CAMP (CAMP)

CAMP (CAMP)

- 68社交熱度指數(SSI)- (24h)

- #25市場預警排名(MPR)0

- 224小時社交提及量- (24h)

- 100%24小時KOL看好比例2位活躍KOL

- 概要CAMP DA usage surged 137%, IP on-chain gained attention, price rose 5.29%

- 看漲訊號

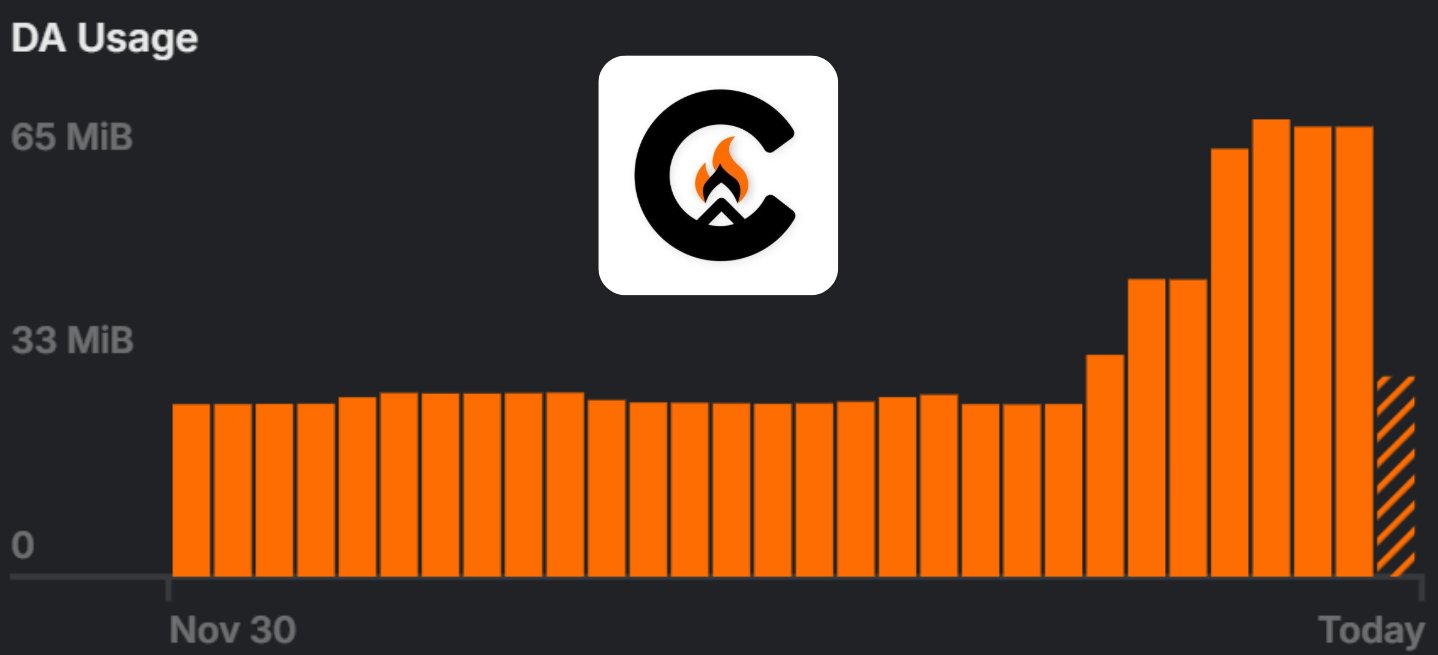

- DA usage up 137%

- Celestia layer support

- IP on-chain gaining attention

- NFT demand expected to increase

- Price up 5.3%

- 看跌訊號

- Social heat index stable

- High interaction limited to 2 posts

社交熱度指數(SSI)

- 總體資料68SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (50%)看漲 (50%)社交熱度洞察CAMP social heat index is moderate (67.75/100) and remains unchanged, activity score full 40, positive sentiment high (26.25/30), but KOL attention low (1.5/30), driven by DA usage +137% and IP on-chain attention.

市場預警排名(MPR)

- 預警解讀CAMP warning rank #25, social anomaly level 100/100 highest, sentiment polarization 56.25/100, KOL attention shift only 1.5/100, mainly due to DA usage surge causing abnormal volatility.

相關推文

Hydraze 🏴☠️ Trader DeFi_Expert C132.40K @Hydraze420

Hydraze 🏴☠️ Trader DeFi_Expert C132.40K @Hydraze420Was such a big year for CAMP looking back, so many success stories that I think have teed us up for a huge 2026. Personally for me the biggest moment was being able to put my own IP on chain. I think the demand for this sort of IP from companies, festivals, TV shows & movies is going to grow considerably next year. Time to go shopping for some more NFT's that I think are going to have big demand IP wise in the coming months/years.

Camp Network ⛺️ D466.13K @campnetworkxyz

Camp Network ⛺️ D466.13K @campnetworkxyzhttps://t.co/UA6H1F4i4X

148 30 5.54K 閱讀原文 >釋出後CAMP走勢看漲CAMP demand will greatly increase, expected to explode in 2026 Cito Zone - DeFi Media Hub OnChain_Analyst DeFi_Expert B8.54K @Cito_Zone

Cito Zone - DeFi Media Hub OnChain_Analyst DeFi_Expert B8.54K @Cito_ZoneCamp Network is ramping up DA usage 🔥📶 🔸 Daily DA usage: 64 MiB (up 137% WoW) 🔸 With @celestia underneath $CAMP https://t.co/4d2jTrp3Mt

12 0 850 閱讀原文 >釋出後CAMP走勢極度看漲Camp Network's DA usage grew 137% week-over-week, showing strong growth.

12 0 850 閱讀原文 >釋出後CAMP走勢極度看漲Camp Network's DA usage grew 137% week-over-week, showing strong growth. P|.edge🦭 DeFi_Expert OnChain_Analyst B2.32K @eth2828

P|.edge🦭 DeFi_Expert OnChain_Analyst B2.32K @eth2828POV: you jump into Camp thinking it's swag and s'mores, and someone hands you the playbook on how @moonbirds is turning holders into licensed creators. not a vague vibe actual commercial rights, templates, distro, make-sell-ship paths that don't require chasing some opaque brand team. i asked how fast you can go from art to shelf and the answer was: weeks if you have a plan then the scale hit me: $500M+ in volume behind the art, now routed into #onchain #IP with $CAMP fueling the rails. bullish on the execution because if they pull it off, the old way of licensing looks slow. question for builders: what would you launch under the Moonbirds license in Q1? #NFTs #licensing

6 4 49 閱讀原文 >釋出後CAMP走勢極度看漲Moonbirds empower commercial licensing through $CAMP, and the author is bullish on its execution.

