%20(1)-20221011143940.png) GMX (GMX)

GMX (GMX)

- 71社交熱度指數(SSI)- (24h)

- #8市場預警排名(MPR)0

- 124小時社交提及量- (24h)

- 100%24小時KOL看好比例1位活躍KOL

- 概要GMX announced a partnership with GMX_IO, entering MegaETH ultra-low latency perpetual and launching a USDM incentive Vault, with price modestly rising 1.4%.

- 看漲訊號

- Partnership with GMX_IO

- Expansion to MegaETH

- Ultra-low latency perpetual

- USDM GLV incentive pool

- Price up today

- 看跌訊號

- Price increase only 1.4%

- Social sentiment unchanged

- Project implementation risk

- Competitor on CEX

- Liquidity still limited

社交熱度指數(SSI)

- 總體資料71SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (100%)社交熱度洞察GMX has high social heat (71/100) and full activity score 40/40, positive sentiment 30/30. Driven by partnership with GMX_IO, MegaETH ultra-low latency perpetual and USDM incentive Vault launch, KOL attention remains low (1/30).

市場預警排名(MPR)

- 預警解讀GMX warning rank is 8, social anomaly 100/100 and sentiment polarization 100/100 are the highest, mainly due to the partnership announcement causing abnormal volatility, KOL attention shift still low (1/100).

相關推文

Limbo TA_Analyst Trader B143.35K @cryptolimbo

Limbo TA_Analyst Trader B143.35K @cryptolimboTeamed up with @GMX_IO to cover their upcoming deployment on MegaETH. They’re engineering this for serious speed, and the specs for low latency perps look incredibly promising. When the gates open, my immediate play is going to be those incentivized USDM-based GLV vaults. Good yield on stables is hard to ignore right now, definitely keeping a close eye on this one.

41 24 3.15K 閱讀原文 >釋出後GMX走勢看漲GMX partners with MegaETH to launch high-speed perpetual contracts and high-yield USDM stablecoin vaults; the author is bullish and plans to participate.

41 24 3.15K 閱讀原文 >釋出後GMX走勢看漲GMX partners with MegaETH to launch high-speed perpetual contracts and high-yield USDM stablecoin vaults; the author is bullish and plans to participate. Niels TA_Analyst Trader B63.90K @Web3Niels

Niels TA_Analyst Trader B63.90K @Web3NielsI’ve partnered up with @GMX_IO to share what they’re building next in on‑chain perp trading. Here’s what’s worth paying attention to: • They’re expanding to MegaETH, bringing their perp infrastructure into a high‑performance environment. • Ultra‑low latency perps, designed to bring on‑chain trading closer to CEX speed with faster execution and smoother UX. • Incentivised USDM‑based GLV vaults, giving liquidity providers structured exposure and fee generation through a capital‑efficient setup. Looking forward to seeing this go fully live.

101 37 1.52K 閱讀原文 >釋出後GMX走勢極度看漲GMX upgrades on‑chain perpetual contract trading, expands to MegaETH, and offers low‑latency trading and incentivised vaults.

101 37 1.52K 閱讀原文 >釋出後GMX走勢極度看漲GMX upgrades on‑chain perpetual contract trading, expands to MegaETH, and offers low‑latency trading and incentivised vaults. Paguinfo DeFi_Expert Tokenomics_Expert B3.20K @NewPaguinfo

