Lido DAO Token (LDO)

Lido DAO Token (LDO)

- 65社交熱度指數(SSI)+22.43% (24h)

- #35市場預警排名(MPR)-6

- 124小時社交提及量0% (24h)

- 100%24小時KOL看好比例1位活躍KOL

- 概要LDO up slightly 0.26%, social hype up 22%; watch ETH volatility leading to withdrawals and bear market capital retention capability

- 看漲訊號

- Slight price increase

- Social hype significantly rises

- Top ETH staking protocols

- ETH rise brings new inflows

- Recent performance remains robust

- 看跌訊號

- Large-scale ETH withdrawal history

- Profit taking and capital withdrawal

- Bear market may accelerate exit

- Long queue waiting times

- Uncertain capital retention

社交熱度指數(SSI)

- 總體資料65SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈看漲 (100%)社交熱度洞察LDO social hype high (65.5/100, +22.4%), sentiment positive ↑120% and KOL attention ↑200% driving, although activity drops 12.5% it still supports a slight rise of 0.26%.

市場預警排名(MPR)

- 預警解讀LDO warning rank rises to #35 (↑6), social anomaly score high at 93.3/100 (down 6.7%), KOL attention shift ↑200% markedly, indicating ETH volatility may trigger withdrawal risk.

相關推文

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

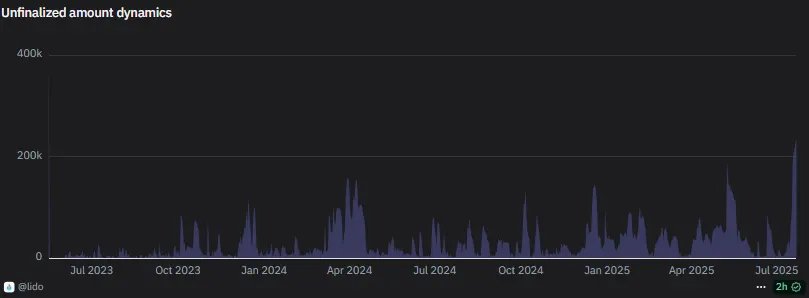

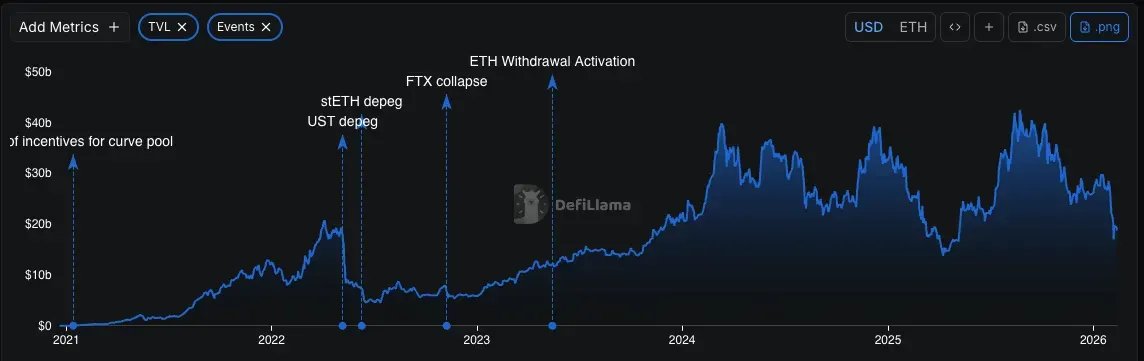

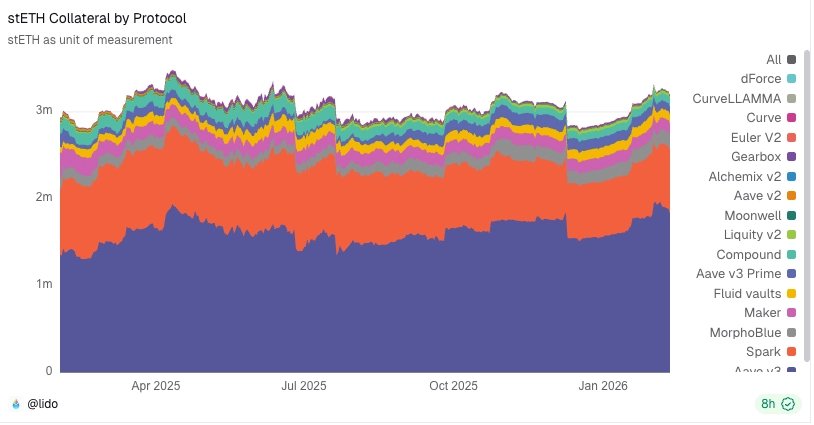

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2GM, lets talk about LiDo today. When ETH crashes, does capital stay in Lido? Bear markets are the real stress test for any protocol. Today I want to talk about @LidoFinance, currently the top 1 liquid staking protocol on @ethereum. For LIDO, the key question is simple: When the market turns bearish, do users rush to withdraw their ETH? And can Lido actually retain capital? ✨ Why do users unstake from Lido? From my research and personal view, there are a few main drivers: 1/ ETH rallies hard → profit taking In July 2025, there was a noticeable spike in the ETH unstaking queue. At one point, around ~228,992 ETH were waiting to be unstaked, with an average wait time of ~71 hours (~3 days), the highest level in nearly two years. When ETH pumps → people take profit. Some unstake to: sell into strength → rotate capital → reposition portfolios. 