6 4 49 閱讀原文 >釋出後CAMP走勢極度看漲Moonbirds empower commercial licensing through $CAMP, and the author is bullish on its execution. tochi 🦇🔈 FA_Analyst OnChain_Analyst B72.45K @OxTochi

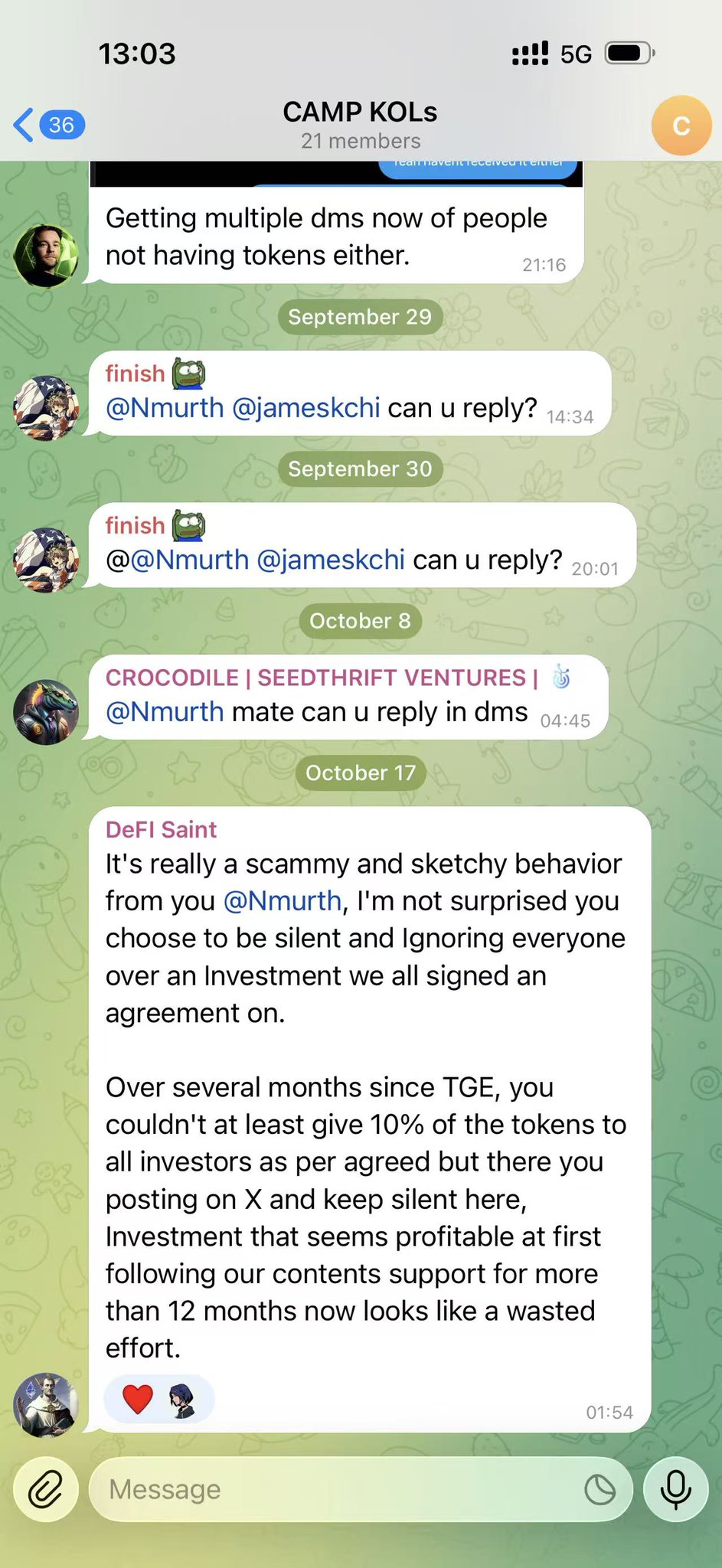