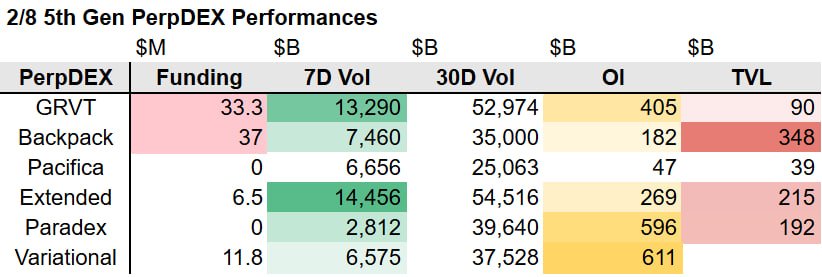

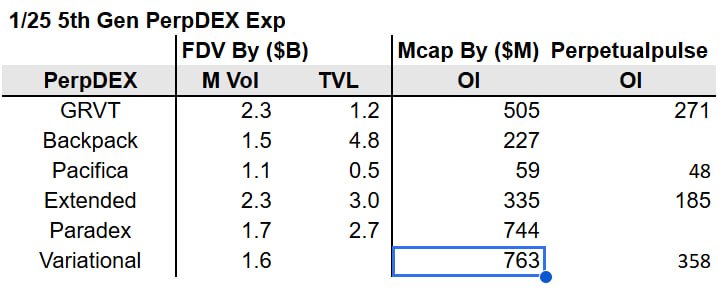

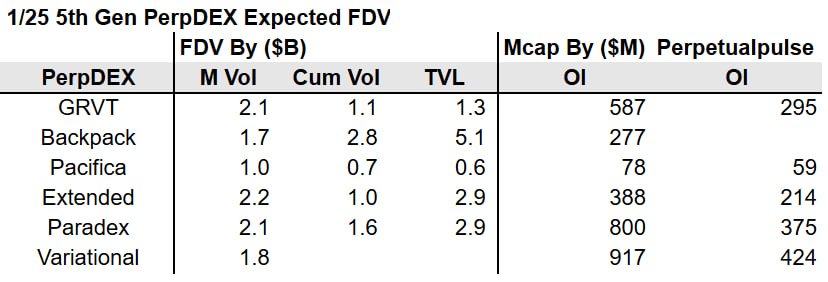

Paguinfo DeFi_Expert Tokenomics_Expert B3.20K @NewPaguinfo5th‑generation PerpDEX – Metrics and projected FDV (2/8) ✅ PerpDEX lineage 1st generation – GMX, dXdY and other early PerpDEXes 2nd generation – Vertex, Aark, LogX, BlueFin, etc., which opened the era of large‑scale public‑deck farming (most of them bombed out) 3rd generation – Hyperliquid (niche) 4th generation – Lighter, edgeX 5th generation – GRVT, Backpack, Pacifica, Extended, Paradex, Variational When challenged, you’re right. ✅ Metric comparison (Performances) - Funding: GRVT/Backpack sit at roughly $30 B, which I think helps to prevent the lower‑bound downside. - 7‑day volume (7D Vol): Extended $14.5 B / GRVT $13.3 B fighting for the top‑two spots. The rest have all fallen below $1 B weekly volume. - 30‑day volume (30D Vol): Extended has exceeded $50 B for two weeks straight, and GRVT also logged $53 B. The others are around the $30 B level. - Open Interest (OI): Overall OI is declining, yet Variational remains #1 with $611 M. Paradex is $596 M and GRVT $405 M, occupying second and third. - Total Value Locked (TVL): Backpack stays #1 at $348 M because spot markets are already active. ✅ Expected FDV / Market Cap The FDV estimate is a simple average of Hyperliquid / Lighter, etc. Cumulative Volume has lost significance and is removed. [FDV] - Monthly Volume (M Vol): Volumes have slipped slightly week over week. Still, compared with the average of prior TGE projects, GRVT/Extended FDV is about $2.3 B – thank you very much ㅜ. - TVL: Backpack is expected to hit $4.8 B, ranking first. [Market Cap] - Simple OI comparison: Variational still leads with an estimated market cap of $763 M, down from $917 M last week. - OI (Perpetualpulse): Even though OI fell, Variational stays #1 at $358 M. GRVT is about $271 M, a slight dip. ✅ Market shift Again, the market is weak. PerpDEX has become mainstream and competition has intensified, making it hard to apply old valuations directly. It makes sense to set a range based on relative metrics and market conditions before responding. Nevertheless, estimating market cap from OI still carries some credibility. It was based on Lighter, but even though LIT’s OI dropped more than 30%, its market cap didn’t plunge, which is worth noting. Also, looking at recent performance, I’m actually curious to see what revenue edgeX will deliver.

