The first "60-days" launch on @virtuals_io is live.

Some notes on the launch mechanism first;

➥ Decay Tax periods for 60-days exists. Presumably the sniper tax tokens are held until after the 60 day mark like with other Unicorn launches (you'll need to factor this in, as will the founder).

➥ Quite astonishingly, the Virtuals team have completely dropped the ball with the airdrops. First off they still are allowing 3% to go to ACP bots which will just dump all of these 60-days charts on launch. Second off, the airdrops are available IMMEDIATELY. Crazy how out of touch the Virtuals team are on this airdrop matter but allowing immediate airdrops in this 60-days environment just seems odd and quit honestly, just not thought through.

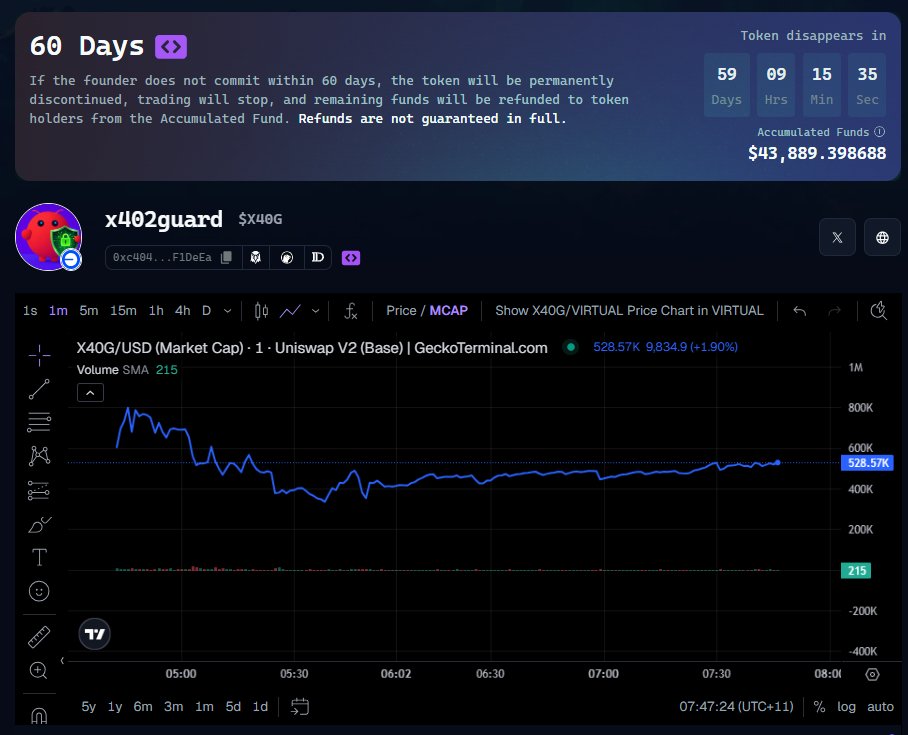

➥ @x402guard launched and hit around $800k. That's actually a great effort in the circumstances. I personally had this as a C Tier levl project as I don't think the moat will last th full 60 days i.e. multiple other projects will do similar/the same task(s). Currently at ~$500k is solid.

➥ There's a nice UI upgrade on the token page on the Virtuals website which outlines the "Accumulated Funds". This includes three amounts which are important for the 60 day mark go or no-go decision;

↠ Released ACF funds.

↠ 70% of the 1% trading fee.

↠ Remaining $Virtual in the liquidity pool (only released at the time of pool removal in the founder 'no-go' scenario).

➥ A reminder that there's no guarantee of a full-refund with this new launch mechanism. You have to monitor the "Accumulated Funds" pool to assess how much would be refunded at the 60 day mark.

➥ I think this launch shows there's interest here in the 60-days concept. I've got the second 60-days launch, 10x, @10xtradingapp, at B Tier and it launches in under two hours so we'll keep a close eye on that one!

Thoughts on 60-days so far? Did you bid the first launch or are you going in on the second one?