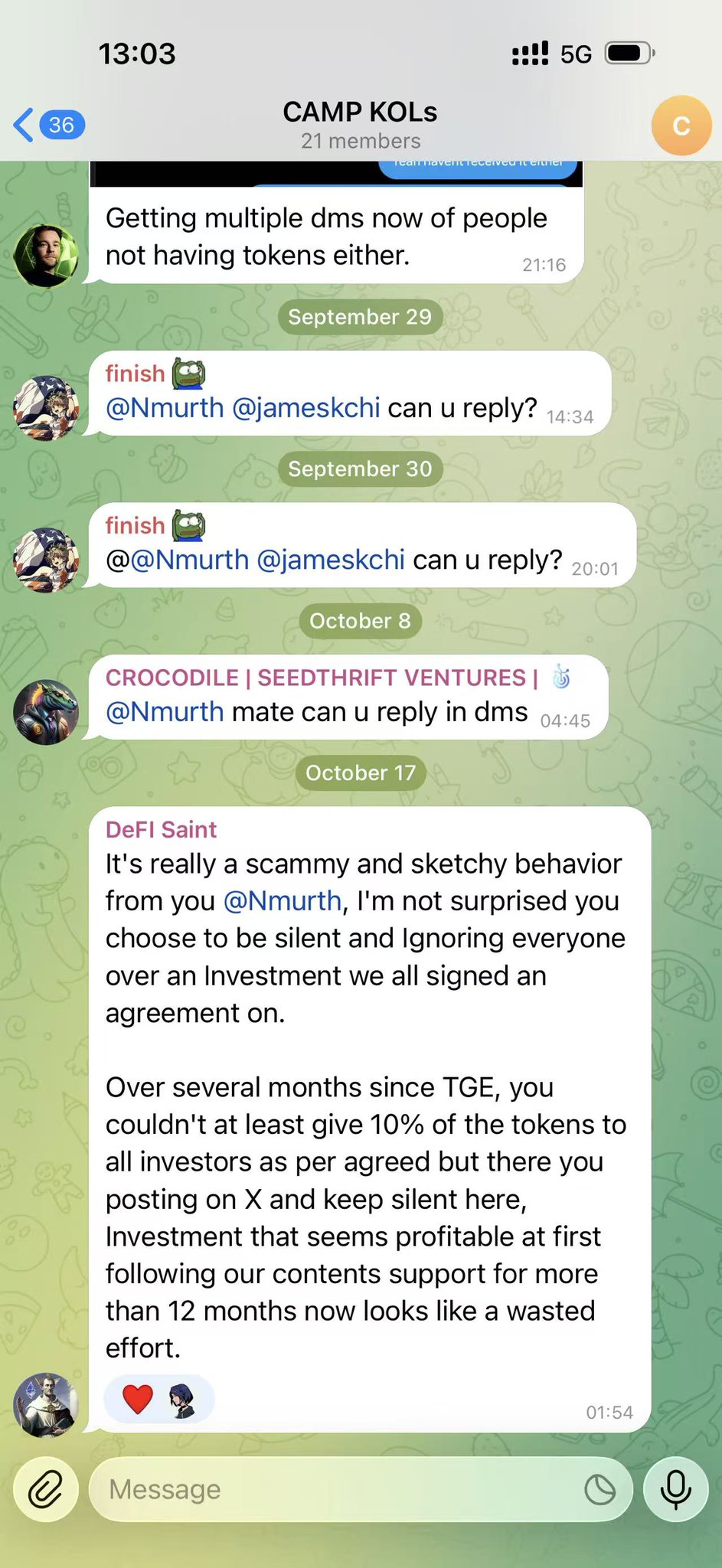

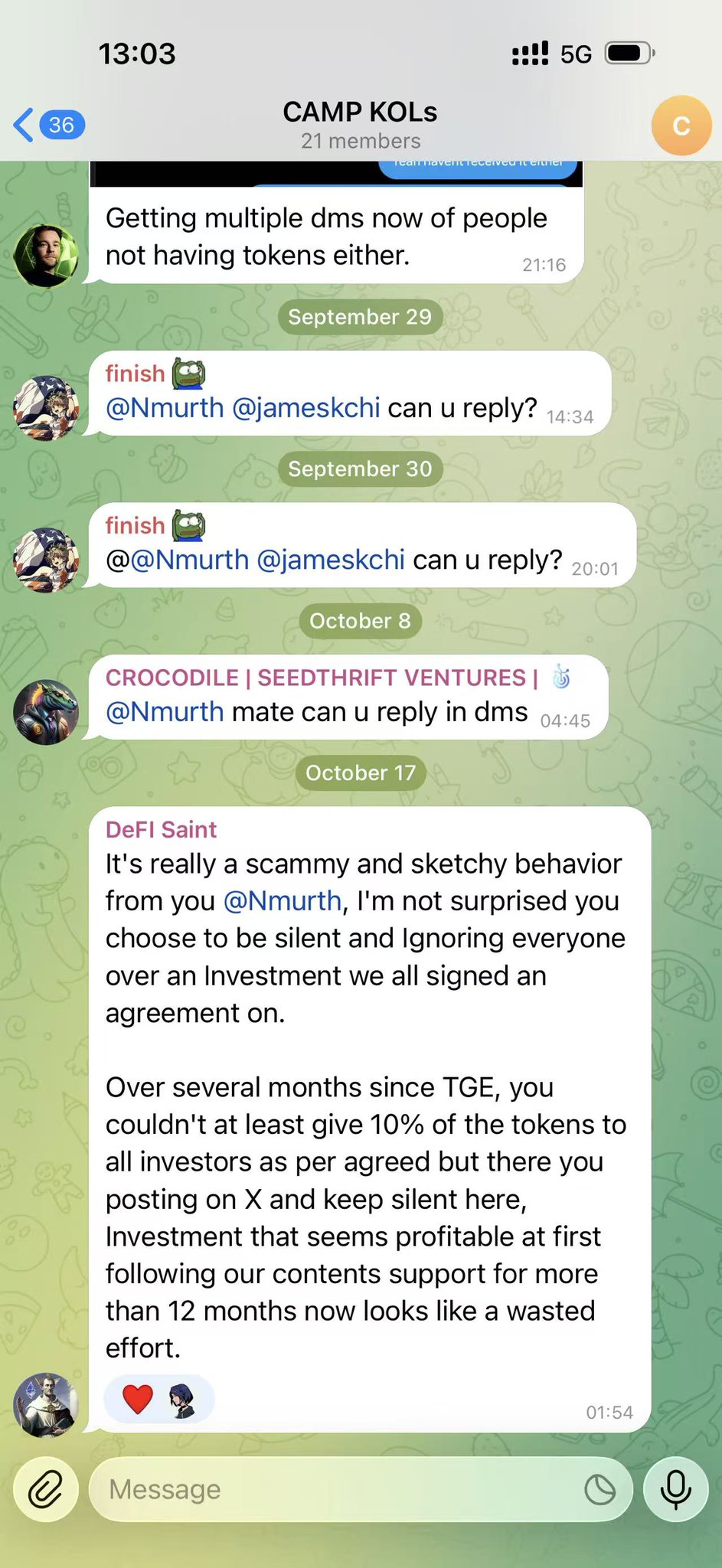

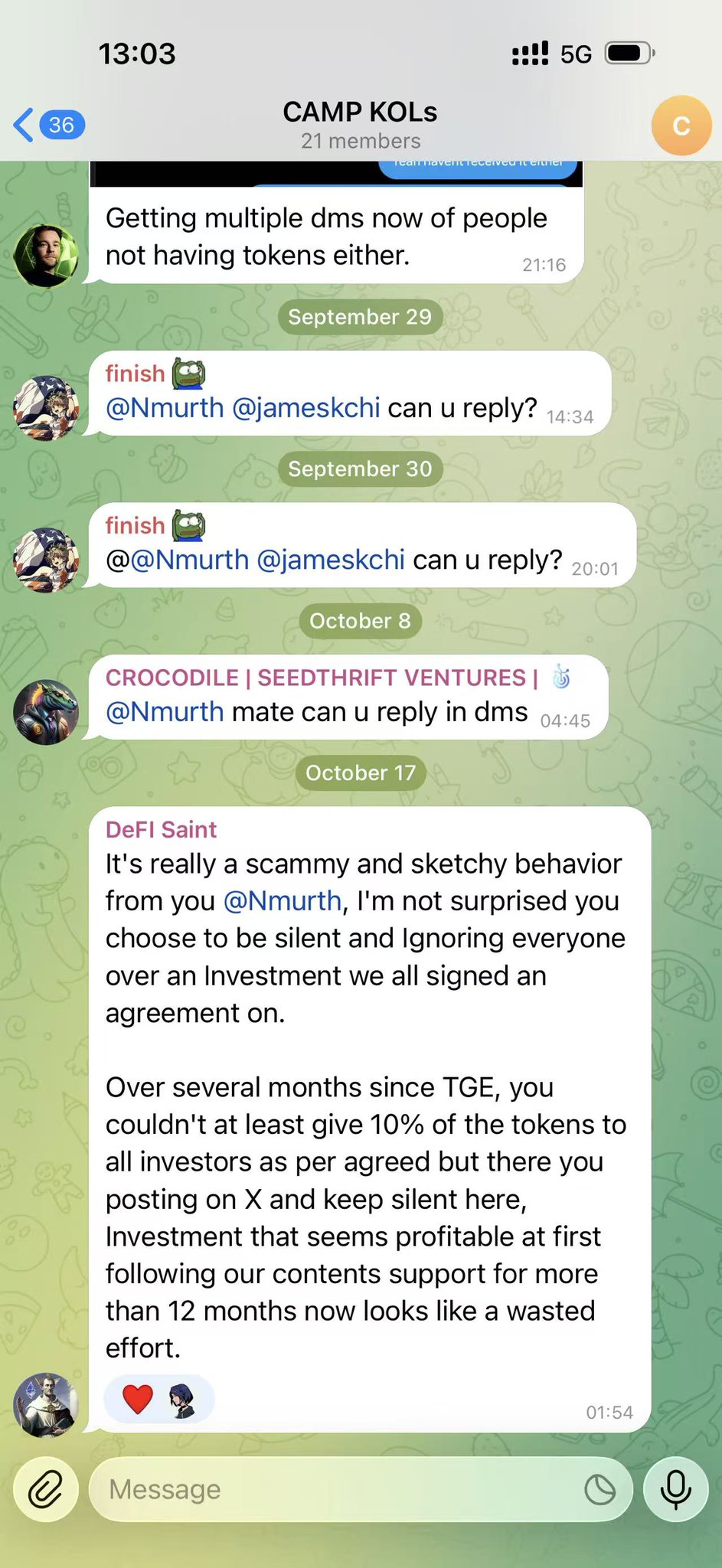

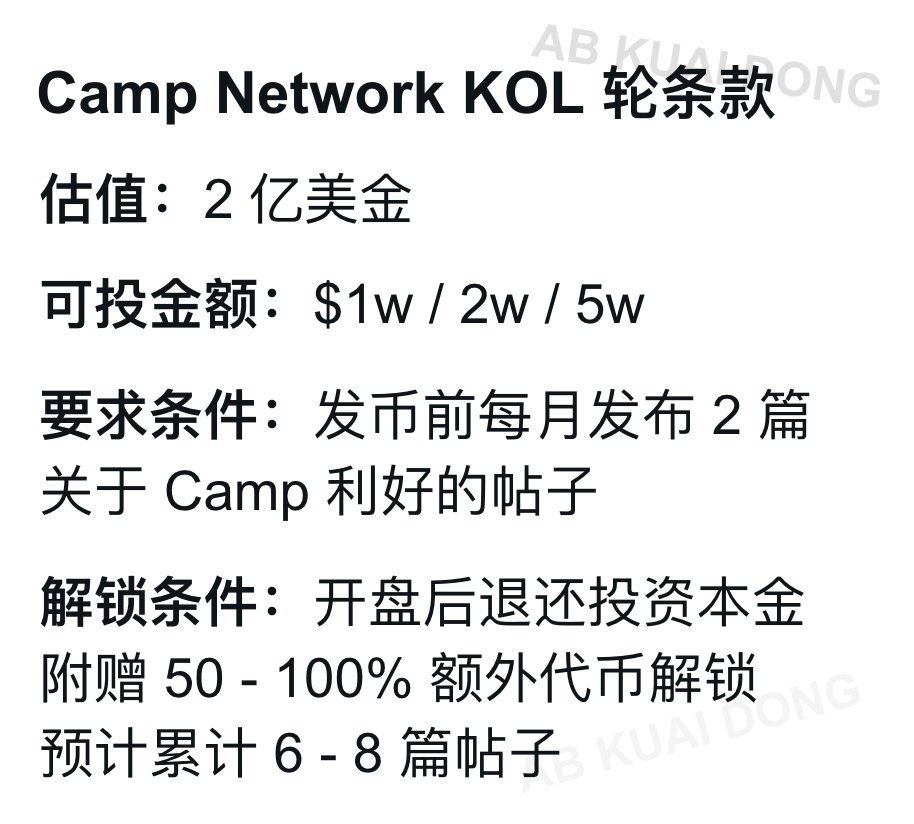