2/ Bearish outlook → reduce exposure If market participants believe a bear phase is coming: They unstake → Sell ETH → Move into stables → Lower risk. Staking yield becomes less attractive when downside risk dominates. 3/ Capital rotation to other staking platforms with higher yield, incentive 4/ Fear of stETH depeg This is the psychological layer. ✨ The 2022 stETH Depeg Event – Cause: Heavy selling pressure from large funds such as Celsius and Alameda Research, combined with liquidity concerns around withdrawing stETH (at the time it could not be redeemed directly 1:1 for ETH), triggered market panic. – Depeg: stETH fell to a recorded low of 0.9197 ETH, representing roughly an 8% discount to ETH. – Impact: The event caused significant market turbulence, increasing risk for positions using stETH as collateral (such as on Aave) and raising broader concerns about the safety of liquid staking derivatives. – Recovery: It gradually returned close to its 1:1 parity with ETH. ✨ Can stETH depeg again? My view: 1/ Structural depeg like 2022? Much less likely. Today, users can redeem stETH directly 1:1 for ETH via Lido (with ~3 day withdrawal delay). That redemption mechanism creates a hard anchor. 2/ Short-term deviations? Still possible. If: – ETH dumps sharply – stETH is widely used as collateral on Defi like Aave – Large liquidations trigger forced selling Then stETH could temporarily trade below peg. But arbitrage + redeemability pulls it back toward 1:1. ✨ My conclusion In a bear market, we will likely see: – Higher unstake demand – Volatility in stETH pricing – Capital rotation But compared to 2022, Lido’s structure is stronger today. There will always be users who sell ETH. But there will also always be users accumulating. For long-term ETH holders, staking remains one of the cleanest ways to stay exposed while earning yield. And from a protocol perspective, Lido remains one of the few DeFi platforms that: – Generates real revenue – Has clear product-market fit – Is directly integrated into Ethereum’s core mechanics Lido can survive the bear.

120 48 10.85K 閱讀原文 >釋出後LDO走勢看漲Lido's structure has been strengthened, enabling it to withstand bear market shocks, and the risk of stETH depegging is reduced.

