IO.NET (IO)

IO.NET (IO)

- 69社交熱度指數(SSI)- (24h)

- #28市場預警排名(MPR)0

- 124小時社交提及量- (24h)

- 100%24小時KOL看好比例1位活躍KOL

- 概要IO launched a Christmas mascot creative contest and gave away 2000 $IO, social heat remained stable, price slipped slightly by 0.46%.

- 看漲訊號

- Creative contest activates the community

- Giving away 2000 $IO rewards

- KOL encourages participation

- 看跌訊號

- Slight price decline

- Low engagement, only 12

- No increase in social heat

社交熱度指數(SSI)

- 總體資料69SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈看漲 (100%)社交熱度洞察IO social heat index is moderate (68.5/100, stable) due to the Christmas mascot creative contest activating the community, sentiment is positive (27.5/30) and improving but activity is saturated, KOL attention remains low (1/30).

市場預警排名(MPR)

- 預警解讀IO warning ranking #28, social anomaly score reaches the maximum 100/100, sentiment polarization at 50/100 (mid), linked to the stable post-Christmas contest hype and slight price drop; the anomaly mainly stems from the social anomaly metric.

相關推文

AlexHUP ❤️ 🇻🇳 Dev OnChain_Analyst B2.11K @Alex394959

AlexHUP ❤️ 🇻🇳 Dev OnChain_Analyst B2.11K @Alex3949592000 $IO up for grabs for reimagining @ionet’s mascot with a Christmas twist. Creative contests like this aren’t just funthey deepen the culture of a community. Let’s see if the art can match the ambition of the tech

Nazo D7.10K @0xnazo_

Nazo D7.10K @0xnazo_🎄@ionet End of the Year Creator Contest . 🎁 2000 $IO Reward Pool. Creators are invited to re-imagine the official @ionet mascot with a Christmas theme and turn festive vibes into art. 1- Use any https://t.co/sTOSLtn12J discord sticker, 2- Share what https://t.co/sTOSLtn12J means to you 3- Add a greeting card saying: Happy New Year to @ionet the Community. Post on X & tag @ionet.

10 5 103 閱讀原文 >釋出後IO走勢看漲IO.net举办圣诞主题创意大赛,奖励2000 $IO,鼓励社区参与。

10 5 103 閱讀原文 >釋出後IO走勢看漲IO.net举办圣诞主题创意大赛,奖励2000 $IO,鼓励社区参与。 EMK TA_Analyst Trader B5.50K @emkfinans

EMK TA_Analyst Trader B5.50K @emkfinans#USDT.D wants us to go with two-way orders, and we continue to play the game according to the rules. #IO, #PYTH short orders gave nice profits, and in the reversals, going long will also provide good returns, profit fits the pocket https://t.co/LMuIIEUDno

22 2 772 閱讀原文 >釋出後IO走勢看漲The author successfully shorted PYTH and IO for profit and plans to go long on reversal.

22 2 772 閱讀原文 >釋出後IO走勢看漲The author successfully shorted PYTH and IO for profit and plans to go long on reversal. Bitcoin Meraklısı TA_Analyst Educator A100.09K @Bitcoinmeraklsi

Bitcoin Meraklısı TA_Analyst Educator A100.09K @Bitcoinmeraklsi#IO Testing the long‑standing downtrend. It has risen sharply now and a reaction sell‑off may occur from this trend. At the same time, a possible trend breakout will aim for the upper levels I indicated on the chart. Keep it under close watch. https://t.co/P5bA5yEHhn

192 13 16.86K 閱讀原文 >釋出後IO走勢看漲IO tests the long‑term downtrend line; a breakout could rise to 0.192/0.243.

192 13 16.86K 閱讀原文 >釋出後IO走勢看漲IO tests the long‑term downtrend line; a breakout could rise to 0.192/0.243. Altcoins France 🇫🇷 Media Influencer A23.26K @AltcoinsFrance