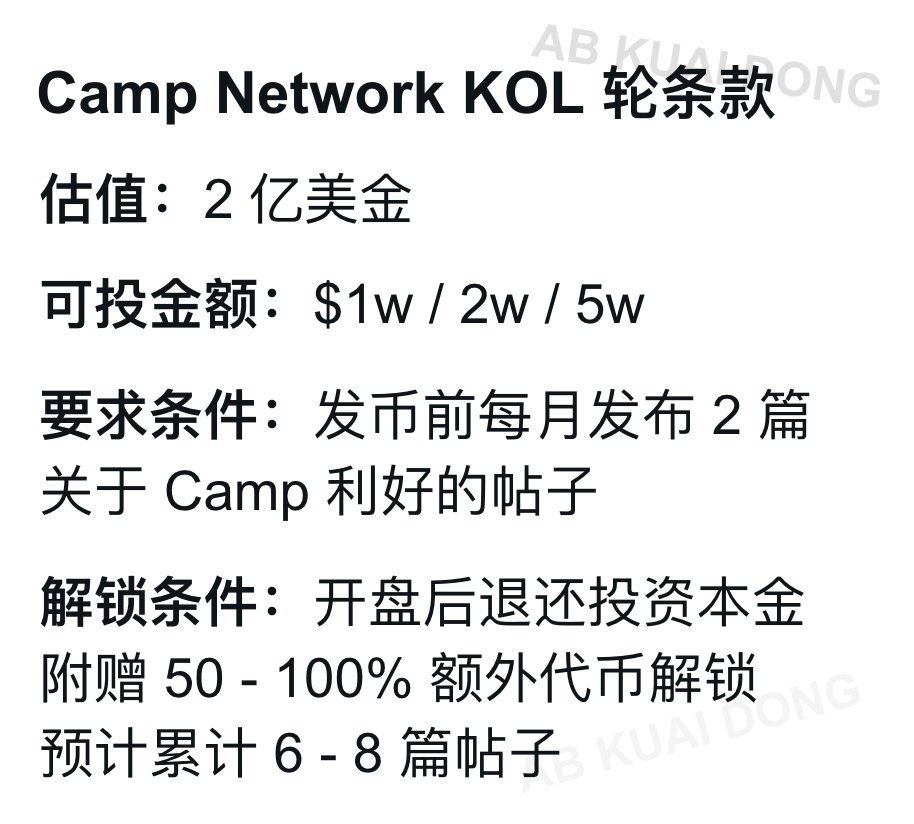

tochi 🦇🔈 FA_Analyst OnChain_Analyst B72.45K @OxTochicamp kols lmao so kols still do kol round? ngmi lol btw this is camp network they swore cooked for rewarding 50 yappers