120 48 10.85K 閱讀原文 >釋出後LDO走勢看漲Lido's structure has been strengthened, enabling it to withstand bear market shocks, and the risk of stETH depegging is reduced. Emperor Osmo 🐂 🎯 D91.92K @Flowslikeosmo

Emperor Osmo 🐂 🎯 D91.92K @Flowslikeosmo@pym0xe @maplefinance @aave I have. https://t.co/EAwm1zT0cj

Emperor Osmo 🐂 🎯 D91.92K @Flowslikeosmo

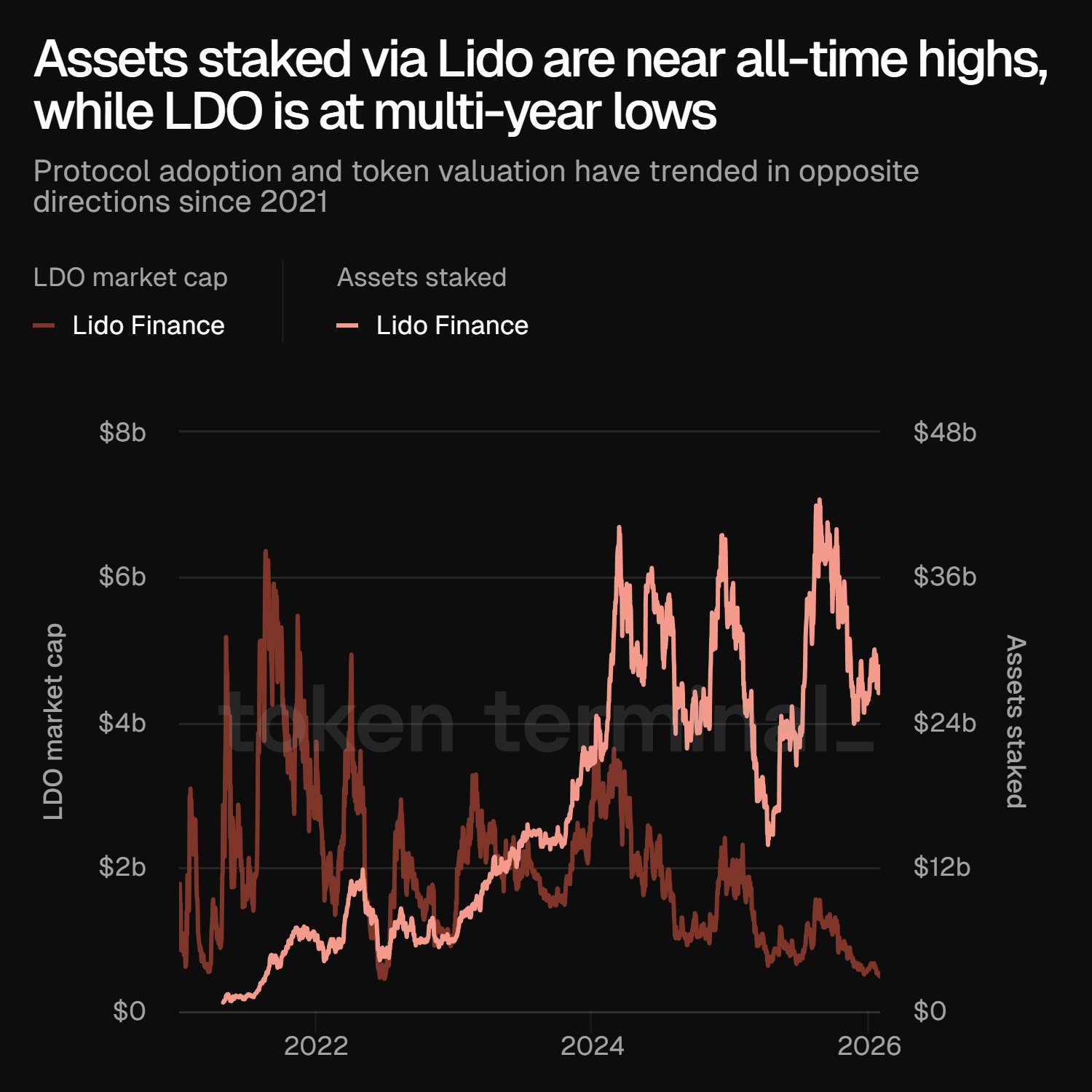

Emperor Osmo 🐂 🎯 D91.92K @FlowslikeosmoLido is the perfect story of a sound business with poor tokenomics. Staked assets remain near ATHs, while $LDO is down -97% from its ATH. - Cost of revenue stands at 90% - Meanwhile, incentives have not increased earnings over the past year. $LDO used to be thought of as an $ETH beta, if only they would drive some of that revenue back to token holders. Data: @tokenterminal

1 1 6 閱讀原文 >釋出後LDO走勢看跌LDO's poor tokenomics cause a price crash, diverging from high staking volumes.

1 1 6 閱讀原文 >釋出後LDO走勢看跌LDO's poor tokenomics cause a price crash, diverging from high staking volumes. MAD Vincent 🎒 Trader Quant B32.65K @MadVincent666

MAD Vincent 🎒 Trader Quant B32.65K @MadVincent666 Dun🎒 D1.60K @js_dun

Dun🎒 D1.60K @js_dunHappy @backpack points day This week turned out a bit more productive than the last one. The conversion was solid (around 3 points per $1k in volume). I traded only LDO. Trying to hold platinum while