Paguinfo DeFi_Expert Tokenomics_Expert B3.20K @NewPaguinfo

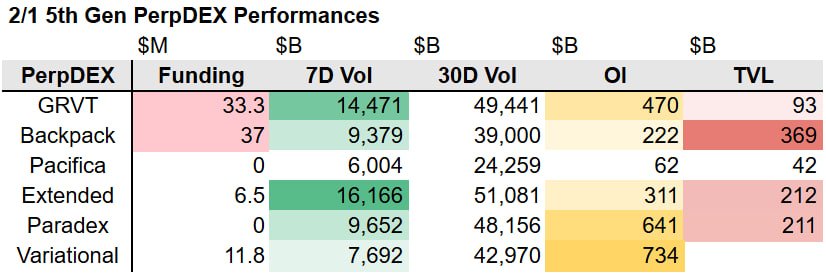

Paguinfo DeFi_Expert Tokenomics_Expert B3.20K @NewPaguinfo5th‑generation PerpDEX – Metrics and projected FDV (2/1) ✅ PerpDEX lineage 1st generation – GMX, dXdY and other early PerpDEXes 2nd generation – Vertex, Aark, LogX, BlueFin, etc., which opened the era of large‑scale public‑deck farming (most of them bombed out) 3rd generation – Hyperliquid (niche) 4th generation – Lighter, edgeX 5th generation – GRVT, Backpack, Pacifica, Extended, Paradex, Variational When challenged, you’re right. ✅ Metric comparison (Performances) - Funding: GRVT/Backpack sit at roughly $30 B, which I think helps to prevent the lower‑bound downside. - 7‑day volume (7D Vol): GRVT and Extended set new ATHs, recording $14 B and $16 B respectively. The rest have dropped below $10 B. - 30‑day volume (30D Vol): Over a month, Extended alone topped $50 B, with GRVT at $49 B and Paradex at $48 B trailing. - OI: Variational’s OI plunged but still leads the 5th generation at $734 M. Paradex is $641 M, followed by GRVT at $470 M. - TVL: Backpack remains #1 at $369 M because spot markets are already active. ✅ Expected FDV / Market Cap FDV estimate is a simple average of Hyperliquid / Lighter. [FDV] - Monthly Volume (M Vol): Based on increased volumes, GRVT/Extended/Paradex each have FDV over $2 B. Pacifica is projected around $1 B. - TVL: Backpack is expected at $5.1 B, ranking first. [Market Cap] - Simple OI comparison: Variational still leads with an estimated market cap of $917 M. - OI (Perpetualpulse): Even though OI fell, Variational stays #1 at $424 M.

4 3 862 閱讀原文 >釋出後GMX走勢中性The tweet provides a detailed analysis of the fifth‑generation PerpDEX platform's various metrics and FDV/Mcap forecasts, but adopts a cautious stance on market valuation.

4 3 862 閱讀原文 >釋出後GMX走勢中性The tweet provides a detailed analysis of the fifth‑generation PerpDEX platform's various metrics and FDV/Mcap forecasts, but adopts a cautious stance on market valuation. 𝑺𝒂𝒗𝒐𝒚 🎮✌️ Researcher Security_Expert B5.64K @Savoyonx

𝑺𝒂𝒗𝒐𝒚 🎮✌️ Researcher Security_Expert B5.64K @Savoyonx Work to Earn D14.74K @worktoearn_en

Work to Earn D14.74K @worktoearn_enCyfrin Ambassador Program Semester 2 ✨ Rewards: ambassadors receive recognition, access to opportunities, and performance-based rewards such as bounties and swag. Tasks: - Run events (online & IRL) - Create content - Drive real engagement - Help launch new products this year 👉 Apply: https://t.co/QOmjUO1LtW --- Legit check: Cyfrin has partnerships with GMX, Curve Finance, and more 📍 Credit WorktoEarn when using this content

69 10 3.04K 閱讀原文 >釋出後GMX走勢中性Cyfrin launches second semester ambassador program, offering rewards and seeking community participation.

