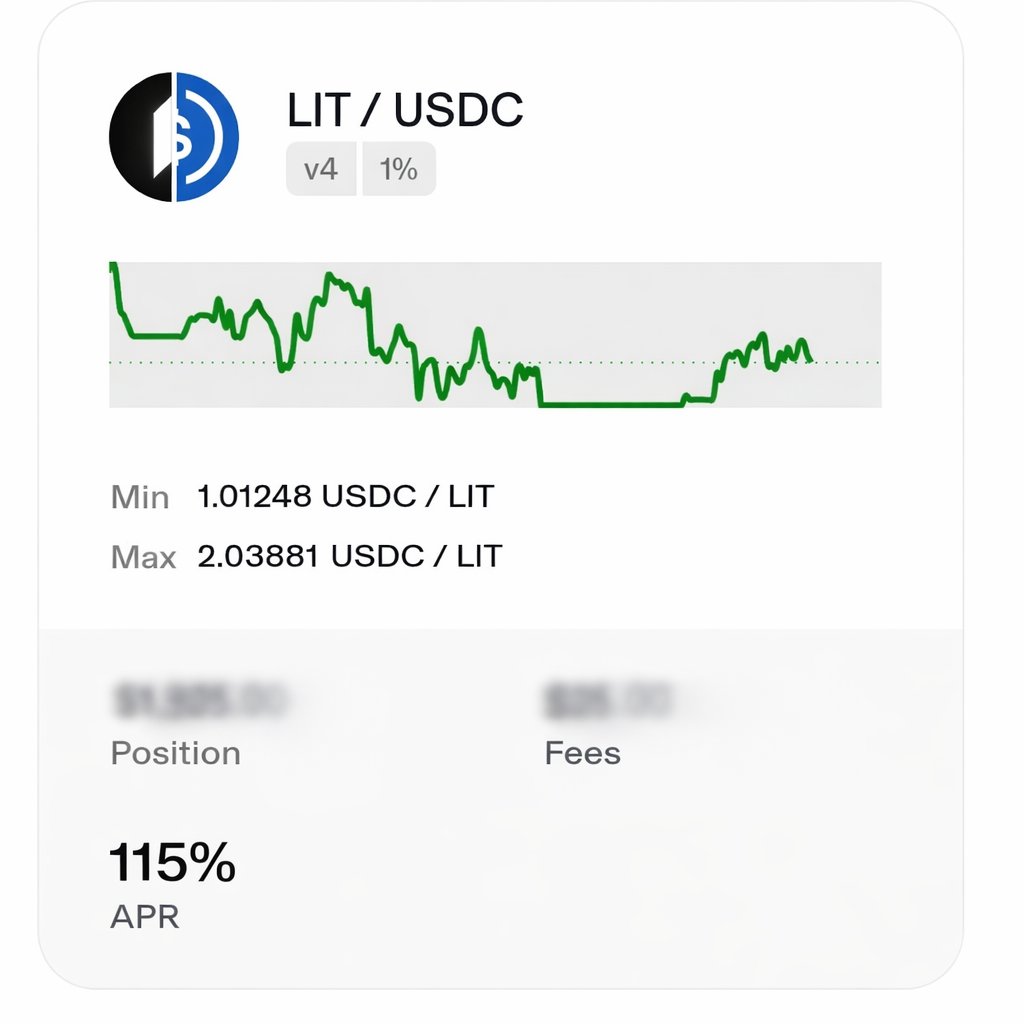

Smart Drop Farmer DeFi_Expert OnChain_Analyst A2.74K @SmartDropFarmerLIT/ USDC LP (Ethereum – Uniswap ) • Current range: 1$ – 2$ • Real APR so far: ~115% If you’re holding $LIT and not sure what to do with it, this can be a nice way to put it to work. Why I’m still in this pool & why I changed the range: - Old range was 1.4 – 2.5 - Market still looks bearish - LIT has been one of the strongest assets vs BTC lately > Price logic: < 1 → insanely cheap, great RR, happy to accumulate LITER > 2 → nice way to slowly sell part of the airdrop

32 3 2.89K 閱讀原文 >釋出後LIT走勢看漲LIT/USDC LP provides 115% APR, the author is bullish on low‑price accumulation of LIT, believing it outperforms BTC.