avoiding heavy expenses Officially, there are two weeks left, so we need to speed up and finish this as strong as possible. If you want to join, you still have time. Don’t buy accounts - just earn points yourself. Current competition level actually makes it possible without too much effort. Just trade smart WAO

58 22 1.56K 閱讀原文 >釋出後LDO走勢看漲Backpack points are progressing well, have reached platinum, encouraging trading LDO to earn points.

58 22 1.56K 閱讀原文 >釋出後LDO走勢看漲Backpack points are progressing well, have reached platinum, encouraging trading LDO to earn points. Laura Shin Media Influencer C281.41K @laurashin

Laura Shin Media Influencer C281.41K @laurashin Seraphim D55.16K @MacroMate8

Seraphim D55.16K @MacroMate8i have recently been getting a few offers from fintech, trading and defi projects and realised i wanna get back into the growth game what i am looking for: - full agency - trading related, esp rwa markets - idgaf about pay. i want glory and credit for making the token pump my cv: - brought in 1b+ tvl across various projects like ethena lido euler - worked with most major traders vcs whales kols - ex goldman fx trader - i know everyone

352 65 49.09K 閱讀原文 >釋出後LDO走勢看漲The author is seeking a full‑agency trading role to drive token price up and enhance reputation. 0x思远 FA_Analyst OnChain_Analyst B132.86K @nftsiy