69 10 3.04K 閱讀原文 >釋出後GMX走勢中性Cyfrin launches second semester ambassador program, offering rewards and seeking community participation. 𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd

𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rdLots of stuff going on last week

Today in DeFi D17.22K @todayindefi

Today in DeFi D17.22K @todayindefiWhat Happened Last Week in DeFi? DeFi Updates📈: - MegaETH schedules public mainnet launch for February 9, 2026 - GMX to deploy on MegaETH with 100x BTC, ETH, SOL perps - SectorOne launches as MegaETH’s first native concentrated-liquidity DEX - Citrea launches BitcoinFi mainnet with cBTC and ctUSD campaigns live - Pendle replaces vePENDLE with sPENDLE liquid staking at 17% APR - Kraken launches DeFi Earn, offering up to 8% APY via on-chain vaults - Bitwise joins Morpho as curator, launches non-custodial lending vault - MetaMask snapshots wallets for upcoming LINEA rewards distribution - Uniswap introduces Continuous Clearing Auctions to curb launch-time bots - Superform launches v1 to v2 migration with higher UP incentives - Superform introduces SuperWETH vault targeting 6% ETH yield Airdrops🪂: - Moonbirds opens BIRB token claim as traffic forces temporary site pause - YO Protocol sets YO token airdrop for February 5 - Drops bot enables airdrop checks directly via Etherscan wallet lookup - USDAI targets CHIP

5 2 1.41K 閱讀原文 >釋出後GMX走勢中性Last week, the DeFi sector saw multiple developments, including MegaETH launch, GMX deployment, and several project airdrops.

5 2 1.41K 閱讀原文 >釋出後GMX走勢中性Last week, the DeFi sector saw multiple developments, including MegaETH launch, GMX deployment, and several project airdrops. 0xztiRoV Founder OnChain_Analyst B5.00K @0xztirov

0xztiRoV Founder OnChain_Analyst B5.00K @0xztirovAsymmetric opportunity Perps appetite is surging and the signal isn’t subtle: HIP‑3 markets just printed a fresh ATH in open interest and GMX is expanding to @megaeth with real‑time matching, 100x leverage and USDm vaults for LPs. CEX feel without the training wheels 👀 Institutional adoption for real‑time execution is EXPLODING. Prediction markets crossing into mainstream sport deals, delta‑neutral bridging yields getting handed out, and builders stress testing live order flow instead pf posting brochures Stress test countdown matters: ~3.5B transactions left before the replay closes, Base→MegaETH bridge is already public for load, faucet seeding lets you click without thinking about fees. You don’t need another thread, you need reps Crypto bros understand what comes next. Spoiler alert: the “on‑chain but instant” era isn’t future tense, it’s a positioning problem. I’m rotating flow where latency is the moat and letting the markets do the talking 🚨

17 10 113 閱讀原文 >釋出後GMX走勢極度看漲Perps market demand is surging, GMX offers 100x leverage on MegaETH with a CEX-like experience, heralding the arrival of an on‑chain instant‑trade era.

17 10 113 閱讀原文 >釋出後GMX走勢極度看漲Perps market demand is surging, GMX offers 100x leverage on MegaETH with a CEX-like experience, heralding the arrival of an on‑chain instant‑trade era. That Martini Guy ₿ Trader Influencer C710.17K @MartiniGuyYT