32 3 2.89K 閱讀原文 >釋出後LIT走勢看漲LIT/USDC LP provides 115% APR, the author is bullish on low‑price accumulation of LIT, believing it outperforms BTC. Smart Drop Farmer DeFi_Expert OnChain_Analyst A2.74K @SmartDropFarmer

Smart Drop Farmer DeFi_Expert OnChain_Analyst A2.74K @SmartDropFarmerGM 🌞 What’s your plan for this Tuesday? Here’s what I’ll be exploring today: • Ethos and Kaito on MocaProof • $LIT pool follow-up • The most underrated perpetual DEX? If breaking news pops up, I’ll cover that too. Let’s make it a productive day https://t.co/cPcYWRojfl

9 5 372 閱讀原文 >釋出後LIT走勢中性Author shares Tuesday plan, including exploring Ethos, Kaito, LIT pool and perpetual DEX.

9 5 372 閱讀原文 >釋出後LIT走勢中性Author shares Tuesday plan, including exploring Ethos, Kaito, LIT pool and perpetual DEX. 레오.마스터 | MemeMax⚡️ TA_Analyst Influencer C11.76K @ezeroho8245

레오.마스터 | MemeMax⚡️ TA_Analyst Influencer C11.76K @ezeroho8245LIT LIT staking has been live for 1 month Currently, 50% of the circulating supply is staked Buyback amount is 2.2% At this rate, after one month More than 90% will be tied up by staking or buyback Worth accumulating over 2-3 months (Not investment advice) https://t.co/ei3jhV2l3N

10 6 644 閱讀原文 >釋出後LIT走勢極度看漲LIT high staking and buyback leading to circulating supply contraction, TVL strong growth, suggest buying on dips within 2-3 months.

10 6 644 閱讀原文 >釋出後LIT走勢極度看漲LIT high staking and buyback leading to circulating supply contraction, TVL strong growth, suggest buying on dips within 2-3 months. DeFi Dad ⟠ defidad.eth Educator DeFi_Expert C177.11K @DeFi_Dad

DeFi Dad ⟠ defidad.eth Educator DeFi_Expert C177.11K @DeFi_Dad@derteil00 I believe $LIT has some big years ahead https://t.co/VUtm1AcdNw

Derteil D15.03K @derteil00

Derteil D15.03K @derteil00That's the biggest problem with $LIT holders imo. They buy $LIT because $HYPE this $HYPE that. There are not many people believing in the vision, team and founder. They buy it, because $HYPE is 20x higher. As far as I know LIT team I'm convinced they will push and do amazing things, same as I believe in Hyperliquid team. It may take time for market to realize thou.

0 0 16 閱讀原文 >釋出後LIT走勢看漲LIT is expected to achieve long-term growth by leveraging Ethereum on-chain fixed income tools Altcoin Sherpa Trader TA_Analyst C260.82K @AltcoinSherpa