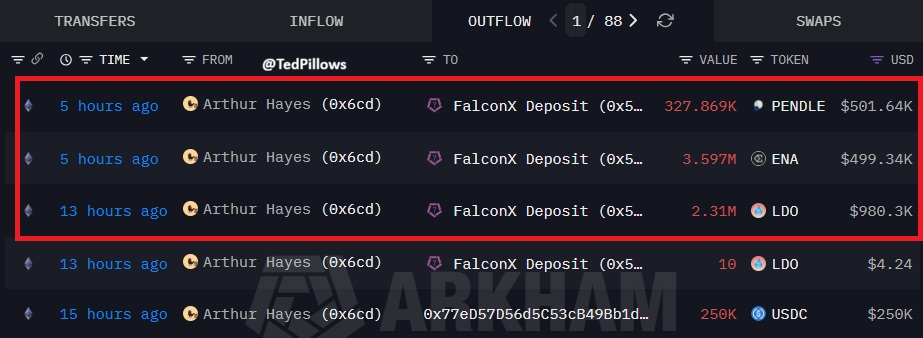

0x思远 FA_Analyst OnChain_Analyst B132.86K @nftsiyIt seems the exchange owner's crypto trading skill is not much different from retail traders; As of February 2026, BitMEX co‑founder Arthur Hayes has disclosed that public on‑chain trades have accumulated losses exceeding $10.37 million (excluding undisclosed positions). Details are as follows: February 2026: liquidated 4 tokens such as LDO, ENA, etc., with a total investment of about $9.35 million, resulting in a loss of approximately $3.48 million; January 2026: bet on BIO, investing $1.10 million, losing $0.64 million, a drop of up to 58%; December 2023: traded LOOKS, ENS, FXS, with cumulative investment over $10.29 million, losses exceeding $6.25 million, each individual asset's drawdown over 50%. Overall, the on‑chain investment drawdown is quite evident.

58 35 16.00K 閱讀原文 >釋出後LDO走勢看跌Severe losses across multiple cryptocurrencies, drawdown exceeding 50%, recommendation: stay on the sidelines. 吴说区块链 Media Researcher D171.57K @wublockchain12

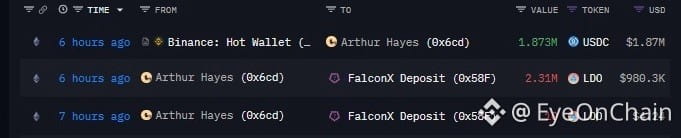

吴说区块链 Media Researcher D171.57K @wublockchain12Wu said he learned, according to monitoring by @EmberCN, that BitMEX co‑founder Arthur Hayes today liquidated the four DeFi tokens he bought in December last year for US$9.35 million, resulting in a total loss of about US$3.48 million. The specific trades were: sold LDO at $0.42 (a loss of US$310,000), sold ENA at $0.13 (a loss of US$1.54 million), sold PENDLE at $1.34 (a loss of US$990,000), and sold ETHFI at $0.47 (a loss of US$630,000). https://t.co/0OOYKI4kla

4 0 5.35K 閱讀原文 >釋出後LDO走勢看跌Arthur Hayes liquidated four DeFi tokens, incurring a loss of about US$3.48 million onchainschool.pro OnChain_Analyst Educator A6.03K @how2onchain