That Martini Guy ₿ Trader Influencer C710.17K @MartiniGuyYTNOBODY IS TALKING ABOUT THIS, BUT PERP DEXES ARE EATING CRYPTO In 2026, traders are abandoning CEXs and moving to on-chain perpetuals. Daily volume is already in the tens of billions. I went down the rabbit hole and tested a few myself. Here’s what surprised me: WHAT IS A PERP DEX? It’s a decentralized exchange for perpetual futures: ∙ No expiry ∙ Long or short ∙ Up to 100x leverage ∙ You keep custody ∙ No middlemen ∙ No KYC Think: GMX, Hyperliquid, dYdX. WHY ARE THEY EXPLODING NOW? Because CEX scandals broke trust. Perp DEXes offer: ∙ Full transparency (on-chain) ∙ Self-custody ∙ Lower fees ∙ Global access Unpopular opinion: CEXs are dinosaurs. Perp DEXes are the meteor. THE HYBRID MODEL IS WINNING Onchain settlement. Offchain matching for speed. And it’s not just theory anymore. HYPERLIQUID’S HIP-3 UPGRADE CHANGED THE GAME ∙ Boosted liquidity ∙ Unlocked equities + commodities onchain ∙ Turned perps into a real multi-asset trading venue You get: ∙ Transparency ∙ And CEX-level performance MY PERSONAL TEST I tested Hyperliquid for a week. Opened a 20x ETH long. Caught a 15% move. Closed instantly. No withdrawal drama. No delays. THE BIG REALIZATION Liquidity pools > order books for perps. Why? ∙ Always fills ∙ Better in volatility ∙ No thin books ∙ No fake liquidity HOW TO GET STARTED ∙ Start small on GMX / dYdX / Hyperliquid ∙ Connect your wallet ∙ Provide liquidity for yield ∙ Or farm points (airdrop meta is hot) IMPORTANT WARNING Leverage will destroy most people. High reward. Higher risk. Most traders don’t lose slowly. They get nuked fast. THE BIG PICTURE Perp DEX volume is now in the hundreds of billions per month. They’re not competing with CEXs anymore. They’re replacing them. DeFi derivatives are the future. Period. WHICH PERP DEX WINS THIS CYCLE?

46 36 5.13K 閱讀原文 >釋出後GMX走勢極度看漲Perp DEXes正迅速崛起并取代中心化交易所,成为DeFi衍生品交易的未来。

46 36 5.13K 閱讀原文 >釋出後GMX走勢極度看漲Perp DEXes正迅速崛起并取代中心化交易所,成为DeFi衍生品交易的未来。 𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd

𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd Today in DeFi D17.22K @todayindefi

Today in DeFi D17.22K @todayindefiToday in DeFi: - Rainbow wallet completed airdrop snapshot - GMX expanding to MegaETH following February mainnet launch - Maple launches syrupUSDC on Aave Base Full details and more news on today's letter: https://t.co/XA0gVkE6Rj

29 11 1.71K 閱讀原文 >釋出後GMX走勢中性GMX will deploy MegaETH, Maple launches syrupUSDC on Base 0xztiRoV Founder OnChain_Analyst B5.00K @0xztirov

0xztiRoV Founder OnChain_Analyst B5.00K @0xztirovSilver finally faded and my DMs instantly turned into perps talk GMX landing on @megaeth means real‑time BTC ETH SOL with 100x and I’m here for day one fills LP side looks cleaner than people think single‑sided USDm vault with yield from perp volume passive MM and GLV buy sell fees solves the “do I rebalancw” headache I’d rather point capital at fees than chase screenshots PriorityTrade picking up PrismFi fpows was the quiet tell one venue to route intent while the chain hahdles speed iw how LPs stop getting chopped up on retries I’m about to full port my bot stack into Mac minis and let them chew latency instead of me if fills don’t slip and vaults print without me babysitting I size faster than I tweet Hyperliquid stays great but I want native real‑time rails under my click path any guesses on day one USDm vault APR or are we still coping over metals?

23 12 206 閱讀原文 >釋出後GMX走勢極度看漲The author is extremely bullish on GMX offering 100x BTC ETH SOL trading on megaeth and passive returns from a single-sided USDm vault.

23 12 206 閱讀原文 >釋出後GMX走勢極度看漲The author is extremely bullish on GMX offering 100x BTC ETH SOL trading on megaeth and passive returns from a single-sided USDm vault. Crynet Media Influencer D4.08K @crynetio

Crynet Media Influencer D4.08K @crynetioGMX: Redefining Decentralized Perpetuals #DeFi #DecentralizedFinance #CryptoTrading #Blockchain #GMX #Derivatives https://t.co/WiBQ5AwPac

1 0 14 閱讀原文 >釋出後GMX走勢看漲GMX will redefine decentralized perpetual contracts, outlook is bullish