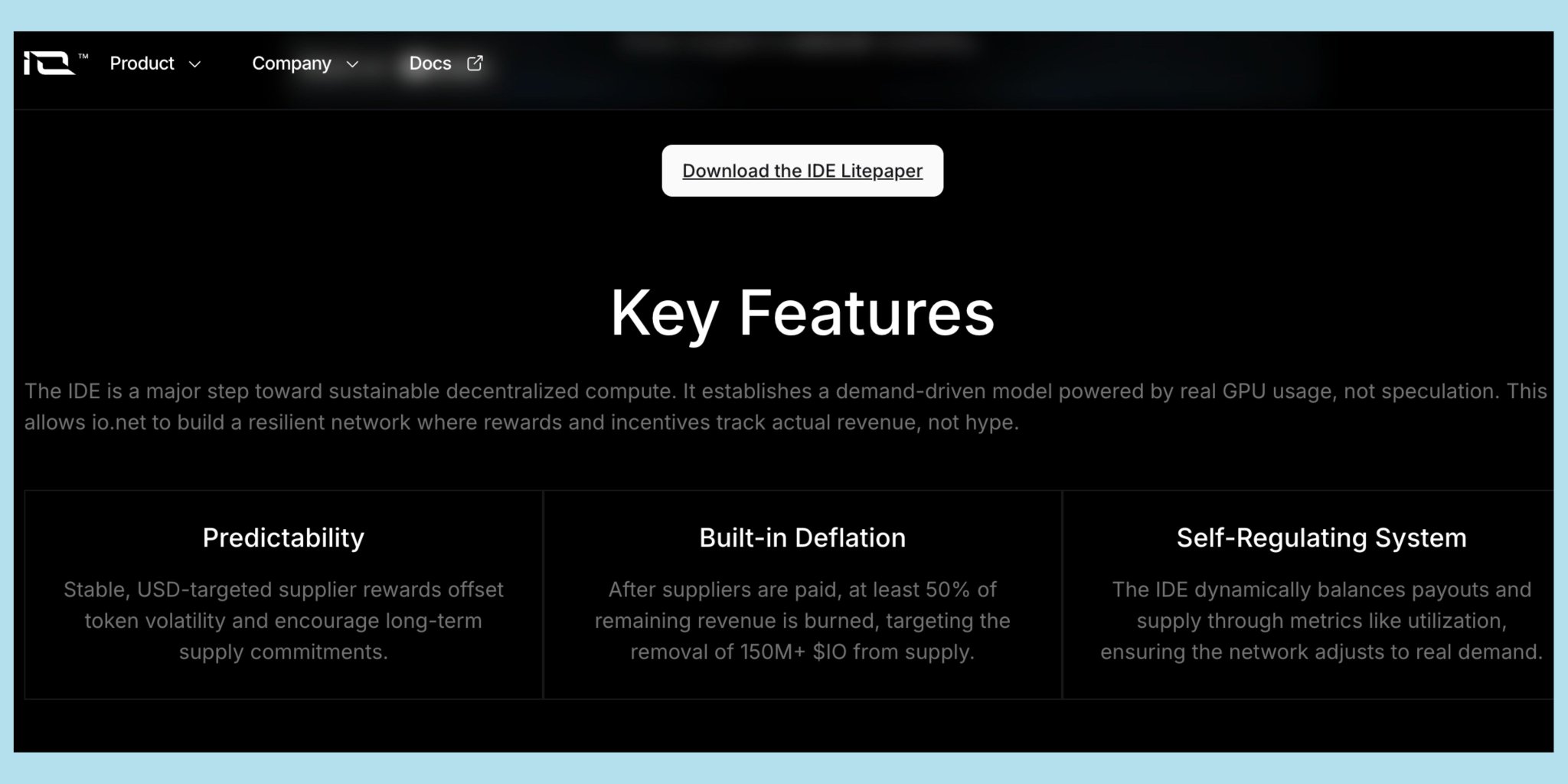

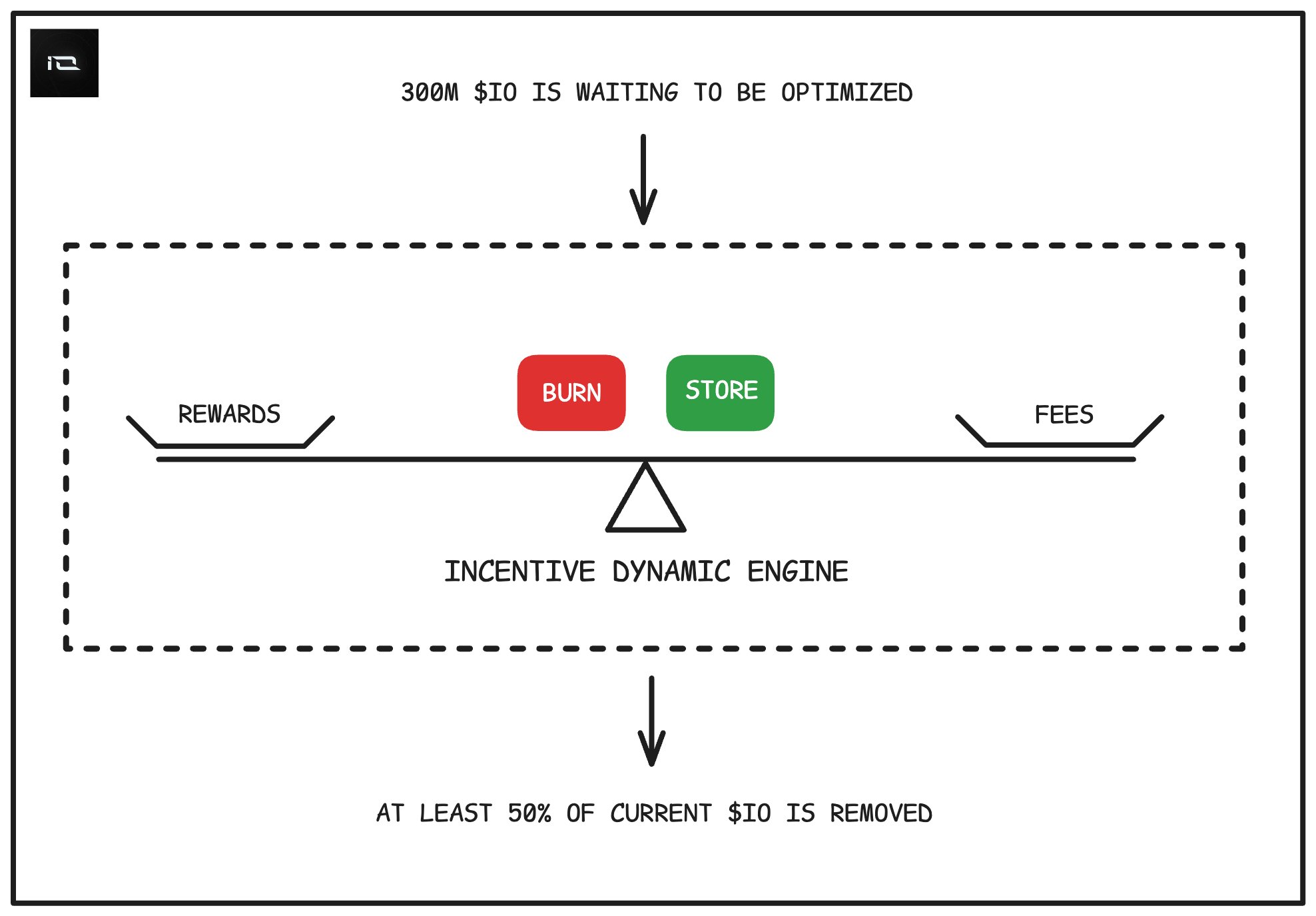

Altcoins France 🇫🇷 Media Influencer A23.26K @AltcoinsFrance♟️ IONET unveiled a new tokenomics model $IO announced a new economic model based on an Incentive Dynamic Engine (IDE). How it works: 👉 the token supply adjusts according to the network’s actual activity 👉 if revenue exceeds payments, tokens are burned 👉 if revenue is insufficient, the supply can increase temporarily Other key points: • at least 50% of net revenue is burned • payments to suppliers are denominated in USD • goal: align revenue, usage, and token issuance

io.net D453.07K @ionet

io.net D453.07K @ionetIntroducing the Incentive Dynamic Engine (IDE), a demand driven tokenomics model for DePIN. Real fees → real burns. USD pegged supplier rewards. Dynamic, usage based supply. Deflation > dilution. Litepaper: https://t.co/RYkTY1LLyC

23 4 5.12K 閱讀原文 >釋出後IO走勢看漲IO uses a dynamic token model, burning tokens when revenue exceeds payments, enhancing deflation. Taken🎒 Educator Tokenomics_Expert B11.57K @T_A_K_E_N_1

Taken🎒 Educator Tokenomics_Expert B11.57K @T_A_K_E_N_1Funny how one update can change how you see a whole project @ionet just rolled out the Incentive Dynamic Engine (IDE) Tokenomics that finally move with real usage Real AI workloads → real revenue → real burns GPU suppliers stay stable, even when the market isn’t Paired with io.intelligence, it actually feels built for the long run Check the IDE litepaper or IO Explorer if you want to see the numbers yourself. Everything’s transparent Thoughts, Is this the new DePIN standard?

