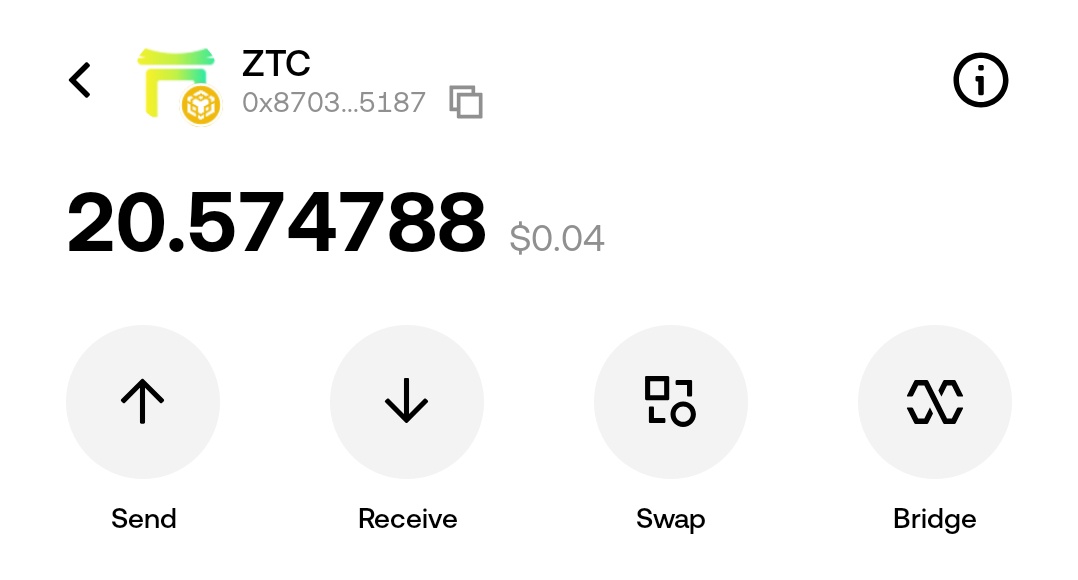

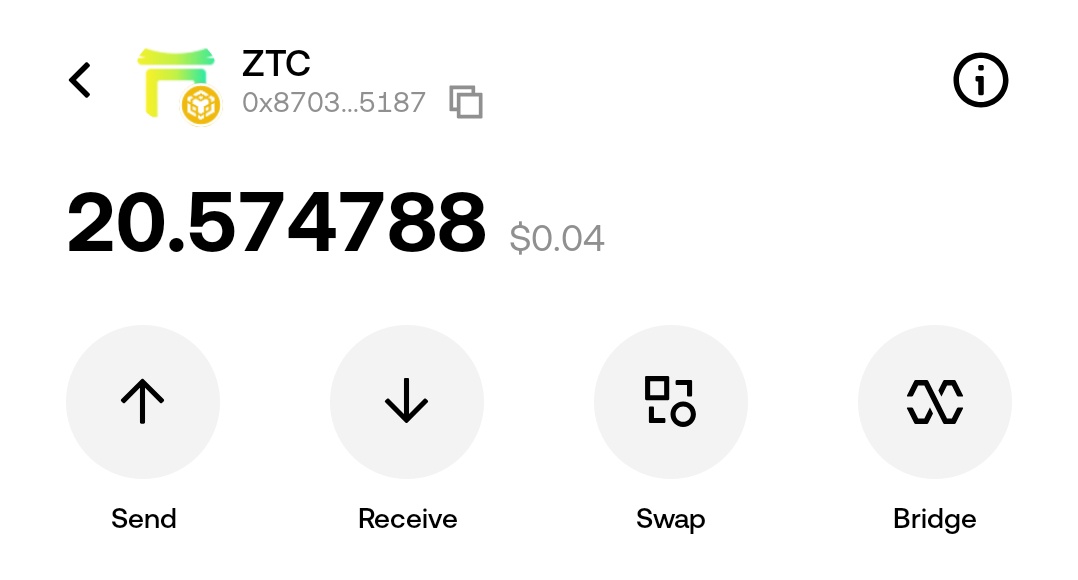

Just when I thought Airdrop is dead... One project I joined over 1yr ago finally sent $20k to me this morning.

Congratulations to me.

My first win of 2026.

Big win. https://t.co/XNFzfbxKac

Just when I thought Airdrop is dead... One project I joined over 1yr ago finally sent $20k to me this morning.

Congratulations to me.

My first win of 2026.

Big win. https://t.co/XNFzfbxKac

Zenchain eligibility checker incoming.

Make sure u verify ur humanity role on their discord.

