Aave (AAVE)

Aave (AAVE)

$123.66 +0.61% 24H

- 46社交熱度指數(SSI)-9.99% (24h)

- #148市場預警排名(MPR)-26

- 1424小時社交提及量+6.67% (24h)

- 72%24小時KOL看好比例12位活躍KOL

- 概要

- 看漲訊號

- 看跌訊號

社交熱度指數(SSI)

- 總體資料46SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (36%)看漲 (36%)中性 (14%)看跌 (7%)極度看跌 (7%)社交熱度洞察

市場預警排名(MPR)

- 預警解讀

相關推文

- 釋出後AAVE走勢看漲

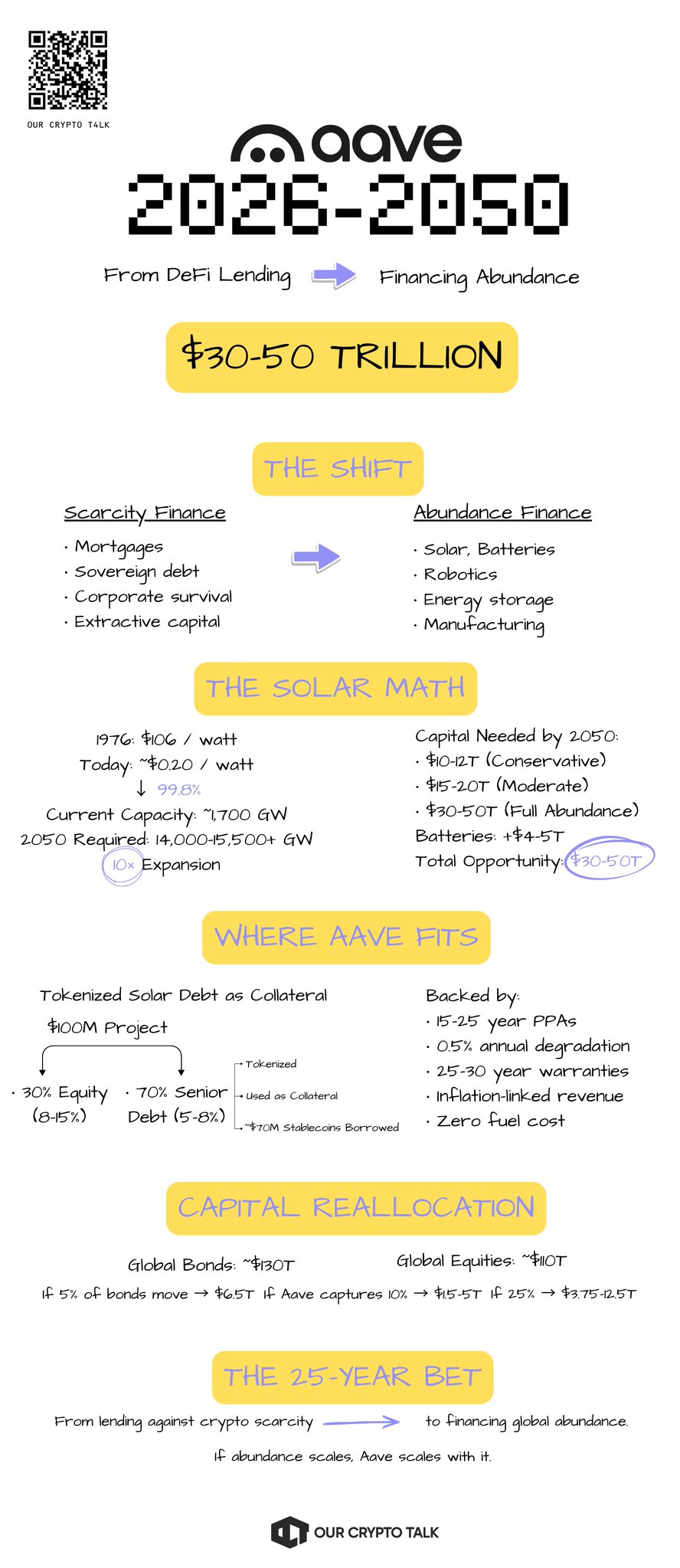

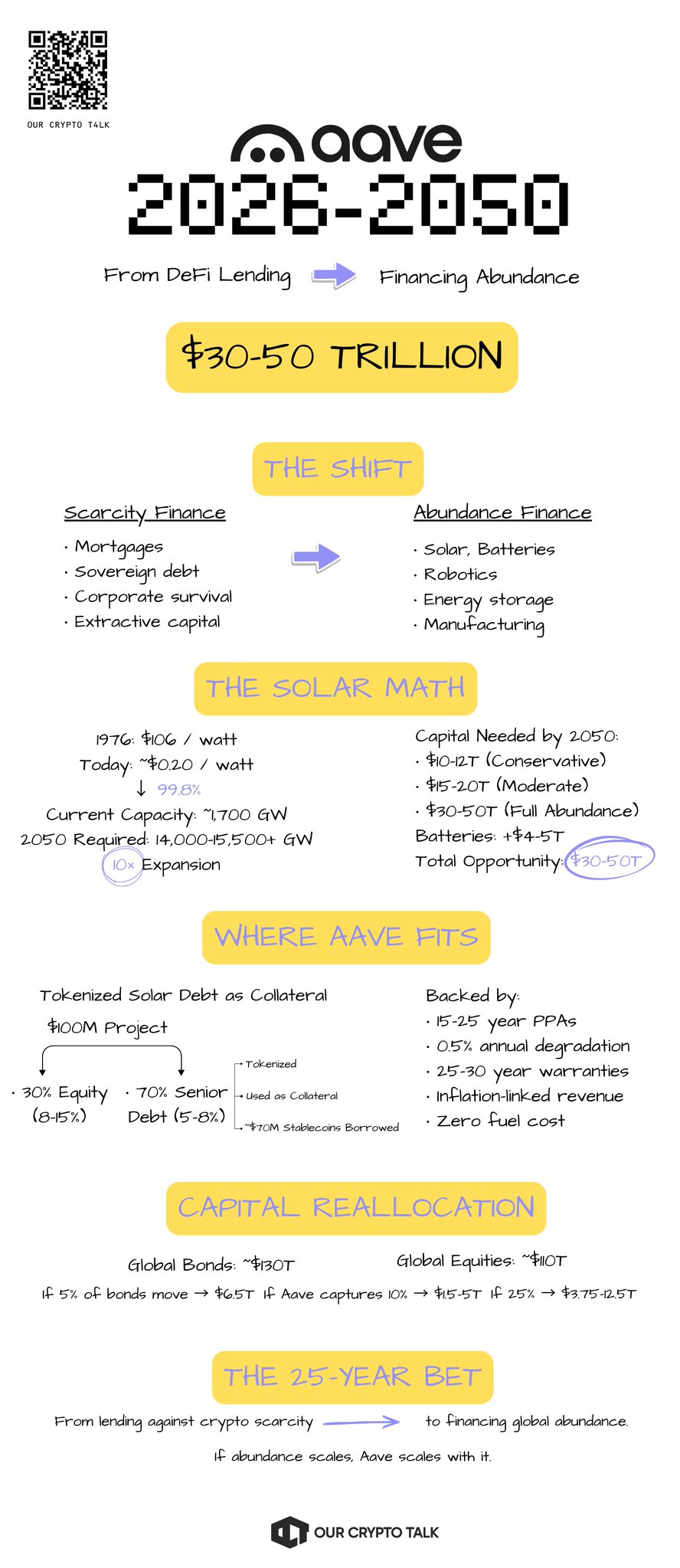

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk Our Crypto Talk Media Influencer C76.65K @ourcryptotalk

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk 29 7 5.68K 閱讀原文 >釋出後AAVE走勢極度看漲

29 7 5.68K 閱讀原文 >釋出後AAVE走勢極度看漲 Our Crypto Talk Media Influencer C76.65K @ourcryptotalk

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk Our Crypto Talk Media Influencer C76.65K @ourcryptotalk