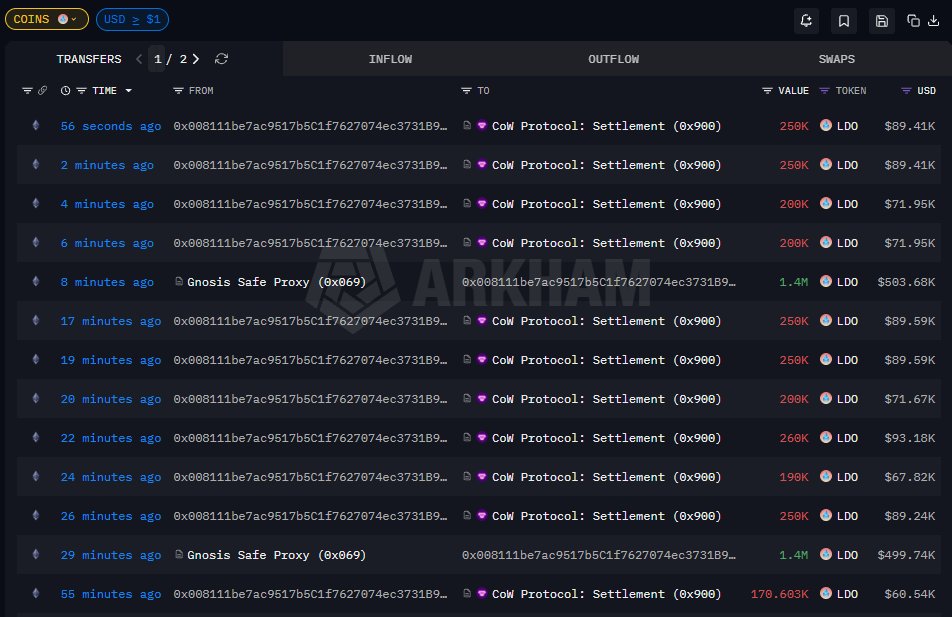

onchainschool.pro OnChain_Analyst Educator A6.03K @how2onchain$LDO SELLING FROM VESTING TOKENS Over the last 30 minutes, $LDO worth ~$1M were transferred to a fresh wallet, which has been actively selling ever since These tokens were received from a vesting wallet two months ago Wallets: 0x069D7567EA4ac2117Ec4656Bcf97b31164248F34 0x008111be7ac9517b5C1f7627074ec3731B926F54

5 1 1.20K 閱讀原文 >釋出後LDO走勢看跌LDO locked tokens were moved to a new wallet and are being sold continuously, creating selling pressure.

5 1 1.20K 閱讀原文 >釋出後LDO走勢看跌LDO locked tokens were moved to a new wallet and are being sold continuously, creating selling pressure. Paolo Diomede OnChain_Analyst Founder B4.92K @pdiomede

Paolo Diomede OnChain_Analyst Founder B4.92K @pdiomedeWhen it comes to security, you have to be paranoid and committed to excellence 🏆 That’s why @LidoFinance trusts @Certora 🛡️ Don’t miss our own @tomer_ganor at ETHDenver 2026, sharing the journey to secure Lido: 👇

Tomer Ganor D393 @tomer_ganor

Tomer Ganor D393 @tomer_ganorSecurity isn’t a feature, it's a commitment. And for the @LidoFinance it's the first priority 🛡️💧 At #ETHDenver2026 I will share the security driven design of Lido V3. Beyond just catching bugs, we’ve been obsessed with outsmarting the most complex edge cases in DeFi to build real resilience. If you want to see how to build robust secure protocols like Lido V3, come catch my talk. 🚀 See you there! #ETHDenver #Lido #Ethereum #Web3Security

4 0 184 閱讀原文 >釋出後LDO走勢看漲Lido V3's secure design enhances the Ethereum ecosystem and is worth watching. CryptGuardian FA_Analyst Tokenomics_Expert B2.50K @GuardianRWATed Influencer Trader A265.77K @TedPillows

CryptGuardian FA_Analyst Tokenomics_Expert B2.50K @GuardianRWATed Influencer Trader A265.77K @TedPillowsArthur Hayes is selling his bags again. Today, he sold: ▫️ $980,300 in $LDO ▫️ $499,340 in $ENA ▫️ $501,640 in $PENDLE Buy high, sell low. https://t.co/0wfBHfPzeE

428 134 32.32K 閱讀原文 >釋出後LDO走勢看跌Arthur Hayes dumped LDO, ENA, and PENDLE, signaling a bearish outlook.

428 134 32.32K 閱讀原文 >釋出後LDO走勢看跌Arthur Hayes dumped LDO, ENA, and PENDLE, signaling a bearish outlook. EyeOnChain OnChain_Analyst Trader C5.51K @EyeOnChain

EyeOnChain OnChain_Analyst Trader C5.51K @EyeOnChainTHIS time with $LDO , Arthur Hayes Made a Few Moves .. and They Didn’t Go Unnoticed! Six hours ago, #ArthurHayes back into the flow, First, 2.31 million #ldo just under $1M moved over to FalconX. Then, 1.873M USDC came out of Binance. WE THINK: when someone like him starts rearranging capital, even slowly, it tends to mean something’s loading. Add: https://t.co/VWLMtnjGMX

3 0 720 閱讀原文 >釋出後LDO走勢看漲Arthur Hayes is moving PENDLE, ENA, and LDO to exchanges, indicating potential selling pressure.

3 0 720 閱讀原文 >釋出後LDO走勢看漲Arthur Hayes is moving PENDLE, ENA, and LDO to exchanges, indicating potential selling pressure.

- 暫無資料