币圈老司机🔶BNB D134.76K @Bqlsj2023

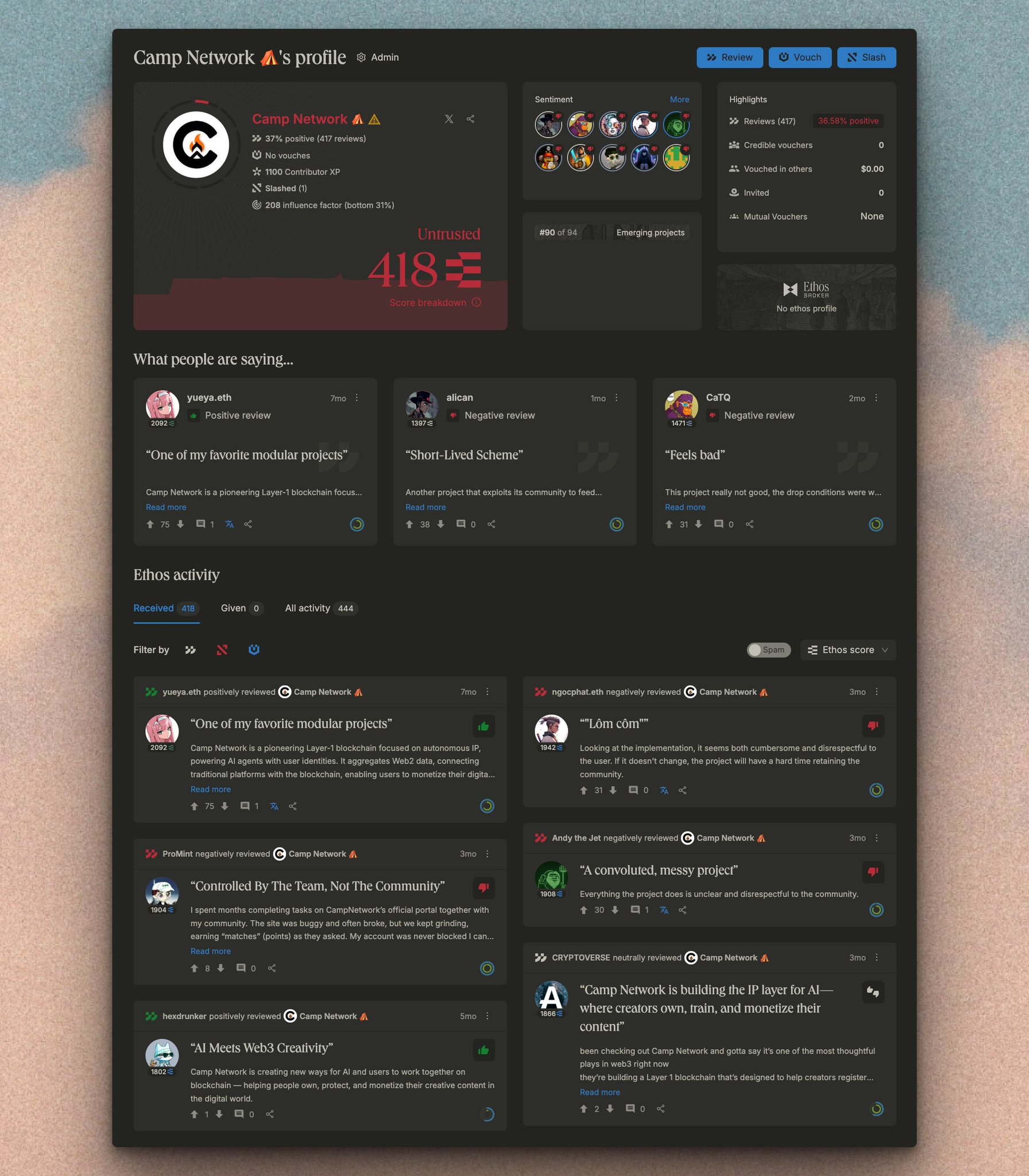

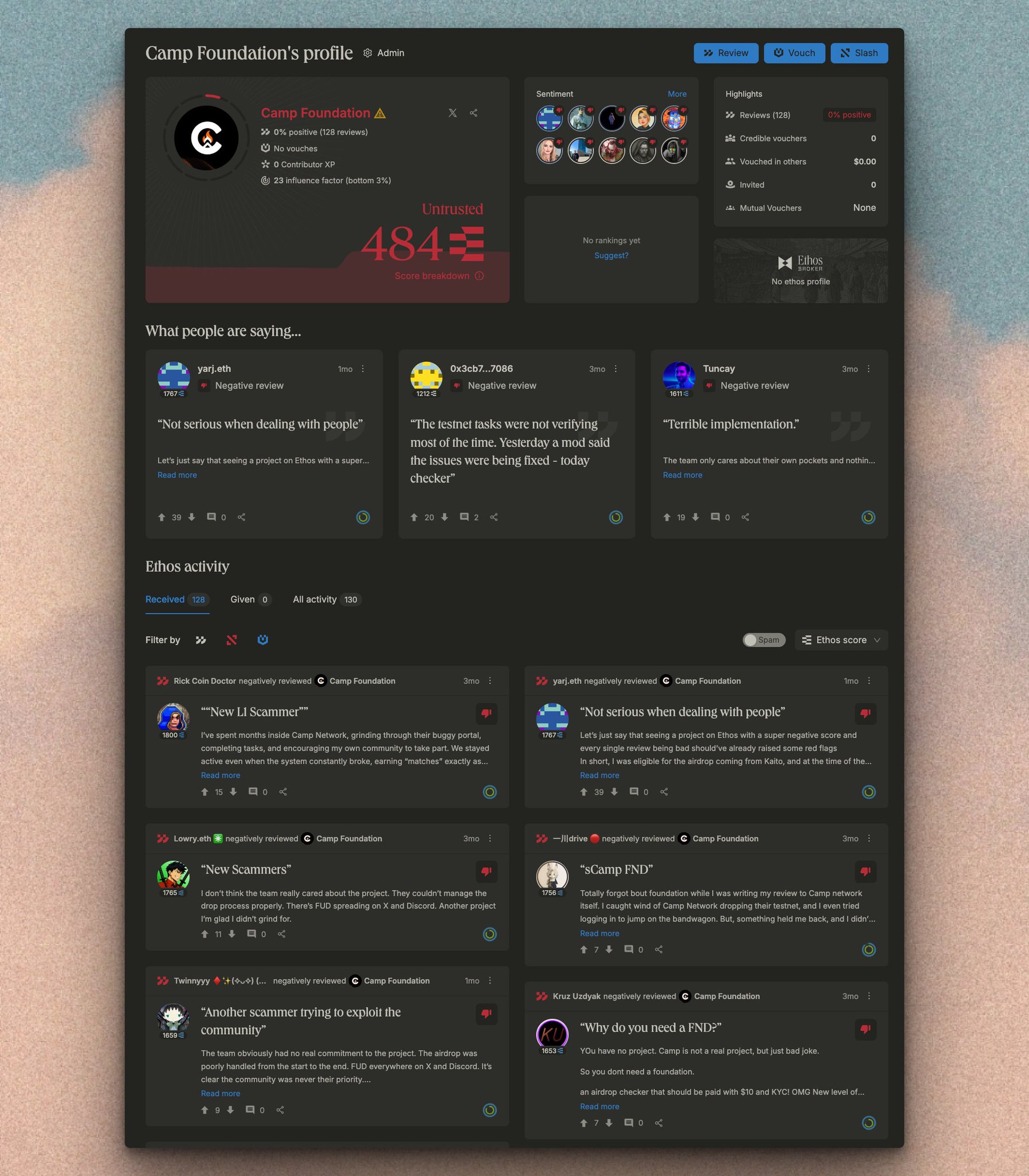

币圈老司机🔶BNB D134.76K @Bqlsj2023Twitter received a leak from a foreign KOL that Camp Network conducted an overseas KOL round but didn’t distribute tokens and just ran away. The project was even listed on exchanges such as @Bybit_Official, @Bitget_zh, @MEXC_Official, etc., and raised tens of millions in financing. But to date, the tokens have not been unlocked and no one responds in the TG group. Here’s what happened: In April 2024, Camp Network organized an overseas KOL round, signing a formal SAFE/SAFT agreement — clearly stating on paper that once the TGE occurs, tokens must be issued to the KOLs. Throughout 2024 to 2025, Camp Network constantly sought agencies to help with promotion, contact KOLs, and coordinate events. The agencies kept providing resources and support, and the cooperation seemed normal. August 27, 2025: Camp Network officially announced listings on top exchanges (Bybit, Bitget, Gate, Kraken, etc.). According to the contract, TGE = token‑distribution day = tokens must be delivered to investors. However, after the agency completed KYC, the system showed “incomplete,” making it impossible to receive the tokens. When the agency asked the project, Camp’s Nirav only replied “will send across” and then never addressed the issue directly. September 16: Various overseas KOLs confronted the project — the agreement is clear that tokens should be released at TGE, yet there was no response. At that moment, the Camp team suddenly changed stance, for the first time demanding to see a KOL performance report, otherwise they would not unlock the TGE. From September 17 to October 4, overseas KOLs directly messaged the three responsible persons on TG (Nirav Murthy, James Chi, Mike Jin). Camp Network’s attitude turned into a uniform response — all messages read but not replied, complete disappearance, total loss of contact. The current KOL round is really risky; it’s heard that each overseas KOL was paid about 20k U, with over 20 people in the group, totaling around $400k. The project got listed on exchanges but didn’t give tokens, didn’t refund, and just fled. Bybit, Bitget, and MEXC listing teams, can you talk to the project to see what’s going on???? Below are screenshots of the foreign user’s rights‑protection claim:

71 37 6.77K 閱讀原文 >釋出後CAMP走勢極度看跌Camp Network is accused of not distributing tokens to KOLs after the TGE and disappearing, suspected of fraud.

71 37 6.77K 閱讀原文 >釋出後CAMP走勢極度看跌Camp Network is accused of not distributing tokens to KOLs after the TGE and disappearing, suspected of fraud. Serpin Taxt Founder Tokenomics_Expert A23.40K @serpinxbt