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk 29 7 5.68K 閱讀原文 >釋出後AAVE走勢極度看漲

29 7 5.68K 閱讀原文 >釋出後AAVE走勢極度看漲- 釋出後AAVE走勢看漲

- 釋出後AAVE走勢中性

Laura Shin Media Influencer C281.42K @laurashin

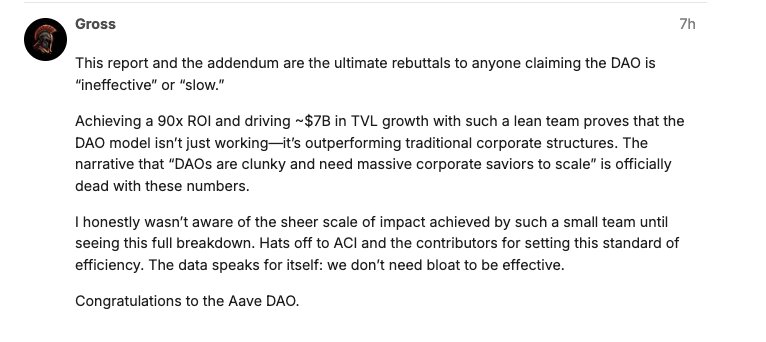

Laura Shin Media Influencer C281.42K @laurashin Marc ”七十 Billy” Zeller D105.30K @Marczeller

Marc ”七十 Billy” Zeller D105.30K @Marczeller 108 10 8.68K 閱讀原文 >釋出後AAVE走勢極度看漲

108 10 8.68K 閱讀原文 >釋出後AAVE走勢極度看漲- 釋出後AAVE走勢看漲

Tim Copeland Media Influencer B41.31K @Timccopeland

Tim Copeland Media Influencer B41.31K @Timccopeland The Block D532.41K @TheBlock__25 3 6.39K 閱讀原文 >釋出後AAVE走勢中性

The Block D532.41K @TheBlock__25 3 6.39K 閱讀原文 >釋出後AAVE走勢中性- 釋出後AAVE走勢看跌

- 釋出後AAVE走勢極度看漲