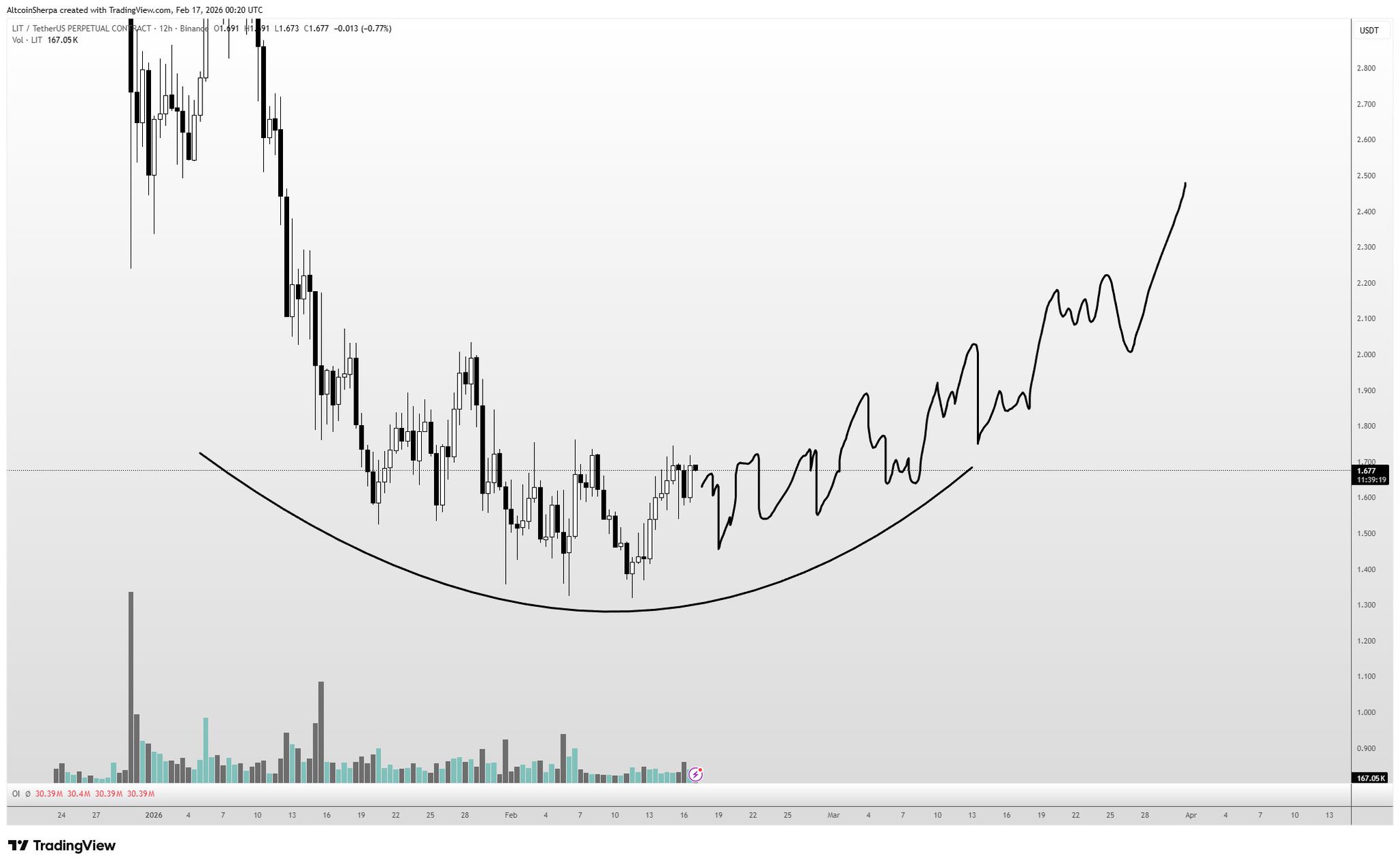

Altcoin Sherpa Trader TA_Analyst C260.82K @AltcoinSherpa$LIT probably the best case scenario for this coin. I don't see much organic demand for Lighter at this time, even if it is cheaper than HL on a relative basis https://t.co/WmHdkabhmZ

60 15 5.62K 閱讀原文 >釋出後LIT走勢中性The author believes LIT lacks organic demand, but the technical chart depicts a potential upward path.