Serpin Taxt Founder Tokenomics_Expert A23.40K @serpinxbtif there is anyone who could be held accountable for @campnetworkxyz & @Camp_FND who would it be? > the VCs who funded it? > the teams that marketed it? or should the accountability only go to the founders? https://t.co/6W1jhRsMpL

币圈老司机🔶BNB D134.76K @Bqlsj2023

币圈老司机🔶BNB D134.76K @Bqlsj2023Twitter received a leak from a foreign KOL that Camp Network conducted an overseas KOL round but didn’t distribute tokens and just ran away. The project was even listed on exchanges such as @Bybit_Official, @Bitget_zh, @MEXC_Official, etc., and raised tens of millions in financing. But to date, the tokens have not been unlocked and no one responds in the TG group. Here’s what happened: In April 2024, Camp Network organized an overseas KOL round, signing a formal SAFE/SAFT agreement — clearly stating on paper that once the TGE occurs, tokens must be issued to the KOLs. Throughout 2024 to 2025, Camp Network constantly sought agencies to help with promotion, contact KOLs, and coordinate events. The agencies kept providing resources and support, and the cooperation seemed normal. August 27, 2025: Camp Network officially announced listings on top exchanges (Bybit, Bitget, Gate, Kraken, etc.). According to the contract, TGE = token‑distribution day = tokens must be delivered to investors. However, after the agency completed KYC, the system showed “incomplete,” making it impossible to receive the tokens. When the agency asked the project, Camp’s Nirav only replied “will send across” and then never addressed the issue directly. September 16: Various overseas KOLs confronted the project — the agreement is clear that tokens should be released at TGE, yet there was no response. At that moment, the Camp team suddenly changed stance, for the first time demanding to see a KOL performance report, otherwise they would not unlock the TGE. From September 17 to October 4, overseas KOLs directly messaged the three responsible persons on TG (Nirav Murthy, James Chi, Mike Jin). Camp Network’s attitude turned into a uniform response — all messages read but not replied, complete disappearance, total loss of contact. The current KOL round is really risky; it’s heard that each overseas KOL was paid about 20k U, with over 20 people in the group, totaling around $400k. The project got listed on exchanges but didn’t give tokens, didn’t refund, and just fled. Bybit, Bitget, and MEXC listing teams, can you talk to the project to see what’s going on???? Below are screenshots of the foreign user’s rights‑protection claim:

37 20 3.66K 閱讀原文 >釋出後CAMP走勢極度看跌Camp Network is accused of not unlocking tokens for KOLs after the TGE and disappearing, suspected of fleeing.