Let all this stress better be worth it . https://t.co/9fB8Vb97eW

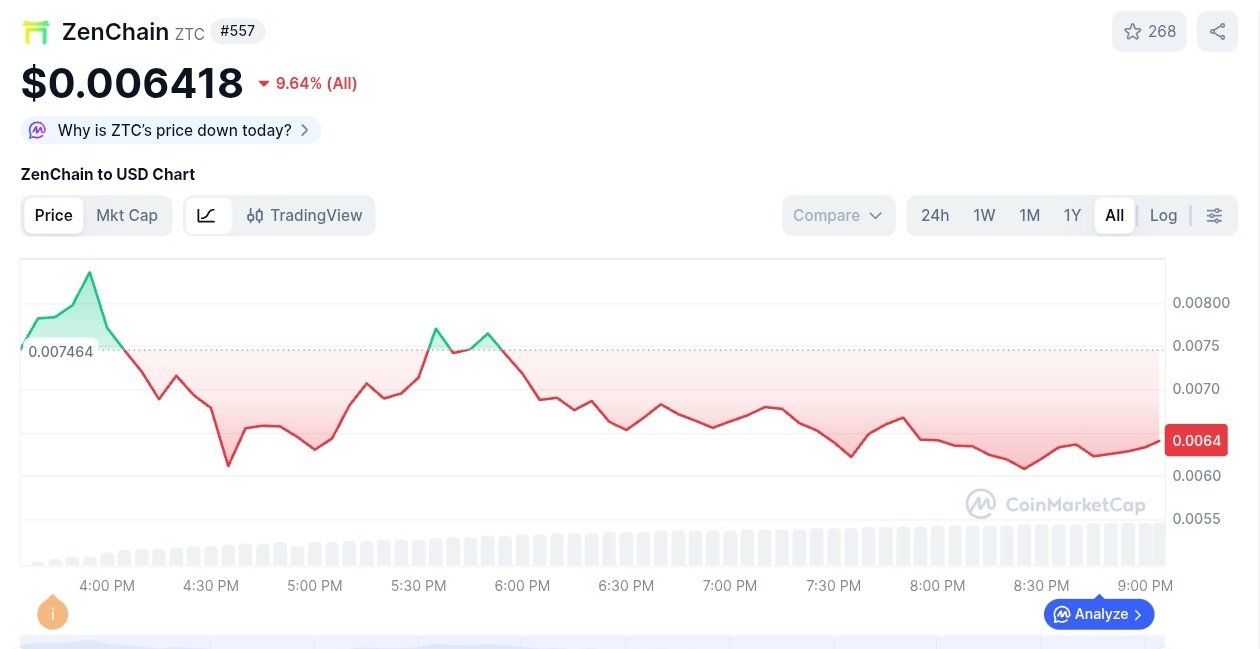

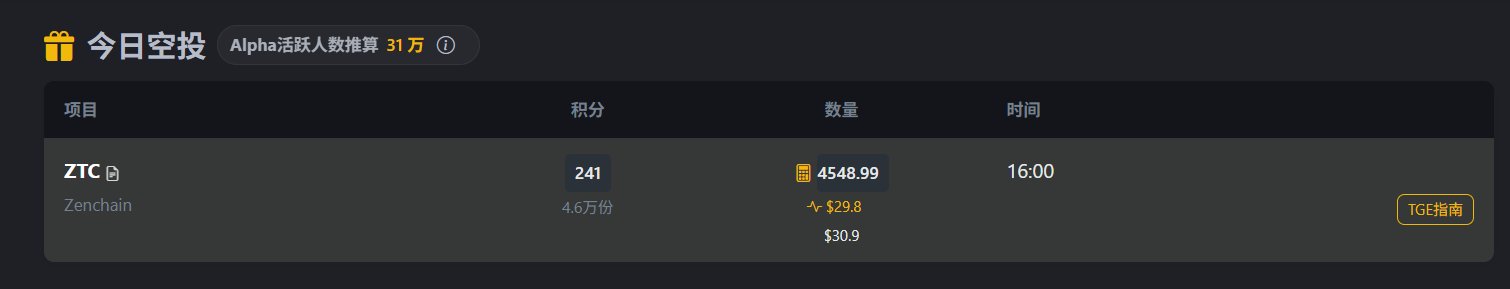

Sure enough, this @zen_chain got a TGE score of 241 today.

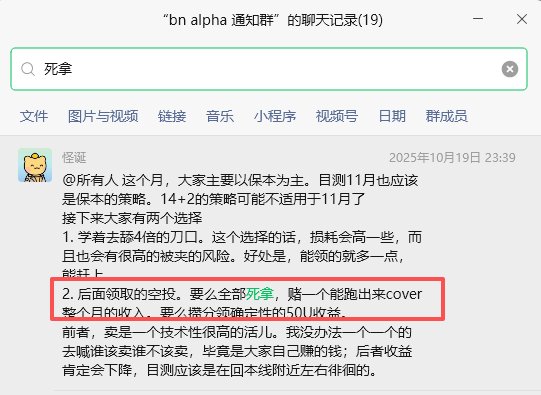

Yesterday we burned a batch of high scores, which so far doesn't seem to have much effect. The result is still an oversubscription of over 2,500×, about 4,549 $ZTC, roughly $32 at the time.

Now the project's secondary market is basically settled, and the FDV is still around $37M. I originally thought it would crash like a waterfall, but it's quite surprising.

In the current alpha stage, ordinary retail investors can make money, and actually holding the airdrop (i.e., “dead‑hold”) is also a strategy. I mentioned this before in a small group.

The logic is simple:

Since this thing isn’t worth much, recouping a small profit isn’t very meaningful, so just keep all the airdrops you receive. As long as any of them rises above $50+, it can cover this month’s earnings.

For example, $COLLECT, $BREV, $RAVE from a few days ago. Of course, most of the time the dead‑hold ends up being worth only a few dollars.

For something like $ZEC, even after the TGE and accounting for loss, the return is roughly the same as a normal airdrop. It hasn’t dropped to the teens within a few hours, which is already quite stable...

🍚 Didn't expect that @zen_chain would also appear on the alpha TGE.

This is a relatively old project; they apparently received a round of financing, with Watermelon Capital and DWF Labs participating. However, I can't find any records now. I won't discuss the latter; the former has also invested in projects like Quant, Algorand, and Sonic.

Although this project is an L1, you can also think of it as a bridge. It is an infrastructure layer built to enable BTC cross‑chain scaling.

It uses Schnorr adaptor signatures to compress cross‑chain transfers into a single Bitcoin transaction. No deposit address is needed; it relies on an encrypted commitment called transferId.

BTC liquidity is routed through Zenchain into DeFi, and the corresponding protocol revenue is used to empower $ztc.

We burned 30 points today; tomorrow's TGE score shouldn't be very high—my blind guess is around 240.