60 15 5.62K 閱讀原文 >釋出後LIT走勢中性The author believes LIT lacks organic demand, but the technical chart depicts a potential upward path. Dead Cat Bounce TA_Analyst Trader B6.01K @DCBcrypto

Dead Cat Bounce TA_Analyst Trader B6.01K @DCBcrypto$LIT trade and the first PA lesson in the group: >> We are looking at today's profile The interesting thing that happened was the deviation below the daily value (circled red) - we got price shortly trading outside of our "daily zone" as I'll call it, and then immediate reclaim back in it. That's now the deviation block with the low of the wick - the dashed line being your invalidation for any long attempt. Now the mindset for finding the entry is the following: The VAL of the day should hold, because there rarely is a second deviation. Broke below -> and you can expect price making new lows. For longs, you need a trigger -And we got just that with the 15min sweep of the VAL and the last attempt at that same area. Entry: VAL Targets: manage the trade through the weekly VWAP - if signs of weakness close early, if not - targeting the weekend highs <<

16 1 843 閱讀原文 >釋出後LIT走勢看漲LIT showed a deviation below the intraday value zone and quickly retraced, creating a bullish entry opportunity with a target at the weekend high.

16 1 843 閱讀原文 >釋出後LIT走勢看漲LIT showed a deviation below the intraday value zone and quickly retraced, creating a bullish entry opportunity with a target at the weekend high. FarmerJoe 🌎☮️ Trader OnChain_Analyst B37.52K @FarmerJoe0x

FarmerJoe 🌎☮️ Trader OnChain_Analyst B37.52K @FarmerJoe0xLighter is onchain Coinbase. Hyperliquid is onchain Binance. Both will win massively in the next cycle.

Sky D3.65K @skytrades8

Sky D3.65K @skytrades8The case for LIT vs HYPE: HL has mechanical buybacks, funneling most fees into HYPE repurchases. Sounds bullish until you realize it's a mindless flywheel with no flexibility. Lighter uses discretionary buybacks. Capital goes where it creates the most value: product, growth, or repurchases when the token is undervalued. On HL, every position is fully visible on-chain. Larger traders with sensitive positioning are sitting ducks. Lighter is built as a zk-rollup. Every trade is cryptographically verified without exposing address positioning. For traders moving real size, this is a big deal. Lighter is headquartered in Miami, founded by an ex-Citadel quant, backed by Founders Fund, Ribbit Capital, Robinhood, and Haun Ventures. Listed on Coinbase, which doesn't touch assets without a thorough regulatory review. HL is an offshore perp exchange with no US entity. Its validators unilaterally delisted $JELLY and force-settled positions at an arbitrary price. Exactly the kind of centralized override that draws regul

5 5 1.07K 閱讀原文 >釋出後LIT走勢看漲LIT, leveraging flexible buybacks and zk‑rollup advantages, is expected to outperform HYPE in the next cycle. 레오.마스터 | MemeMax⚡️ TA_Analyst Influencer C11.76K @ezeroho8245

레오.마스터 | MemeMax⚡️ TA_Analyst Influencer C11.76K @ezeroho8245Recently in Korea Altcoins are back to original Lots of interest

方程式新闻 BWEnews 🏎️ D88.64K @bwenews

方程式新闻 BWEnews 🏎️ D88.64K @bwenewsBithumb Listing: [Market Add] LIT (LIT) KRW market added Bithumb update: [Market Update] Upbit adds LIT/KRW trading pair $LIT MarketCap: $2000M (Auto match could be wrong, automatic matching may be inaccurate)

4 1 770 閱讀原文 >釋出後LIT走勢看漲LIT gains Bithumb and Upbit KRW trading pairs, market attention rises 레오.마스터 | MemeMax⚡️ TA_Analyst Influencer C11.76K @ezeroho8245