37 20 3.66K 閱讀原文 >釋出後CAMP走勢極度看跌Camp Network is accused of not unlocking tokens for KOLs after the TGE and disappearing, suspected of fleeing. 梭教授说 Influencer OnChain_Analyst D173.89K @hellosuoha

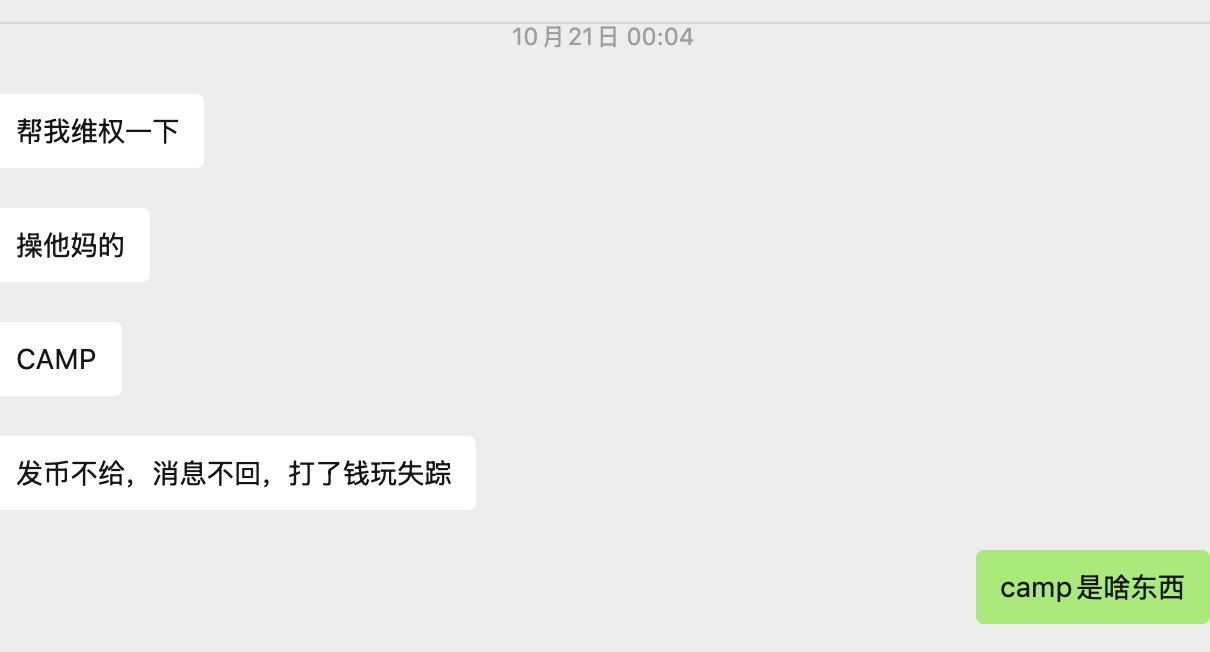

梭教授说 Influencer OnChain_Analyst D173.89K @hellosuohaThese current KOL rounds still require a bit more caution, xdm. It's starting to feel more like P2P. You want interest from me, I want your principal. The key point is not only taking your principal, but also caring about the principal of your contacts, and then making you work for free 🤣. https://t.co/YjpTgHVYzX https://t.co/WGXtvhdnaX

币圈老司机🔶BNB D134.76K @Bqlsj2023

币圈老司机🔶BNB D134.76K @Bqlsj2023Twitter received a leak from a foreign KOL that Camp Network conducted an overseas KOL round but didn’t distribute tokens and just ran away. The project was even listed on exchanges such as @Bybit_Official, @Bitget_zh, @MEXC_Official, etc., and raised tens of millions in financing. But to date, the tokens have not been unlocked and no one responds in the TG group. Here’s what happened: In April 2024, Camp Network organized an overseas KOL round, signing a formal SAFE/SAFT agreement — clearly stating on paper that once the TGE occurs, tokens must be issued to the KOLs. Throughout 2024 to 2025, Camp Network constantly sought agencies to help with promotion, contact KOLs, and coordinate events. The agencies kept providing resources and support, and the cooperation seemed normal. August 27, 2025: Camp Network officially announced listings on top exchanges (Bybit, Bitget, Gate, Kraken, etc.). According to the contract, TGE = token‑distribution day = tokens must be delivered to investors. However, after the agency completed KYC, the system showed “incomplete,” making it impossible to receive the tokens. When the agency asked the project, Camp’s Nirav only replied “will send across” and then never addressed the issue directly. September 16: Various overseas KOLs confronted the project — the agreement is clear that tokens should be released at TGE, yet there was no response. At that moment, the Camp team suddenly changed stance, for the first time demanding to see a KOL performance report, otherwise they would not unlock the TGE. From September 17 to October 4, overseas KOLs directly messaged the three responsible persons on TG (Nirav Murthy, James Chi, Mike Jin). Camp Network’s attitude turned into a uniform response — all messages read but not replied, complete disappearance, total loss of contact. The current KOL round is really risky; it’s heard that each overseas KOL was paid about 20k U, with over 20 people in the group, totaling around $400k. The project got listed on exchanges but didn’t give tokens, didn’t refund, and just fled. Bybit, Bitget, and MEXC listing teams, can you talk to the project to see what’s going on???? Below are screenshots of the foreign user’s rights‑protection claim:

18 21 13.39K 閱讀原文 >釋出後CAMP走勢極度看跌Camp Network project team appears to have run away, KOL did not receive tokens.