Taken🎒 Educator Tokenomics_Expert B11.57K @T_A_K_E_N_1

Taken🎒 Educator Tokenomics_Expert B11.57K @T_A_K_E_N_1You could check it out here: https://t.co/5MWrR21HFm

98 86 1.81K 閱讀原文 >釋出後IO走勢極度看漲io.net has launched the IDE engine, enhancing the IO token's value through a deflationary mechanism and real use cases, and it is poised to become the new DePIN standard. Bukky (Builder Arc) Community_Lead Influencer B7.23K @XBukkyExplorer

Bukky (Builder Arc) Community_Lead Influencer B7.23K @XBukkyExplorerIf you are a big fan of DePIN , this is for you 👇 @ionet just powered the first demand-driven token engine in DePIN To those who don't understand what this means : Ionet is an intelligent stack for powering AI workload and this would be used to launch the incentive dynamic engine (IDE) This simply means that token behaviors (New tokenomics meta for DePIN) would be different this time And there would be more GPU suppliers getting USD-pegged payouts Ionet has a strong partnership with @WalrusProtocol , @nillion , Injective and more Happy to have joined the team to bring awareness about the IDE tool For more information read IDE litepaper using the link below 👇

Bukky (Builder Arc) Community_Lead Influencer B7.23K @XBukkyExplorer

Bukky (Builder Arc) Community_Lead Influencer B7.23K @XBukkyExplorerIonet IDE litepaper : https://t.co/3LXklxU0Uj

56 49 1.80K 閱讀原文 >釋出後IO走勢極度看漲Ionet launches a demand-driven token engine, empowering DePIN and AI. Tory | io.net 🦾 Founder Tokenomics_Expert B80.13K @MTorygreen

Tory | io.net 🦾 Founder Tokenomics_Expert B80.13K @MTorygreenToday we’re turning a page in @ionet’s story. We’re moving from tokenomics that helped us bootstrap to a demand-driven, self-regulating economy we call the Incentive Dynamic Engine (IDE). This shift is about building a network that can last decades, not just quarters. - What We Had to Outgrow - Our first token model did its job: it helped us bootstrap supply. But it also carried the classic tradeoff - fixed emissions mean persistent inflation and weak coupling to real usage. When incentives are too detached from demand, you get fragility. Most importantly, supplier income was exposed to token volatility. In a downturn, this could trigger a negative feedback loop: Price falls → supplier ROI falls → suppliers leave → network utility weakens. We cannot have a compute network that’s only healthy when markets are euphoric. So we rebuilt the incentive layer from the ground up. - What's the IDE? - Think of the IDE as a real-time economic controller for decentralized compute. Instead of “emit tokens and hope demand catches up,” the IDE uses actual GPU utilization and real revenue to shape rewards, supply dynamics, and long-term token supply. We’re shifting from an inflationary, supply-driven model to a demand-driven system that stabilizes supplier payouts and ties $IO value to real network activity. - Under the Hood: IDE Fundamentals - - Two Vaults - We introduced two new "buffers" between fluctuating demand/revenue and stable supplier payouts: ◼ Reward Vault — holds $IO emissions. ◼ Fee Vault — holds fees from real users who consume compute. When paying suppliers, the system draws from these vaults in this order: ◼ Reward Vault – first, payouts are funded with $IO emissions. ◼ Fee Vault – next, the system uses fees collected from compute users. ◼ If the combined flow can’t sustainably support target payouts, the IDE adjusts parameters (like hardware pricing or target ROI) to protect the long-term health of the network. These vaults act as shock absorbers: they smooth out fluctuations in token price, demand, and payment cycles so suppliers can rely on stable, USD-denominated earnings even when conditions are unpredictable. - Why Supplier Earnings Are Now Predictable - Suppliers will earn in stable USD terms, but receive those payout amounts denominated in $IO tokens. This protects the people providing real infrastructure from short-term swings, which is critical if you want professional-grade, long-term compute supply. - The Health Metric to Watch - We’re introducing a simple transparency anchor: ψ = Revenue (R) / Payout obligations (H) ψ > 1 → surplus → burns/deflation ψ = 1 → stable equilibrium ψ < 1 → temporary expansion/buffering to protect suppliers This is the clearest mathematical signal that @ionet’s economy is now being driven by actual utility. - What This Upgrade Enables for Everyone - ◼ For Suppliers You get predictable earnings tied to real economic activity, not pure token volatility. We believe this attracts long-term, professional infrastructure partners - not short-term opportunists. ◼ For Users You get a network that stays online across market cycles - a key requirement for startups, scale-ups, and enterprises who need stability. ◼ For Token Holders The IDE introduces a deflationary orientation: part of net revenue is designed to be burned, enabling a meaningful long-term supply reduction. - What This Means for the Entire Sector - DePIN needs higher standards to move from infancy to maturation. Most networks in this space still rely on the same early-stage logic: heavy emissions and light demand coupling. The IDE is our attempt to prove that decentralized networks can be stable, resilient, and utility-first - not just exciting during bull markets. - Governance, Reality, and Risk - This is not designed as a "set-and-forget" system. Governance will monitor: > the sustainability ratio > reserve runway > vault balances > and total burns Risks include moral hazard, reserve drift, and reflexive dynamics - but these are mitigated through: > circuit breakers > diversified reserves > dynamic parameter adjustment We used emissions to bootstrap the network. Now we’re building an economy that self-regulates around real usage, protects suppliers, and offers predictability for users, developers, and enterprises. If decentralized compute is going to be a real backbone for AI, it can’t be powered by market sentiment and hope. It has to be powered by usage, resilience, and a model that works in every market environment. That’s what the IDE is for.