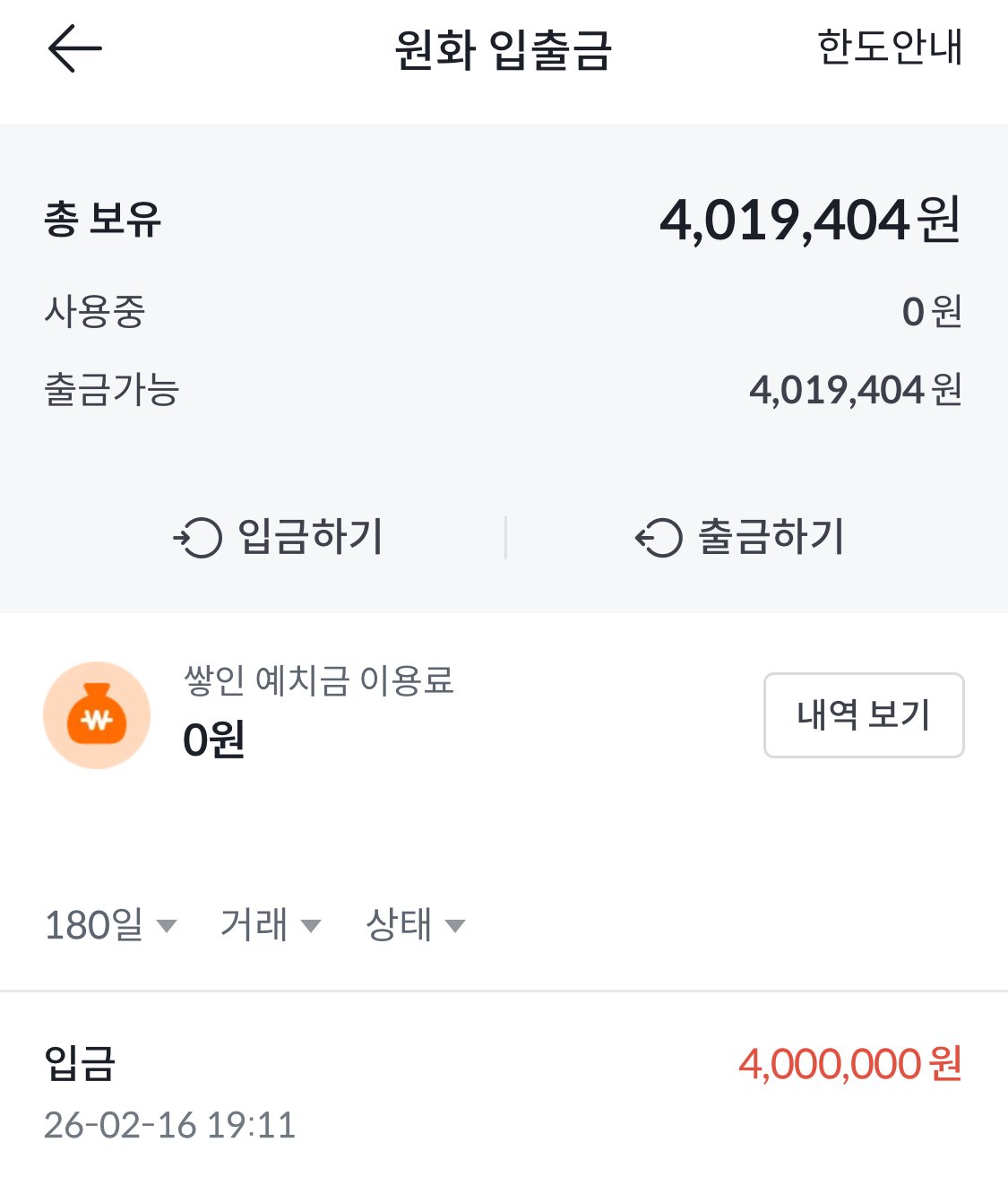

레오.마스터 | MemeMax⚡️ TA_Analyst Influencer C11.76K @ezeroho8245LIT Bithumb lists LIT KRW pair Deposited 4 million KRW Bought worth 2 million KRW was executed Sell completed Earned 19,400 KRW and finished Still, the KRW market listing Feels great . https://t.co/ItJRZ7tIw1

10 5 708 閱讀原文 >釋出後LIT走勢看漲User made a profit of 19,400 KRW by trading after LIT was listed on Bithumb's KRW market.

10 5 708 閱讀原文 >釋出後LIT走勢看漲User made a profit of 19,400 KRW by trading after LIT was listed on Bithumb's KRW market.