18 21 13.39K 閱讀原文 >釋出後CAMP走勢極度看跌Camp Network project team appears to have run away, KOL did not receive tokens. CryptoMaid加密女仆お嬢様 .edge🦭 OnChain_Analyst Trader D137.99K @maid_crypto

CryptoMaid加密女仆お嬢様 .edge🦭 OnChain_Analyst Trader D137.99K @maid_cryptoToo many KOL rounds have run away, it's heartbreaking https://t.co/xlT9fR51sH

币圈老司机🔶BNB D134.76K @Bqlsj2023

币圈老司机🔶BNB D134.76K @Bqlsj2023Twitter received a leak from a foreign KOL that Camp Network conducted an overseas KOL round but didn’t distribute tokens and just ran away. The project was even listed on exchanges such as @Bybit_Official, @Bitget_zh, @MEXC_Official, etc., and raised tens of millions in financing. But to date, the tokens have not been unlocked and no one responds in the TG group. Here’s what happened: In April 2024, Camp Network organized an overseas KOL round, signing a formal SAFE/SAFT agreement — clearly stating on paper that once the TGE occurs, tokens must be issued to the KOLs. Throughout 2024 to 2025, Camp Network constantly sought agencies to help with promotion, contact KOLs, and coordinate events. The agencies kept providing resources and support, and the cooperation seemed normal. August 27, 2025: Camp Network officially announced listings on top exchanges (Bybit, Bitget, Gate, Kraken, etc.). According to the contract, TGE = token‑distribution day = tokens must be delivered to investors. However, after the agency completed KYC, the system showed “incomplete,” making it impossible to receive the tokens. When the agency asked the project, Camp’s Nirav only replied “will send across” and then never addressed the issue directly. September 16: Various overseas KOLs confronted the project — the agreement is clear that tokens should be released at TGE, yet there was no response. At that moment, the Camp team suddenly changed stance, for the first time demanding to see a KOL performance report, otherwise they would not unlock the TGE. From September 17 to October 4, overseas KOLs directly messaged the three responsible persons on TG (Nirav Murthy, James Chi, Mike Jin). Camp Network’s attitude turned into a uniform response — all messages read but not replied, complete disappearance, total loss of contact. The current KOL round is really risky; it’s heard that each overseas KOL was paid about 20k U, with over 20 people in the group, totaling around $400k. The project got listed on exchanges but didn’t give tokens, didn’t refund, and just fled. Bybit, Bitget, and MEXC listing teams, can you talk to the project to see what’s going on???? Below are screenshots of the foreign user’s rights‑protection claim:

4 4 3.71K 閱讀原文 >釋出後CAMP走勢極度看跌The CAMP project team ran away, did not distribute tokens to KOLs, and exchanges such as Bybit, Bitget, MEXC may be implicated.

4 4 3.71K 閱讀原文 >釋出後CAMP走勢極度看跌The CAMP project team ran away, did not distribute tokens to KOLs, and exchanges such as Bybit, Bitget, MEXC may be implicated. 大宇 FA_Analyst Influencer C288.46K @BTCdayu

大宇 FA_Analyst Influencer C288.46K @BTCdayuThe KOL round is often like lending money that isn’t repaid, or only partially repaid, depending on fate. https://t.co/xWJfMLD2oF

AB Kuai.Dong Media Influencer A97.41K @_FORAB

AB Kuai.Dong Media Influencer A97.41K @_FORABKOL also got cut? I asked around, and surprisingly it's true; not sure if it's a new market signal. Roughly last year, when Camp started the KOL round financing, the team went through several different agencies to raise the KOL round, which lasted over a year. On average, each participating KOL had to write frantic promotional articles for the project every month in order to unlock after the launch. The current news is: the principal is not returned, the tokens are not unlocked, and the KOL's fans, who suffered huge losses from participating, are also seeking redress from the KOL. But in reality, this team may have overissued tokens. After all, they raised the KOL round for more than a year..

34 35 20.67K 閱讀原文 >釋出後CAMP走勢極度看跌Camp Network's KOL round financing failed, resulting in losses for KOLs and their fans, and the token CAMP plummeted 84.54%.

34 35 20.67K 閱讀原文 >釋出後CAMP走勢極度看跌Camp Network's KOL round financing failed, resulting in losses for KOLs and their fans, and the token CAMP plummeted 84.54%. AB Kuai.Dong Media Influencer A97.41K @_FORAB

AB Kuai.Dong Media Influencer A97.41K @_FORABKOL also got cut? I asked around, and surprisingly it's true; not sure if it's a new market signal. Roughly last year, when Camp started the KOL round financing, the team went through several different agencies to raise the KOL round, which lasted over a year. On average, each participating KOL had to write frantic promotional articles for the project every month in order to unlock after the launch. The current news is: the principal is not returned, the tokens are not unlocked, and the KOL's fans, who suffered huge losses from participating, are also seeking redress from the KOL. But in reality, this team may have overissued tokens. After all, they raised the KOL round for more than a year..

106 100 127.69K 閱讀原文 >釋出後CAMP走勢極度看跌Camp Network's KOL round financing failed, resulting in losses for KOLs and their fans, and the token CAMP plummeted 84.54%.

106 100 127.69K 閱讀原文 >釋出後CAMP走勢極度看跌Camp Network's KOL round financing failed, resulting in losses for KOLs and their fans, and the token CAMP plummeted 84.54%. Hydraze 🏴☠️ Trader DeFi_Expert C132.40K @Hydraze420

Hydraze 🏴☠️ Trader DeFi_Expert C132.40K @Hydraze420Minto returning to CAMP is no joke, they're a genuine web 2 household IP with 9B+ sticker downloads. It’s clear that CAMP are here to stay & plan to deliver real value over the long term. People are finally starting to wake up to the true potential of IP licensing on chain & this is fast becoming one of the most exciting sectors in crypto for me. With that said I now think $CAMP is the number one most undervalued project within this IP arena and expect it to re-price soon enough.

Camp Network ⛺️ D466.13K @campnetworkxyz

Camp Network ⛺️ D466.13K @campnetworkxyz9B+ sticker downloads across Asia, and a roster of core internet phenomena. Minto is returning to Camp through a new licensing partnership between @Remaster_io and @TopTierAuth, expanding their iconic IP portfolio beyond Japan’s messaging platforms. This partnership enables their first-time access to Telegram, evolving their footprint from regional platforms to global channels. ↴

180 52 8.13K 閱讀原文 >釋出後CAMP走勢看漲CAMP is seen as the most undervalued project in the IP sector, expected to be re‑priced soon.