57 12 5.50K 閱讀原文 >釋出後IO走勢看漲IO launches demand-driven incentive engine, supplier revenue more stable Taken🎒 Educator Tokenomics_Expert B11.57K @T_A_K_E_N_1

Taken🎒 Educator Tokenomics_Expert B11.57K @T_A_K_E_N_1 Taken🎒 Educator Tokenomics_Expert B11.57K @T_A_K_E_N_1

Taken🎒 Educator Tokenomics_Expert B11.57K @T_A_K_E_N_1DePIN has been one of the standout out narrative tech here in web3 But most of the projects launch a token first, and then pray the economics survive reality @ionet is doing it differently; they're literally engineering sustainability into the system While digging through their new Incentive Dynamic Engine (IDE) It felt like watching a network learn how to balance itself in real time It's quite simple When GPU demand goes up, revenue covers payouts, and the system burns or stores the tokens When demand cools, the IDE steps in with temporary emissions to keep suppliers paid in stables USD terms No hype cycles and death spirals Just a network that adjusts to real usage automatically It honestly feels like the first time a DePIN model is behaving like an actual business instead of a speculative loop And when you combine that with what io.intelligence Real AI teams actually using decentralized GPUs, the whole picture becomes clearer This is demand-driven, self-regulating tokenomics built

146 136 13.61K 閱讀原文 >釋出後IO走勢極度看漲io.net's DePIN model is highly regarded for its sustainable and demand-driven token economics.

146 136 13.61K 閱讀原文 >釋出後IO走勢極度看漲io.net's DePIN model is highly regarded for its sustainable and demand-driven token economics. Unique singh Influencer Educator B15.98K @uniquesingh__

Unique singh Influencer Educator B15.98K @uniquesingh__Most Depin projects fall apart once their token price goes down @ionet fixed a big problem in crypto When customers pay for GPU → $IO tokens get destroyed (less supply = better for holders) GPU owners get paid in stable dollars (no worrying about token prices jumping around) Half of all profits go to burning tokens (permanently removing them) Only creates new tokens when absolutely needed (no endless printing) Why this matters: Most crypto projects print tokens non‑stop until they collapse. ionet built theirs to survive, even in crashes. The proof: $21.3M+ earned (you can check it on-chain) 3,000+ GPUs ready to work across 130+ countries Real partners: Walrus, Nillion, Injective

143 127 1.77K 閱讀原文 >釋出後IO走勢極度看漲io.net deflationary token model uses burning and dollar rewards, aiming for long‑term survival and has achieved significant milestones.

143 127 1.77K 閱讀原文 >釋出後IO走勢極度看漲io.net deflationary token model uses burning and dollar rewards, aiming for long‑term survival and has achieved significant milestones. andrew.moh FA_Analyst Educator B53.38K @andrewmoh

andrew.moh FA_Analyst Educator B53.38K @andrewmohIt's no argument that DePIN is positioned at the 1st place by reward-optimized route to users. However, regular tokenomics models are still not able to handle this. @ionet fixes this with Incentive Dynamic Engine (IDE). tl;dr: + IDE splits up the vault into 2 pieces: reward and fee + a ratio mechanism of burn and store is used to keep these vaults balanced ➜ The result lies in how $IO supply is optimized and ties IO token value directly to real usage. For instance, IDE helps route the computing cost directly to the hardware providers. IDE suits not only IOnet; it's built for sustainable DePIN models.

io.net D453.07K @ionet

io.net D453.07K @ionetIntroducing the Incentive Dynamic Engine (IDE), a demand driven tokenomics model for DePIN. Real fees → real burns. USD pegged supplier rewards. Dynamic, usage based supply. Deflation > dilution. Litepaper: https://t.co/RYkTY1LLyC

73 40 7.07K 閱讀原文 >釋出後IO走勢極度看漲IOnet launches the IDE model, optimizing IO token supply through a burn mechanism, achieving deflation and enhancing token value.